Blog

Click here to go back

Is it a Check or a Bill?

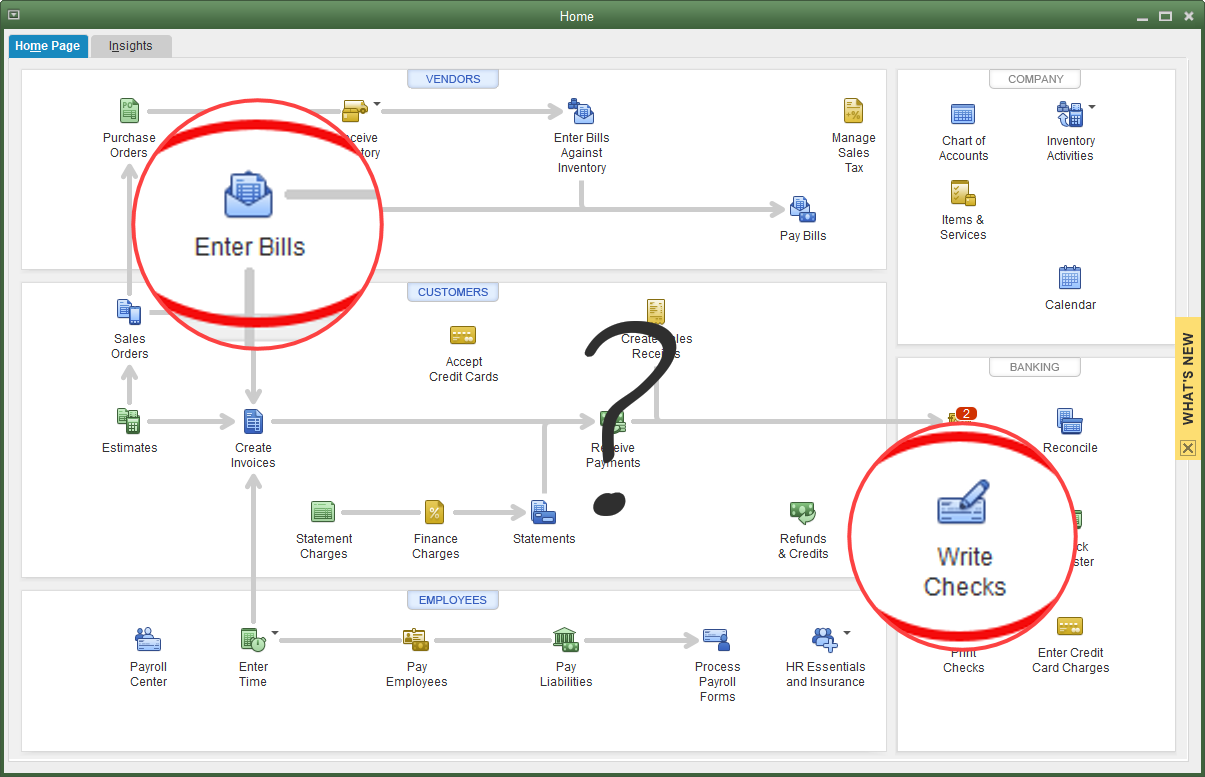

This is a question that arises from time to time. Should I be entering expenses into QuickBooks as checks or as bills?

To answer that, we need a little background on what these two transactions do. When a check is created, whether by using the check form as will happen with the Write Checks icon circled in the above image, or in the Check Register, the amount will post to the account used in the Account field, and the bank balance will be lowered. That’s it. It’s a simple transaction.

You can see the two affected accounts in the above screenshot. The bank account, in which the balance will be reduced, at the top. The account that shows lower in the graphic is the expense account that will be increased by the same amount.

Now, what if you enter an expense as a Bill?

The bill form still increases expense, posting to the account you enter on the stub portion of the form as shown. It does not affect a bank account though. Instead, the other side of the accounting entry posts to Accounts Payable.

For the QuickBooks user, that means with a bill an expense is created and a debt to the selected vendor is also created. The bank account is not affected until the bill is paid.

If you refer back to the screenshot of the Home Page, the first graphic in this article, you see the Pay Bills icon to the right of the Enter Bills icon. When paying bills that have been entered, this is the choice you want to make.

So, using bills is a two-step process instead of one like Write Checks. Why use it?

The expense posts to your books as of the date on the check or bill, whichever you use. Sometimes, it’s important for an expense to show in a certain month, the month in which it was incurred. But, we plan to pay later, perhaps in thirty days. Using a bill allows you to do that.

If such control over dates is unimportant, you may be fine with Write Checks instead.

Always follow the correct procedure. Write Checks is one step. If you Enter Bills, you Pay Bills when that time comes. Remember, the bill creates the expense. If you enter a bill for something and then come back later and write a check to actually pay it, you have created that expense twice in your books.