Blog

Click here to go back

My Company

Basic QuickBooks, From Step One

Let’s take a few weeks, and examine using QuickBooks much as we would in a class. With a desire to learn the product. Make your life a little easier. Make bookkeeping both simpler and less time-consuming.

We might also find some ways that will correct a few unnoticed errors that have slipped into your accounting procedures. Find some better numbers to tell you how your business is really doing.

Today, a brief look at the My Company section of QuickBooks. It won’t take long and you might learn why certain pieces of information pop up on forms and reports.

First, the My Company window. Navigate to Company->My Company.

Note the pencil-point icon circled in the My Company window. This opens the smaller window shown in front of the screenshot.

Sure, most of this is self-explanatory, but let’s just look at a couple of things for clarity.

Fill out the Contact Information section. I know you know your own address, etc., but QuickBooks will pull from this section when putting your company information on an invoice header, customer statement, etc.

Fill out the Legal Information as well. Again, while QuickBooks may pull from the Contact Information section for things like customer forms, other functions will search the Legal Information area. Payroll forms, 1099s, etc.

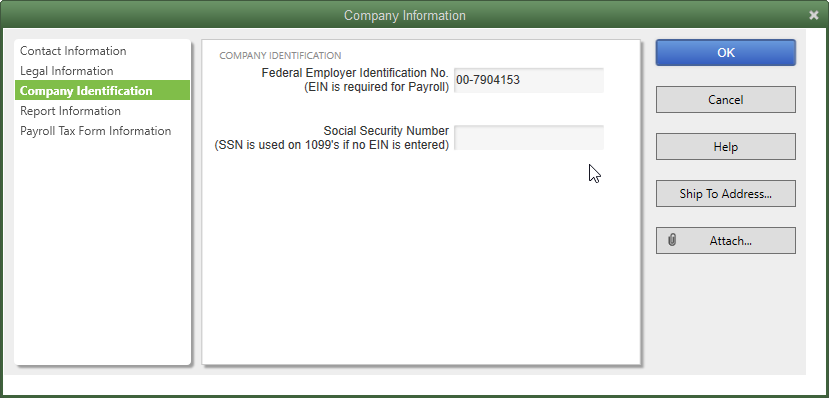

Company Information is short. If you have a Federal Employer Identification number, enter it here. If you don’t, use your Social Security number in the bottom field.

Most people get a Federal ID number when they either start payroll, or when they form a business entity other than sole proprietor. Think Partnership, LLC, S Corp, etc.

You may use your Social Security number if you are a sole proprietor with no payroll.

QuickBooks is going to use one of these numbers (and Needs one of these numbers) when filling out official forms. Filing payroll tax returns? QuickBooks looks here for the Federal ID. Create 1099s? QuickBooks looks here for your number, either Federal ID or Social Security.

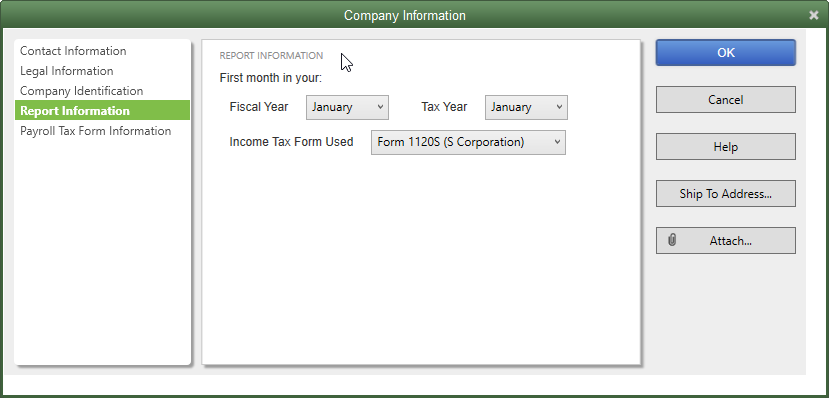

If the Report Information section sounds trivial, pause here a minute and understand how QuickBooks uses it.

This determines your fiscal year. The setting shown above means that reports are going to show on a calendar year basis. You may be non-profit with a year-end of June 30. If your QuickBooks were set as above, and you asked for a Profit and Loss report for this year, you’d get from January 1 forward, not July 1 forward.

It’s not uncommon for this question to come to me. No worries. If the dates are set incorrectly, just change them. Nothing bad will happen and you can change the dates here at will.

In more than twenty years, I have yet to find anyone who wanted their tax year set differently than their fiscal year, but it’s possible.

The Tax Form setting usually only becomes significant if you use income tax software that pulls the data directly from QuickBooks and fills out the return. I have yet to experience that either.

Yeah, the last section, Payroll Tax Form Information, is a little more involved. Of course, you only need to fill it out if you are doing payroll from QuickBooks. Otherwise, it’s irrelevant. The AutoFill Contact Information window only opens if you choose the AutoFill button.

It’s handy if you complete your own payroll tax returns. Fill out the information once here and Quickbooks fills it in each time you create a 941, 940, W2s, or state payroll forms. It’s not required, but it’s a BIG time saver.

There you have it. The My Company section of QuickBooks.

Next time? Lists!