Blog

Click here to go back

Is Your QuickBooks File Slow?

Let’s look at what to do when saving a transaction, or creating a report seems to take minutes instead of seconds.

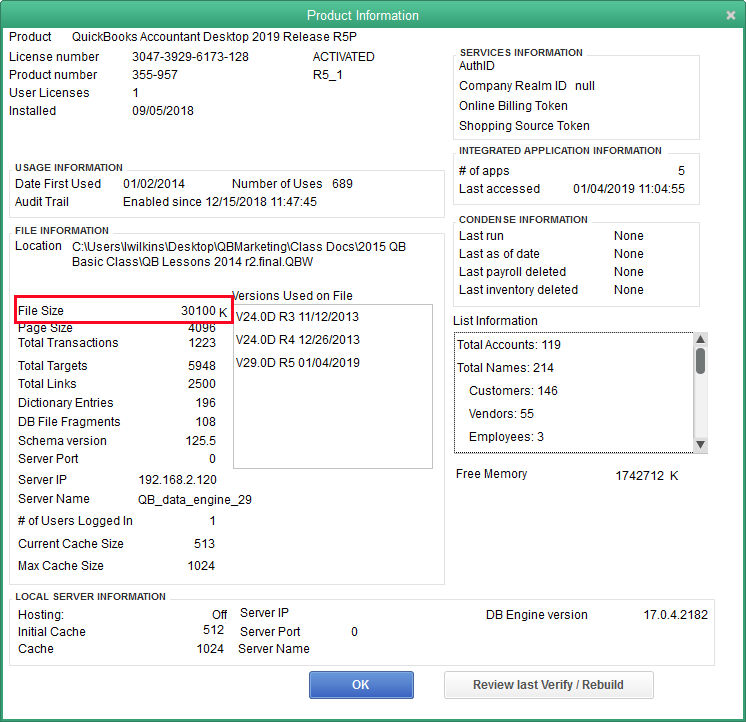

Pressing the key combination CTRL-1 from within QuickBooks opens the following window.

There’s a lot of information here, but what concerns us today is the highlighted line. File size.

There’s actually 1024 kilobytes in a megabyte, but we often round that to an even thousand in order to make quick calculations. So, in this case, we could say this QuickBooks company file is about 30 MB (megabytes).

That’s a small file. It should feel pretty crisp when entering transactions or creating reports. When QuickBooks starts to feel sluggish, it’s a good idea to check this screen. If the size of the company file is 250MB to 300MB, you know the day is not far distant when you will need to do something in order to keep the file at a more usable size.

There’s nothing in QuickBooks that will prevent you from using a larger size file, but performance declines. Too large and errors are more common. You’ll find these whenever Verify Data runs as part of a QuickBooks backup. QuickBooks can almost always fix these small errors itself. Still, it’s annoying and a little scary to know damage exists fairly regularly in your company file.

There are a couple of options when your company file becomes too large. Which you choose can depend on solutions you may have used, if any, to deal with this problem in the past. Let’s start with the easiest.

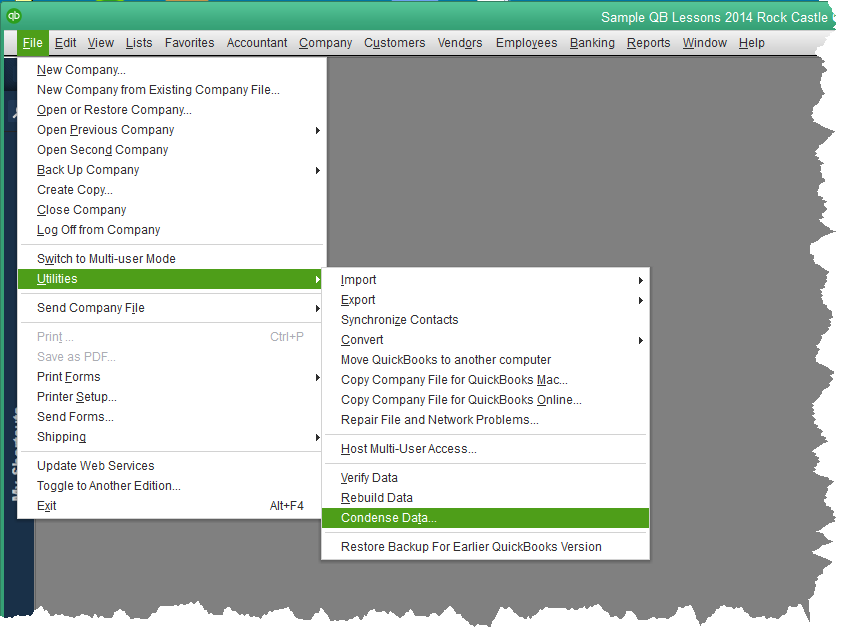

Condense Data

QuickBooks has an option called Condense Data. It’s been in the program a long time, but has been improved in recent years, including a marked improvement in the 2019 version.

The screen shot above shows you how to access this option. Below is the window that will open once we select it.

What’s new in QuickBooks 2019 is the option that’s selected in the graphic, “Keep all transactions but remove audit trail info to date.”

QuickBooks has maintained an audit trail since the 2006 version. Even if deleted, a transaction’s history remains in QuickBooks. One can see what the original transaction was, what date and time it was entered, who entered it, all that same information for each time the transaction was changed and/or deleted.

That’s a lot of information. It takes a lot of space. Starting with QuickBooks 2019, one way to make the company file smaller is to remove all that detail up to a specific date selected by the user.

If you choose this option, you want to keep a copy of the existing QuickBooks company file somewhere safe. On the off-chance you would need to go back and research a particular transaction, you would have access to all the details.

Going forward, the audit trail feature still works, it’s just that the history was deleted.

The other option, “Remove transactions you select…”, is similar. It will remove all transactions before last year, as an example. The reason the new QuickBooks 2019 feature is such a great choice is that you can still have all that transaction history in your company file, but it’s faster and responds better because, without all the audit detail, the file is much smaller.

The day may come when these options are no longer sufficient. When this happens, it’s time for a new file.

There are special tools in QuickBooks to deal with that. We’ll cover that in a future post.