Blog

Click here to go back

The Customer’s Check Bounced, Now What?

There is a feature, introduced in QuickBooks 2014, that will make the entries for a customer’s bounced check in QuickBooks. It uses the method we have suggested to QuickBooks users in the past, but those entries had to be created manually. Now, the software does it automatically.

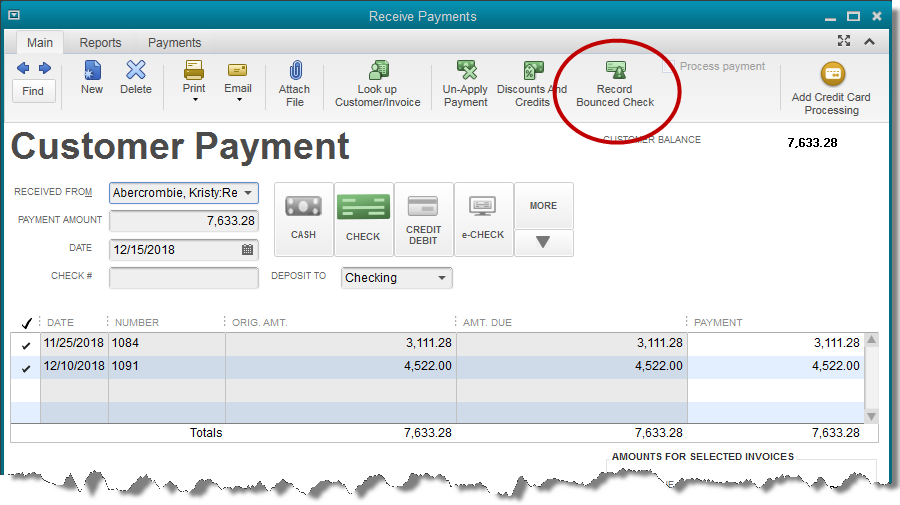

Above is a screenshot showing a typical payment transaction in QuickBooks and highlighting the icon on the transaction ribbon that will activate the Bounced Check feature. Note the manner in which the payment is currently allocated.

Above is the window that opens once the Bounced Check icon is selected. Note that all the fields in this popup window are editable. You are able to choose the amount the bank has charged you for the bounced check. You are also able to set the transaction date, the expense account charged for the bank fee, class (if you use the class feature), and the fee you wish to charge your customer.

Once the information is filled in correctly, you may select the Next button at the bottom of the window.

This is an informational window, explaining what entries QuickBooks will make.

Note that in section 1, QuickBooks is explaining that the two original invoices paid by this payment, are now marked as open, or unpaid. Section 2 explains that the amount of the bad check, $7,633.28 and the service amount charged by the bank, $25.00, have both been deducted from the QuickBooks bank balance.

Section 3 informs you that a new invoice will be created for the customer, charging them and adding to their balance, the amount you, the QuickBooks user, chose to charge your customer for the returned check. We chose $35.00.

The customer name in the graphic is “Remodel Bathroom” which can seem a little confusing. This sample file is for a contractor who tracks income and expense by job. The payment was for a particular job, Remodel Bathroom. In your QuickBooks file, if you used an actual customer name on the invoice, rather than a job, that name would show here.

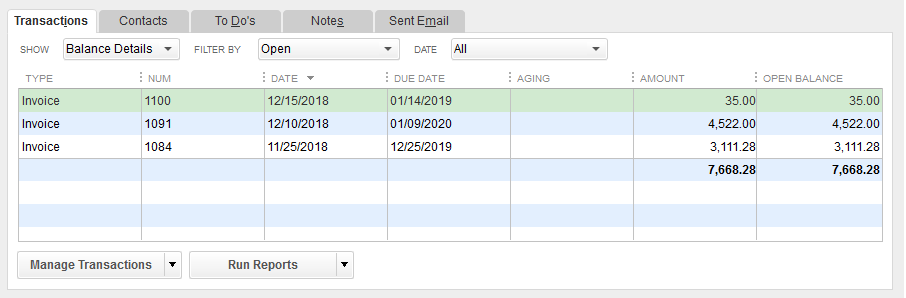

This last graphic is the portion of the Customer Center showing the customer’s transactions. It has been filtered to show only open transactions. Note that there are only three invoices open.

The bottom two are the invoices originally marked paid when the payment from the customer was first received. QuickBooks has marked these as open. This procedure allows these invoices to age properly, as of the original invoice date since, in reality, they were never really paid.

The third invoice, the one shown on line one in the graphic, is the invoice charging the customer the $35.00 fee for the dishonored check.

Recording a customer’s bounced check is as easy as a couple of mouse clicks.

Since this feature has been available since the 2014 version, have you ever used it?