Blog

Click here to go back

The Chart of Accounts - What’s Different in QuickBooks Online vs. Desktop?

There are two good reasons to review the chart of accounts today. One, there is a setting when creating a new account that is unique to QBO. Two, knowing how to create accounts will make your company’s financial reports more accurate.

The account, from the chart of accounts, tells the financial software how to handle the amounts we post there when we create transactions. If the account is an asset or liability, the balance in the account is increased or decreased depending on the type of transaction we use and that balance remains, even across multiple years. It’s the account type that makes that happen.

On the other hand, with an income or expense type of account, the dollars posted there only appear on reports for certain time periods. We determine that time period when we create the report. A Profit and Loss report for June 2017 will show the expense amount of in particular account for that time period only, regardless of what may have happened in the past.

A 6/30/2017 balance sheet will show the total of all transactions in an asset or liability account since the beginning of the QuickBooks file, up through 6/30/2017.

So, it is very important to use correct account types. QBO takes another step.

You can view your chart of accounts by navigating to Transactions on the left panel and then choosing Chart of Accounts.

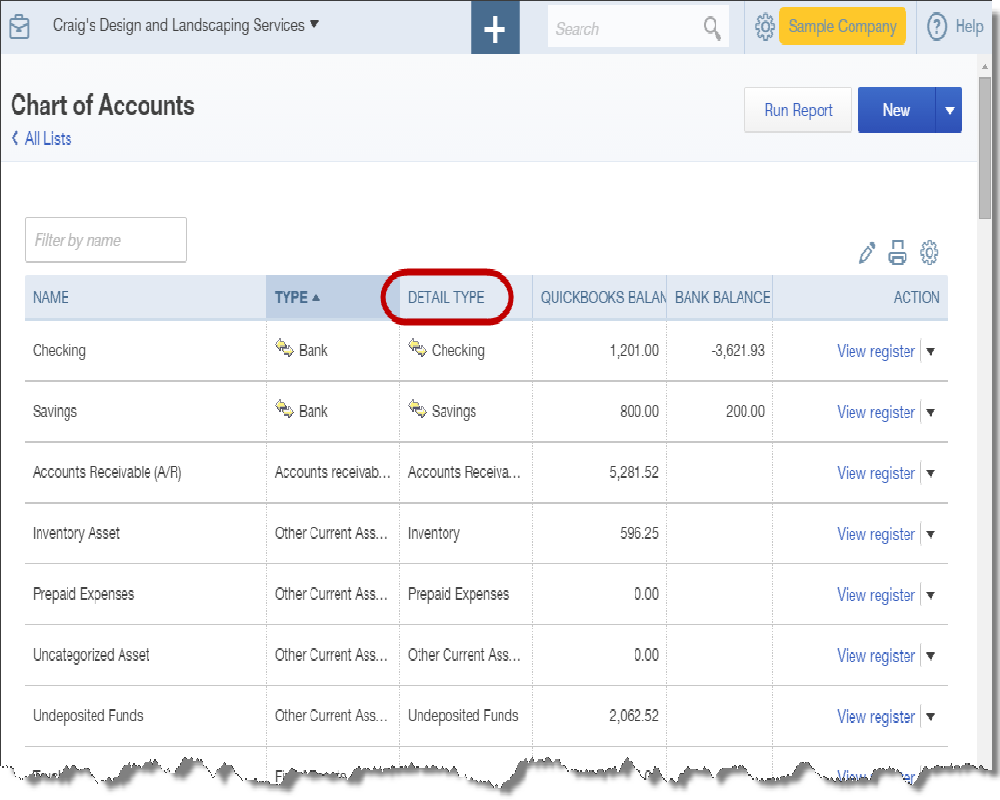

Above is a screenshot showing how the list appears. Note the column headers.

The first column from the left displays the name of the account. This is usually specified by the QBO user.

The second column shows the account type as explained a few paragraphs ago. In the graphic, Bank, Accounts Receivable, and Other Current Asset types of accounts appear in the list.

The third column is circled. This is the Detail Type.

Detail Type is not part of account setup in QuickBooks Desktop, so if you are new to QBO, you may not be familiar with it. It’s a way QBO gathers more information about how you intend to use this account. That information helps QBO decide where the account balance should appear on financial reports like Profit and Loss and Balance Sheet.

The fourth column shows the account balance, but only for balance sheet accounts. Those would fall into the general categories of assets, liabilities, and equity.

Scroll down this list to the income and expense accounts and you find that no balance shows. Income and expense accounts close, that is the balance is zero’d out for reporting purposes, at the end of each year. QuickBooks does not maintain an indefinite running balance for those types of accounts.

Also note that there are two account balances for the bank accounts shown. If the screenshot were long enough that you could see the credit card account type also, you would see both account balance columns filled there as well.

This tells us there is a difference between what our QuickBooks balance in this account is and the balance coming from the financial institution. There are transactions we need to match or enter from our bank feeds.

Once you are more familiar with and understand the QBO chart of accounts, it becomes easier to create new accounts correctly.