Blog

Click here to go back

Old Invoices in QuickBooks? A Simple Fix

From time to time, it becomes necessary to write off a customer balance that has become uncollectable. Let’s look at how to record this transaction in QuickBooks.

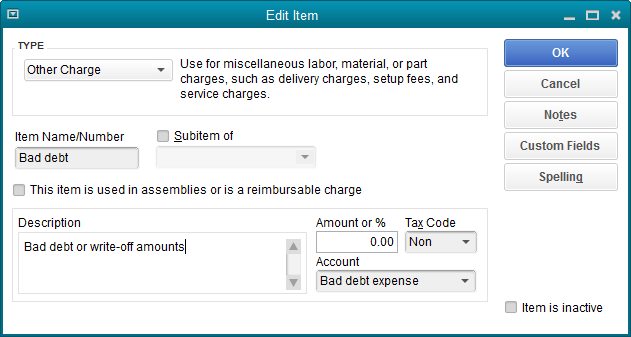

1. Add a new Item for Bad Debts

Open the Item list, click the Item button in the lower left corner, and select New.

Select ‘Other Charge’ as the item type.

Name the item ‘Bad Debt’.

Do not enter a default amount.

Make the item taxable and in the Account field, select the expense account for Bad Debt Expense. If you don’t already have an expense account for this purpose, you can create one without leaving item setup.

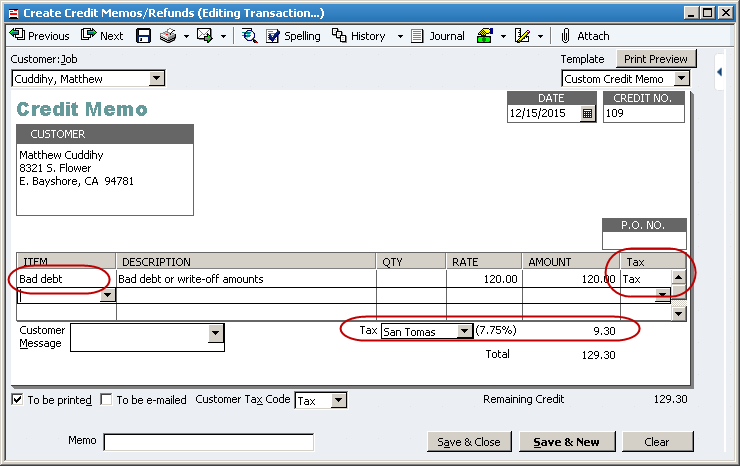

2. Issue a Credit memo

Choose the Refunds and Credits icon from the Home Page or select Create Credit Memos/Refunds from the Customer drop- down menu

Enter the customer, a current date, etc. in the header of the credit memo.

Use the bad debt item just created as the line item in the credit memo. Enter the amount to be written off exclusive of any sales tax amounts.

Enter the appropriate Sales Tax Code. Use a non-taxable code if there is no sales tax to be written off.

If applicable, select the appropriate Sales Tax Item from the drop down list at the bottom of the Credit Memo form

Click Save and Close.

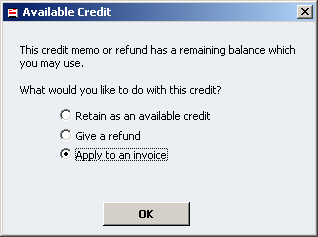

3. Apply the Credit Memo.

Choose the selection to Apply to an invoice when this popup appears.

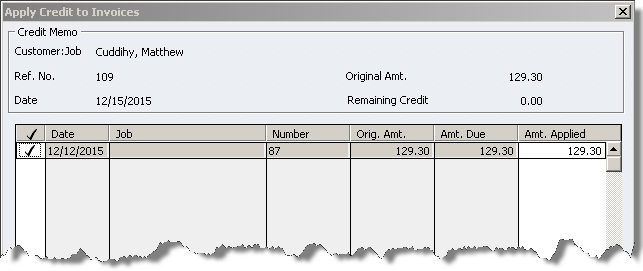

Be sure the correct invoice, if there is more than one, is selected in this window, and click Done.

That’s it. This method allows the recovery of any sales tax that may have been paid on the customer’s original invoice. As long as you use a current date for the credit memo, it preserves the account balances from previous periods. Your accountant will thank you for that.