Blog

Click here to go back

How QuickBooks can Track Long Term Loans

QuickBooks has a little-known tool known as Loan Manager. With this tool, you are able to setup and track payments on a loan. You can create amortization schedules. You can record loan payments so that the interest portion of each payment is expensed, and the principle portion reduces the amount owed in the loan’s liability account.

Setting up a Loan in Loan Manager

Once the information on a new loan is available it can be setup in QuickBooks. Create the Long Term Liability account on the chart of accounts first. Then, be sure the vendor name has been added to the vendor list and the account balance entered into the long term liability account. These actions must be done before setting up the loan in Loan Manager.

Once this information has been entered, select Loan Manager from the Banking menu. The following window appears:

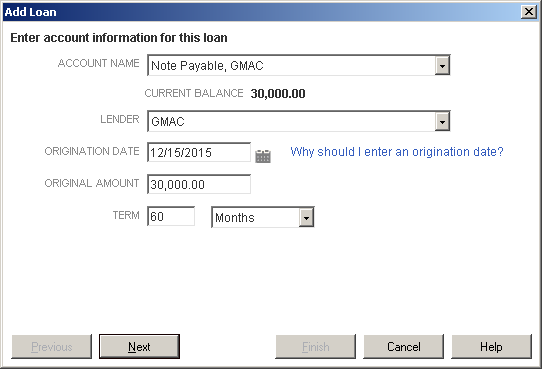

Next, click the button that says “Add a Loan”. Complete the information in the various fields.

Remember that the Account name and the Lender must have been setup before opening Loan Manager and then selected from the drop-down lists available in both of those fields.

Complete the fields as shown. The Origination Date of the loan is the date the loan was created by the financial institution and funds disbursed, not the date of the first payment.

Once your information is entered, click Next.

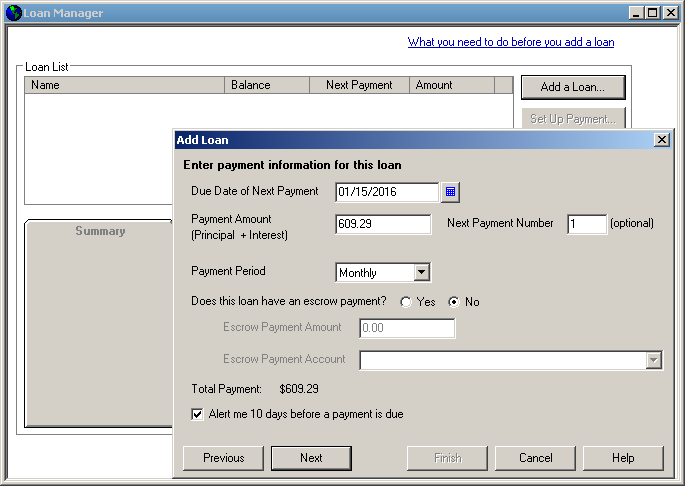

You should have a screen that looks much like the one above. Enter the payment amount and the frequency, in this case $609.29 due monthly.

An escrow payment would be an additional amount over the payment. Think of a mortgage escrow that will pay things like insurance and property taxes for the property owner. Most loans will not have an escrow account.

If you wish, you may set a reminder to trigger before a payment is due.

Once this screen is complete, click on Next and the following screen appears:

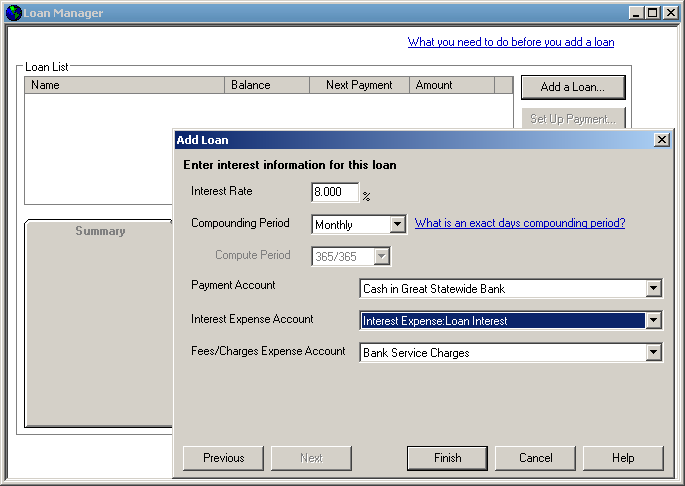

Your screen will not have the information already filled in as this one does.

Enter the interest rate and the compounding period. Enter the QuickBooks bank account from which the checks for the payments should be written.

The interest expense account will be selected from the dropdown. It will be an expense type of account on your Chart of Accounts.

Enter an account for any fees and charges if there happen to be any, and your setup is complete. When you click on finish, your screen will look similar to the one below.

The above screenshot has selected the Payment Schedule tab in the lower part of the window. This shows the amortization schedule for the loan that you just created. Your loan is now complete. Click on the Close button.

Making Loan Payments in Loan Manager

Once the loan is set up it is important to use Loan Manager when making payments.

You will see a screen like the one above. If you have more than one loan setup, you will see all of the loans listed in the Loan List window.

Select the loan for which you want to make a payment. Click the button “Set Up Payment”. You will see a window similar to the one below.

Most of the information is already on the screen. QuickBooks knows this information from the original setup of the loan. If you need to, you can edit some of the fields shown. Normally, you will want to accept what QuickBooks presents to you.

In the Payment Method portion of the screen, choose whether you want to write a check for the payment or enter a bill. If you select Write a Check as the lesson does here, you will see the following screen when you click OK.

Any details on the check can be edited, such as the date. Otherwise, the payment is ready to go. Be sure the check number is correct if writing the check by hand. If printing a check, be sure that box is checked.

You have now recorded your payment with amounts recorded to interest and to the loan balance. It will be easy for the payments to follow the amortization schedule if you always use loan manager to make payments. Also, your profit and loss reports will be more accurate since the correct amount of interest expense will be recorded.