Blog

Click here to go back

Sales Tax Code - Sales Tax Item - Which to Use?

Sometimes people are confused about sales tax items vs. sales tax codes. A simple way to think of it is this: the sales tax item computes how much sales tax, the sales tax code tells QuickBooks whether something is taxable or not.

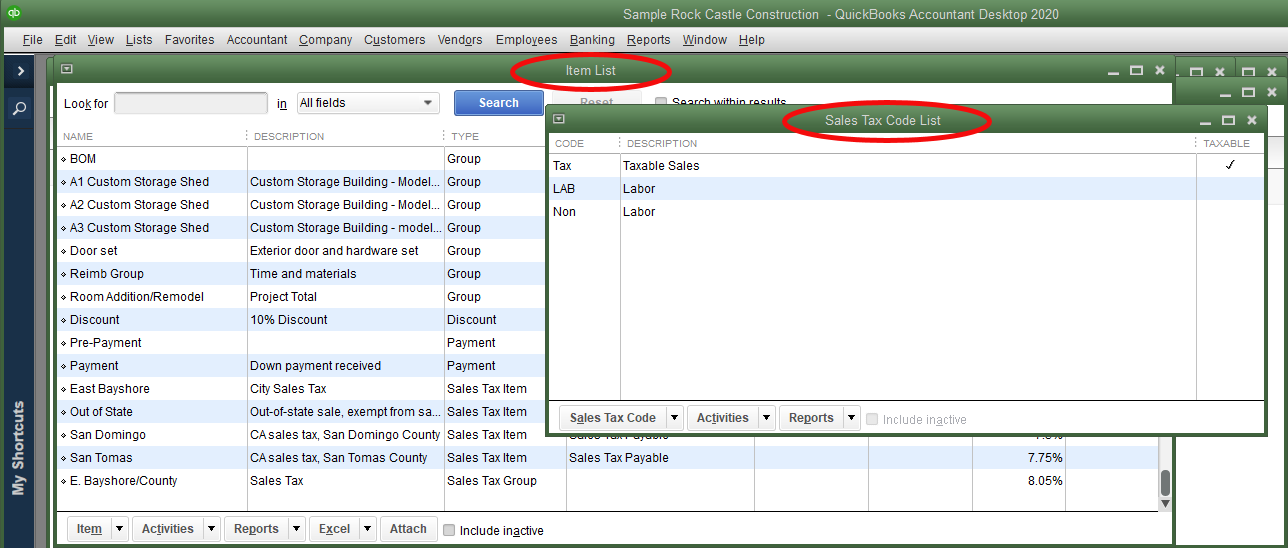

There are two different lists. Sales Tax Items are on the Item List. They usually show near the bottom of the list if you haven’t changed the sort order. So, sorted by item type (most common), you will scroll to the bottom of the list to find sales tax items.

Sales Tax Codes have their own list. Lists->Sales Tax Code List.

Sales Tax Codes appear on sales forms like invoices in the right-hand column.

While the tax code can be set on the sales form by changing what appears in that tax column, the field auto-fills from other settings in QuickBooks. It depends on what customers and what items may be taxable.

If a company sold on a Resale basis to other retailers, they would set such customers like this:

Determining an item’s taxable status is also part of the item’s setup in QuickBooks.

The above item, Light Pine Cabinets, is set as a taxable item. QuickBooks will normally compute sales tax on it when sold. That is, unless it is sold to a non-taxable customer like Kristy Abercrombie who we used to demo sales tax setup for customers. In that case, QuickBooks will follow the customer setup and make the item non-taxable.

So, the sales tax codes serve two very useful functions. First, they tell QuickBooks whether or not something is taxable.

If set up to do so, sales tax codes will also tell QuickBooks why something is not taxable. To accomplish that, one needs to create a non-taxable sales tax code for every reason a product might be exempt from sale tax.

Some examples would be Labor, Resale, Out of State, Sales to Federal Government, etc. By setting up the sales tax codes needed in your business and using them, more information is available to you at the time of creating the sales tax return.

The Sales Tax Revenue Summary report, will show sales for the period by sales tax code. The report will then show the amount of sales for taxable, how much for labor, how much for resale, and so on.

If you have multiple reason a sale might not be taxable, this report will give you that information which is usually required for completing a sales tax return.