Blog

Click here to go back

Do You Sell at a Profit? Are You Sure?

Items are necessary for selling to customers. We can’t create a sales receipt or an invoice without them.

In their most basic form of setup, items contain a description for the sales document, the price, taxable status, and for accounting, an income account to tell QuickBooks where to post the revenue.

Items can also be used in expense transactions. Inventory is a good example. In an inventory situation QuickBooks must record cost as well as sales information in order for the inventory system to work. Accordingly, an expense type of account is part of the required item setup for inventory.

There are other times when both expense and income needs to be tracked by item even though the QuickBooks user is not tracking inventory. In these cases a service type item is usually created.

An example of this kind of setup would be a company selling services and the user wants to track activity by job or project. Besides contractors, examples of companies using this sort of technique would include architectural firms, engineering firms, and the like.

In these cases, the QuickBooks user must instruct the software to track both sides of transactions by item.

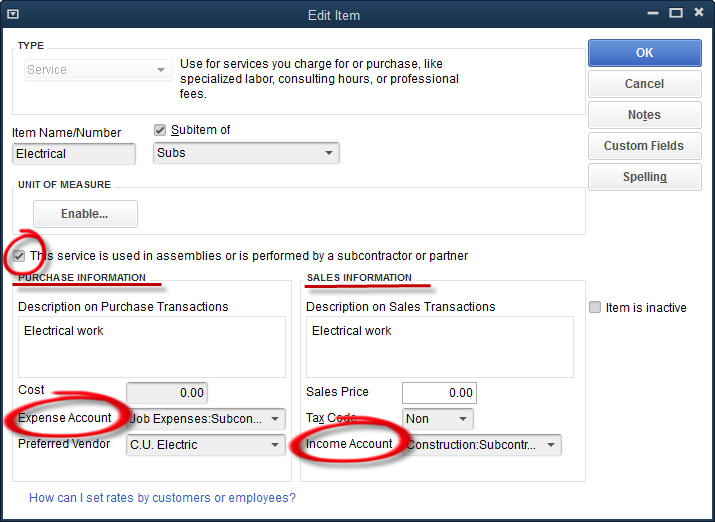

For our example, we will use the sample company Rock Castle Construction, a company specializing in remodeling projects. Above is a screenshot showing the edit window of a two-sided item. Note the checkbox in the center-left of the window.

“This service is used in assemblies or is performed by a subcontractor or partner.” This explanation can confuse some QuickBooks users, but basically the setting means there will be both a purchase side and an income side to the item setup.

You can see the lines drawn underneath the labels, purchase information and sales information. Then, even lower in the window, the circled areas denoting the appropriate accounts for each type of transaction.

With this setup, QuickBooks will know which account to use depending upon the type of form selected for a transaction. Checks and bills will cause it to use the expense account, invoices and sales receipts will post to the income account.

The reason for this setup is to allow the comparison of income and expense for a certain item. Let’s create an expense and income for a particular job, Kristy Abercrombie’s Kitchen. We’ll create an expense and then invoice the customer for the electrical work.

A bill is created using the Items tab (as shown) rather than the Expenses tab. As you can see, the Electrical item shown earlier in this article has been used to create an expense for this project in the amount of $588.75.

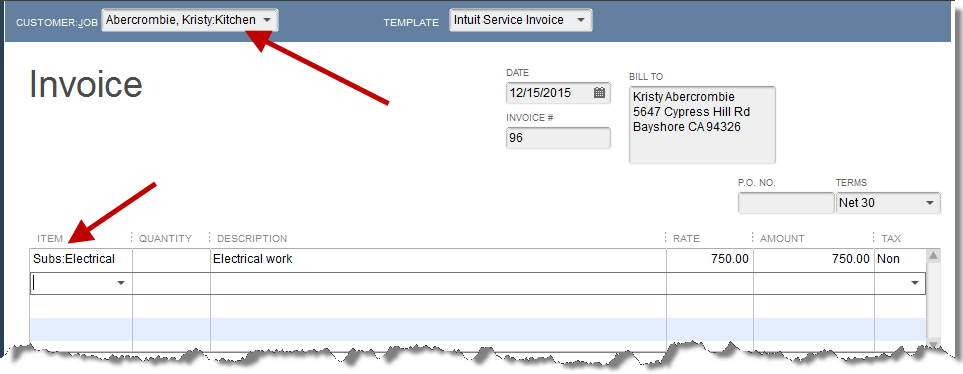

Let’s invoice Kristy $750.00 for the work done by C.U. Electric.

Above is an invoice for the Kristy Abercrombie Kitchen project using the same item, Electrical, that was used in the bill for C.U. Electric.

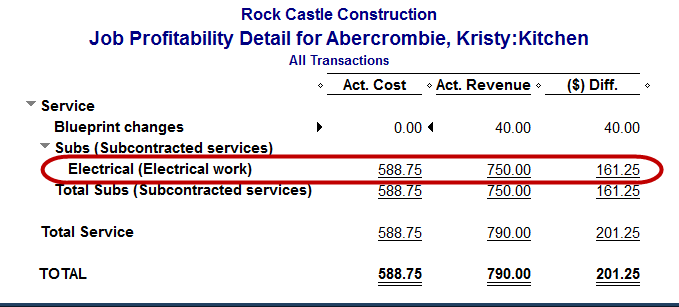

Now, let’s look at a report that will compare our expense and income for this project.

The highlighted line shows how the Job Profitability Detail report compares the revenue and the cost for one particular item for one particular project or job.

This is only possible with the use of two-sided items. Using the Expenses tab in transactions will prevent this comparison in this report. Fail to use jobs/projects in either expense transactions or invoices and this report will not work.

Used properly, two-sided transactions, in companies that sell by jobs or projects, can yield valuable information greatly affecting the company’s profitability.