Blog

Click here to go back

Divisions and Locations in Your Business

![]()

QuickBooks has a feature called Class. It provides another “bucket” besides accounts in which to congregate transactions.

This is often used in an organization where the same or similar income and expenses need to be tracked for different departments, locations, funds, etc.

If you wished to track donations as income, but wanted to know if those donations were for general use, building fund, or other special purposes, class might be your solution.

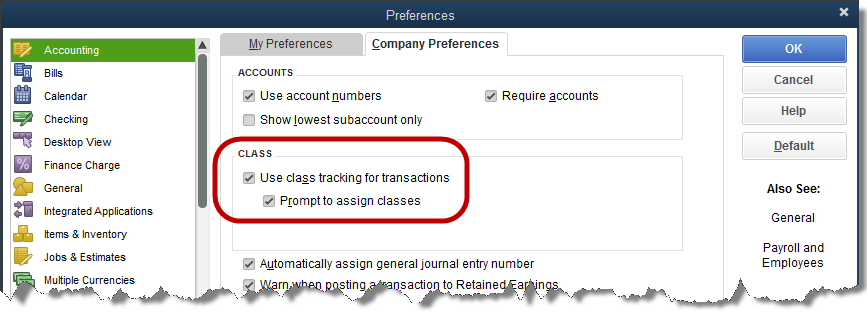

Turn on the class feature in preferences.

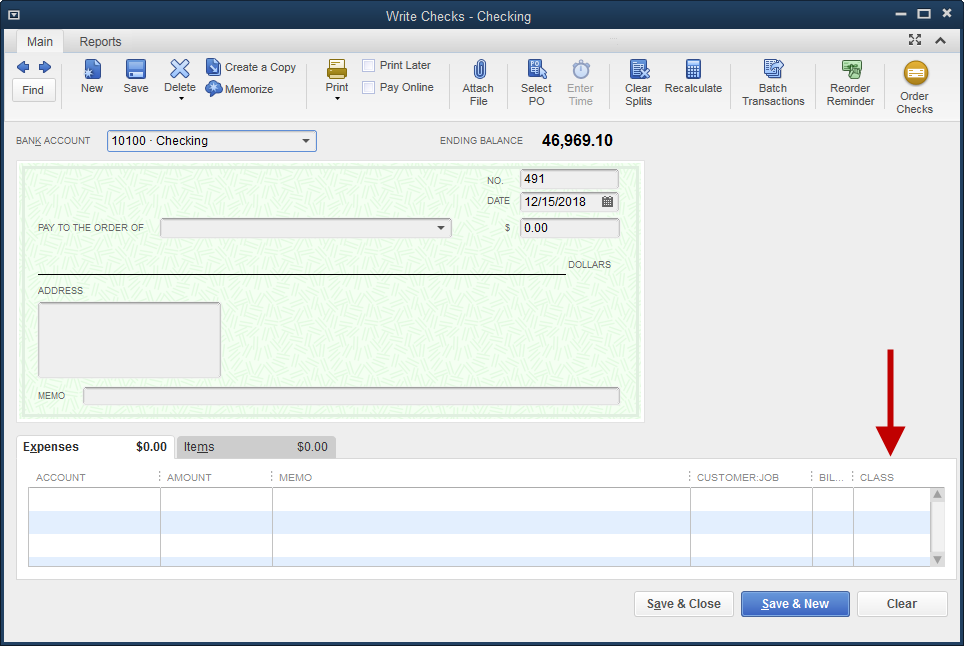

Once the option is turned on, transaction forms contain an added column for this information.

Classes can be added ‘on-the-fly’ by typing in the name in the class column and selecting Add when QuickBooks does not recognize the name. Or, you can navigate to Lists->Class List and enter your desired classes there.

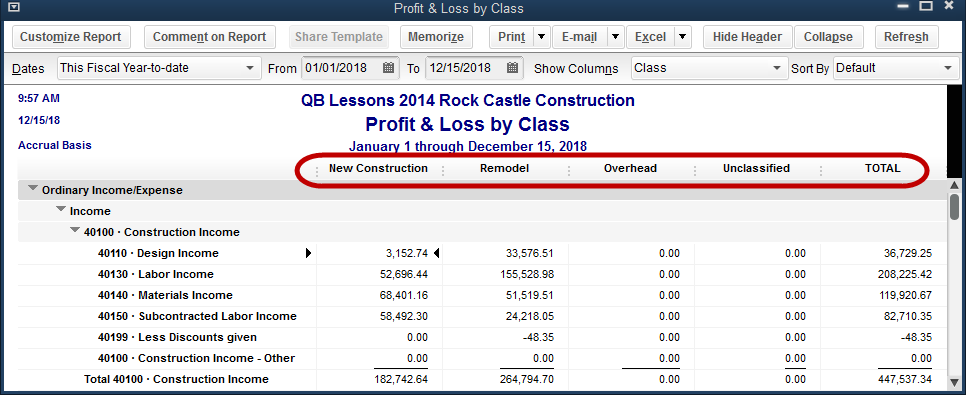

Using class designations on your transactions results in a profit and loss report that can be analyzed based on whatever criteria you are tracking with the class feature.

Keep the following in mind:

Use only one criteria. Using both location and department for classes will create a confusing report.

Create a general or administrative class for transactions that do not fit into any of the special class categories. That way, when unclassified transactions show up on the Profit and Loss by Class, you know they need to be corrected.

Class is for income and expense, not for assets and liabilities. While QuickBooks offers a balance sheet by class, it is cumbersome and difficult to use and requires stringent guidelines on entering transactions.