Blog

Click here to go back

Searching for Profits - Divisions and Locations

In the search to understand our business, we’re looking for ways to whittle down the mass of transactions in QuickBooks to smaller chunks we can understand and evaluate.

This post is for companies that can divide their business activity by divisions, maintenance & repair services vs. new construction, or location. To do this, we use a feature called Class.

If this might work for your business, you can turn on the feature in Preferences.

The screenshot shows where to select the option to use Classes. If you are going to make this choice, you almost certainly want the option to Prompt to assign classes as well.

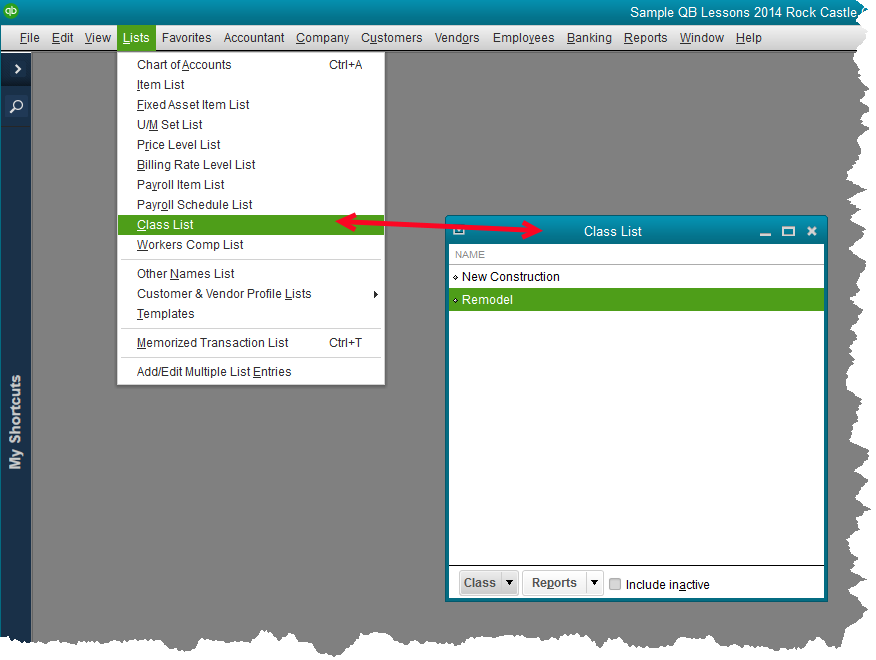

With the Preference set, you now have a new list on the Lists dropdown menu. In the QuickBooks sample file, the two classes already established are New Construction and Remodel.

Creating a new class is simple. See the screenshot below. Really, you only need a name.

You can also add a new class ‘on-the-fly’ by typing in a new name as a new transaction is entered.

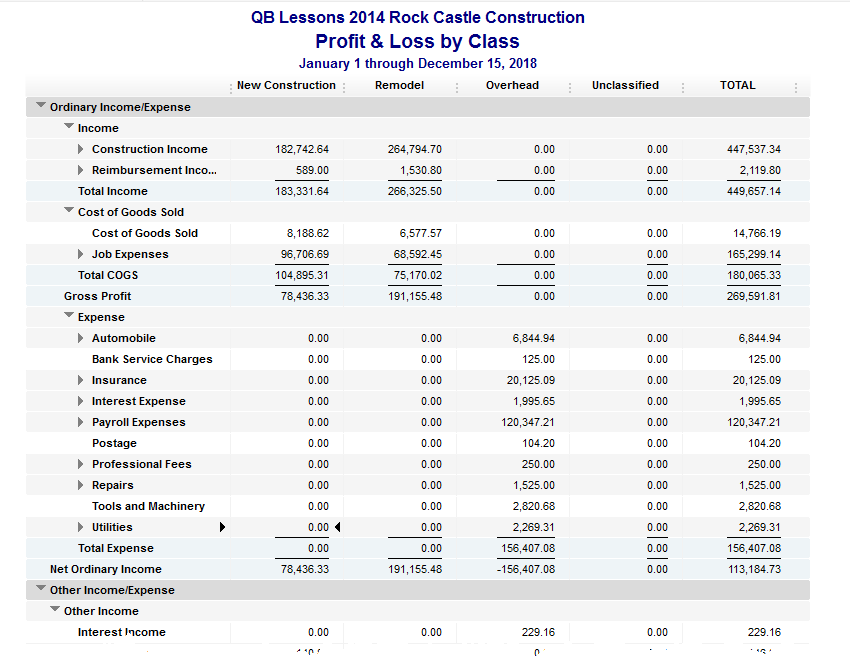

The main benefit in using this feature is keeping the chart of accounts from becoming overwhelmingly large, and the ability to create reports that are far more readable than using the chart of accounts as the only set of ‘buckets’ in which to categorize income and expense.

While the QuickBooks sample file gives a very limited example of how the class feature is used, it’s enough to visualize how this could benefit your organization. Instead of having expense accounts for Cost of Goods Sold, New Construction, and another expense account for Cost of Goods Sold, Remodel, there is only one Cost of Goods Sold account. Transactions posting to that account are then categorized, using the class feature, as New Construction or Remodel, and as many additional classes as you think necessary.

The reports are eminently more readable.

Some Additional Considerations

- Class should be used for only one strategy. That is, to break up business operations by location or grant. If you use class for grant, and also for location for instance, the reports fail to be very informative.

- If you opt to use class, create a class for General, or Administrative, or similar. That way, even transactions that don’t fall neatly into one of your main classes can be categorized by class. This way, when you create a Profit and Loss by Class report, and you see transactions in the Uncategorized column, you that’s an error and you can open and fix those transactions.

- Class works for income and expense accounts and creates a great profit and loss report broken down by these additional criteria. It is very complex and rarely works well with balance sheet accounts. So, it won’t help you if your organization needs separate balance sheets.

For a more visual demonstration and some more in-depth ideas on using it, see this video:

https://www.facebook.com/mgreenandcompany/videos/406010763431187/