Blog

Click here to go back

Managing Purchases

Purchase orders, like estimates and sales orders, are non-posting. The QuickBooks user is free to create as many as desired, void, delete, or alter regardless of the date on the form. None of these activities will affect the financial reports of the company.

Purchase orders are used to track commitments made for certain expenditures that are upcoming.

Traditionally, PO’s are used by businesses tracking on hand quantities of inventory. This adds one more measurement to the available to sell, or to the re-order computations.

QuickBooks knows how many of a certain product is on hand and in its reporting.

It can also advise you of how many have been ordered but not delivered to customers (sales orders) and how many have been ordered but not received (purchase orders).

Project based companies can use PO’s to good effect as well. When a contractor creates an estimate for a job, the company can also create purchase orders for work to be performed by subcontractors and/or for materials needed.

Using PO’s in this way gives added information to the manager of a job or project.

The estimate, as explained earlier, will show the actual cost vs. the estimated cost. Purchase orders can show how much is yet expected to be spent on a particular project or job. This gives managers an early warning if a project is in danger of going over budget.

Activate the Purchase Order feature by selecting it in the Items & Inventory section of Preferences.

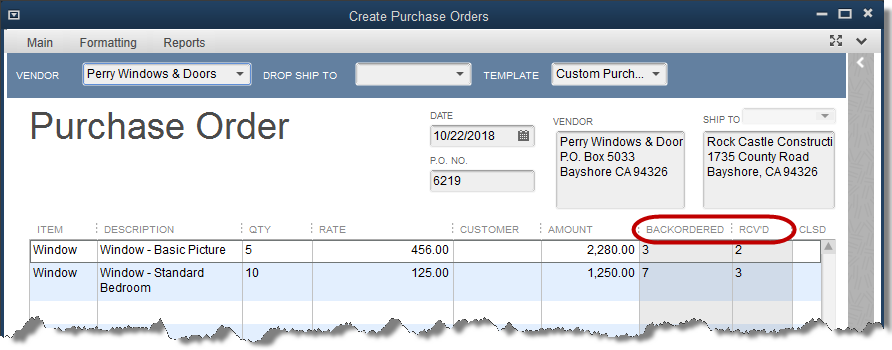

A purchase order is very straightforward to fill out. Once the items on a purchase order are received, a bill can be created from the PO without needing to re-enter manually the items listed. If only some of the items are received, QuickBooks will allow a partial receipt, continuing to keep the purchase order open until all is received. See the above screenshot.

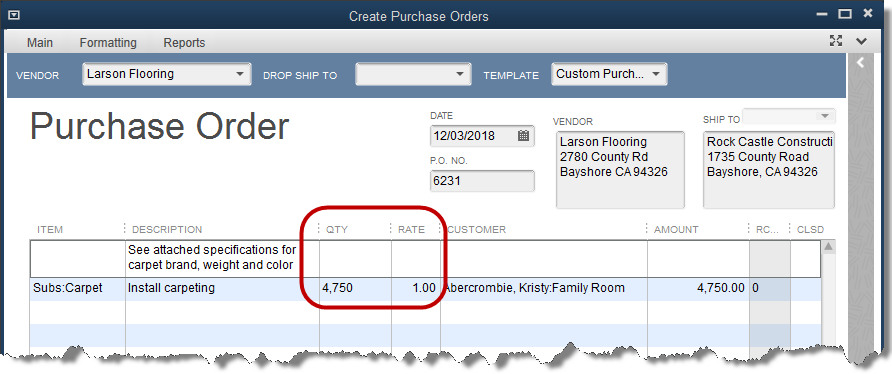

There is a trick for job and project managers. Purchase orders are closed by quantity. If a PO is created for a bid amount with a quantity f one, any receipt against that PO will close it.

Some subcontractors may require several payments. For instance, a plumbing contractor may plumb a house in three phases, expecting payment for each phase.

If the PO is created for one amount, the first payment will close the PO.

Instead, use the bid amount as quantity and the price as 1. That way, each of the three phases can be received against the PO, leaving the remaining work to be done on the open purchase order.

Which and how many purchase orders are open can be viewed on reports in QuickBooks. Look in either the Purchases section of the reports menu, or the Jobs, Time, and Mileage section.

Both list reports showing open purchase orders by job.

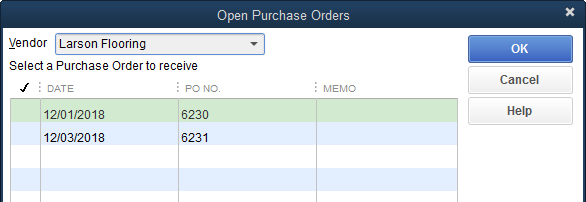

At the appropriate time, a bill is created for a vendor having outstanding purchase orders. When this happens, QuickBooks will display a message asking if you want to create the bill from an open PO.

Answering yes will bring up a list of the open PO’s for that vendor.

Simply select the appropriate purchase order from the list. The bill form will be populated with the items from that PO.

If necessary, you can change the quantities on the bill to reflect the number actually received, if received amounts are less than ordered.