Blog

Easy Customer Refunds in QuickBooks

For many businesses, customer refunds are a fact of life. Defective products, services that didn’t work, or just to pacify an unhappy customer, occasionally a refund will need to be processed.

As common as this situation is, it is surprising how few QuickBooks users are familiar with the process.

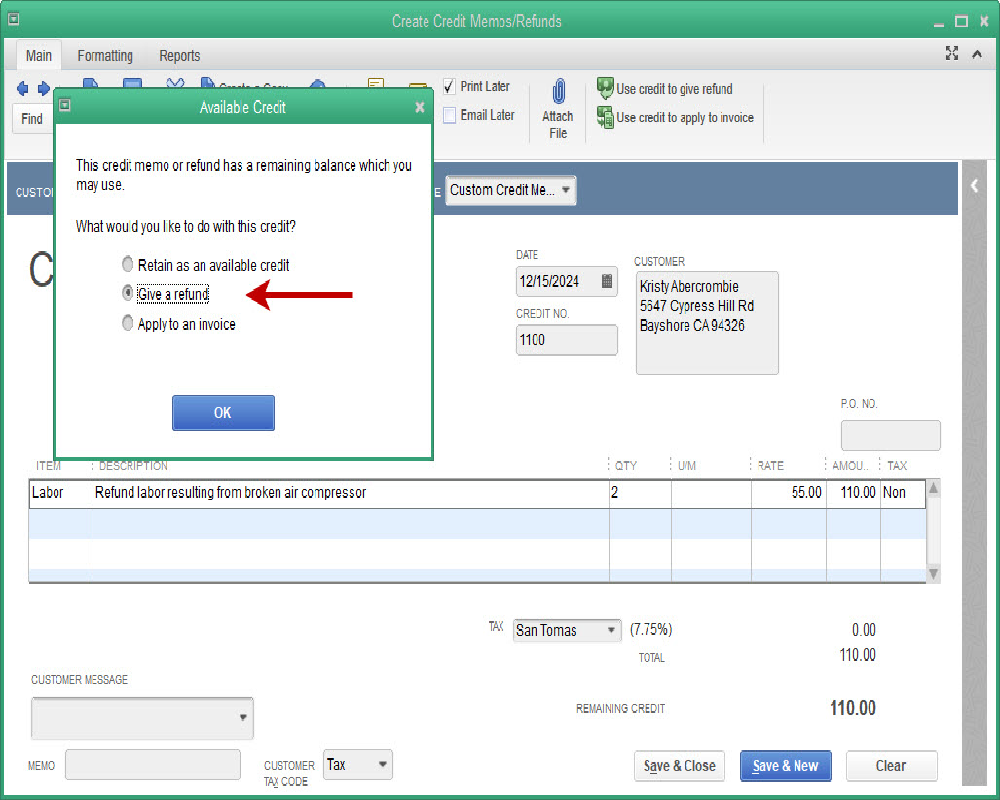

Refunds are created using credit memos. Customer -> Create Credit Memos/Refunds.

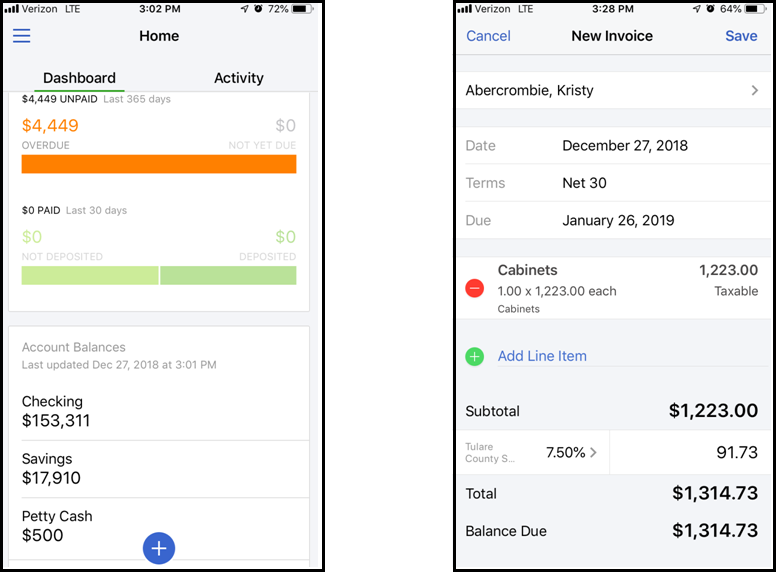

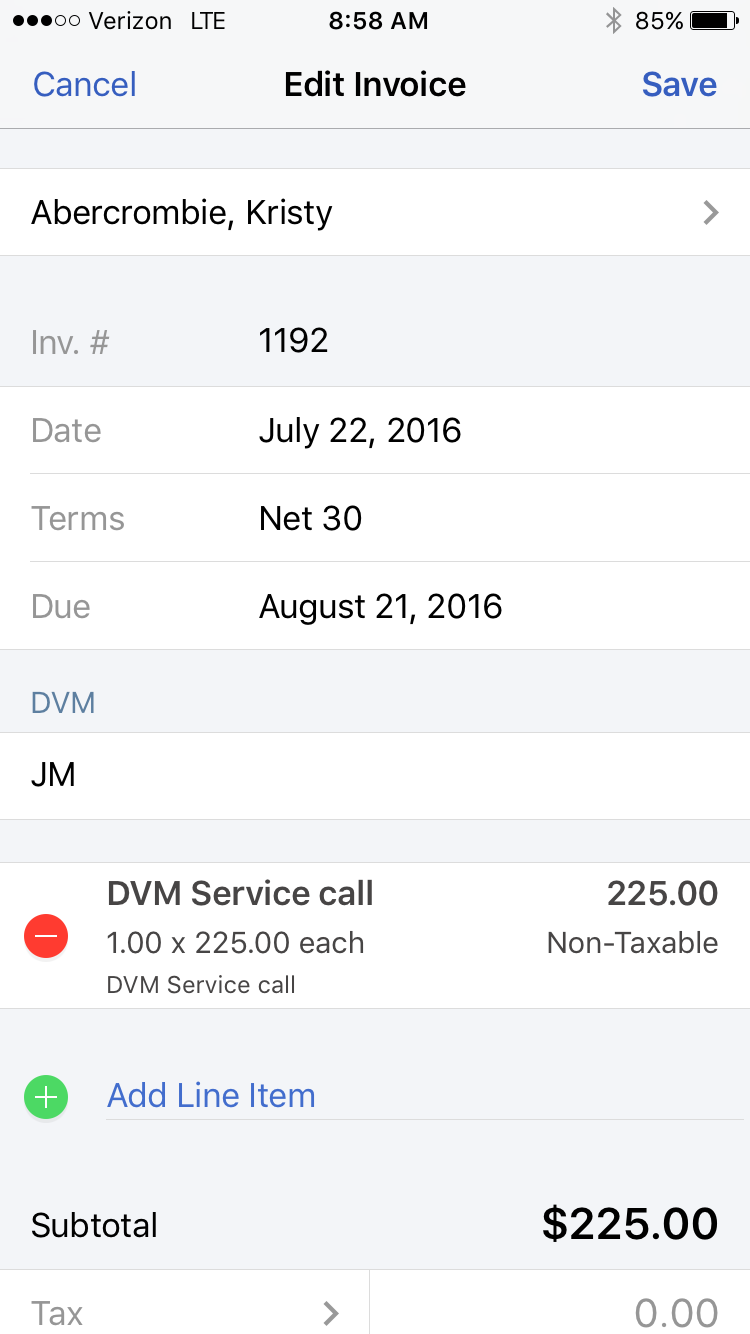

In this example, Rock Castle Construction refunds their customer, Kristy Abercrombie, for two hours of labor that resulted from the breakdown of their air compressor.

When saving the credit memo, QuickBooks uses a popup screen to ask the following question.

Selecting “Retain as available credit”, keeps the credit memo as a credit in the customer’s balance. “Apply to invoice”, allows the QuickBooks user to apply the credit against an unpaid invoice for this customer.

In this instance, let’s say the customer had already paid the invoice and we wanted to give them an actual refund check. We would select the middle option, “Give a refund”.

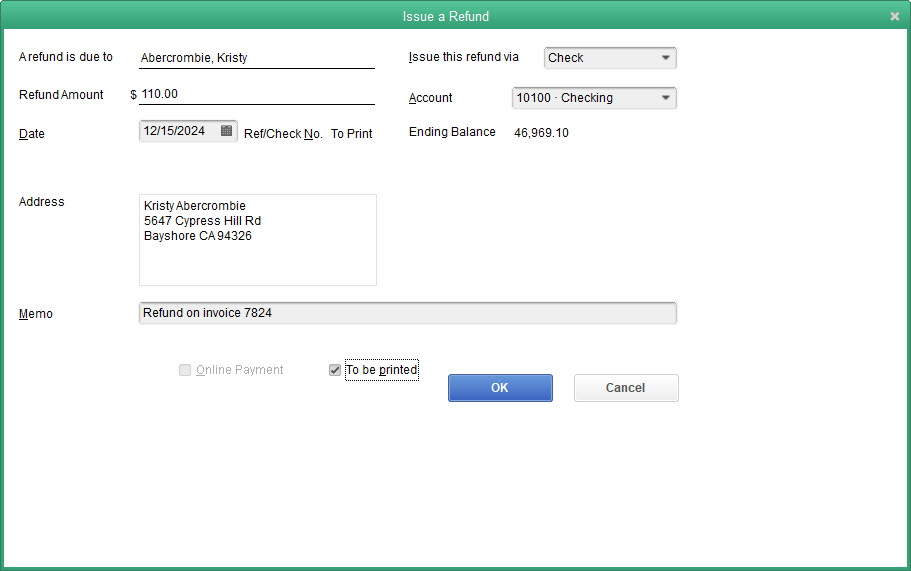

Once the refund option is chosen, QuickBooks displays the above screenshot with all the information filled in. You can change it if necessary.

Usually, you can select OK with the data QuickBooks has used. The refund check is created, ready to be printed.

Have you ever used this feature?

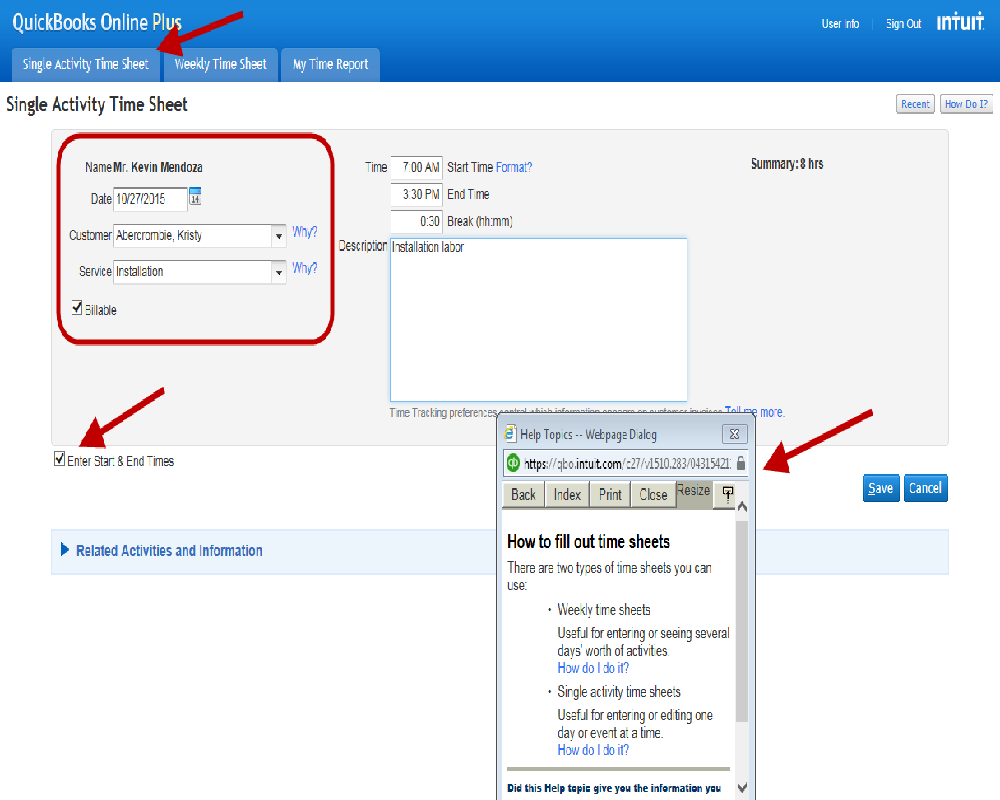

Invoicing from Time and Costs

QuickBooks has the ability to track expense and time transactions recorded by the user and holding those so they can be used on an invoice for a customer.

This can be as simple as postage purchased for a client who will be invoiced for the cost. It can also be as complicated as a major time and materials job requiring details spanning a twenty-five-page invoice.

In either case, those amounts do not need to be kept on any list outside QuickBooks to remember to invoice the customer, QuickBooks becomes that list.

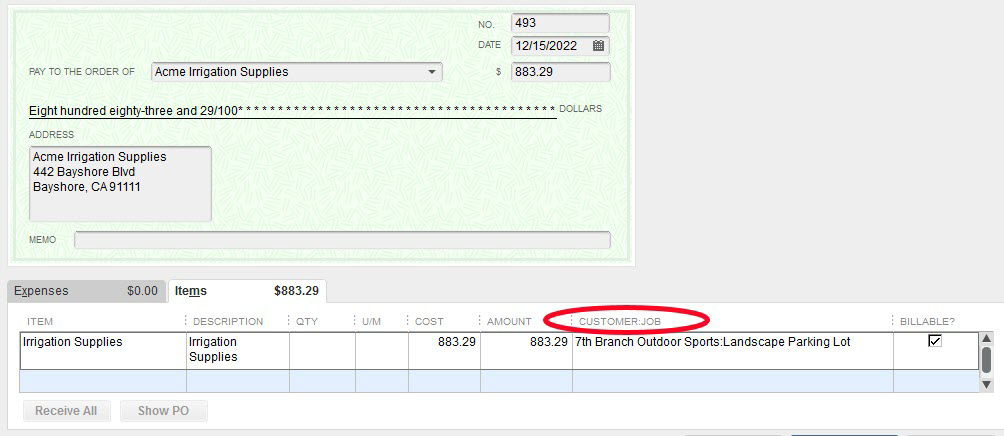

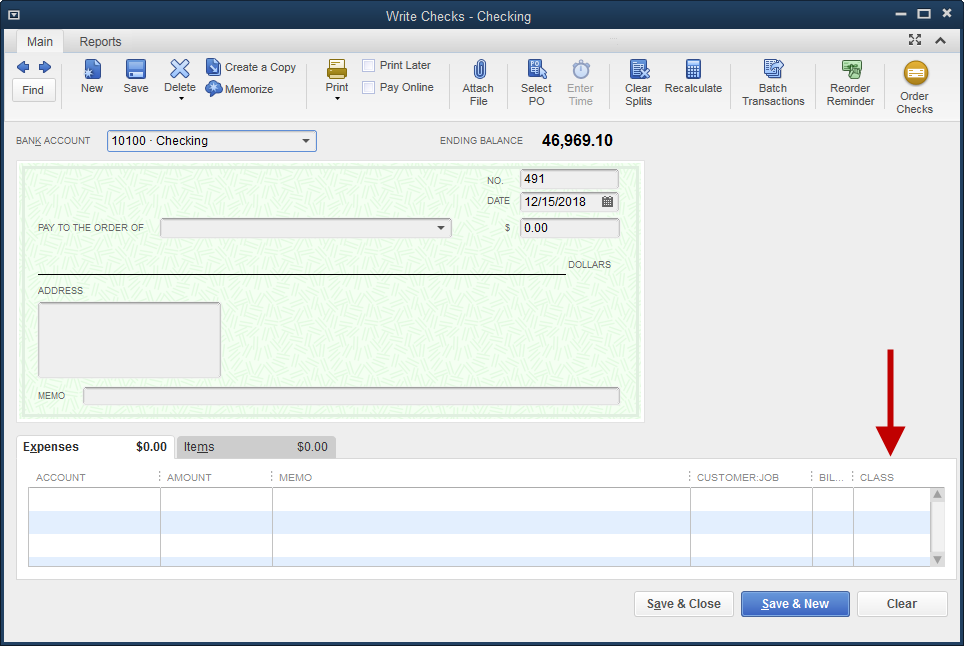

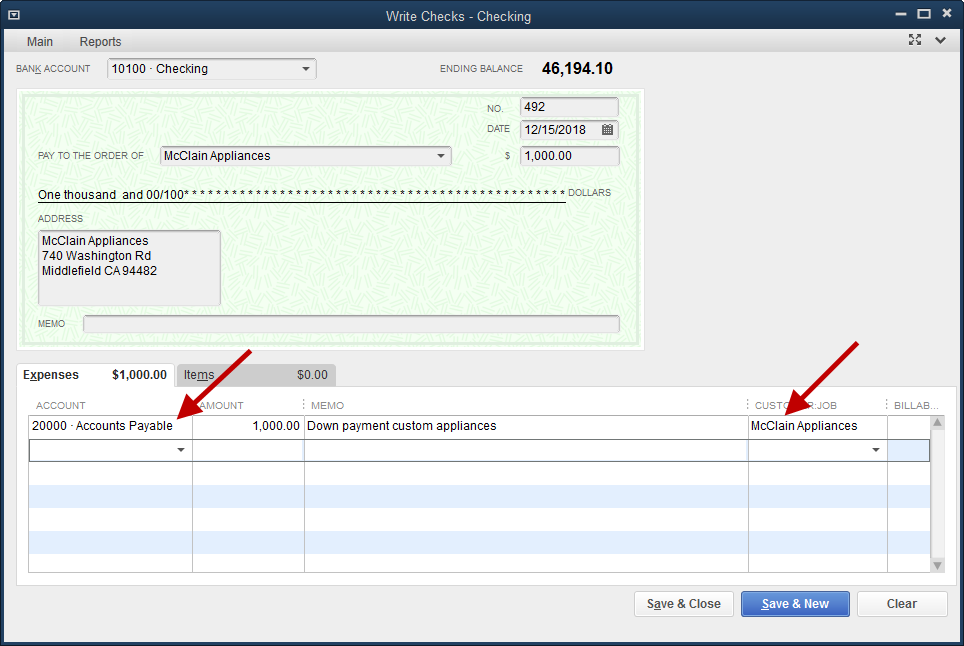

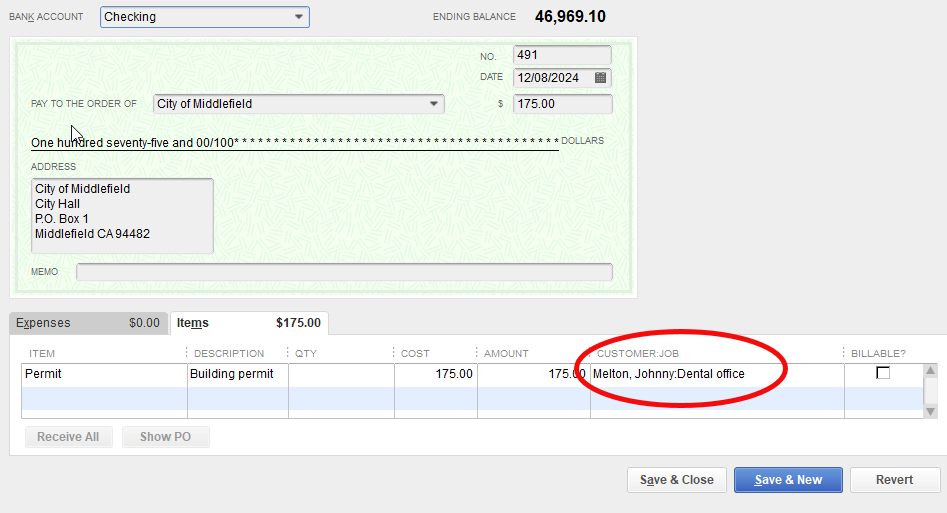

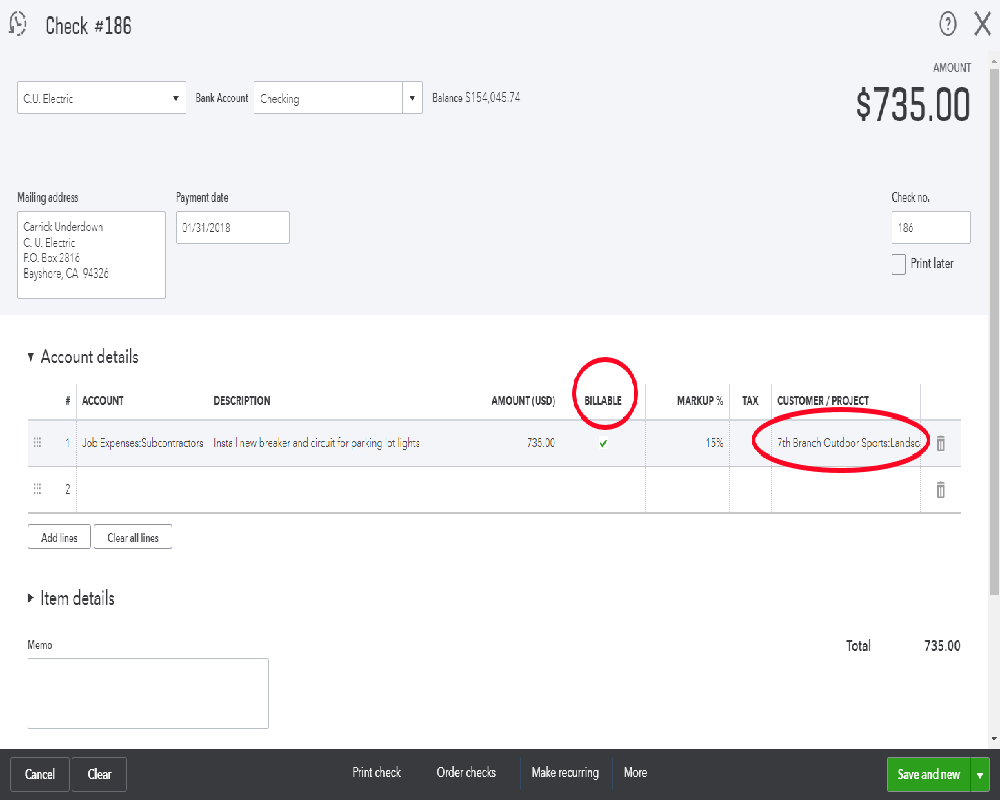

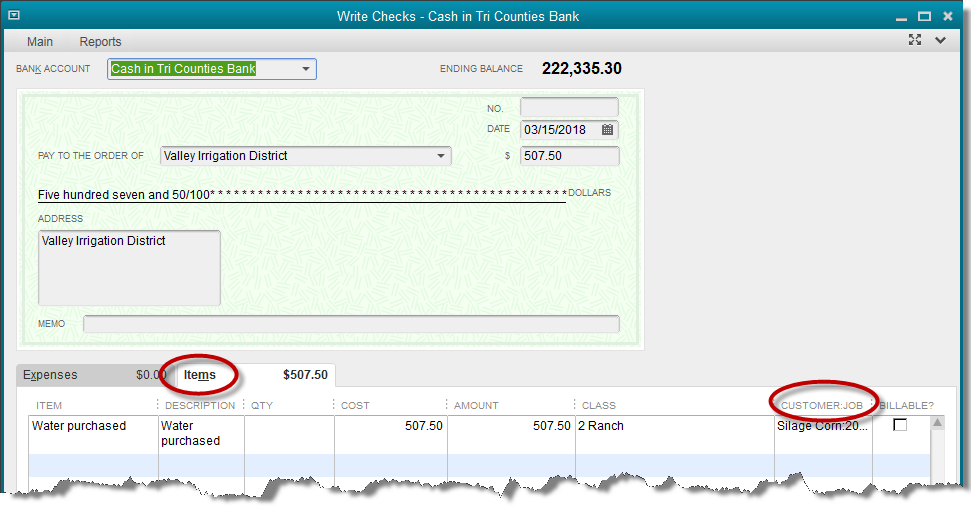

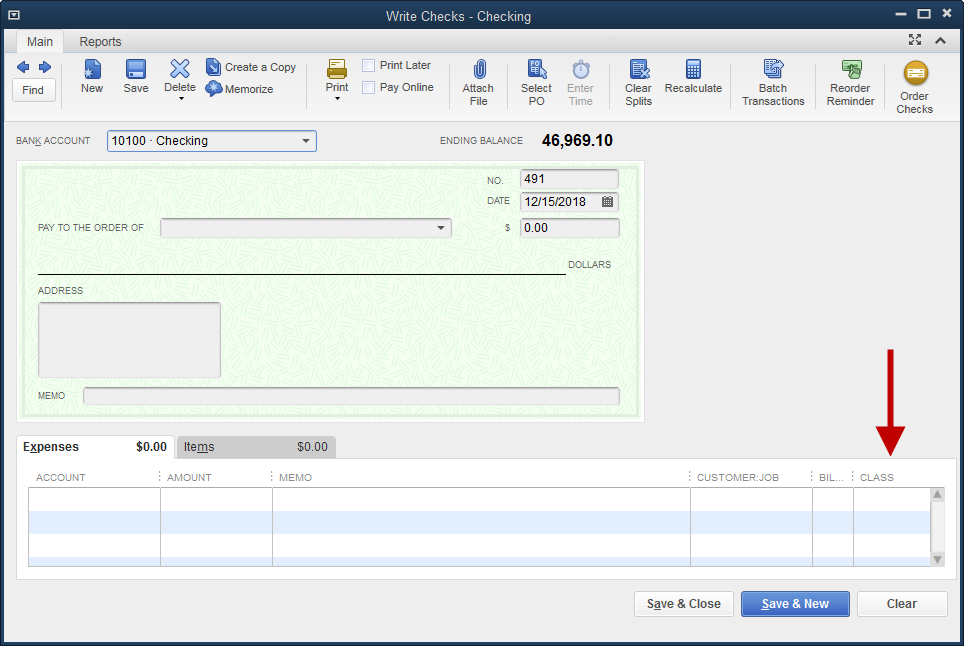

The check in the above screenshot will be available for invoice creation in QuickBooks without additional manual entry.

Note the two arrows. A Customer:Job name has been selected in the appropriate column of the stub portion of the check. Even if jobs are not used in your business, the customer name needs to be entered here in order to use this invoicing feature.

Entering the customer name allows the Billable column to be selected. Placing a checkmark here directs QuickBooks to keep track of this expense. It will be used later to create an invoice for this customer.

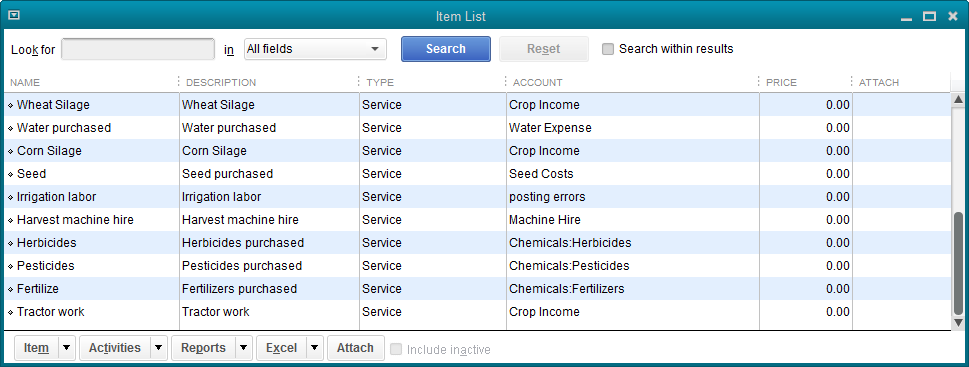

The line drawn around the two tabs of the check stub highlights an important method for entering these types of expenses. Note that the Items tab has been used, not the Expenses tab.

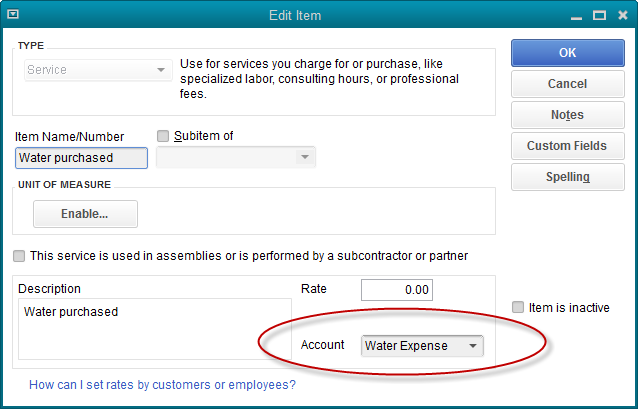

The Expense tab requires an account from the Chart of Accounts to be used to identify the expense. The Items tab requires an item.

The benefit to using an item rather than expense is superior reporting. While the item may be created to post to the very same account that might be used on the Expense tab, using the item will improve reports in QuickBooks that use these types of transactions.

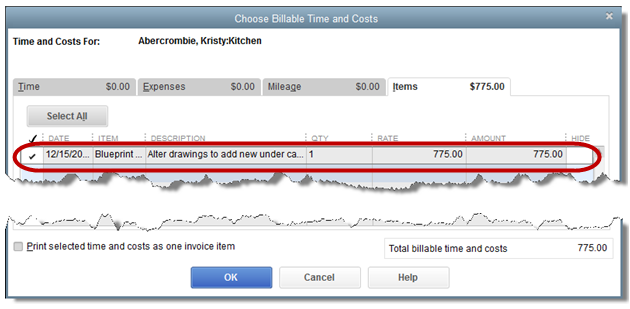

Now it is time to invoice the customer for the blueprint changes and see how our job is made easier by using the above method for creating the check.

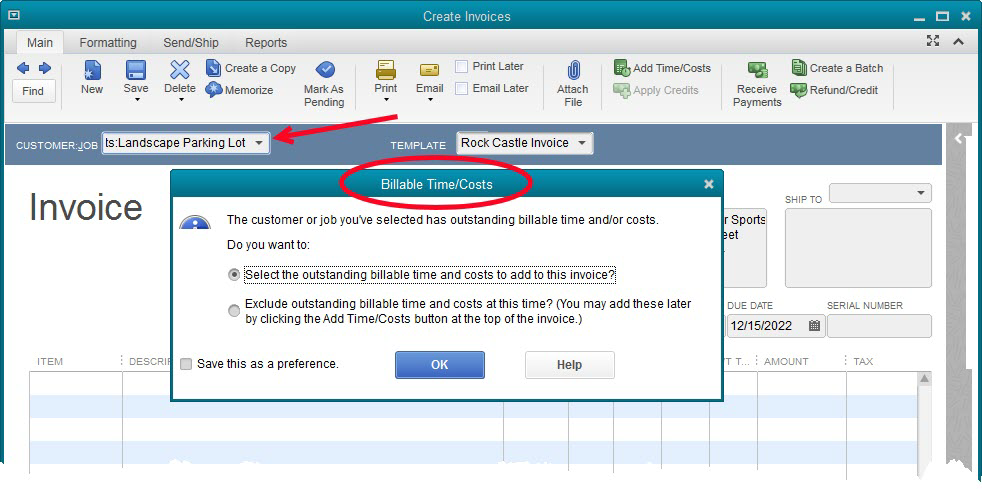

What you see when creating an invoice for this customer depends upon how the above preference is set. Should QuickBooks give you a list of available time/costs to add? Should it do nothing? Should it popup a message asking the user what should be displayed.

![]()

This screenshot shows the popup message that will ask if the user wishes to add billable costs to this invoice. Even if Exclude is selected, or the preference is set for this popup not to appear (“Don’t add any”), the option is still available. The Add Time/Costs icon on the invoice ribbon will allow using that list to create the invoice.

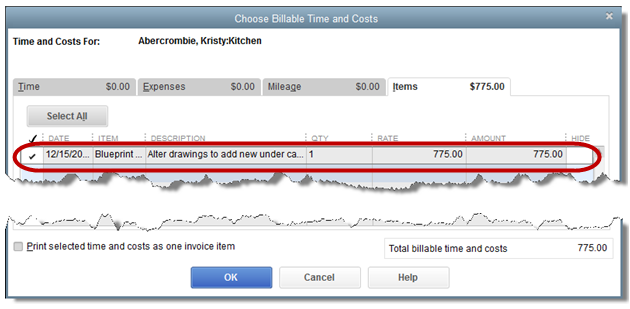

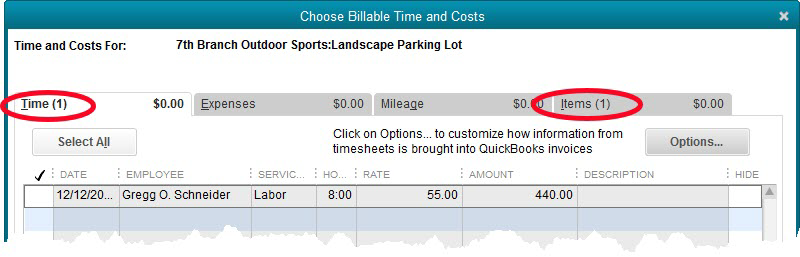

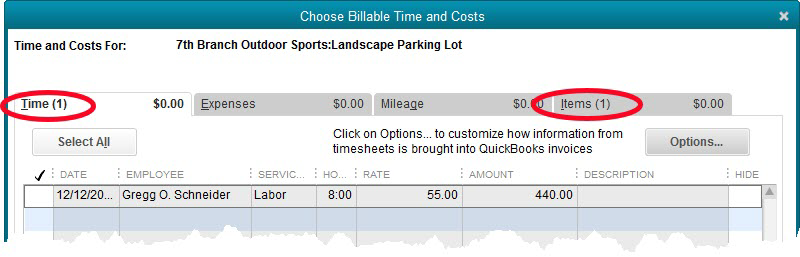

However you access it, this is the Choose Billable Time and Costs window. Note that the check we created using an item is listed here on the Items tab. Other tabs exist for time, expenses, and mileage.

The memo used in the on-screen check stub is shown here as the default description for the invoice. It can be overridden. Since there is no price entered on this particular service item (Blueprint Changes), the cost is suggested. A different price could be entered on the invoice.

The invoice has been created without any alterations from the check we used to pay the expense. It only took seconds.

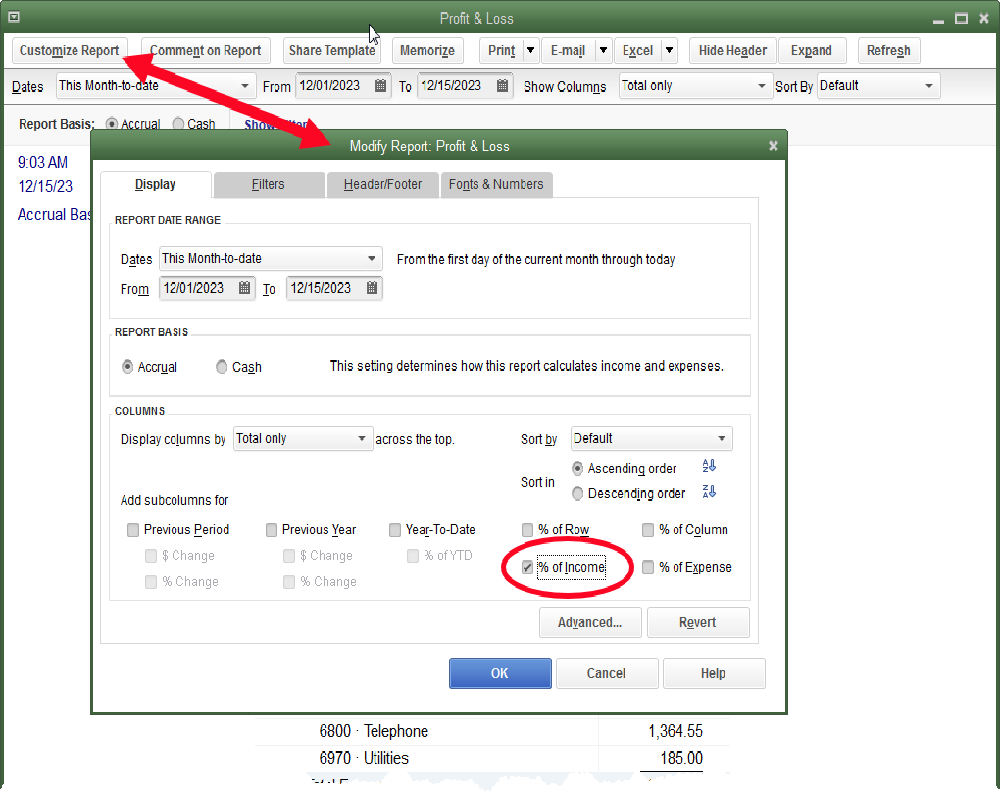

Sales Tax in QuickBooks Part 2

Part 2 - Testing Our Setup

Let’s create a couple of invoices to test our setup.

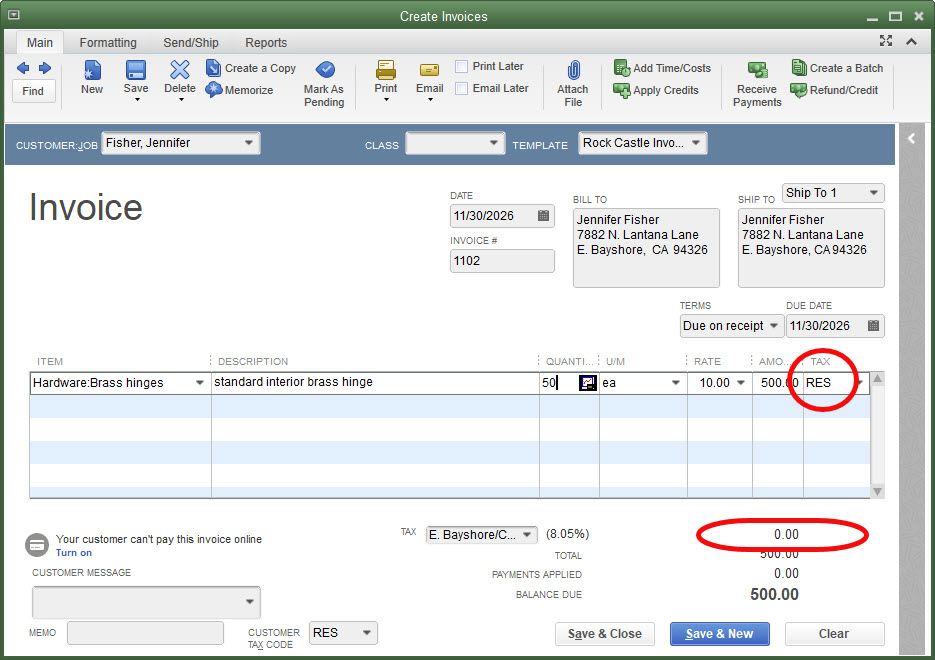

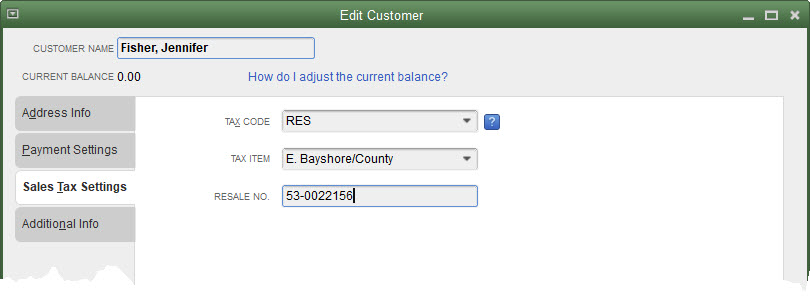

Jennifer Fisher is the customer we edited, telling QuickBooks she was ordinarily a resale customer so should not be charged sales tax. As a result, when we choose Jennifer as the customer on an invoice, QuickBooks automatically marks the sale with the RES (Resale) sales tax code and makes the sales tax amount zero.

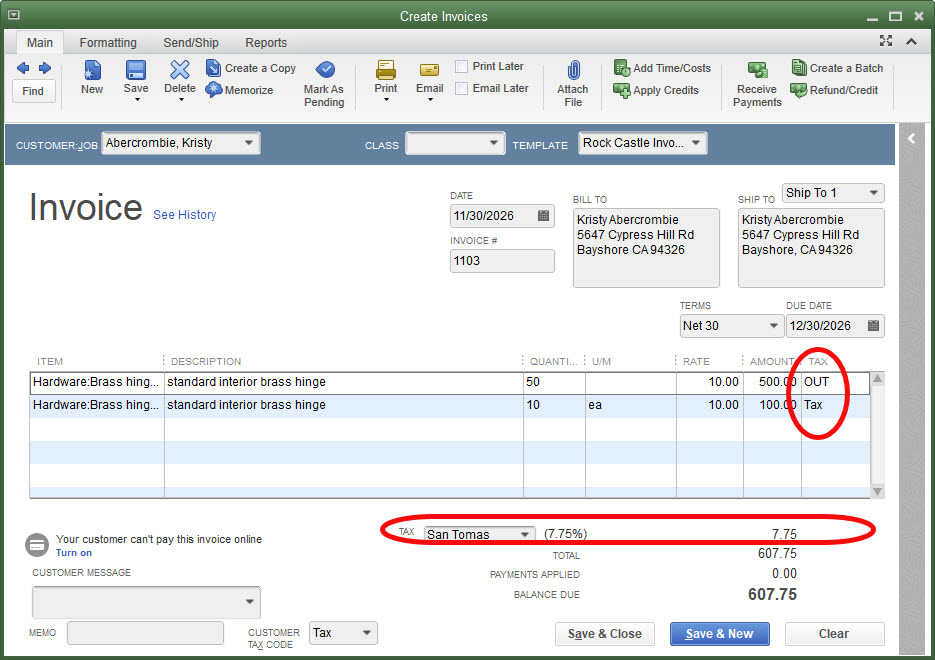

Here is an invoice you will never create. It’s done this way to demonstrate the sales tax feature.

The first line of the invoice is a sale of $500. The sales tax code has been changed, that can be done manually on each line of the invoice if desired, to OUT, designating this as a nontaxable out of state sale.

The send line of the invoice is a $100 sale marked Taxable. The sales tax line shows sales tax of $7.75, which is the tax amount for line two of the invoice. No tax is generated from the first line.

Sales Tax Reports

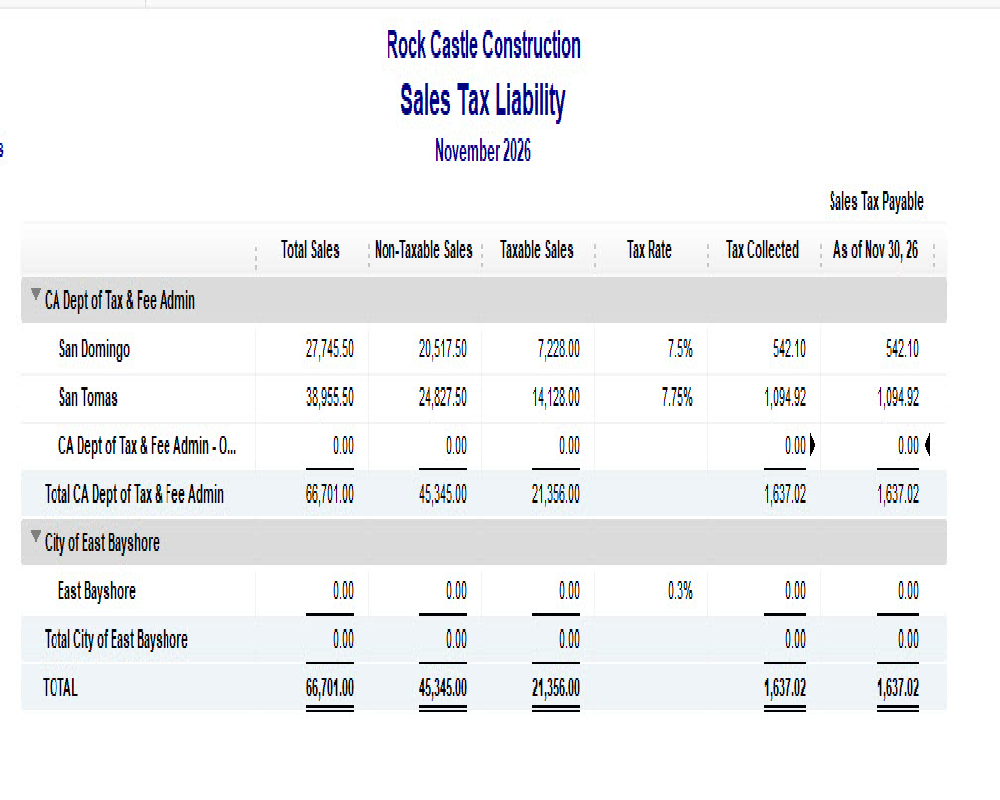

The Sales Tax Liability report is the most common report used for reporting sales tax. Reports->Vendors & Payables->Sales Tax Liability.

The report is pretty straightforward. It shows sales taxable and non-taxable and in which sales tax jurisdiction the sale was made.

Anyone who has ever completed a sales tax return knows one must report not only how many dollars in sales were nontaxable, but why those sales were not taxable. This is where the multiple sales tax codes come in.

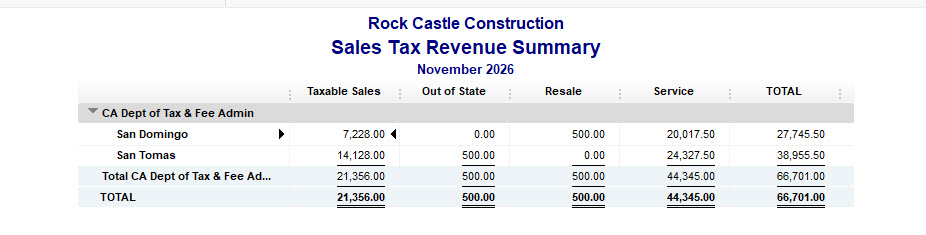

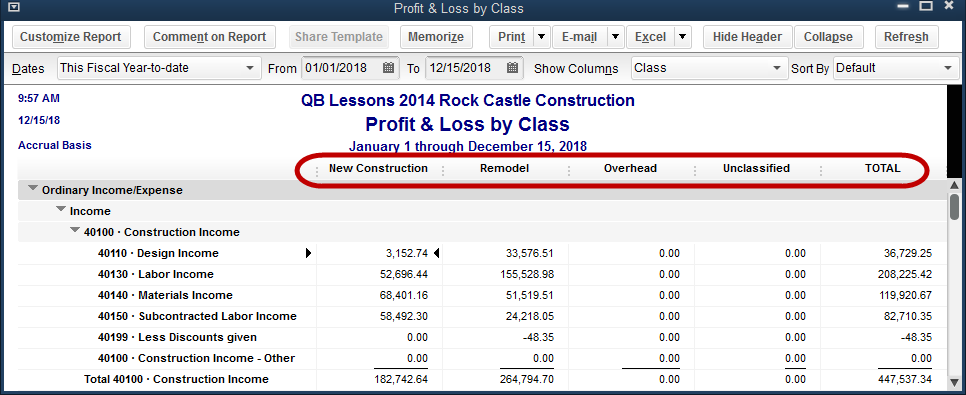

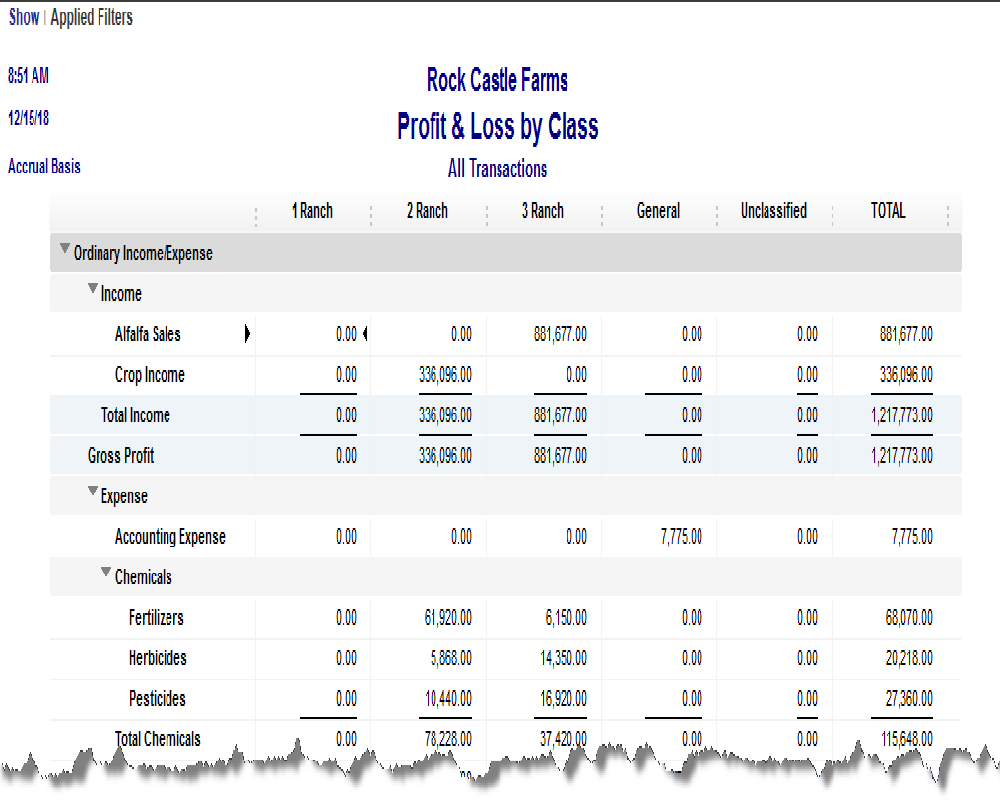

The next screenshot is the Sales Tax Revenue Summary report.

If you do the math, you will find nontaxable sales of $45,345. Same as the sales tax liability report. Only now we know that $500 is for out of state customers, $500 is for a resale customer, and the remaining $44,345 is for nontaxable services.

That’s the value of the multiple sales tax codes and the sales tax revenue summary report.

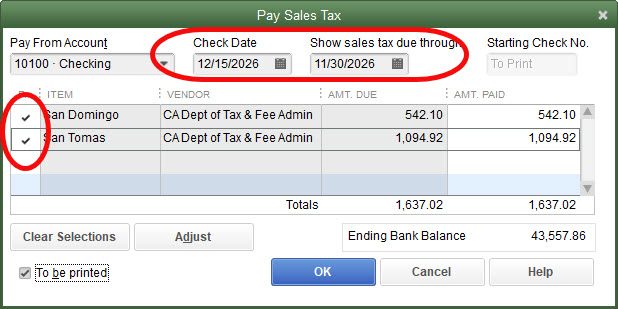

Pay Sales Tax

Similar to the way payroll taxes should always be paid using the Payroll Center, QuickBooks provides a way to pay sales taxes. This is less critical than payroll taxes but does help the program keep track of what is owed. Especially if the tax must be paid to different vendors.

Navigate to Vendors->Sales Tax->Pay Sales Tax and you can use the following window to pay sales tax. Make sure the proper dates are selected. Check the tax being paid, often this will be all the lines in the window, then click OK to create the check.

Armed with this information, you should be ready to tackle sales tax with QuickBooks.

Sales Tax in QuickBooks

Part 1 – Setup

The sales tax feature in QuickBooks desktop uses several steps for setup. It also requires knowledge of multiple components of the program. Once setup is complete though, it functions as well or better than any program we know. Compare it to sales tax in QuickBooks Online where things get very challenging very quickly.

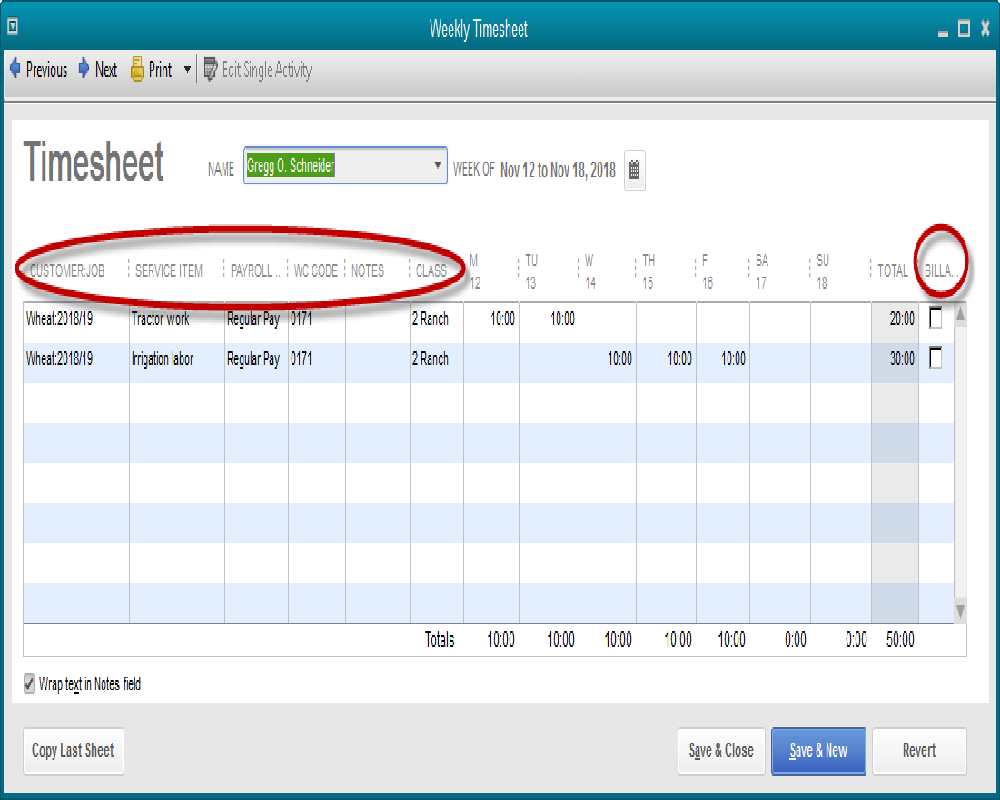

Sales Tax Items

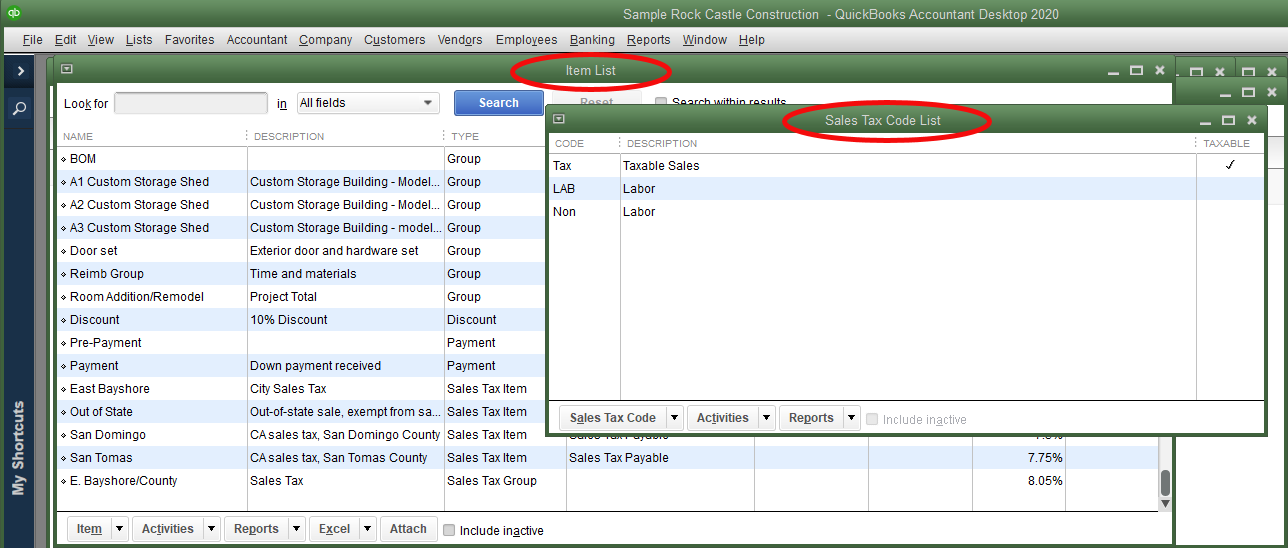

Setting up sales tax in QuickBooks starts with an item.

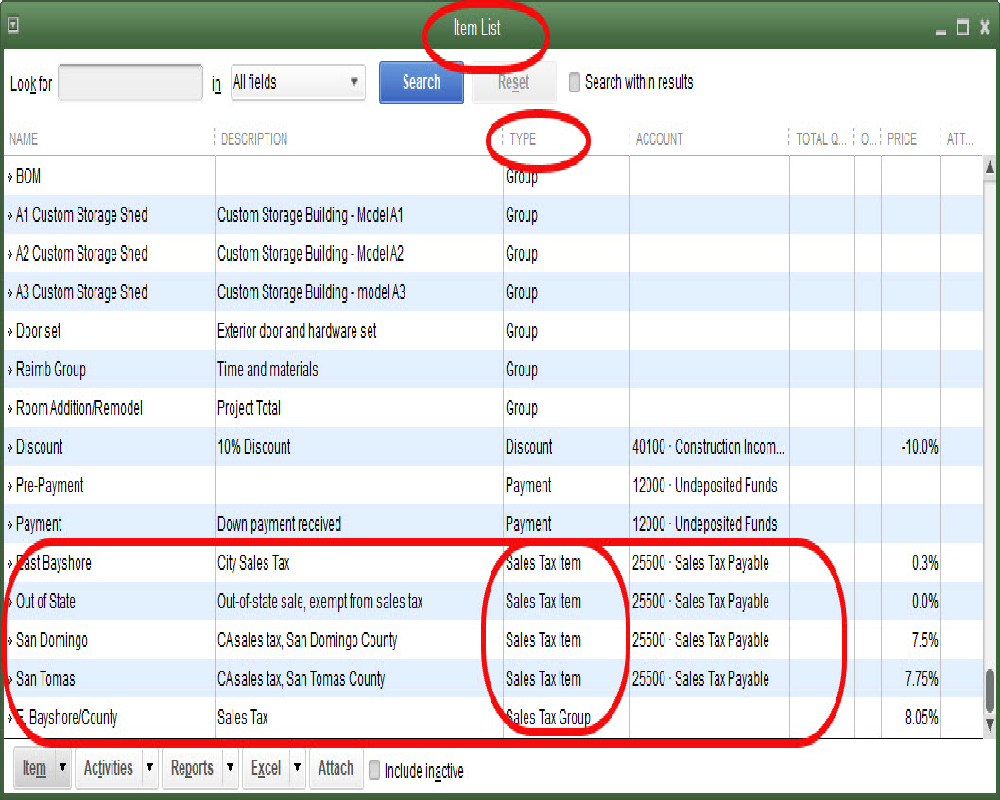

Typically, if the item list is in default order, the sales tax items will appear at the bottom of the list.

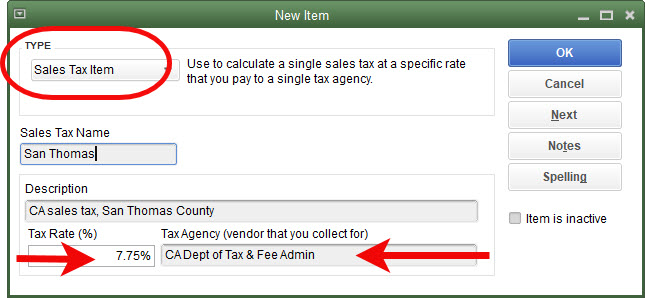

Creating or editing a sales tax item is straightforward. See the screenshot below.

The item must be created as a sales tax item. The name and description can be your choice but use something that helps describe what this particular sales tax item is for. The sample file used in the screenshot is a good example.

Be sure the rate is correct as this obviously determines how much tax is charged the customer. Using the correct vendor is also important. Using an incorrect vendor will give you headaches when it comes time to pay the tax.

You may only need one sales tax item if all your customers are charged the same. Some will need multiple sales tax items as they may be delivering or working for customers in different sales tax jurisdictions with different rates.

Sales Tax Groups

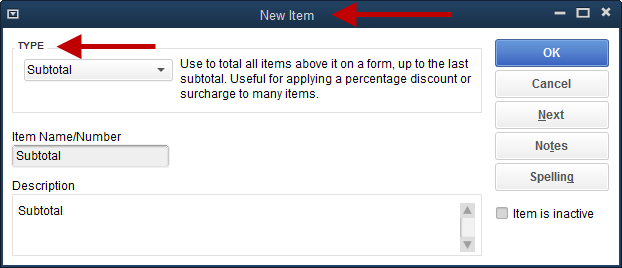

If you have a sharp eye, you may have noticed that in the first graphic showing the item list is an item with the type, Sales Tax Group.

Sales taxes are usually made up of several components. In California, the largest portion goes to the state, another part to the county, some to the city, and in some cases, another small portion to a special district created by the voters.

Other states may have some, all, or none of these splits. If they have some, there are places where at least one of the components of the total tax rate must be paid to a different vendor. The purpose of groups is to allow each component piece of the tax to be created, selecting the vendor it should be paid to. Then, the components can be grouped to be used on customer invoices as one tax rate, which is all QuickBooks can use on a single invoice.

In California, we are fortunate that all components of the sales tax amount are payable to the state. So, with one vendor, we only need one sales tax items for the entire amount.

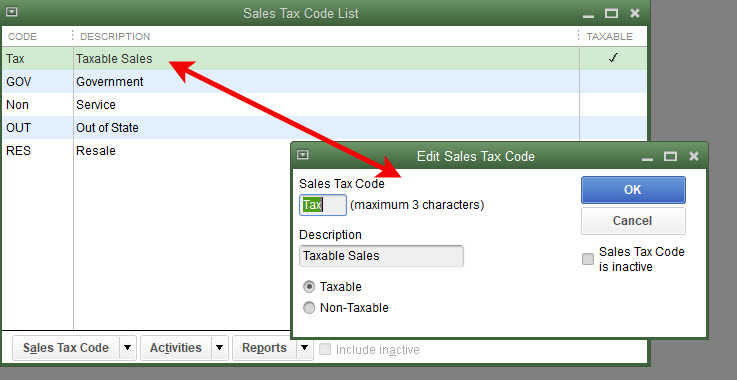

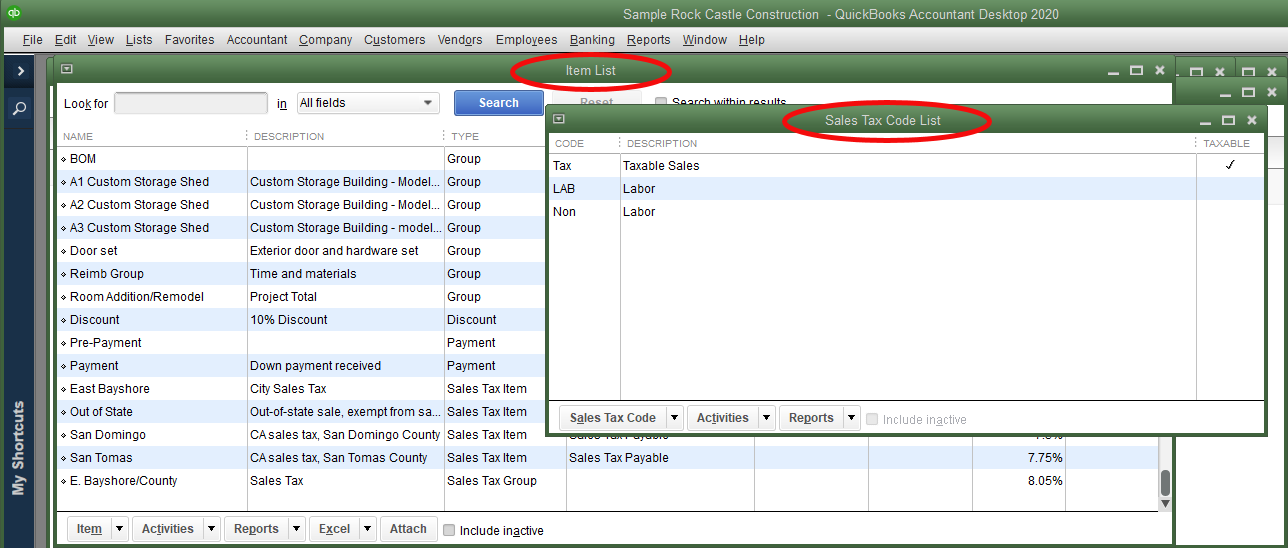

Sales Tax Codes

This can sound confusing to someone new to setting up sales tax in QuickBooks, but the software has both sales tax items and sales tax codes. As we saw in the earlier section, sales tax items tell QuickBooks, among other things, what the sales tax rate is and who (the vendor) to pay that sales tax to.

Sales tax codes tell QuickBooks if something is taxable or not. Expanding on this feature, it will tell us why something is not taxable as well.

Navigating to Lists->Sales Tax Code List will access the list of sales tax codes. In the above graphic, the edit window for Tax has been opened by double-clicking on the list entry.

The codes GOV, RES, and OUT were added to the sample file. The description for Non was changed from Nontaxable to Service. All these additions and changes will be better understood later as we use them in transactions and reports.

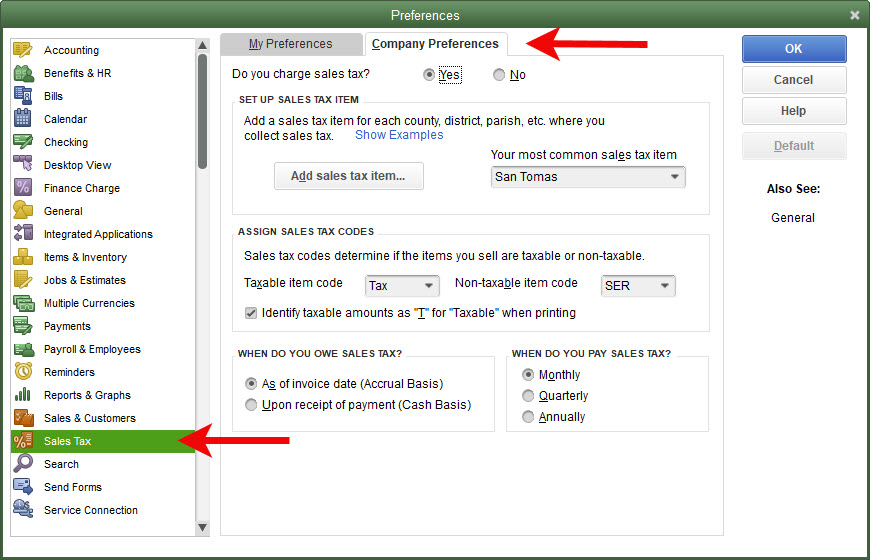

Preferences

There are several preference settings for sales taxes. Note that, if you have sales tax ‘turned on’, QuickBooks wants a ‘most common’ sales tax item selected. Some QuickBooks users may only have one sales tax item, so this is an easy choice for them. Even if you have more than one sales tax item, QuickBooks will not do much with this preference once you tell it what sales tax items should be used with each customer.

The “When do you owe sales tax” is an important question. Most states will regulate this so check with the appropriate agency in your state.

In California, the “As of invoice date (Accrual Basis)” is mandated. You must pay sales tax to the state based on the date of the sale, regardless of when you receive payment from the customer.

What About Nontaxable Sales?

We need to tell QuickBooks what is taxable and what is not.

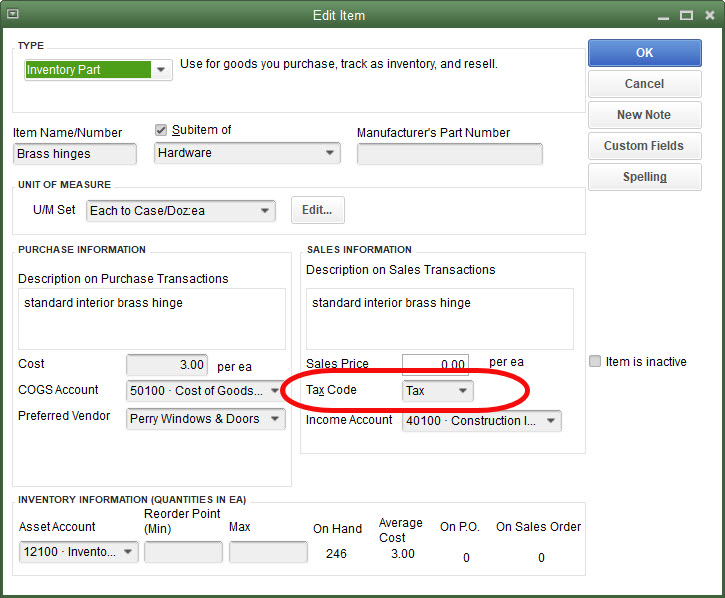

Brass hinges are a taxable item.

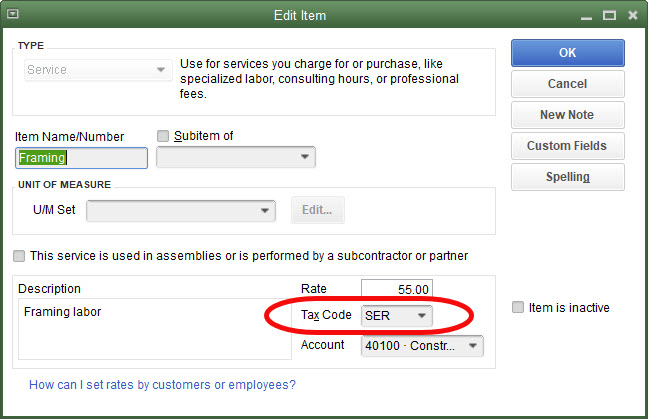

Charges for labor, like framing are not.

That’s all QuickBooks needs in order to determine whether an item should be charged sales tax or not. That can change in certain situations, like who purchased the brass hinges, but ordinarily brass hinges will be taxable so that’s how we will set them up in QuickBooks.

What About Nontaxable Customers?

Some businesses may have both taxable and nontaxable customers. Retail customers pay sales tax, others registered as re-sellers, may not be charged sales tax.

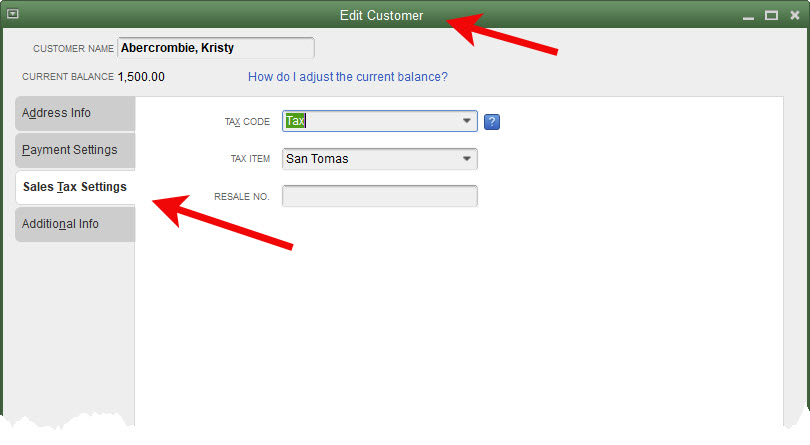

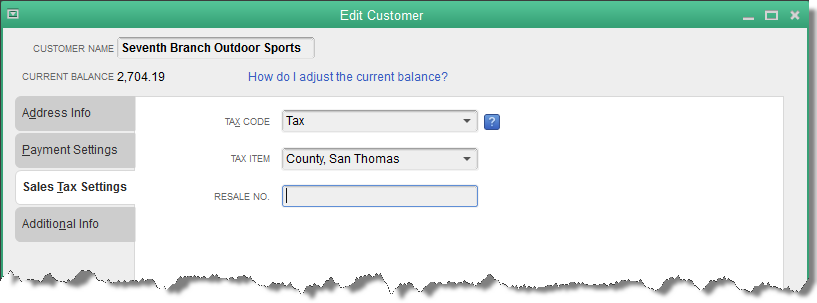

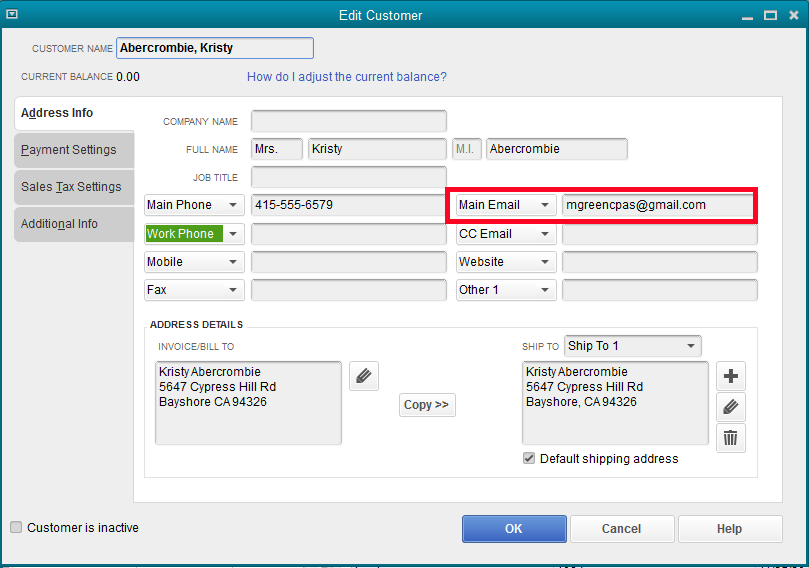

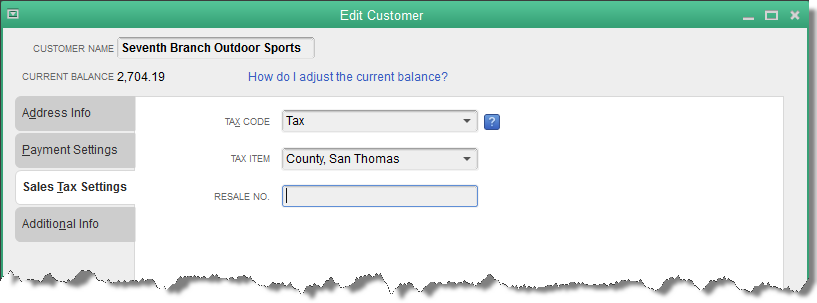

Edit the customer. Choose the Sales Tax Settings tab on the left. Choose the appropriate sales tax code.

Here is where you will use one of those custom sales tax codes shown in the earlier screenshot. If Kristy Abercrombie were a customer that did not pay sales tax because she purchased our products to re-sell later to her customers, I would choose the Resale (RES) sales tax code shown earlier.

Let’s set up a resale customer to use later when we get to reporting.

Next post, we’ll test our setup.

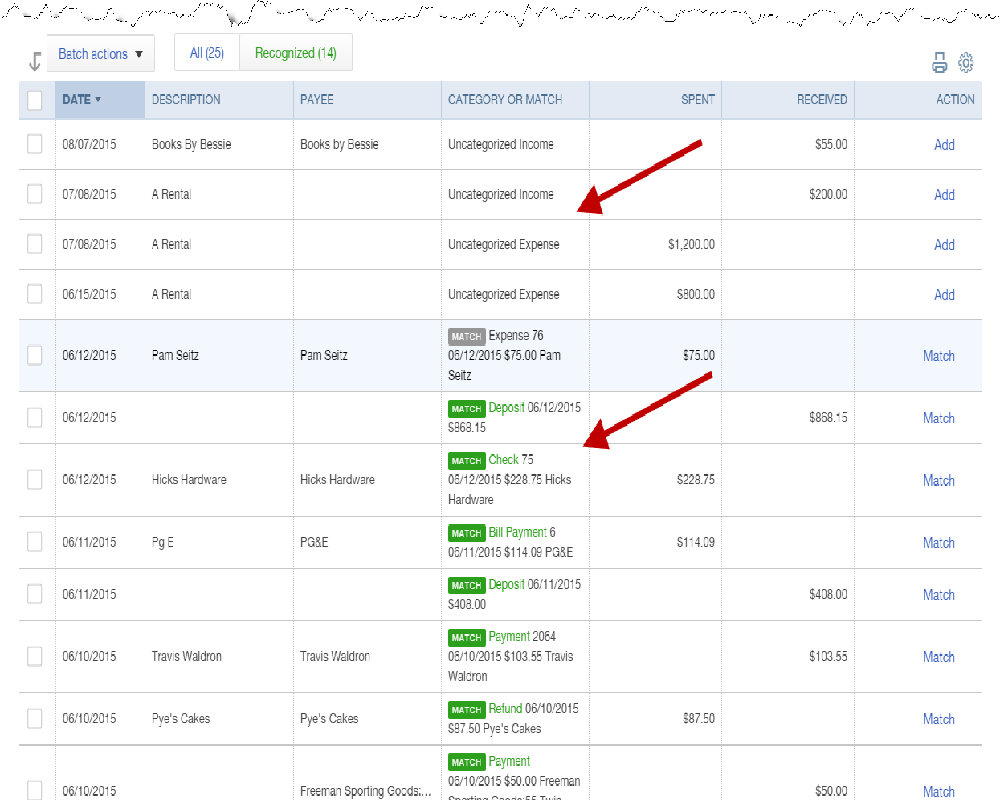

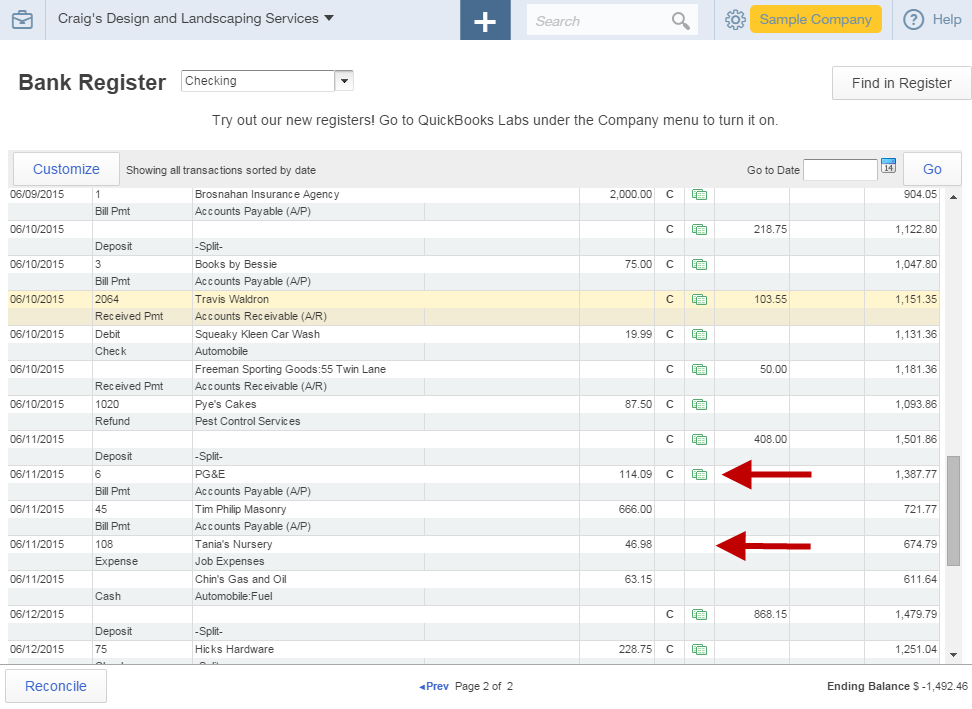

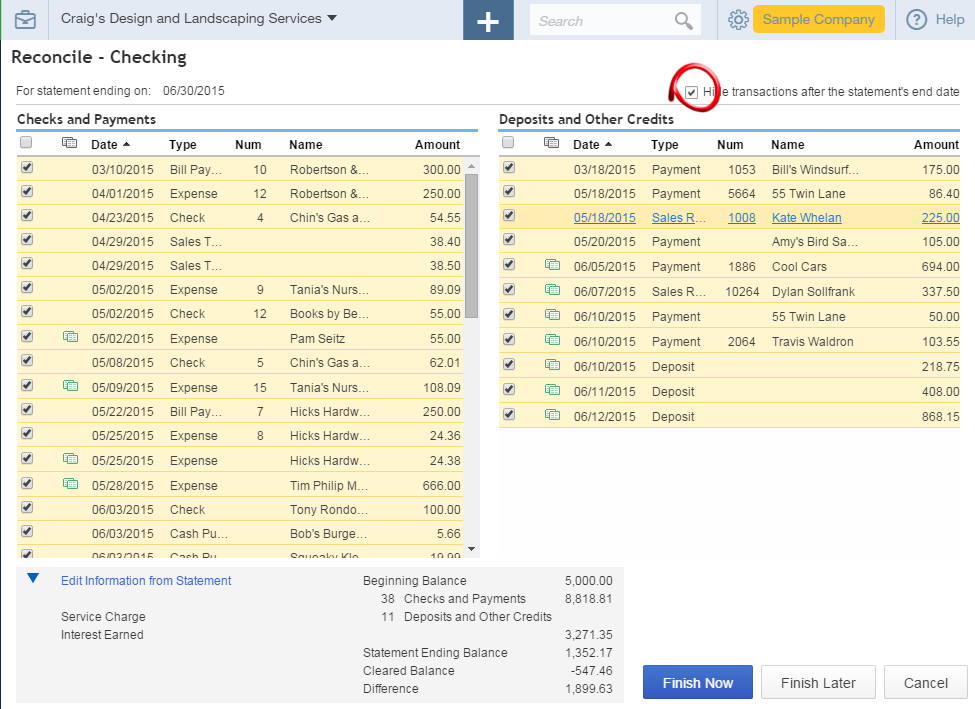

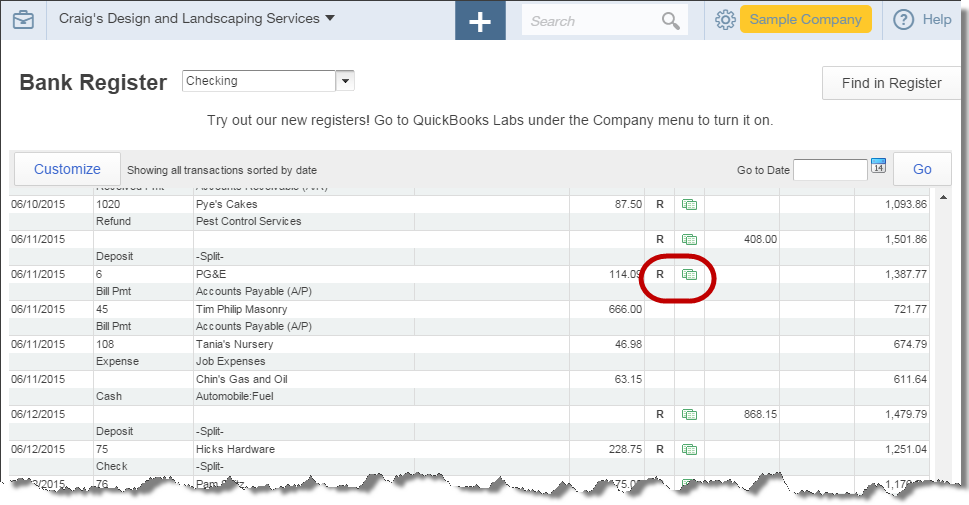

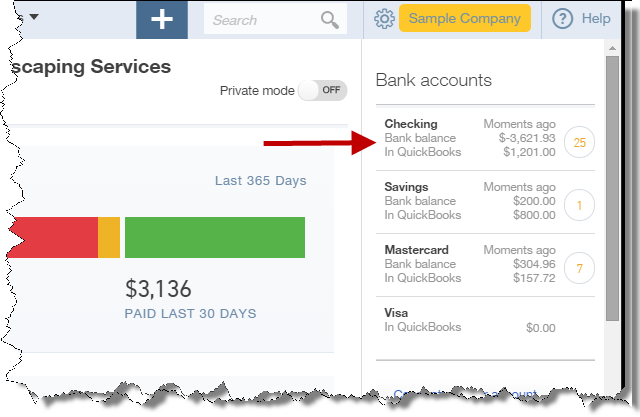

Tips for QuickBooks Bank Reconciliation

Today’s post discusses several tips to make reconciling the bank account in QuickBooks easier.

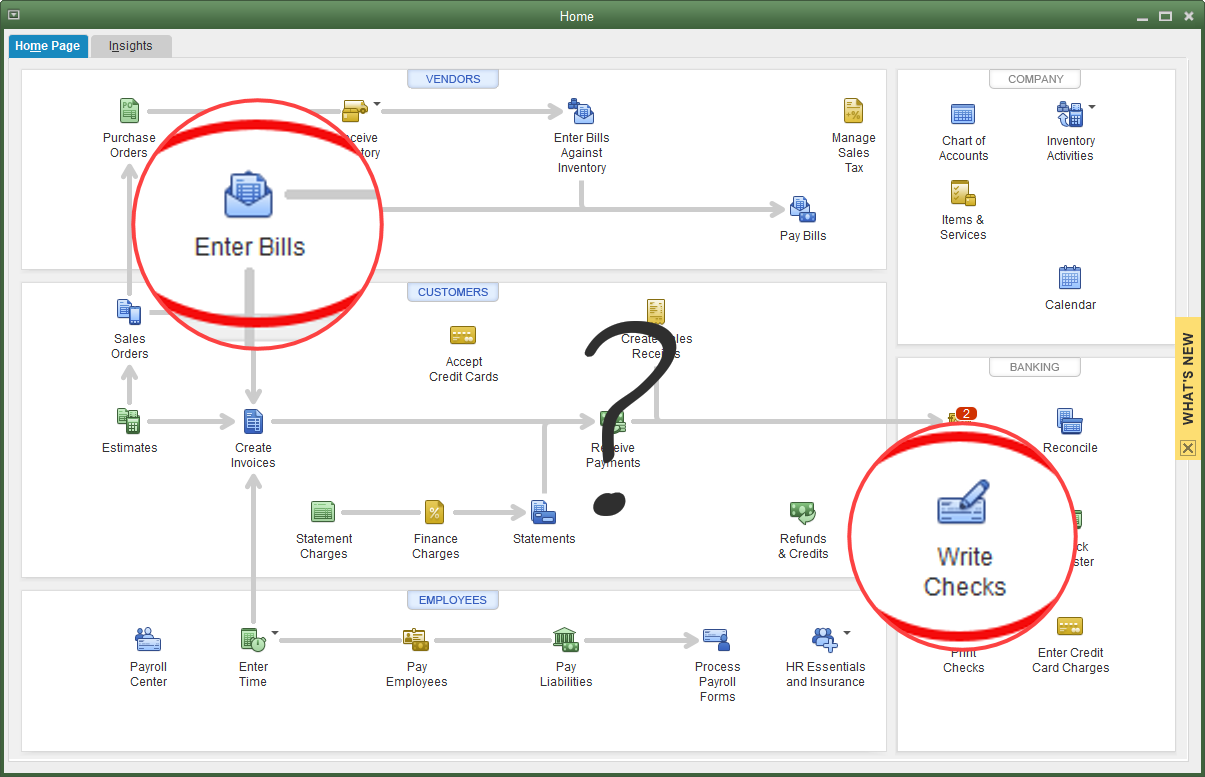

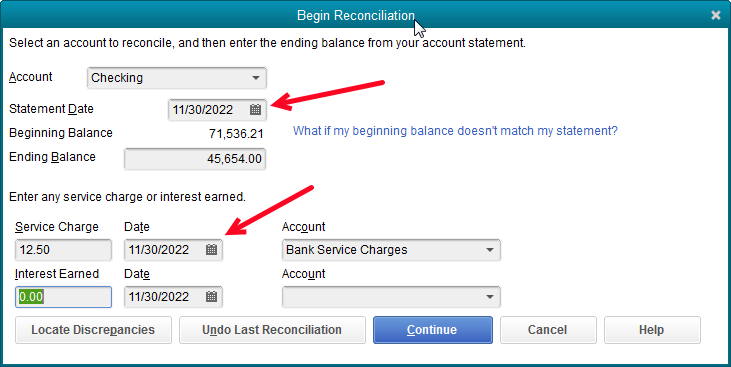

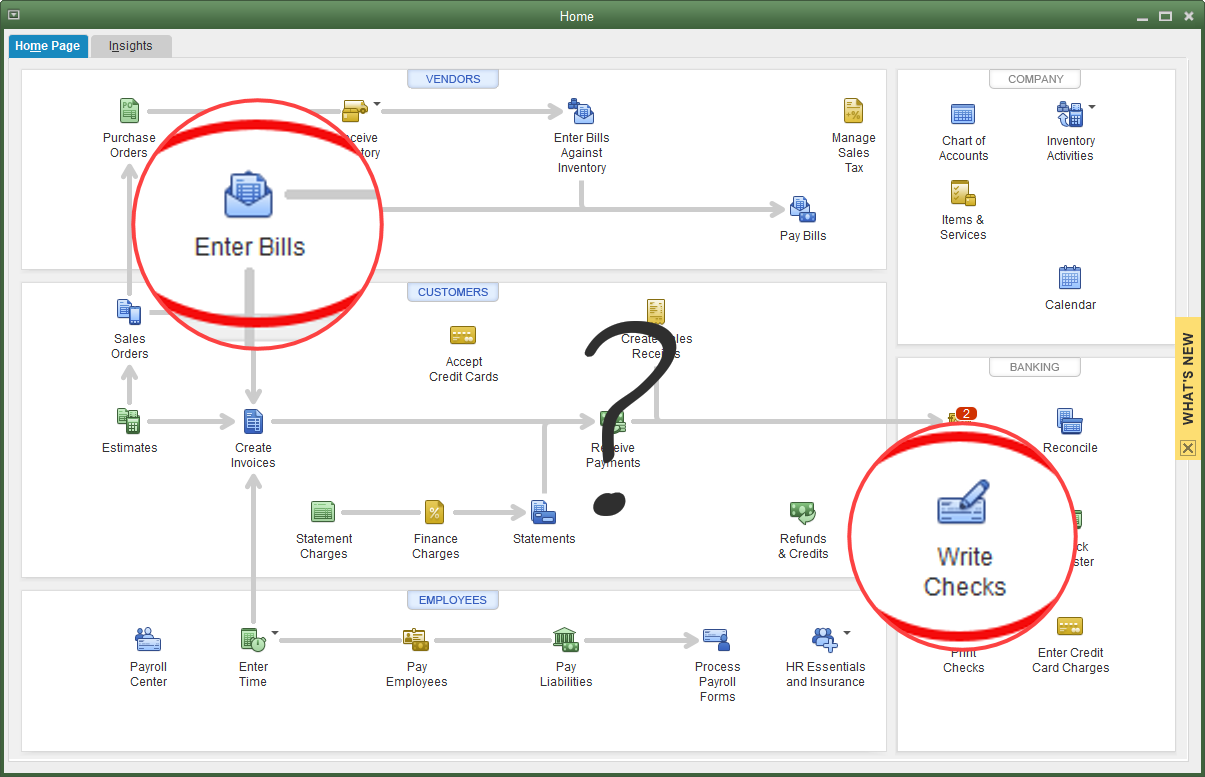

First, navigate to the bank reconciliation screen from the Reconcile icon on the Home Page.

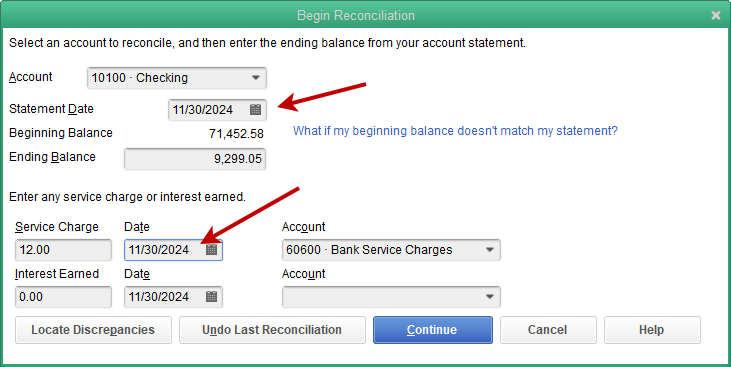

First tip, make sure your statement date and the date of any service charges or interest earned, agree.

Often these dates can become out-of-sync. Many QuickBooks users will click through this screen without even checking, unacquainted with what effects this may have on their QuickBooks file.

When the transaction date for the service charge is later than the statement date, the bank reconciliation report will not agree with the actual check register. While overall numbers are still correct, any accountant working on your numbers for reporting purposes will be sent looking for the cause of the discrepancy. For you, it’s needless billable time spent over a very small error.

One of the improvements in the bank reconciliation window from a few years back is the ability to sort the data from any of the columns. This works for either the check side or the deposit side.

It used to be that checks sorted by number only. With the increasing number of EFT and other type payments that did not align with the numbering sequence of paper checks, finding the checks became more difficult.

Now, the user can select to sort by check number, date (as in this example) or any of the other columns.

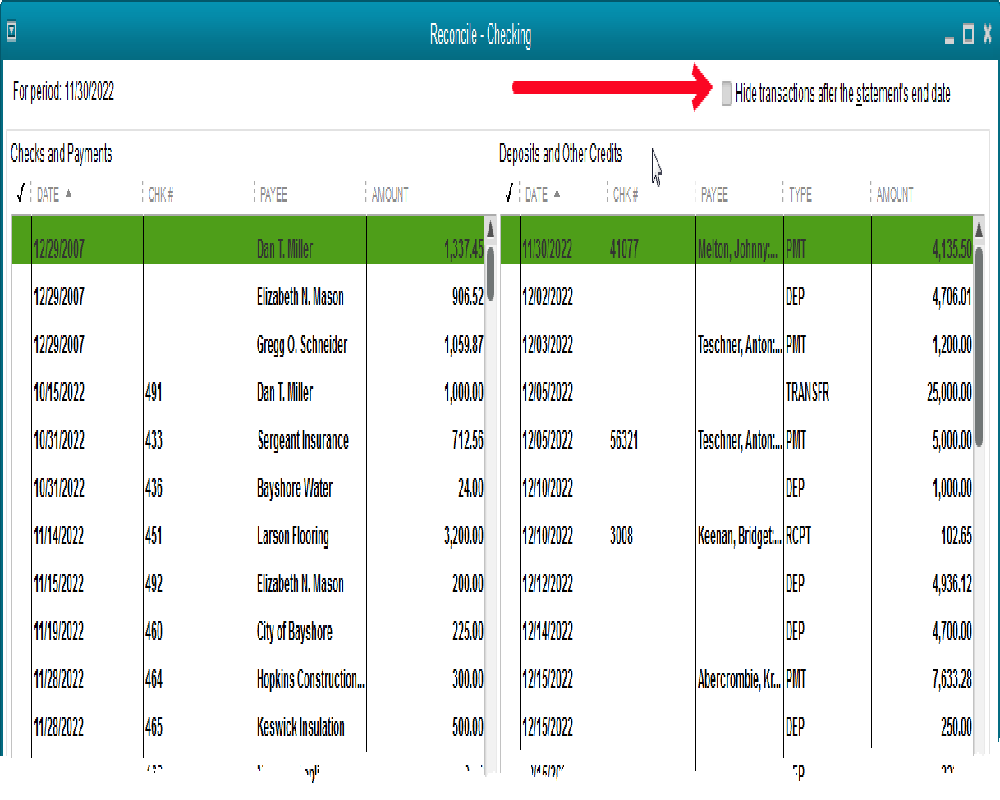

This one we’ve had for awhile. The checkbox to eliminate all transactions dated after the statement date. This results in a much shorter list of transactions to work with while finding items to clear.

Another tip. Especially for those companies that issue debit cards to certain employees. Being in the middle of a reconciliation and finding items that have not been entered into QuickBooks can be frustrating.

The check register can be opened and additional transactions added without closing the reconciliation window. It will automatically update. When you close the register, the new transactions will show in your list to be cleared.

Another frustration is items with small differences from the amount that cleared on the bank statement. From within the reconciliation window, items can be brought up in their original detail window with a double-click of the mouse.

This works best with regular checks. The amount can be edited. It will update immediately in the reconciliation window and be ready to mark as cleared.

In either of these last two cases, if the reconciliation needs to be put on hold for such an amount of time that the window needs to be closed, no worries.

You can click the Leave button. When you next return to the reconciliation window, all your work has been saved.

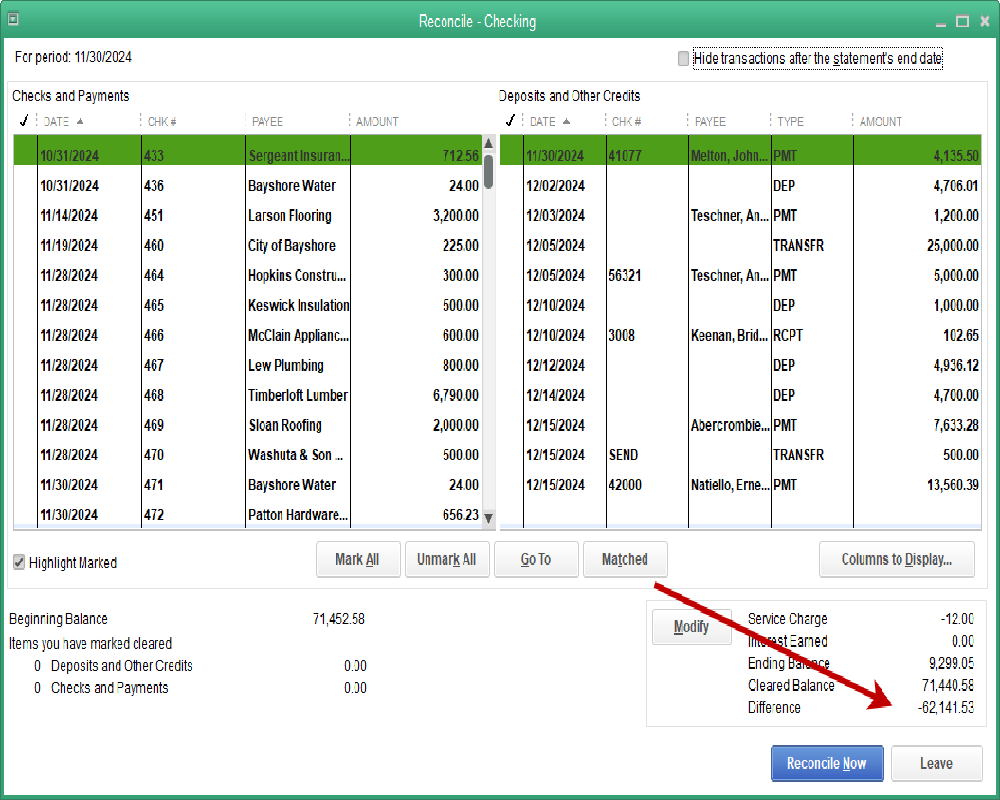

One last tip. Remember to continue correcting and reconciling till the Difference line is zero.

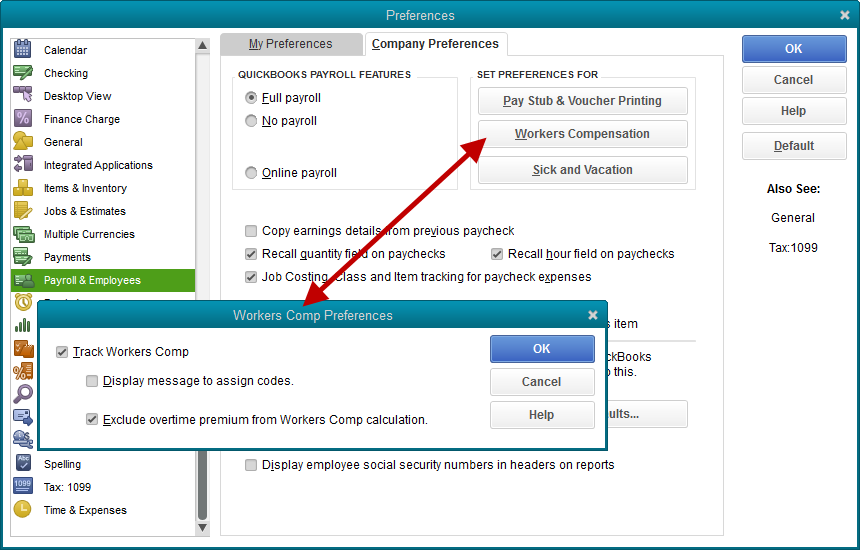

Accruing Sick and Vacation Time

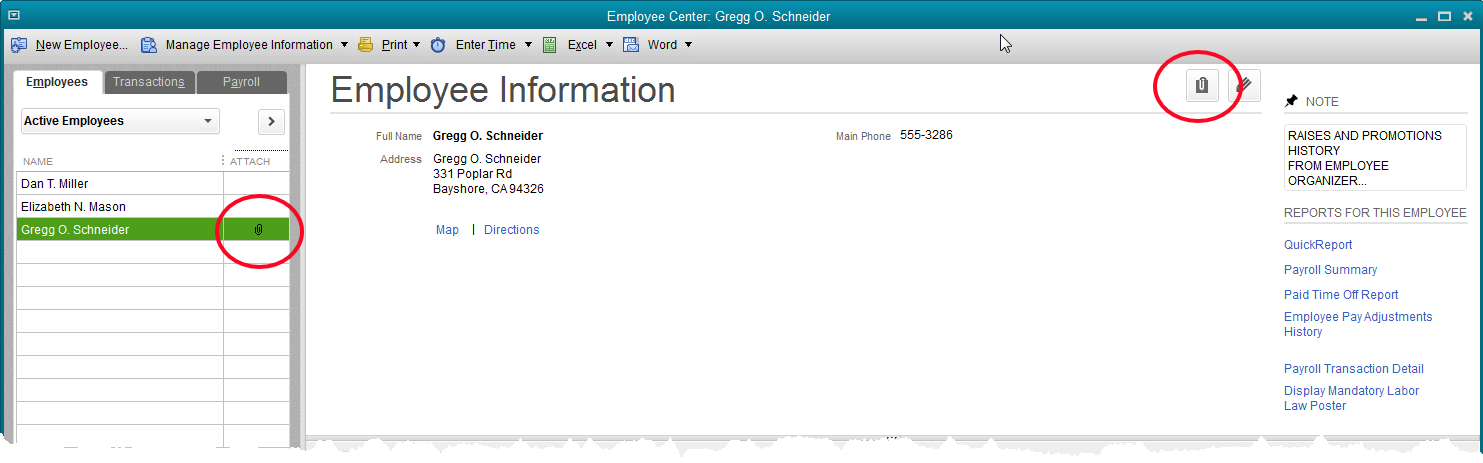

Recently, more questions have been arising about this feature in QuickBooks. We examined this a few years ago when California instituted a requirement in 2015. This law required one hour of paid sick time be accrued for every thirty hours worked. Let’s revisit how to do this. The instruction, of course, can be applied to any sick or vacation benefits you may wish to provide.

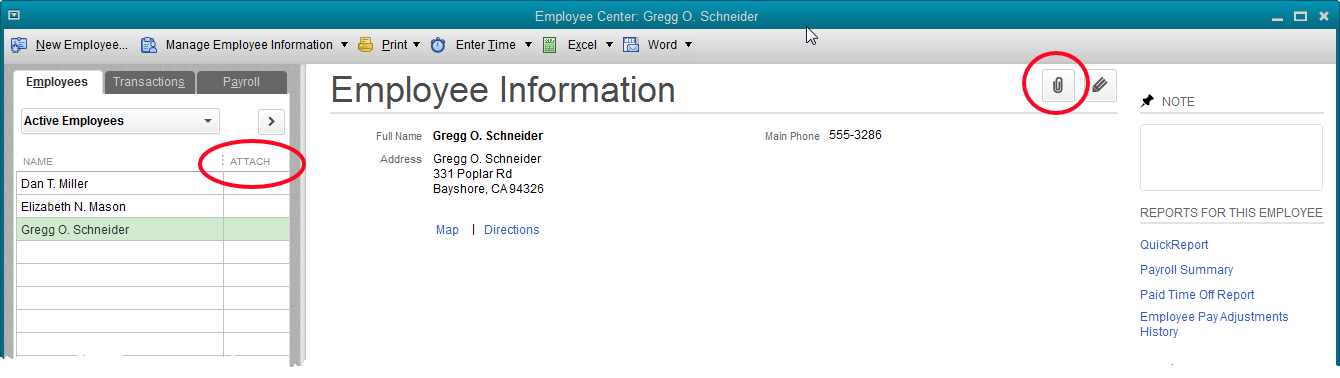

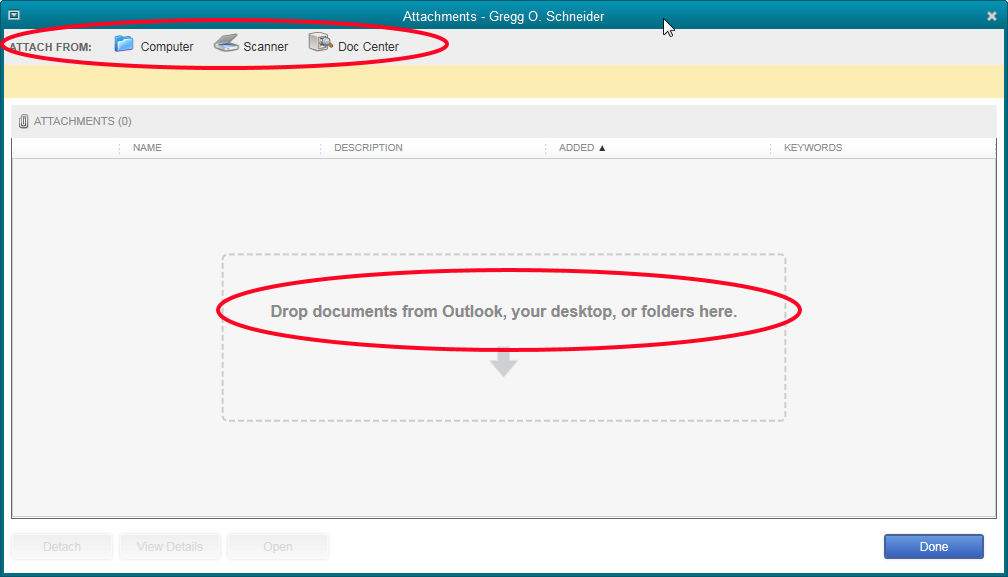

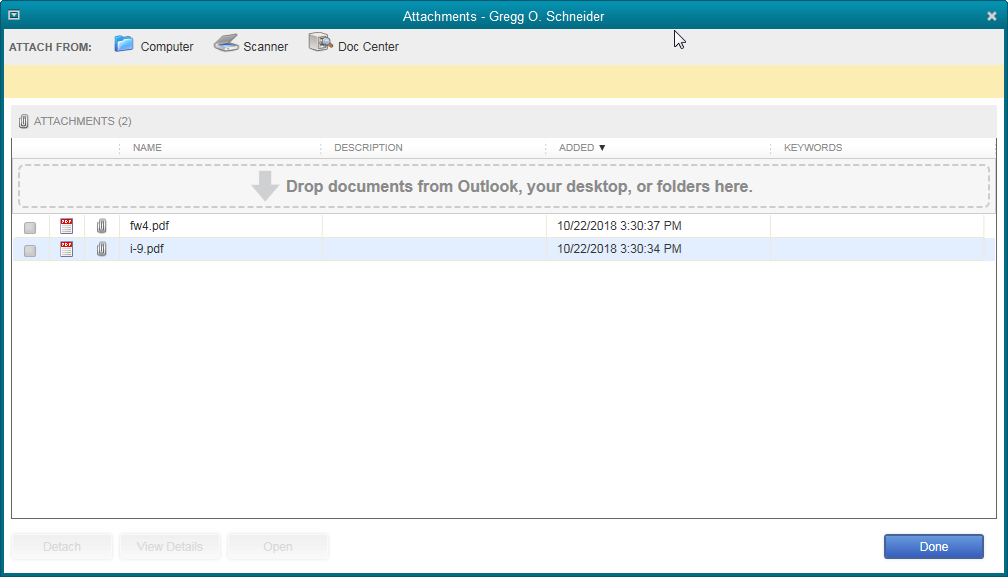

We will setup this time off accrual in Employee Defaults, that way it will be the default setting every time we hire a new employee.

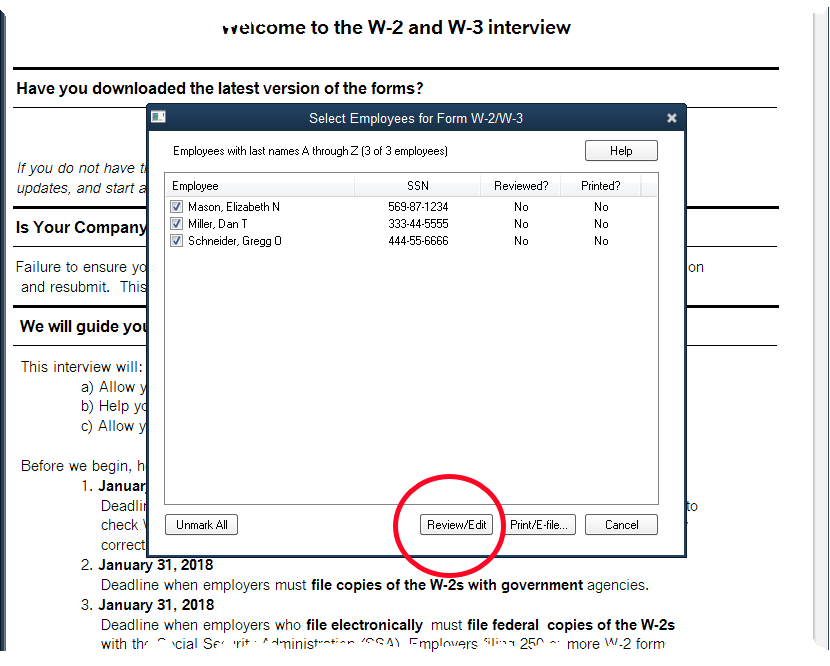

Open the Employee Center. From the Manage Employee Information dropdown menu, choose Change New Employee Default Settings. Click on the button, Sick/Vacation.

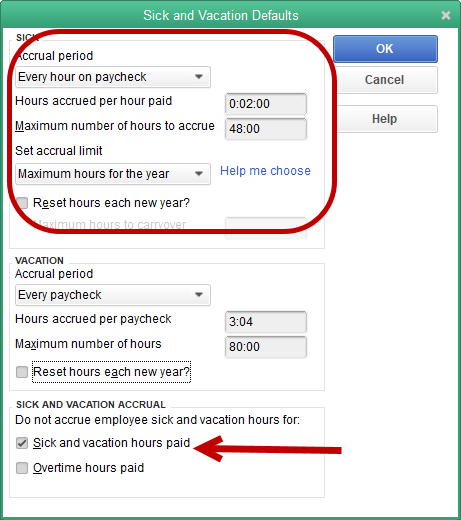

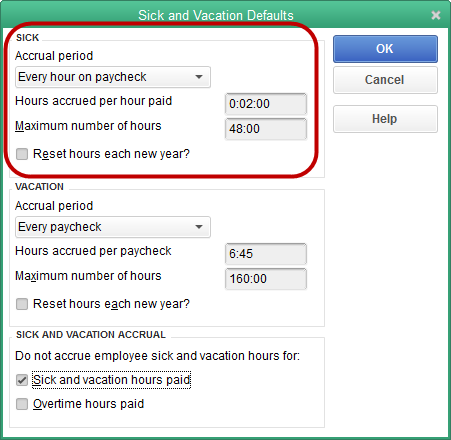

The top portion of the Sick and Vacation window is the portion we will use. It is specifically labeled for sick time, the bottom portion for vacation.

The accrual period is set for “Every hour on paycheck.” In this instance, that’s what we need. A certain fraction of an hour for each hour worked.

The next field tells QuickBooks how much time to accrue for every hour worked. In the sample file for Rock Castle Construction, time is set to show in hours and minutes. This is a setting in preferences. The time could show as a decimal.

In our case, the amount of time to accrue per paid hour is two minutes. 0:02:00. This setting will accrue sixty minutes by the time the employee has worked thirty hours, exactly what we need.

If time showed as a decimal, this amount would show as .03333.

The employee will be allowed to accrue a maximum of forty-eight hours. At that point, time ceases to accrue until some hours are used, bringing the amount available below forty-eight again.

The hours will not reset each year, a setting that is not permissible in many areas.

Note the checkboxes in the bottom portion of the window. We don’t want paid sick to accrue on sick and vacation time used, so we will make that selection here.

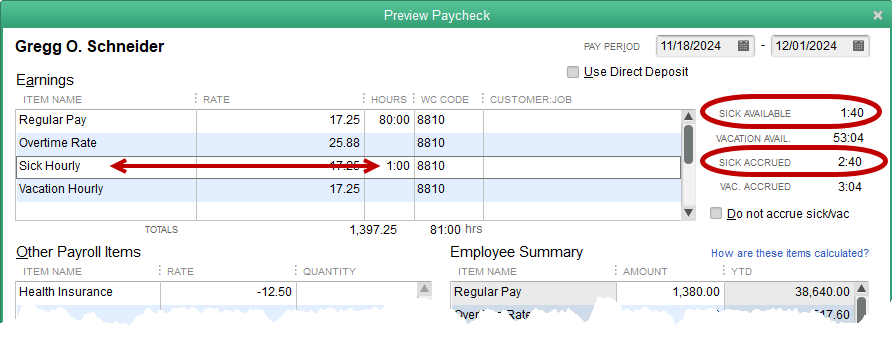

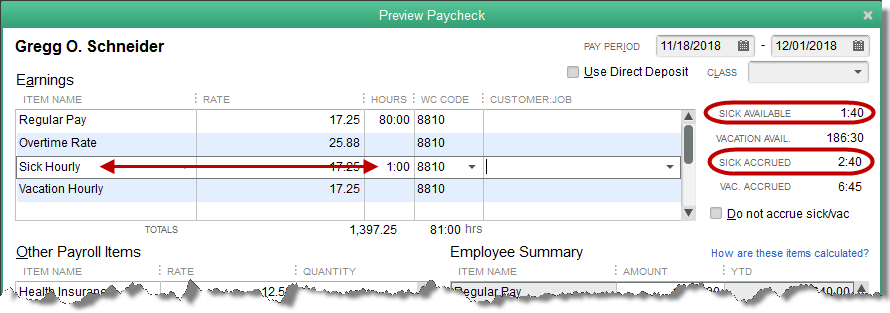

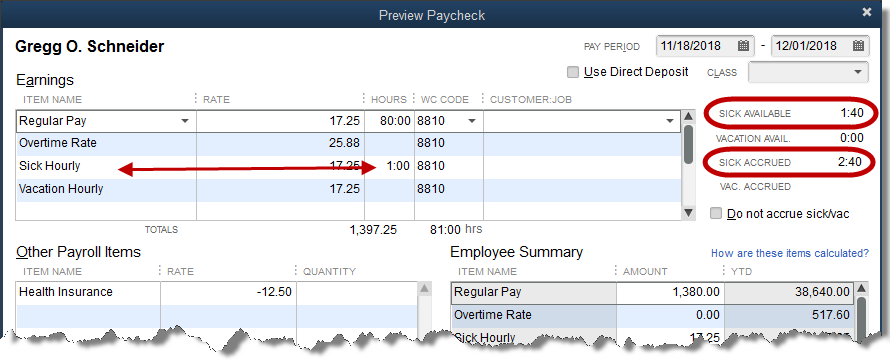

Above is a paycheck created for a Rock Castle employee. Note the circled areas on the right. The lower of the two shows that Gregg has accrued 2:40 in sick for the hours on his check. That’s eighty hours times two minutes each, resulting in 160 minutes, or two hours and forty minutes, for this paycheck.

The double headed arrow points out that we have added one hour of sick time to be paid. This lowers the amount of sick time available to 1:40. That is the amount shown by the top circled area, Sick Available.

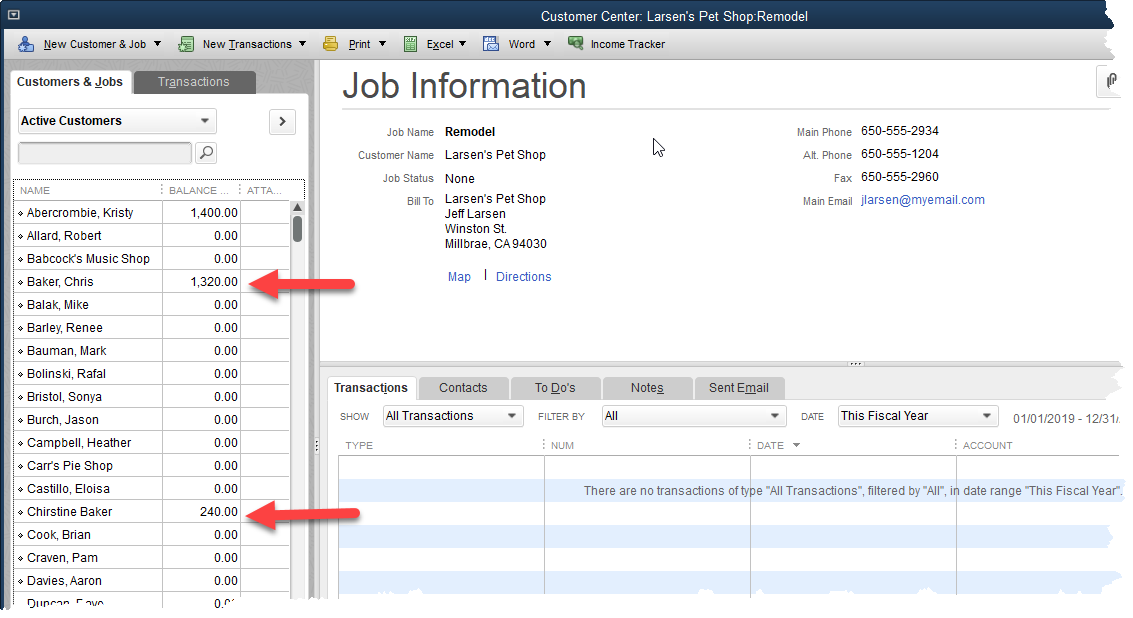

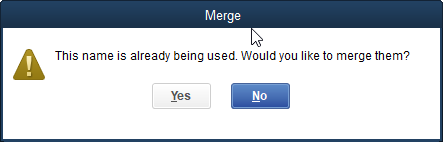

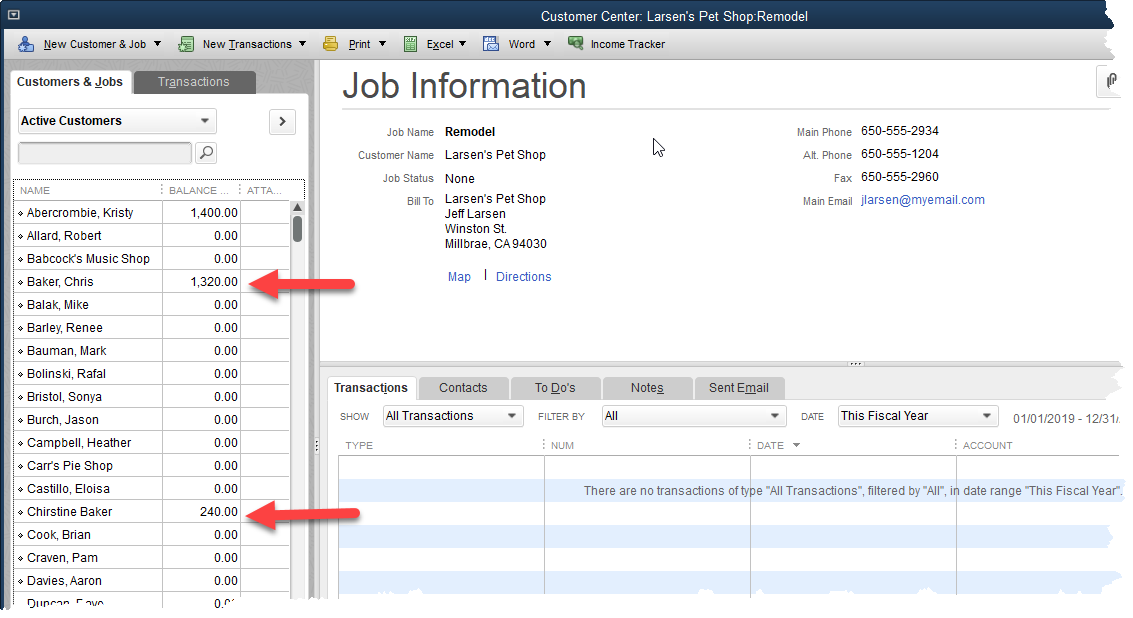

How to Manage Duplicate Names in QuickBooks

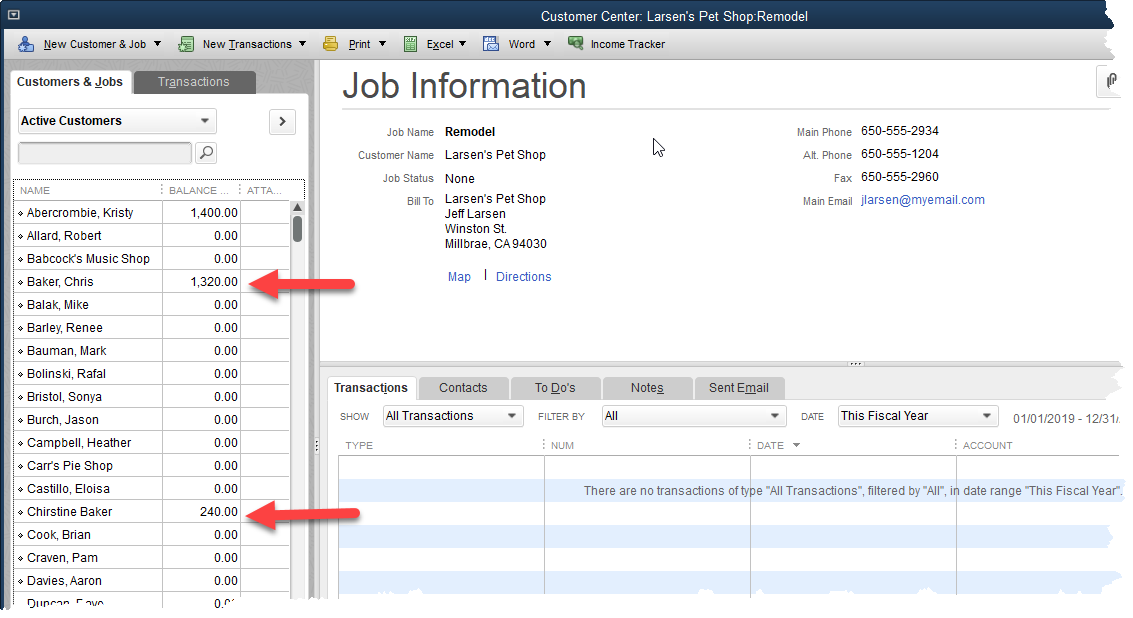

It happens. Baker, Chris has been a customer for a long time. But so has Christine Baker. And they’re the same person.

If you have used QuickBooks long enough, you know that if you try to delete one of those customers, QuickBooks won’t allow you to do it. At least, not if transactions have been recorded under both names.

You could go back and change the customer name on every transaction, leaving one of those duplicate entries with no activity in your QuickBooks company file. Then you could delete it. But there’s an easier way.

Above is our customer center. You can clearly see the duplicate customers. Both names have a balance due. Both have transactions.

To fix this, we first need to decide which version of the customer name we want to keep. Christine Baker? Okay, let’s do that.

Either click on the Baker, Chris name and choose the Edit icon, or right click on the name and choose Edit from the popup menu.

This is how that edit window appears now:

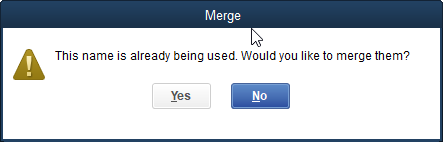

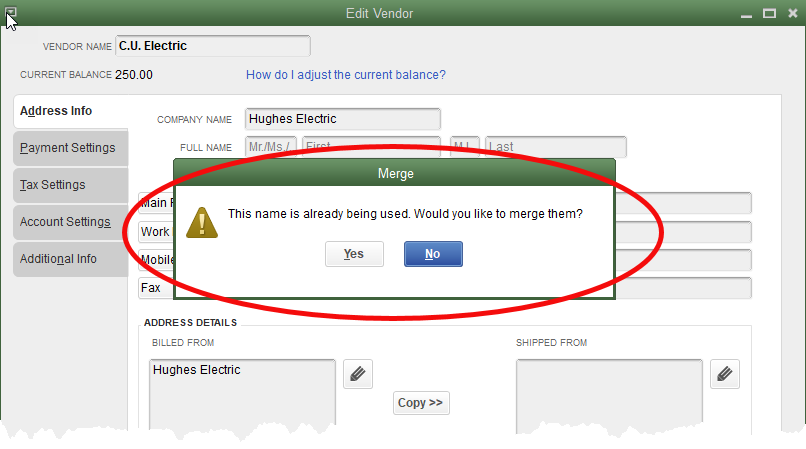

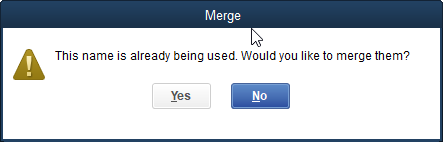

The very first field of this window is what QuickBooks sees as the customer name. That is Baker, Chris. Edit that to read Christine Baker. Then click okay and if you’ve spelled the new name right, you should get this warning message.

QuickBooks gives you a chance to reconsider since this is a permanent change. There’s no going back. Once you say yes to this message, QuickBooks has no way of recovering the old information.

In this case, it’s a simple change and we know we want to do it, so we’ll choose Yes. As soon as we do, our new customer list looks like this:

There is only one Chris or Christine Baker now. The two customer balances are now one. All transactions in the QuickBooks company file that used to show Baker, Chris as the customer name now show Christine Baker as the customer name.

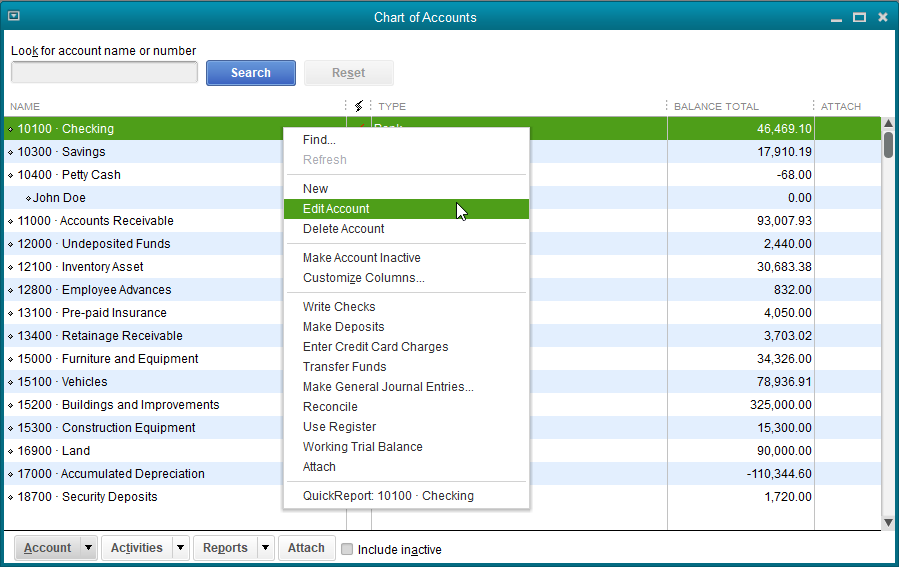

This works with other lists as well. You can re-vamp your chart of accounts by editing and merging account names. Vendors, classes, items, etc. Just use care and think through your change before implementing it.

If there is some question about the impact on your company file, create a backup, make your change, and see how it works for you. If some surprising result pops up that makes you wish you hadn’t made the change, restore the backup and you’re back to your original company file.

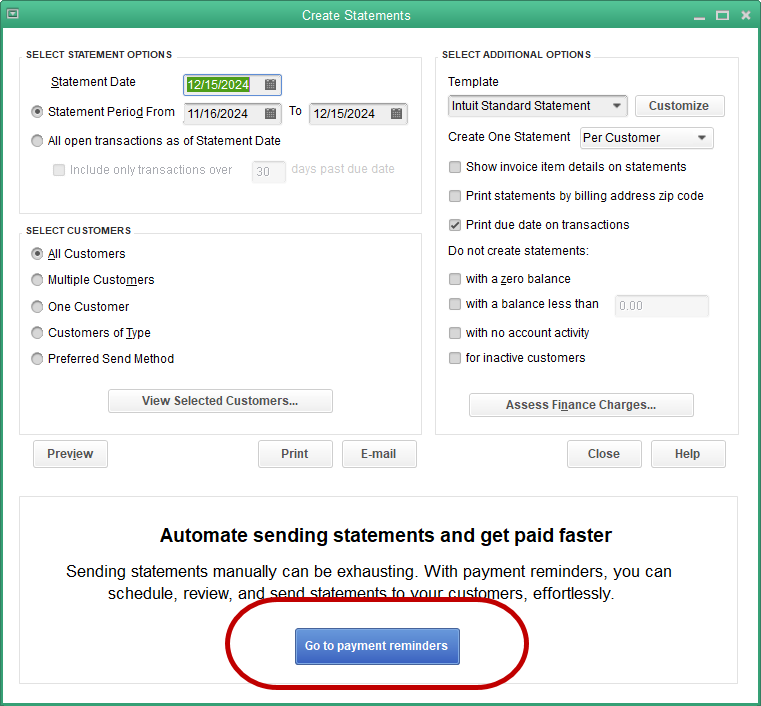

Automated Customer Statements

In QuickBooks, it’s possible to automate the process of sending customer statements. We’ve written about customer statements before. They’re an excellent tool to remind customers to pay outstanding balances. In recent years, QuickBooks has enabled this process to be automated.

The screenshot below shows the screen used for creating customer statements. Click the blue ‘Go to payment reminders’ button.

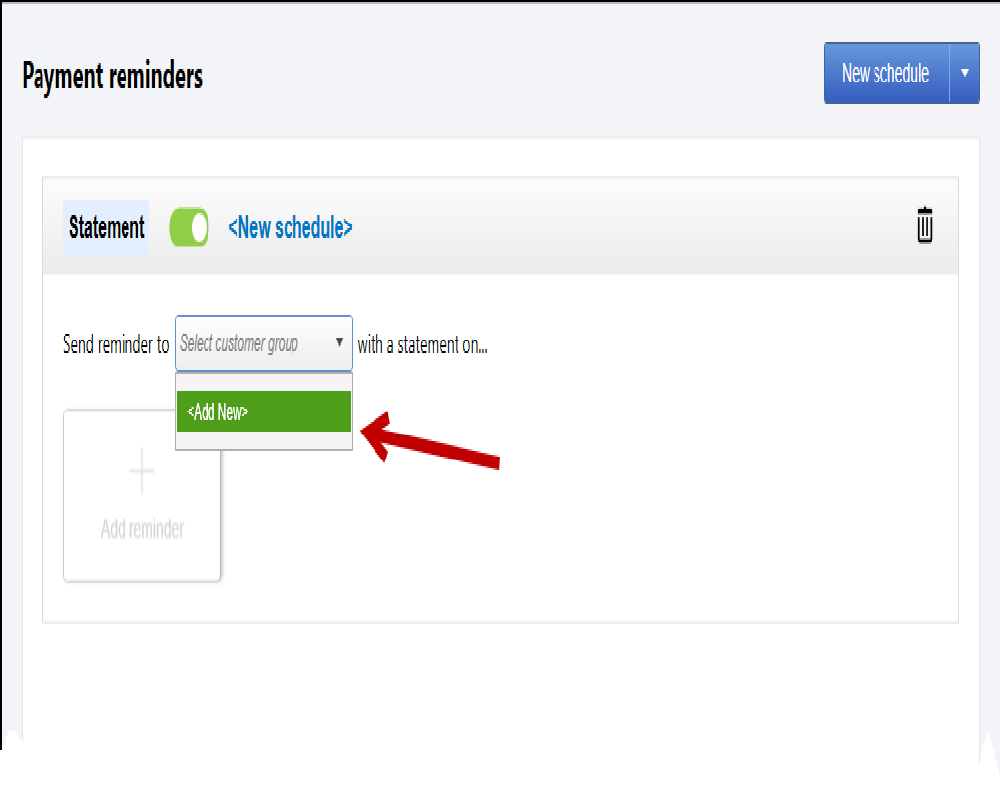

The first step in automating the statement process is to create a schedule. Who is going to get statements and when?

The first thing QuickBooks wants to know is, who? Who gets a statement?

In the screenshot above, the Add New refers to adding a new group of customers so you can instruct QuickBooks on how their statements should be handled.

Once you select the Add New button, QuickBooks will ask you to create a name for this group. So, examples might be Commercial, Retail, over $500 balance, etc.

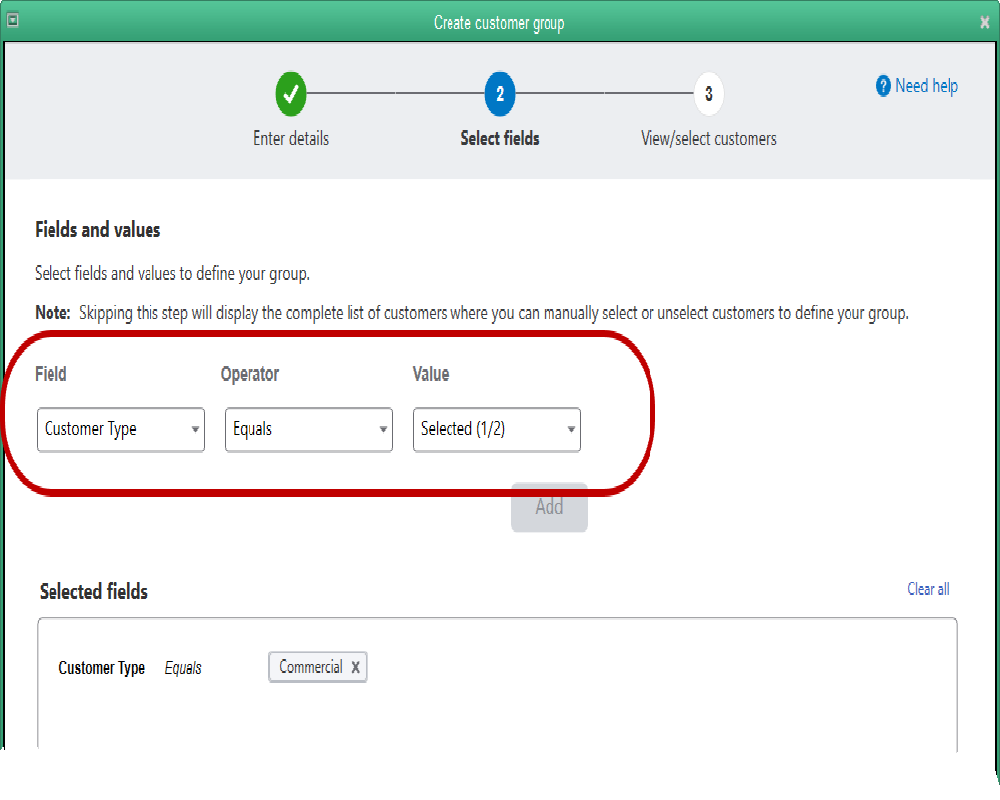

In the screenshot below, we set the criteria so QuickBooks can determine who should be in this new group.

In the example above, Customer type has been selected as the field QuickBooks should look to in order to find the data to decide who should be in this group. There are quite a few other options.

You can choose customer balance, then in the Operator dropdown, choose “Greater Than”. This would enable you to choose all customers with an outstanding balance greater than $XXX.XX. That would become the customer group. It would change as customer balances change. At the appropriate time, QuickBooks will send those statements.

There are other options like all the customers with a certain Sales Rep, in a certain country, state, or using a certain sales tax item.

In our example, we’ll create a group of all the Customer Type = Commercial.

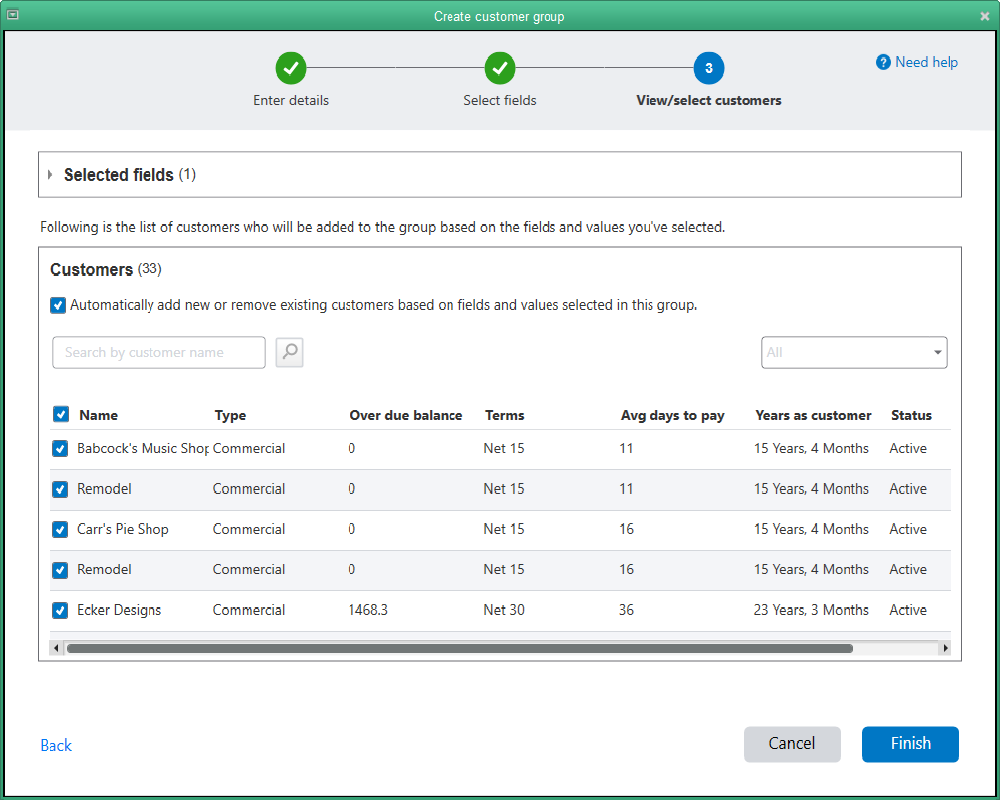

And there we are. All of Rock Castle Construction’s customers of the customer type commercial, are now in this group.

What’s next?

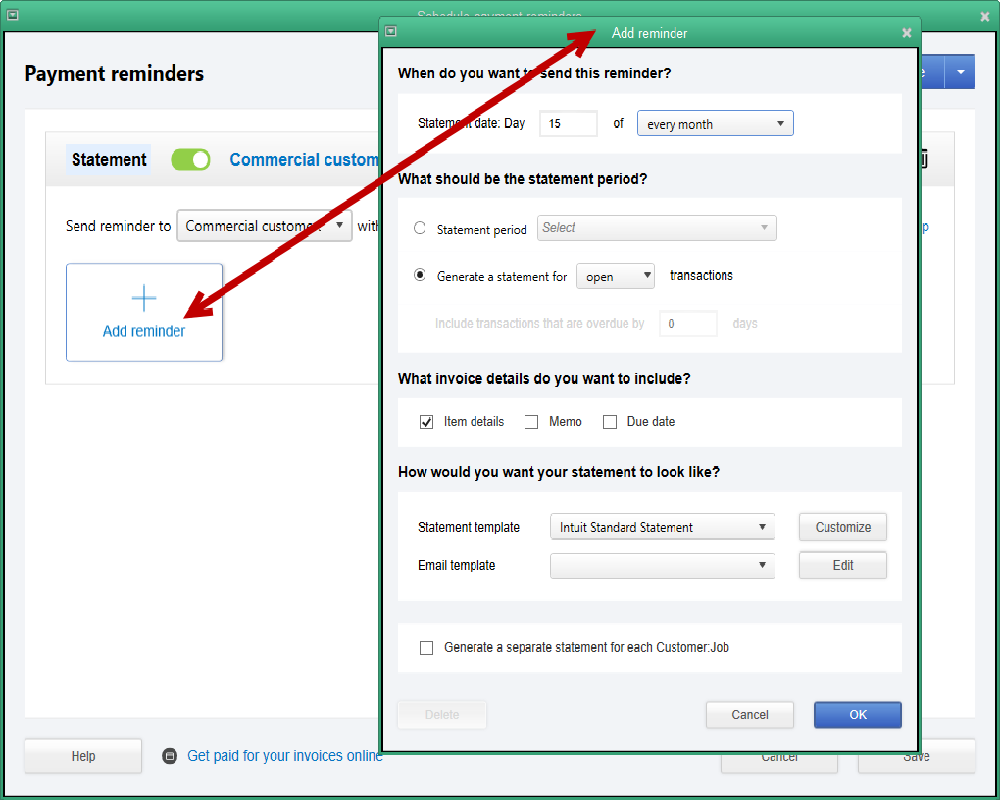

Clicking the Finish button opens a new window with the option to “Add reminder”. Choose that option. When you do, QuickBooks allows you to set a number of options about how your statements should appear.

What day should QuickBooks choose? What statement period? Invoice details. What template? And so on.

One of the choices is email template.

Automated Payment Reminders will electronically send customer statements. Be sure you have that setup already with customer email addresses, how you want your email to appear, etc.

Then, on whatever schedule you chose, QuickBooks will automatically send those statements out for you. One less task you will need to spend time on.

Purchasing With Credit Cards in QuickBooks

This QuickBooks capability is used by some but ignored by many others. Some are not sure how to use it. Others fear using it will be too time consuming and tedious. Let’s examine how the feature is designed to work, then look at some short cuts that might help some of you.

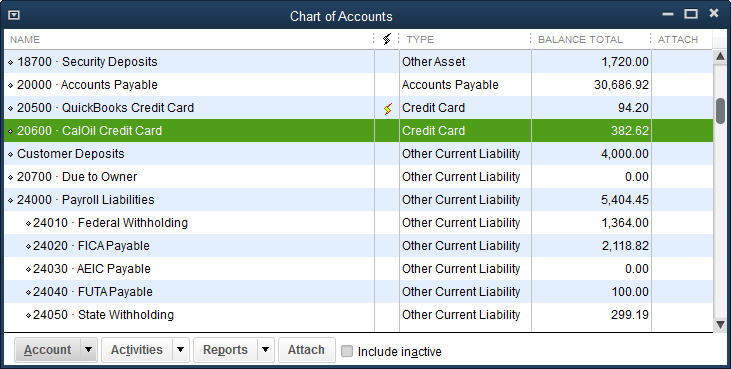

First, to use the credit card feature, you must have setup at least one credit card type of account on the chart of accounts.

See the screenshot below. Setting up an account as Credit Card type, like the CalOil Credit card highlighted, will tell QuickBooks to activate this feature.

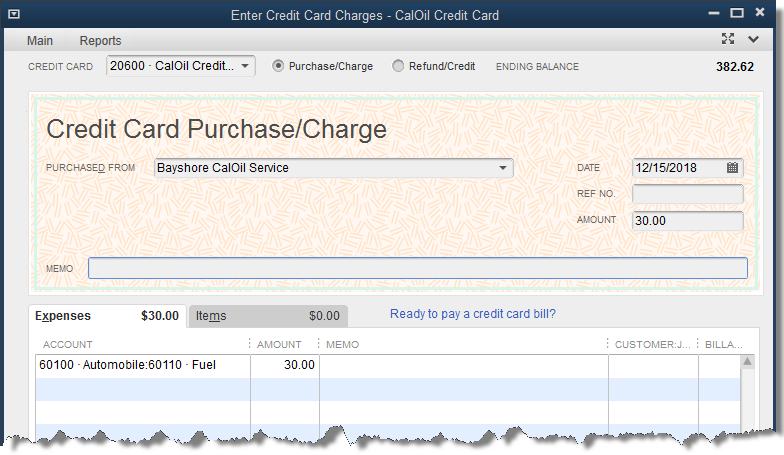

If using the feature as designed, one would fill out a Credit Card Charge form, like the graphic above, for each credit card charge made. It fills out much like a bill or check form in QuickBooks.

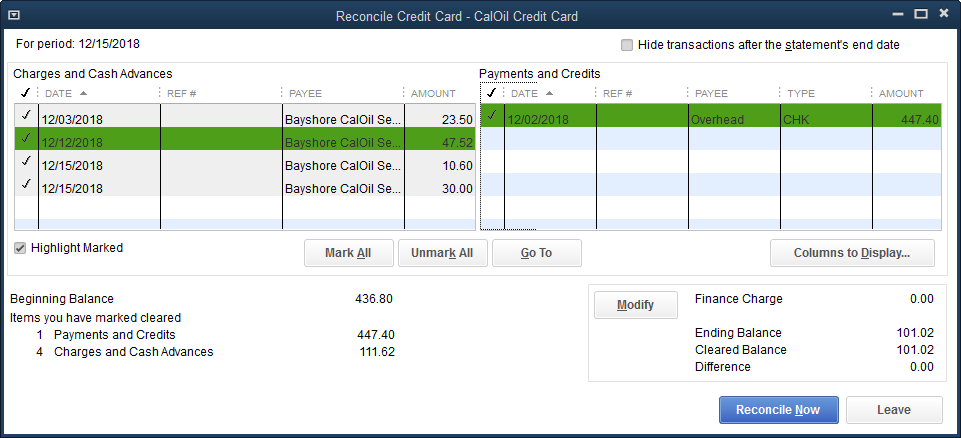

When the statement from the credit card company comes, the account in QuickBooks can be reconciled just like a bank account.

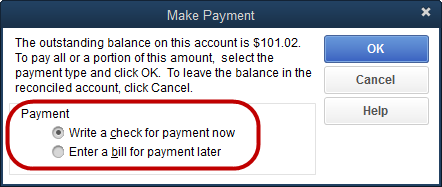

Checking off the appropriate items, again like reconciling a bank account, will complete the process for the month. When the Reconcile Now button is selected, QuickBooks displays the following window.

This allows you to create a payment for the credit balance, or a lesser amount, at this time. That isn’t required though. One could cancel out of this window without affecting the reconciliation work just completed. If choosing this option, later, when a payment is entered for the card, be sure to post it to the credit card account rather than an expense account.

In this case, any check created to pay on this credit card balance would use CalOil Credit Card as the “expense” account on the stub portion of the check form in QuickBooks.

If maintaining a balance on the credit card, that is, the entire balance is not paid each month, this method is best. It helps keep the amount owed to the credit card company accurate in QuickBooks which keeps your reports accurate.

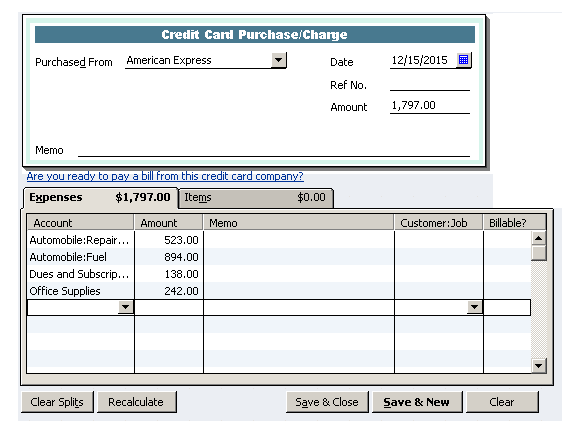

If, however, you need a streamlined process to track credit card expenditures, some people will use the following method successfully.

In this instance, the QuickBooks user will not enter any credit card charges until the monthly statement arrives. Then, they will consolidate the charges by expense account as shown in the screenshot above.

The amount shown on the Credit Card Charge screen should total the credit card charges made for the period on the statement sent by the credit card company.

This can then be easily reconciled with a couple of mouse clicks and the payment created in QuickBooks to pay the balance due.

Reimbursing Employees for Mileage

What could go wrong? She added mileage reimbursement to her employee’s paycheck. No need to write an extra check. Why was it costing her hidden fees and why was the employee upset?

It didn’t happen exactly that way, but close. Actually, working with a client, we discovered her mileage reimbursements were being reported as wages. Subject to withholding, social security, Medicare, and more. It’s actually easy to do. Here’s how to prevent that.

To reimburse an employee for mileage, I can easily add the amount to a paycheck. It’s easier and faster if done right.

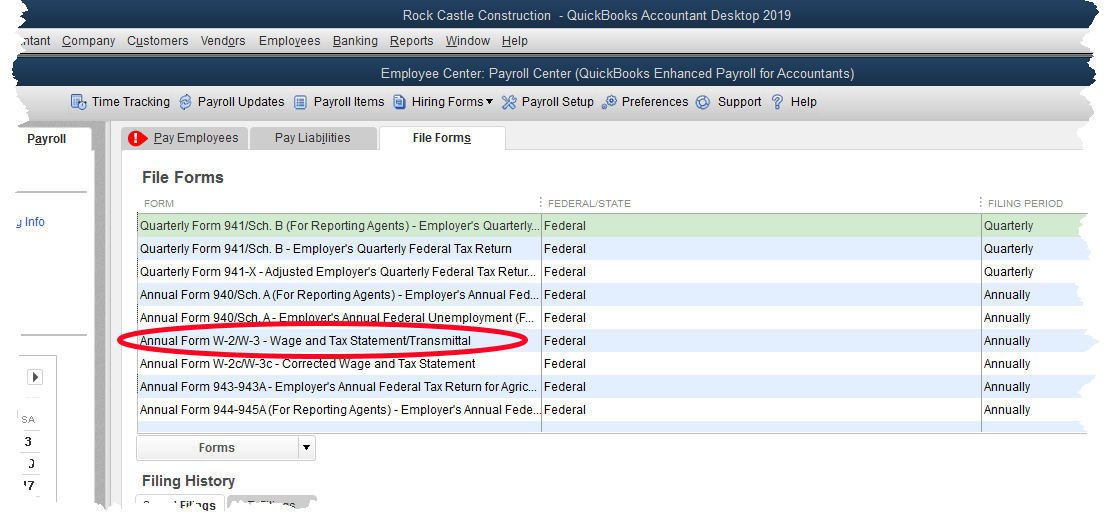

The first step is to setup a payroll item. From Lists->Payroll Item List, choose the Payroll Item button, then select New.

I always choose the Custom Setup in the first window. There just isn’t enough flexibility in EZ Setup.

Once we make this selection and click Next, the following window appears.

This is an Addition, right? We are adding an amount to an employee’s paycheck.

In the next step we need to name the payroll item we’re creating. Mileage Reimbursement seems like a good name.

Following that, we’ll need to tell QuickBooks what expense account should be used when this item is added to a paycheck and QuickBooks needs to post the dollars to a specific expense account. I like to create an expense account called Mileage Reimbursement. If you like, you can make it a subaccount of Automobile Expense. See the screenshot below.

The next window is of great importance.

Tax tracking type is always the most important decision when setting up any payroll item. The selection in this window determines whether or not the amounts will be taxed, how the amounts will appear on payroll tax forms, and on W2s. It’s important.

The default when creating an Addition type item, which we are doing here, is Compensation. Compensation is taxable wages. We definitely do not want that. This is a reimbursement to an employee for miles driven for the company, it’s not taxable wages.

Change the Tax tracking type selection to None.

A few windows follow, allowing for additional information. There’s one for Taxes. I’ve never seen an instance where something needed to be changed in this window. If the tax tracking is correct, the Taxes window should already be correct without any input from us.

Our payroll item IS based on quantity, not on hours. So, make that selection. It will be based on the number of miles driven.

It is added to Net Pay, not Gross Pay.

Default rate and limit. Usually the default rate will be the current federal mileage rate. As of this writing, that’s .625 per mile.

There’s no limit, so we’ll leave that blank.

Click Finish and that’s it. Add this to an employee’s paycheck at the time of paycheck creation. Enter the number of miles and QuickBooks will do the rest.

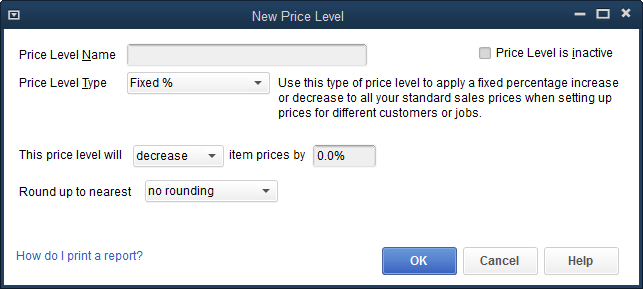

Customer Discounts – Price Levels

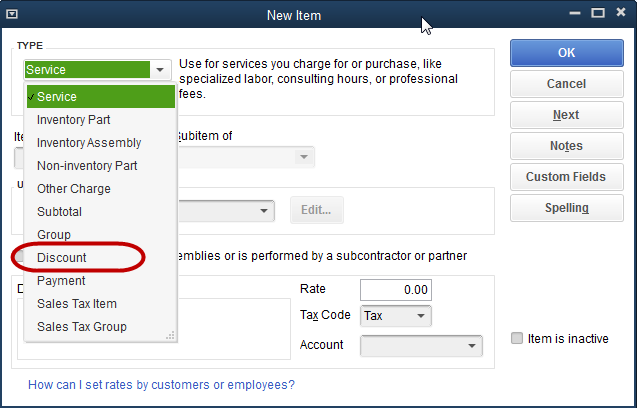

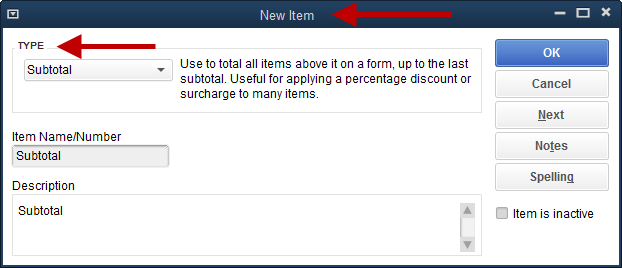

There are several ways to offer discounts in QuickBooks. If you use discounts on a regular basis or as the normal price for certain customers, Price Levels will offer an easy solution.

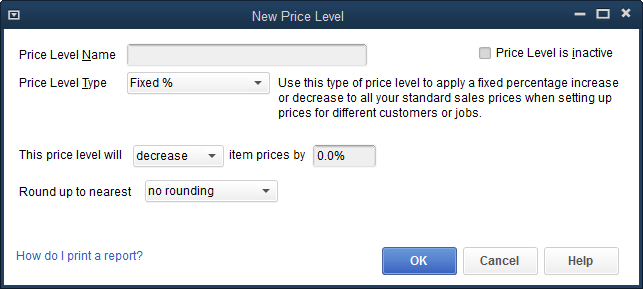

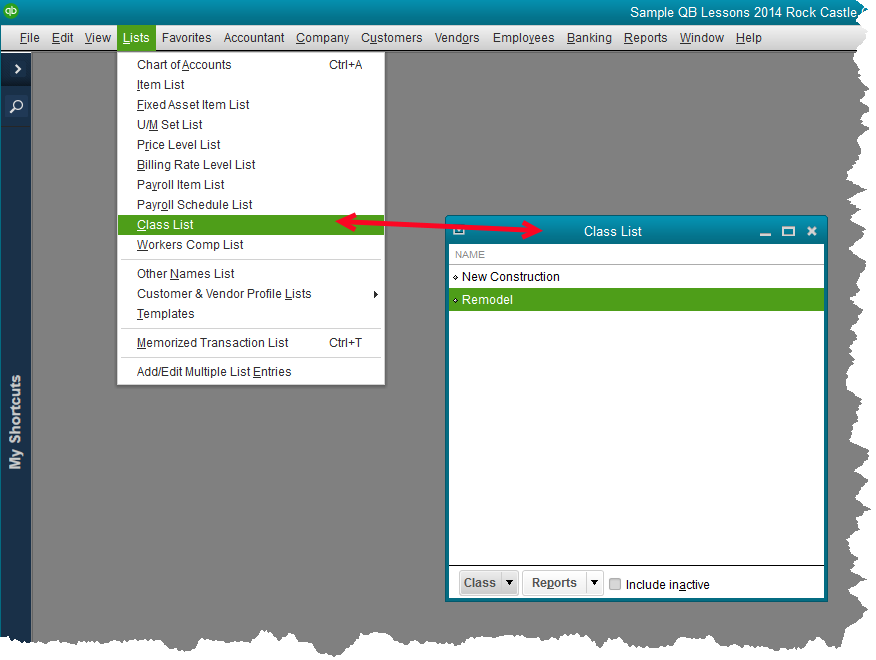

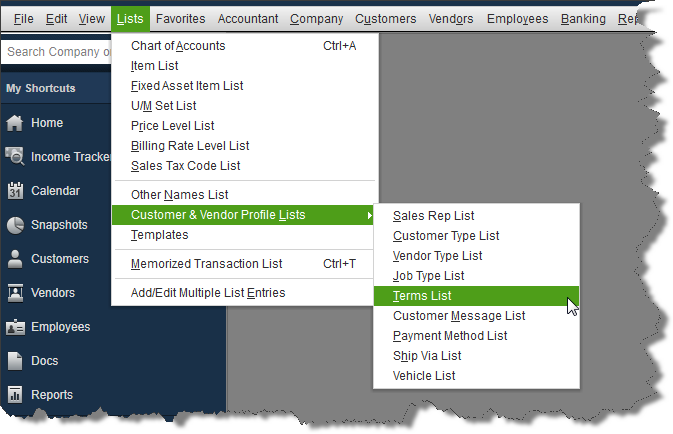

Price Levels are found on the Lists drop down menu. Different types of Price Levels are available in the Pro and Premier levels of QuickBooks.

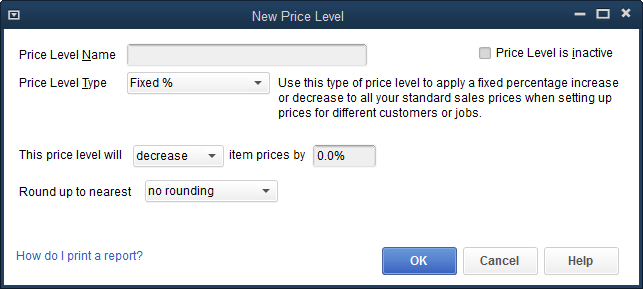

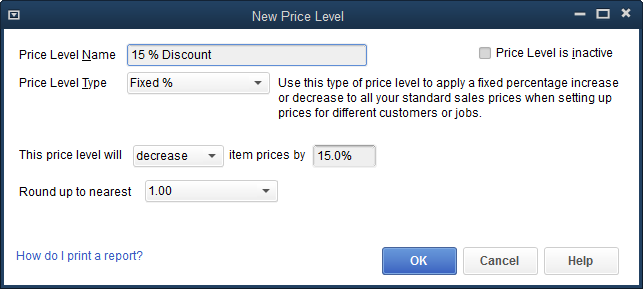

In QuickBooks Pro, only Fixed % price levels are available.

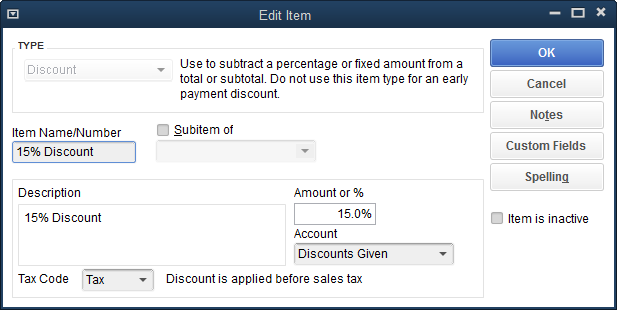

Navigate to Lists->Price Levels and select New from the menu that pops up with a right mouse click. You will see the above window.

Name the price level so it can easily be identified. Set whether the price level is an increase or a decrease over the price set in the Item List.

Then round in a way you wish prices to appear on your customer invoices.

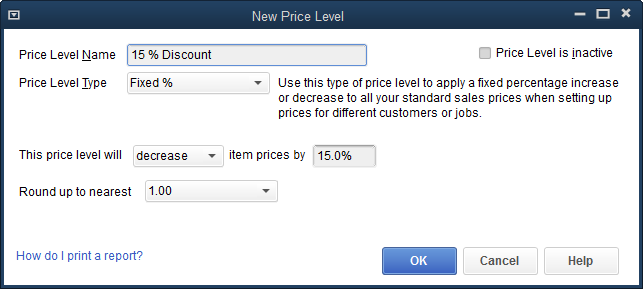

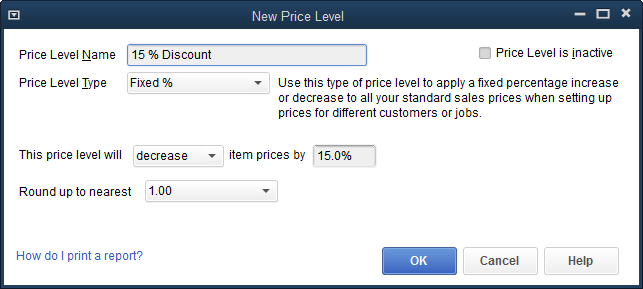

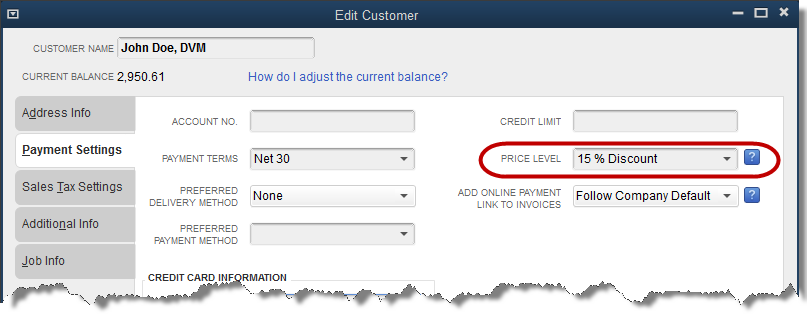

The completed Price Level is shown in the above graphic. We’ve named our new price level “15% Discount.” The price level will decrease item prices by 15%.

The rounding has been set so discounted prices will show as whole dollars. There are many options for rounding. Prices can be specified to end in .25, .50, .49, .89, .99 and many others.

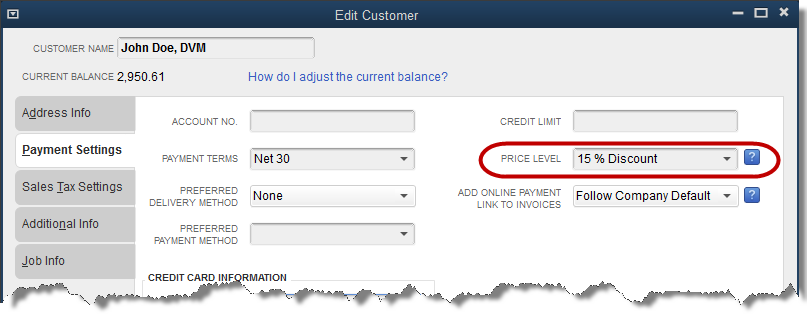

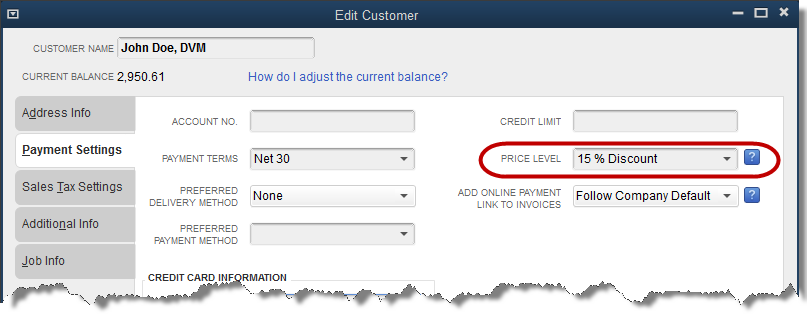

A powerful feature in the use of price levels is assigning a certain price level to a certain customer. Then QuickBooks will always use that price for that customer without any ‘reminding.’

To specify that a certain customer should receive a certain price level, access the Payment Settings tab in the customer edit window.

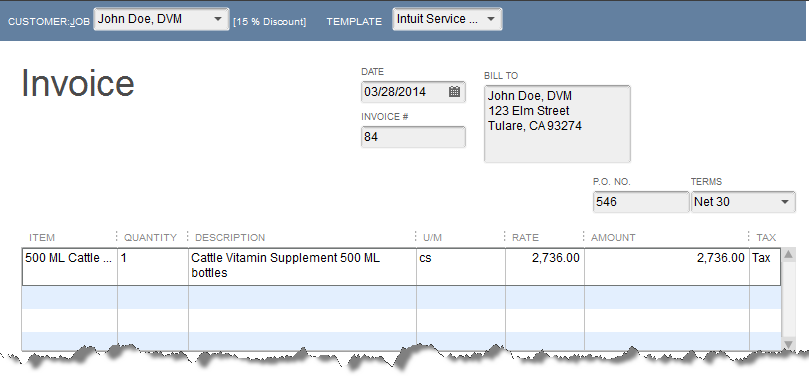

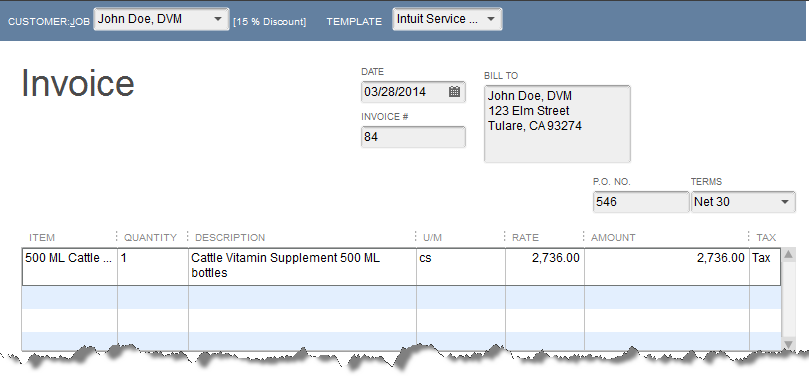

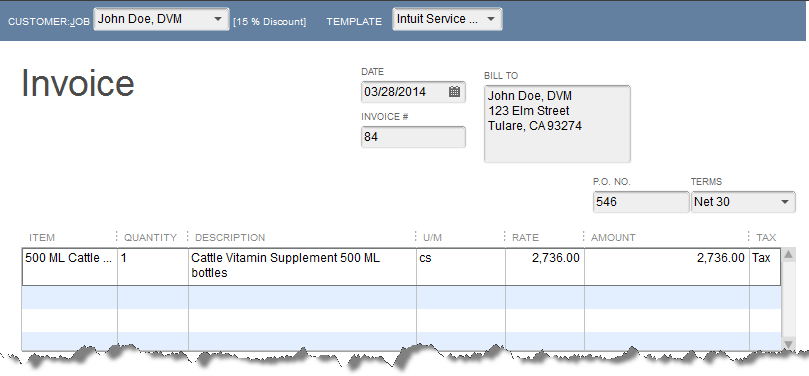

Now, without the need for a discount item, the lower price comes up automatically for this customer.

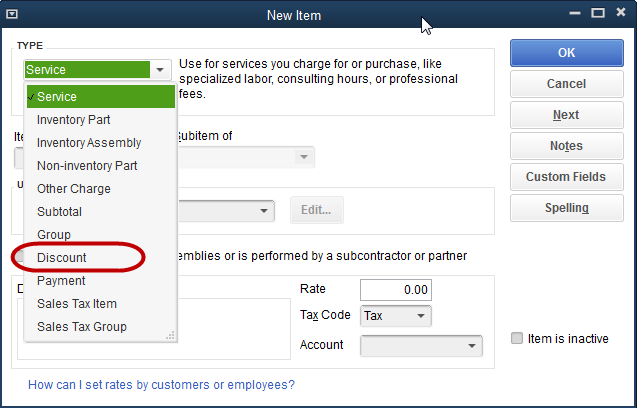

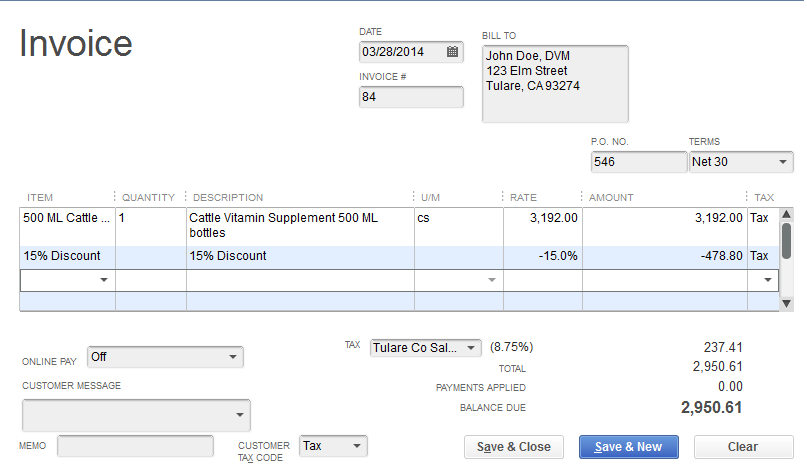

Using a 15% Discount Item (a different blog post), results in a different customer price than using a 15% Discount Price Level. QuickBooks uses a different calculation for each of the two methods.

Not important, and the difference is small, but the question sometimes arises from someone doing a lot of discounting by customer in their business.

The Premier level of QuickBooks offers an additional option to price levels. Per Item price levels.

Many of the same calculation and rounding parameters found in Fixed % type price levels are available options for Per Item price levels as well. But, a Per Item price level can apply to specific items rather than all items.

In addition, the calculation can be based on the price, as with Fixed % price levels, or cost.

Just like Fixed % price levels, the Per Item price levels can be applied to one or more specific customers.

Unfortunately, only one price level can be applied to a customer.

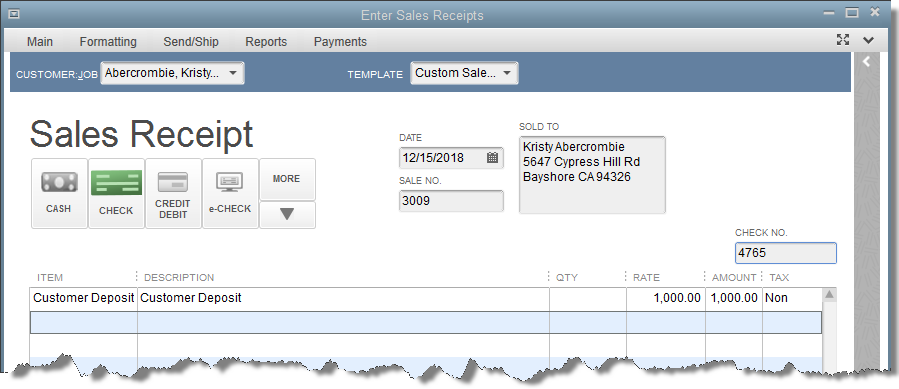

Create Customized Receipts for Customer Payments

This feature was new with QuickBooks 2021. It allows the QuickBooks user to create a customized form to print a receipt for customers making a payment. Here’s how it works.

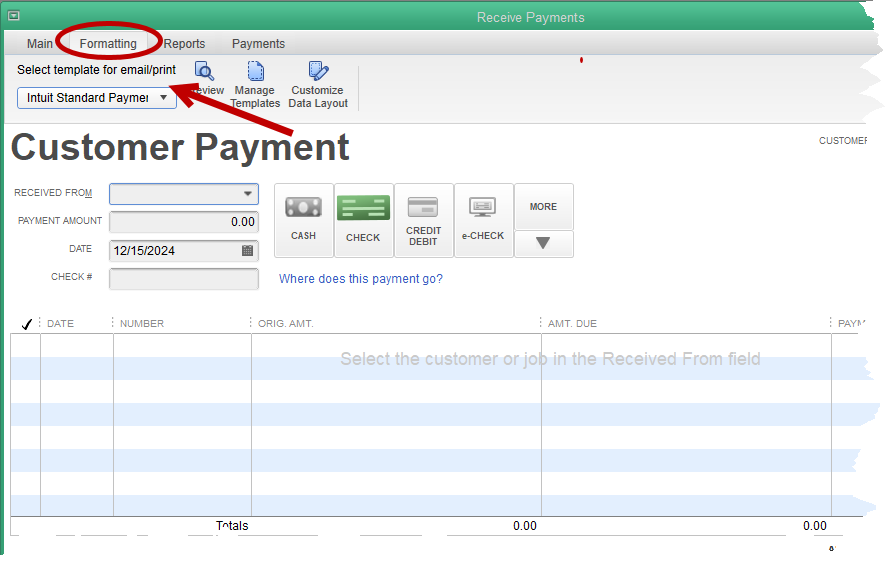

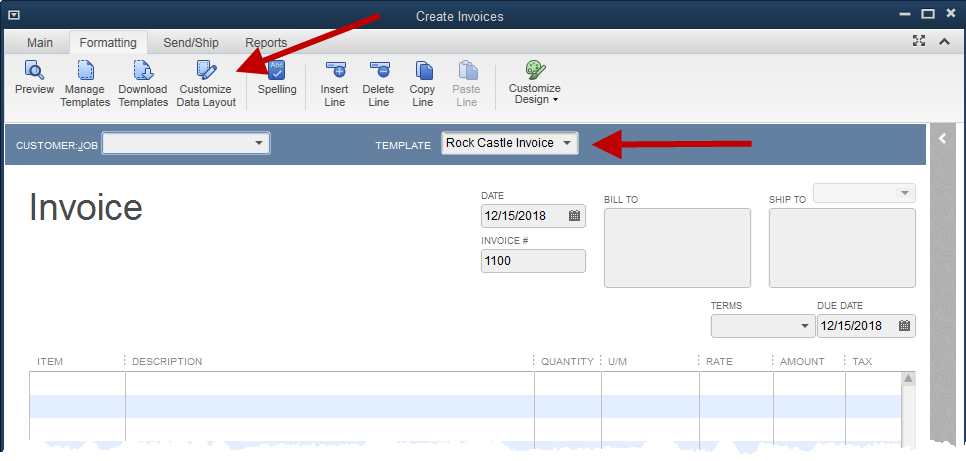

The starting point is accessing the Receive Payments screen either from the Home Page icon or the dropdown menu across the top. Once QuickBooks has opened that window, switch to the Formatting tab.

You can see in the above screenshot that the window now has a dropdown making multiple templates available, just like the Create Invoice screen.

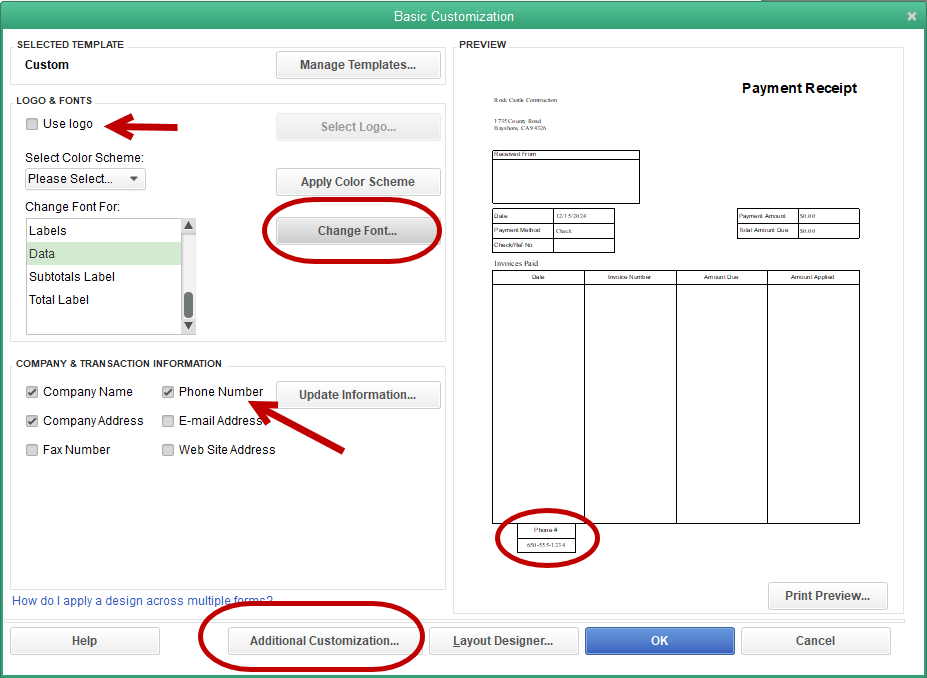

On the Formatting tab, choose Manage Templates. You will need to copy the existing Intuit Standard Payment Receipt and then rename it to something you choose. In this demonstration, I chose the name Custom.

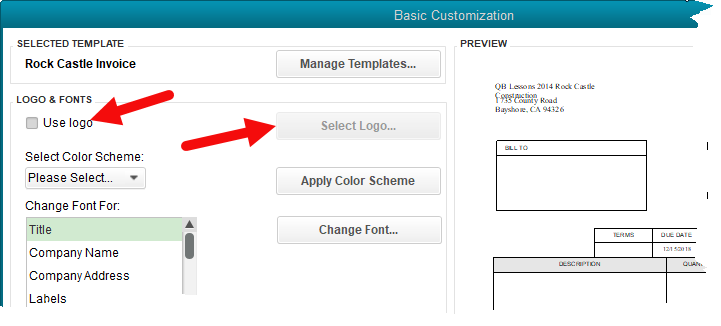

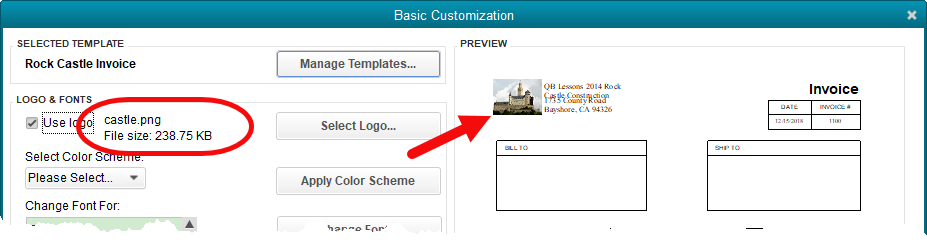

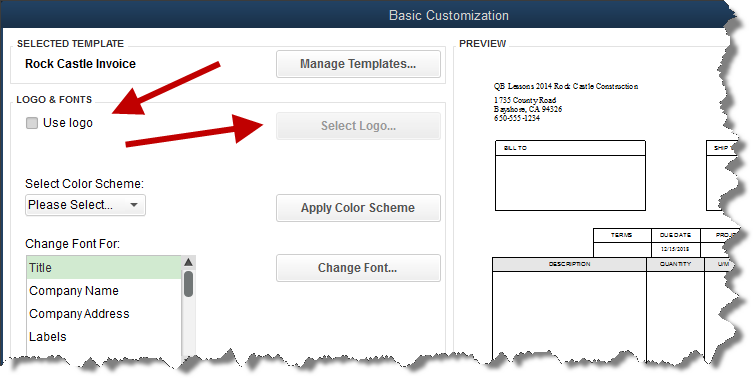

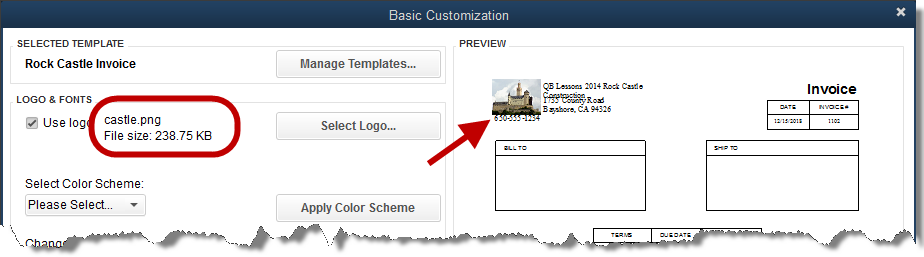

Once the name is created, you are taken to the Basic Customization screen.

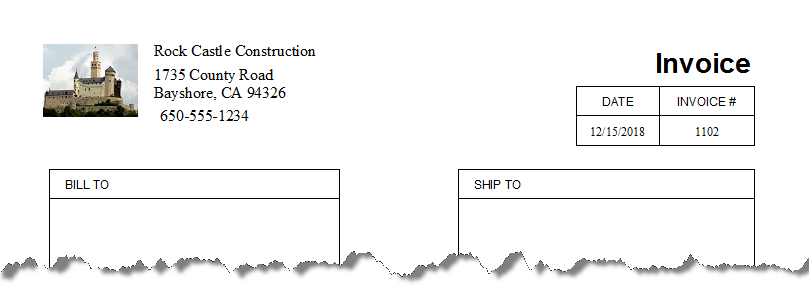

There are a host of available custom choices here. At this point the process becomes almost identical to that of customizing an invoice which we’ve covered in a different blog post.

A company logo can be added. The fonts of the printed form changed. Company information like telephone number included and so on.

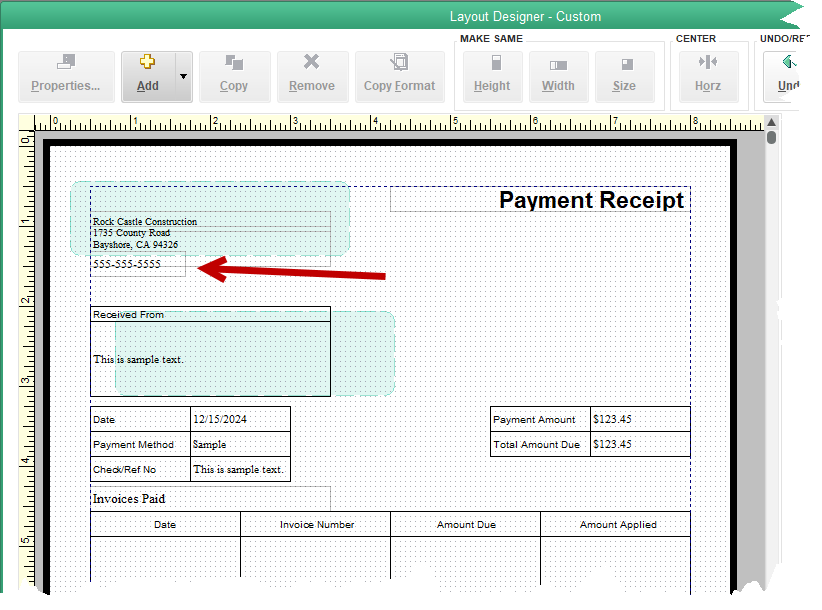

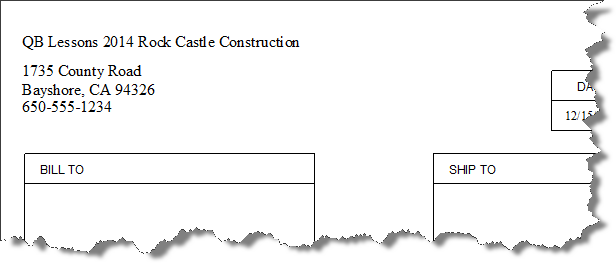

In this screenshot, you can see the phone number was added. The addition shows in the lower left of the preview. QuickBooks doesn’t know where we want that piece of information yet. We’ll tell it before we finish this process.

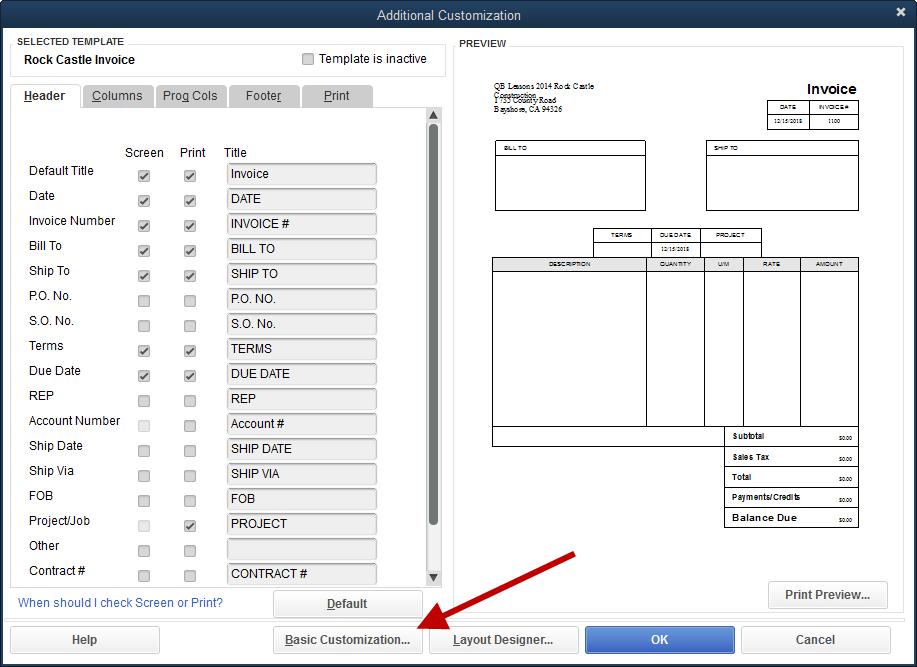

Click on Additional Customization.

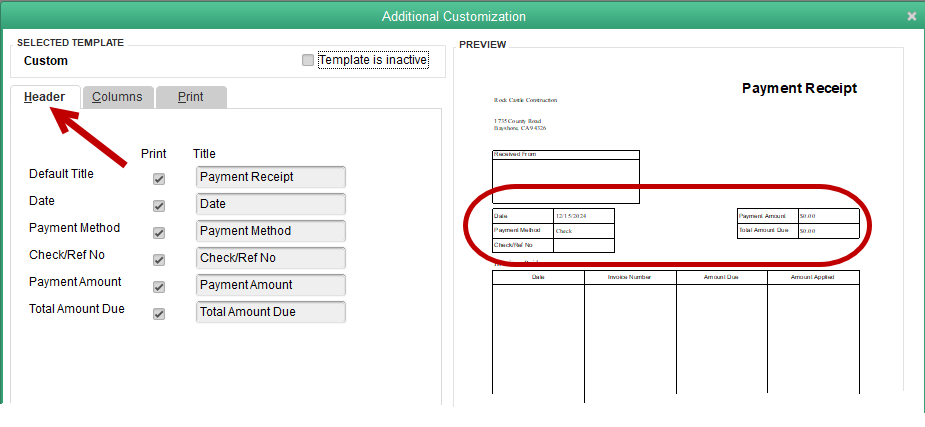

In this screen, you have three sections of the template to work on. The first is Header. You can see the various pieces of information available and the checkboxes telling QuickBooks we want that data on the Payment template.

The highlighted section on the Preview page shows where these selections end up showing on the printed form.

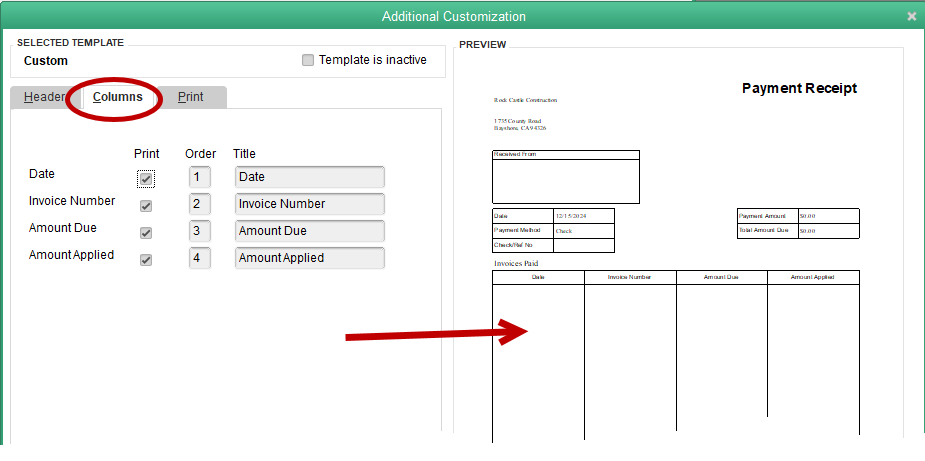

The next tab is Columns. You can change which columns print and in what order they appear on the finished template.

The Print tab isn’t used as often. There are options there to always print multiple copies, print to a special printer, etc.

The above graphic shows the Layout Designer view of our custom template. The arrow indicates the phone number that was moved to appear just below the company address. The font was changed to match the rest of the form. Left-justified was selected so the number would line up on the left like the rest of the section. These actions are all available by selecting the Properties button in the upper left of the window.

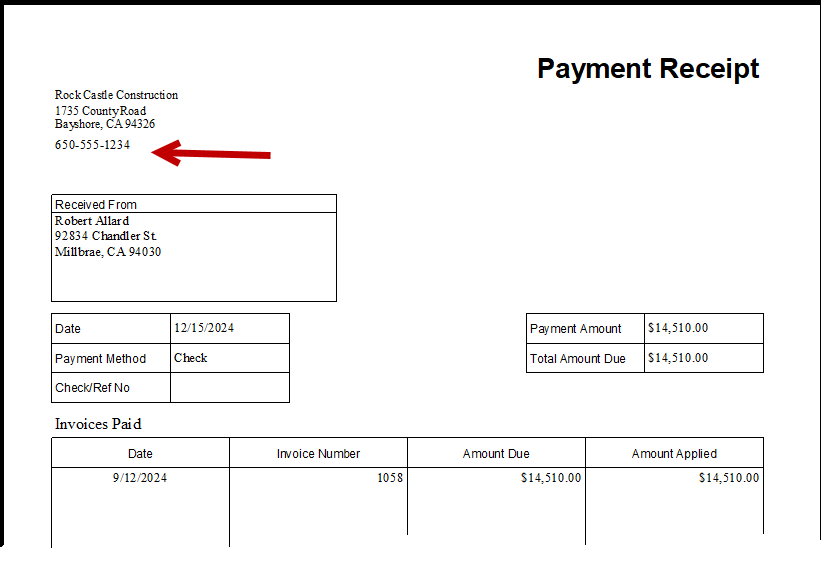

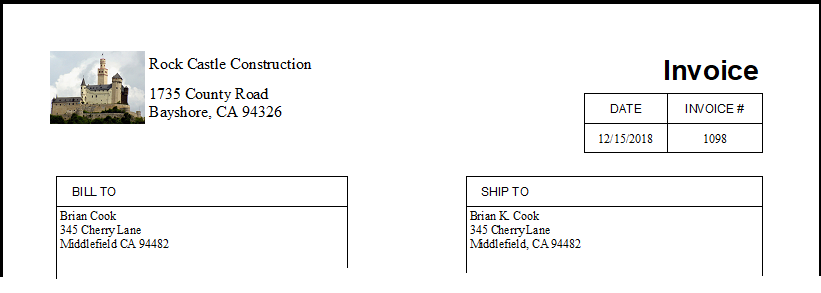

And above is our finished form.

The only change made in this demo was the phone number, but this is just an example. You know how to access this feature now and how it can be changed. Your receipt, should you need one, can look completely custom, unlike that of any other QuickBooks user.

Creating a QuickBooks Backup

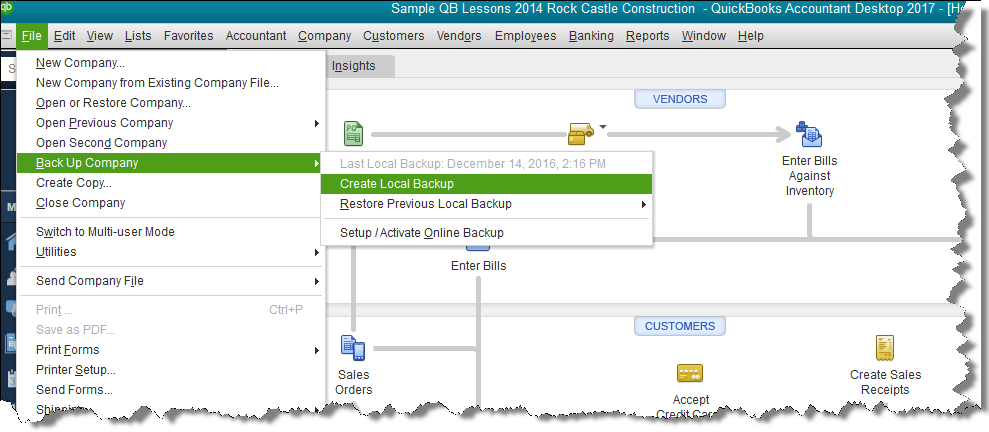

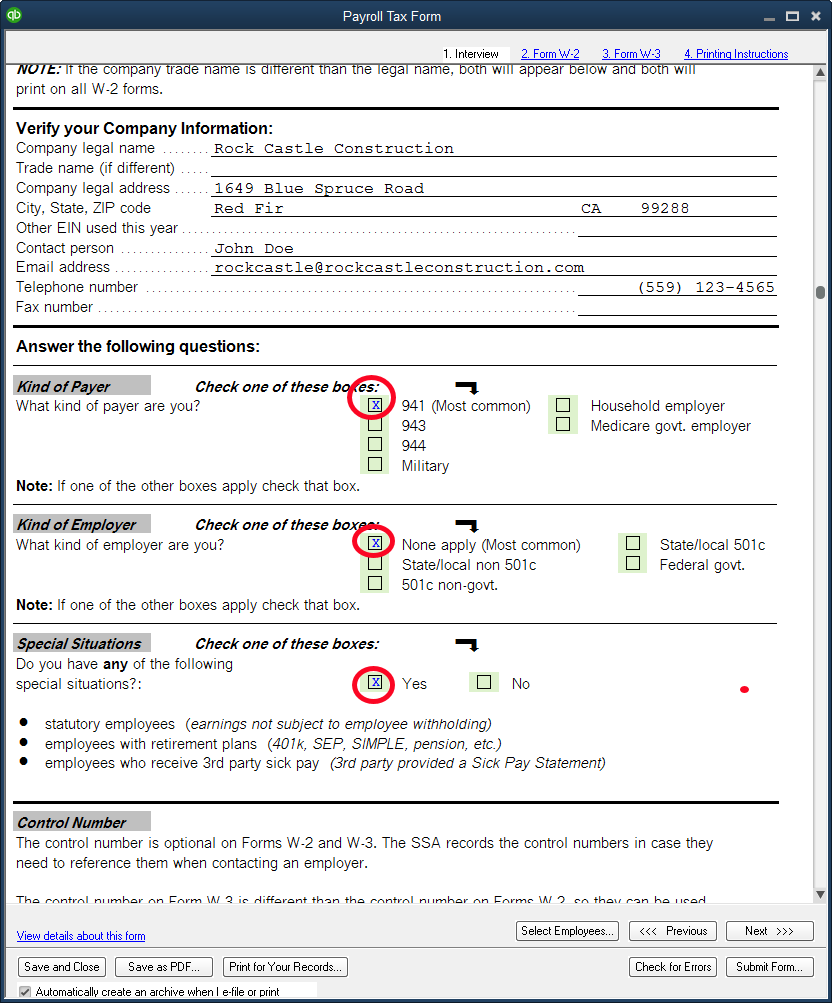

First, select Create Backup from the File dropdown menu.

Accept the default selection, Local backup, in the next window.

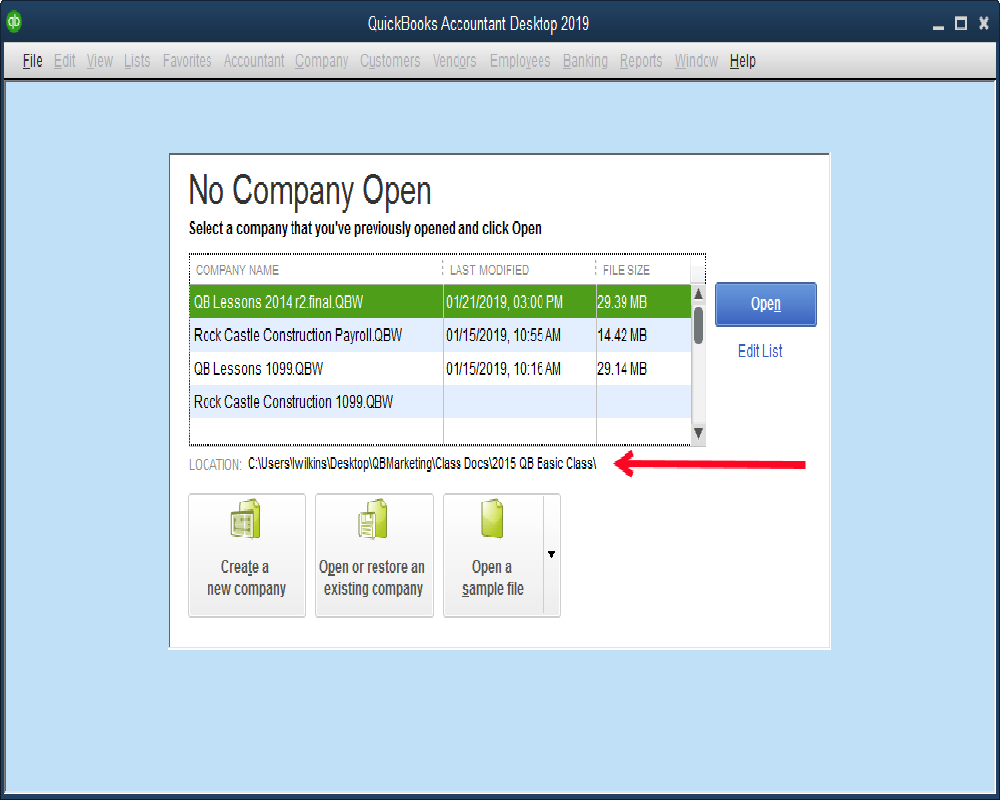

QuickBooks will want to know where it should save your backup file. Clicking the Browse button as indicated in the above screenshot will open the smaller Browse for Folder window shown.

Select a location for the backup file. You can select one of the drives by letter. The letter designations (yours will certainly be different than this example), indicate some of your options. If you were planning to save the backup to a flash drive, your choices in the above example would be either E or F.

By scrolling up the selection list, you could choose Desktop to save the file on your computer desktop.

Importing Accountant’s Changes Back into Your QuickBooks Company File

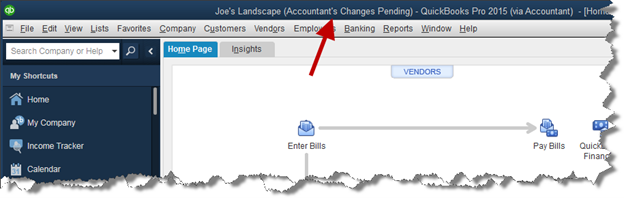

All during the time your accountant/bookkeeper has the accountants copy, the header of your QuickBooks company file should display the message. “(Accountant’s Changes Pending)”.

Once the changes are imported, you will no longer see the message in the header.

You will receive the ‘Change File’ back so it can be imported into your QuickBooks. In the example we’ll use, we will have the change file on a flash drive. If you were to receive the change file attached to an email, just save the email attachment to your computer. The procedure will be the same.

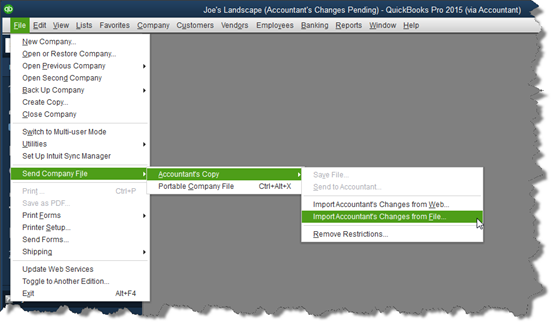

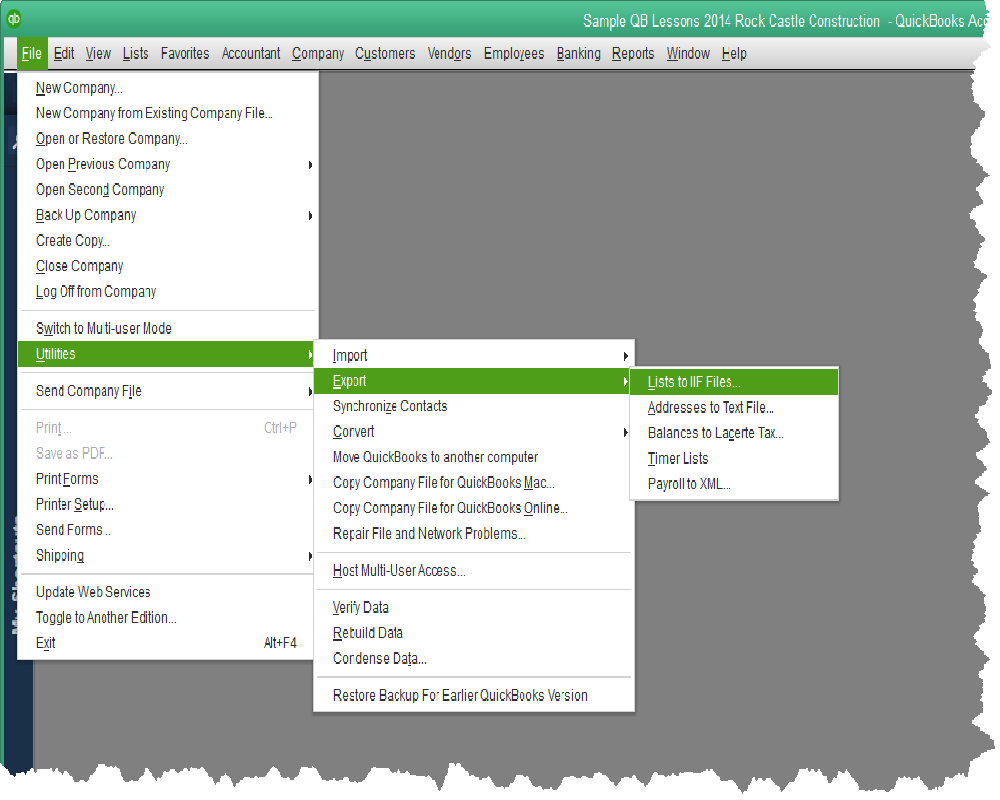

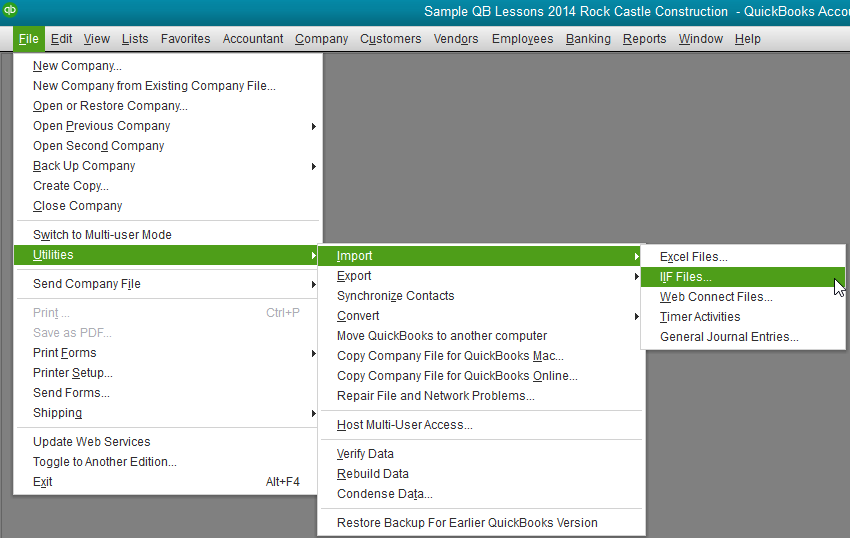

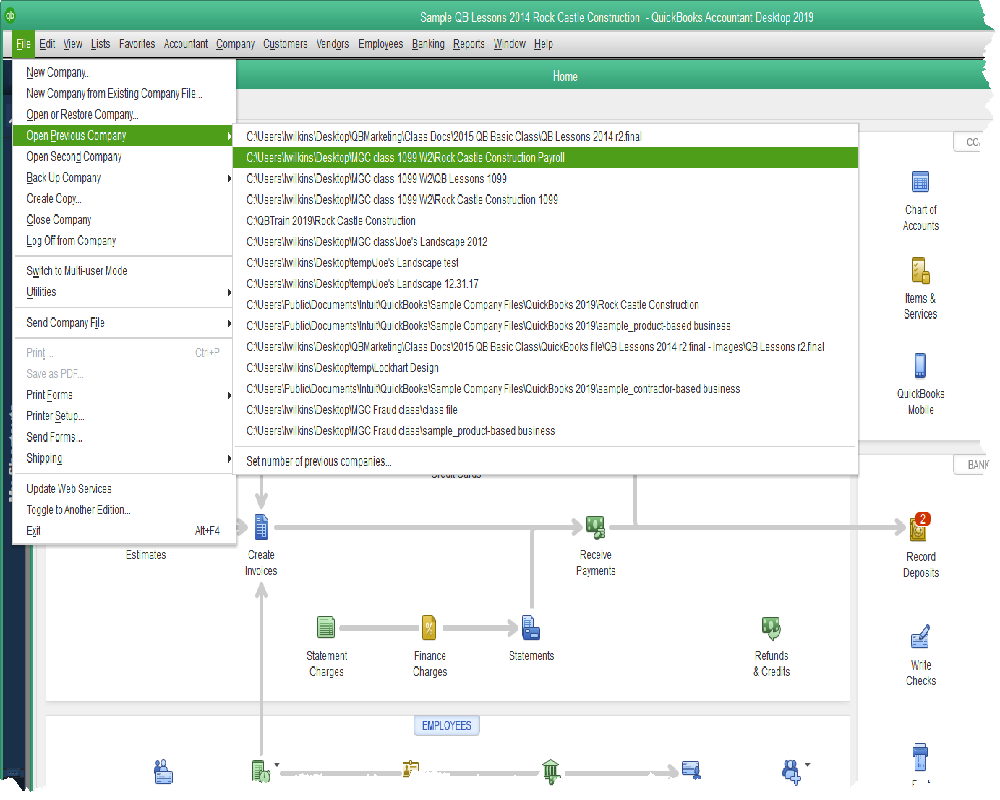

Above is the menu selection to import the change file. Select this and QuickBooks will ask where the change file is located.

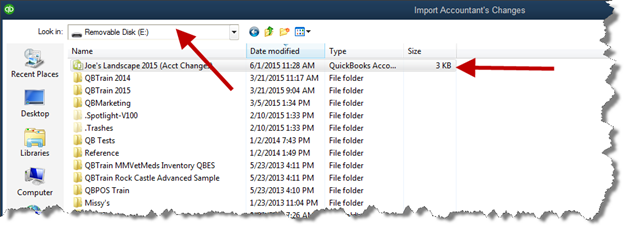

Again, we select the location where the change file is located. In this case, the flash drive designated as Drive E (upper-left arrow).

QuickBooks will find the accountants change type of file. On this drive, there is one file of that type. See the arrow in the right portion of the screenshot.

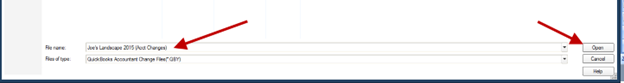

Above is the bottom portion of the window where we selected which file to import. When we select (click on) the file name in the upper part of the window, QuickBooks fills in the name here. Click the ‘Open’ button in the lower right.

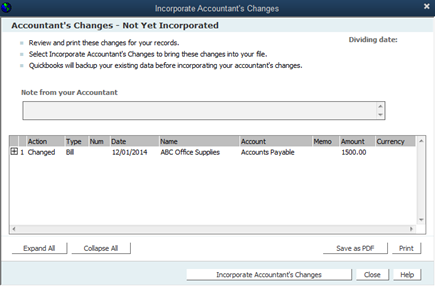

QuickBooks will display a screen listing the changes made by the accountant.

Click the button labeled “Incorporate Accountant’s Changes”.

QuickBooks will require a backup, you only have to tell it where.

As the backup concludes, QuickBooks imports the changes without any more input from you.

The import is complete and you are ready to go.

The video is less than 4 minutes.

How to Create an Accountants Copy in QuickBooks

QuickBooks has a unique type of file copy named Accountants Copy. This file type allows you, the QuickBooks user, to send a copy of your QuickBooks company file to your accountant much like you would a backup.

Once you have created the copy, you are free, with certain limitations, to continue to use your QuickBooks company file for ongoing business needs.

The accountant is able to view the company transactions in the copy sent to them. They can also make changes to the data for financial statement, tax return, or other needs.

The real value of the accountants copy comes when the accountant has completed their work. QuickBooks will create a special file of only the changes the accountant makes. That file can be imported into the original QuickBooks company file.

The original QuickBooks file is updated with all the accountants work. Your transactions and reports now match any statements, returns, etc the accountant has completed. In addition, the accountant will have the correct beginning balances for the next year. When the time comes and another copy is sent, the work for previous periods does not need to be redone to make the new file copy current.

Here’s how to create an accountants copy for your accountant.

Notice that in the graphic ‘Save File’ is selected rather than ‘Send to Accountant’. This will be the more common choice.

Screen 1

Accountants Copy will almost surely be selected already. Just check to be sure it is.

Screen 2

In screen 2, the Dividing Date is the important entry. The dividing date determines what part of the file is open to the accountant. That part is restricted to you, the QuickBooks user.

Ask your bookkeeper/accountant if you are unsure. Several options are available on the dropdown that reads “Custom” in the screenshot. Selecting Custom allows you to set any date in the field below it.

Screen 3

QuickBooks will display a message that it needs to close all windows. Select OK.

Screen 4

In this next screen QuickBooks wants to know where you want to save your accounts copy. Notice arrow 1. From the dropdown, we have selected drive E, a flash drive we have inserted into a USB drive on the computer.

Arrow 2 designates the name of the copy we are creating. Shown is the name QuickBooks inserted and is suggesting. There is rarely a need to change this.

Arrow 3 points to the save button. When you click here, QuickBooks will save the copy in the location you specified in the window.

You’re done!

Give the flash drive to your accountant/bookkeeper. They can now work on your QuickBooks company file in past periods, you continue to work in current and future periods.

A couple of cautions.

In past periods, there is little you can do. If you try to edit, delete, or in some way change these past transactions, QuickBooks will prevent you from proceeding.

It may tell you that you can “Remove Restrictions” and then have full access to your QuickBooks company file. If you do this however, you break the accountants copy and the work your accountant/bookkeeper is doing will not import back into your QuickBooks.

This negates the entire purpose of the accountants copy. It also means, someone will have to manually edit all the transactions affected by the accountant/bookkeeper. This is often a long and tedious process.

It is usually a good idea not to reconcile accounts while an accountants copy is pending. Check with your accountant/bookkeeper if you feel you need to reconcile accounts before they finish their work.

If you prefer to see this process in a video, showing each of the necessary steps, click here:

The video is less than 4 minutes.

Is Your QuickBooks File Slow?

Let’s look at what to do when saving a transaction, or creating a report seems to take minutes instead of seconds.

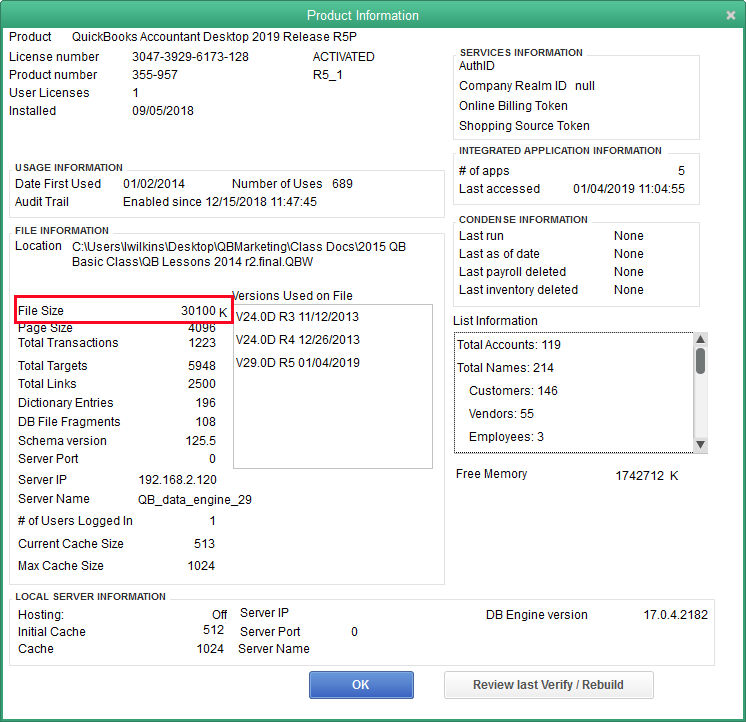

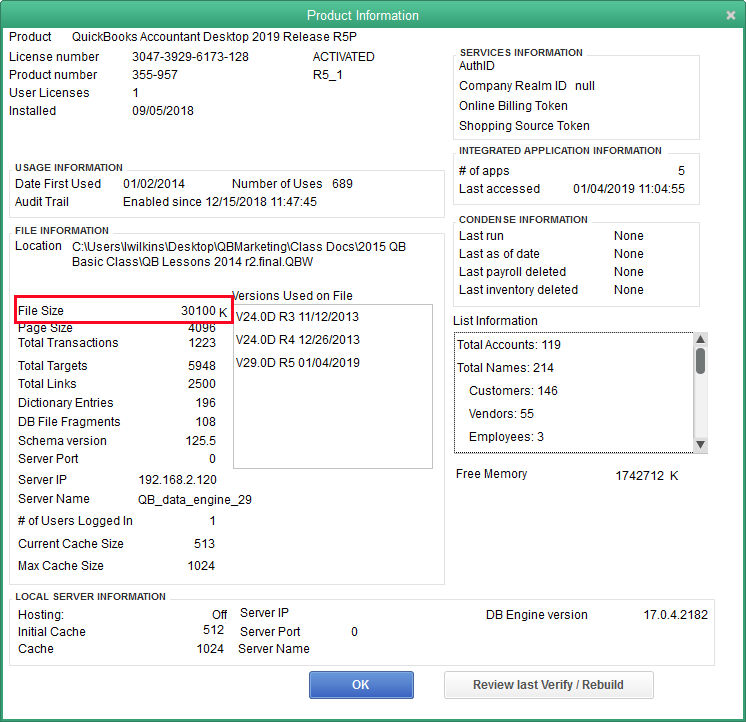

Pressing the key combination CTRL-1 from within QuickBooks opens the following window.

There’s a lot of information here, but what concerns us today is the highlighted line. File size.

There’s actually 1024 kilobytes in a megabyte, but we often round that to an even thousand in order to make quick calculations. So, in this case, we could say this QuickBooks company file is about 30 MB (megabytes).

That’s a small file. It should feel pretty crisp when entering transactions or creating reports. When QuickBooks starts to feel sluggish, it’s a good idea to check this screen. If the size of the company file is 250MB to 300MB, you know the day is not far distant when you will need to do something in order to keep the file at a more usable size.

There’s nothing in QuickBooks that will prevent you from using a larger size file, but performance declines. Too large and errors are more common. You’ll find these whenever Verify Data runs as part of a QuickBooks backup. QuickBooks can almost always fix these small errors itself. Still, it’s annoying and a little scary to know damage exists fairly regularly in your company file.

There are a couple of options when your company file becomes too large. Which you choose can depend on solutions you may have used, if any, to deal with this problem in the past. Let’s start with the easiest.

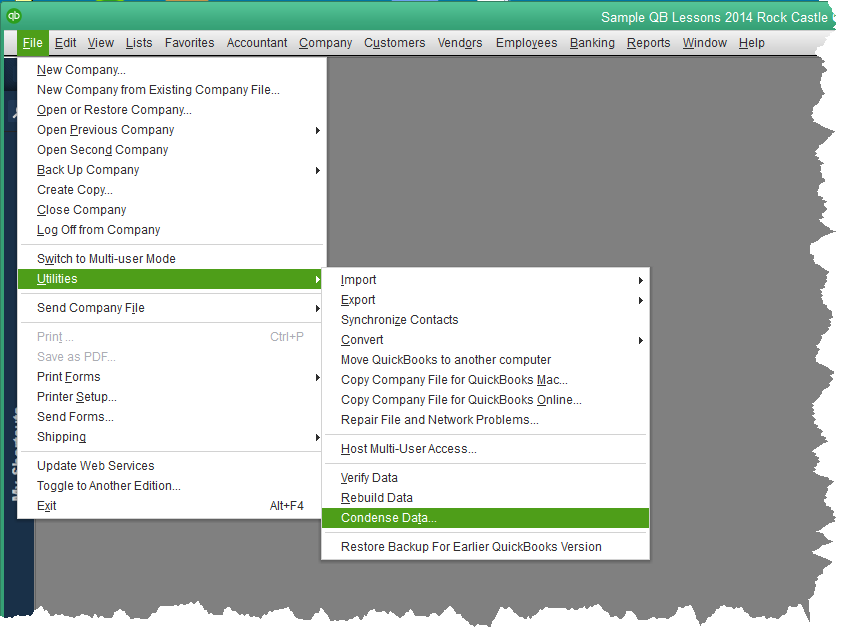

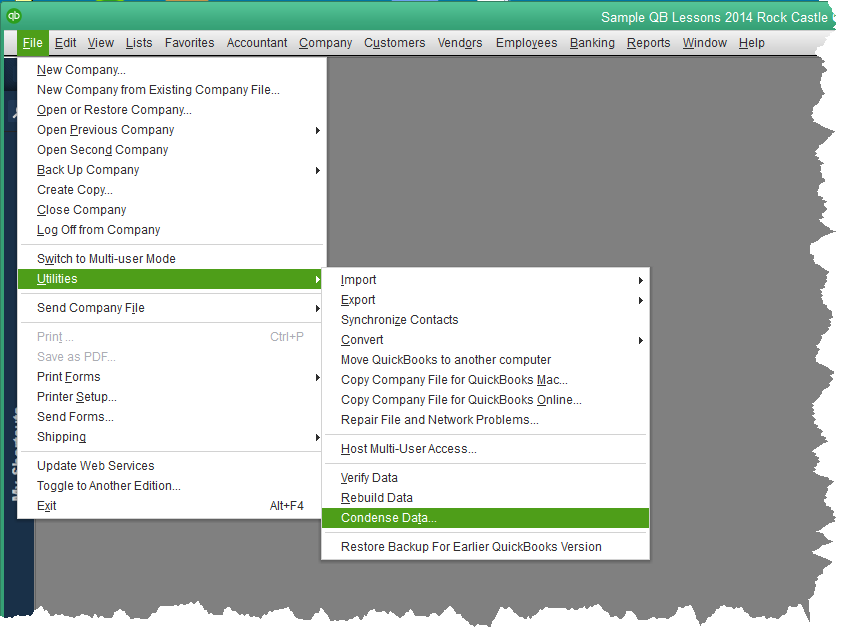

Condense Data

QuickBooks has an option called Condense Data. It’s been in the program a long time, but has been improved in recent years, including a marked improvement in the 2019 version.

The screen shot above shows you how to access this option. Below is the window that will open once we select it.

The newest option is the one that’s selected in the graphic, “Keep all transactions but remove audit trail info to date.”

QuickBooks has maintained an audit trail since the 2006 version. Even if deleted, a transaction’s history remains in QuickBooks. One can see what the original transaction was, what date and time it was entered, who entered it, all that same information for each time the transaction was changed and/or deleted.

That’s a lot of information. It takes a lot of space. Starting with QuickBooks 2019, one way to make the company file smaller is to remove all that detail up to a specific date selected by the user.

If you choose this option, you want to keep a copy of the existing QuickBooks company file somewhere safe. On the off-chance you would need to go back and research a particular transaction, you would have access to all the details.

Going forward, the audit trail feature still works, it’s just that the history was deleted.

The other option, “Remove transactions you select…”, is similar. It will remove all transactions before last year, as an example. The reason the new QuickBooks 2019 feature is such a great choice is that you can still have all that transaction history in your company file, but it’s faster and responds better because, without all the audit detail, the file is much smaller.

The day may come when these options are no longer sufficient. When this happens, it’s time for a new file.

There are special tools in QuickBooks to deal with that. We’ll cover that in a future post.

Voiding Bill Payment Checks And Paychecks in QuickBooks

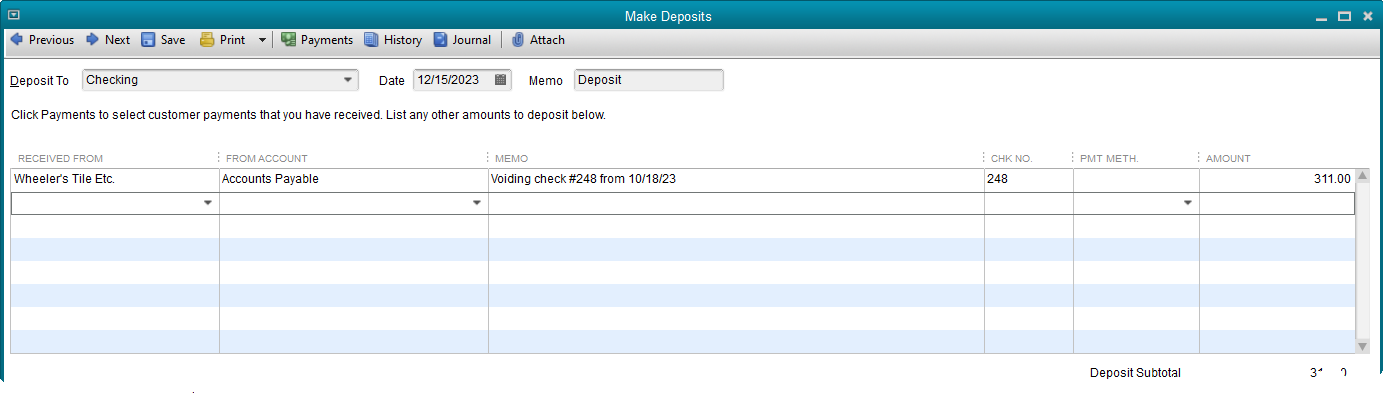

Voiding a bill payment check does not reduce any expense in QuickBooks. Payments to vendors are being reduced.

If a bill payment check is voided, the bill originally paid by a voided bill payment check, will now appear on the list of open payables. It is no longer a paid item.

If the bill payment was from a prior period, use the procedure outlined in the blog post for regular checks with two modifications.

The Name column in the Make Deposit window must have the vendor name the original check used. The Account column must be filled in with the account Accounts Payable.

The above transaction causes an increase in the vendor’s balance by the deposit amount.

That’s not right. We need the bill associated with the check to be voided as well.

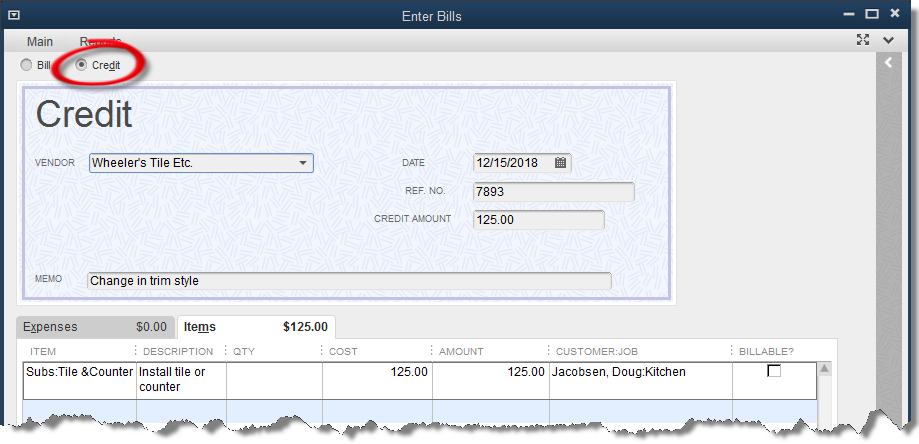

Use the Enter Bills window, but change the radial button setting in the upper left of the window to Credit rather than Bill. Create the transaction just as you would a bill, using the same expenses or items as were on the original bill.

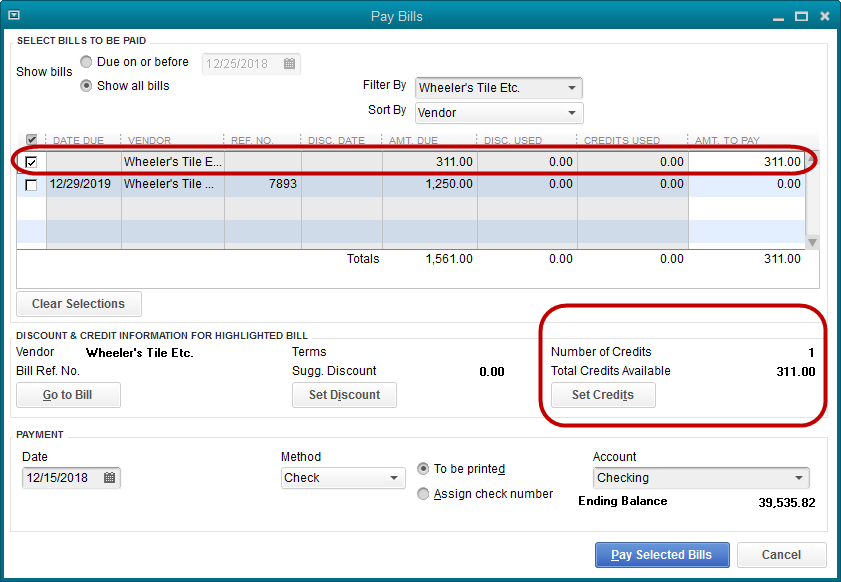

The next step is to access the Pay Bills feature, find the bill for that vendor, and use Set Credits to apply the credit to the bill.

Voiding and Replacing Paychecks

Fortunately, the usual scenario in which a paycheck needs to be voided is when an employee loses a paycheck and it needs to be replaced. Here is an easy way to solve this sticky problem without affecting any other payroll transactions.

If the paycheck to be replaced were check number 287, create a regular check using the same payee (the employee), the date of the lost paycheck, and the same check number.

Use the Payroll Expenses account on the stub portion of the check but leave the amount of the check as zero. Create a memo explaining this is a voided paycheck, then save the check.

QuickBooks will display a warning message that the number already exists, but will allow the check to be saved. Now void the check using the QuickBooks Void command.

This completed step is merely to have a record in QuickBooks that the old paycheck number is a voided transaction.

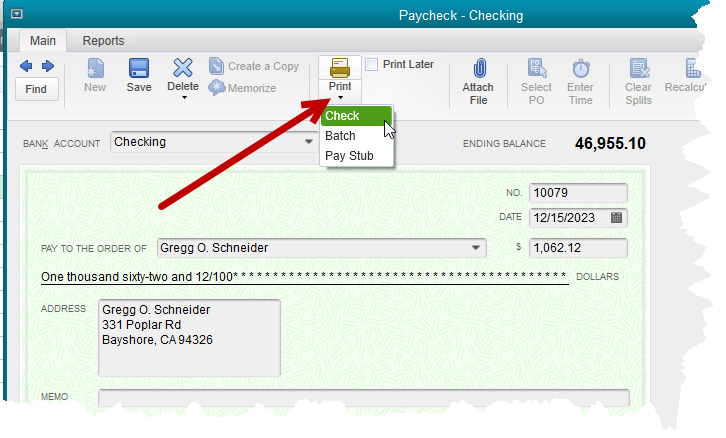

Now display the original paycheck. Click on the Print icon at the top of the transaction ribbon.

Select Print. QuickBooks will suggest a new number for the check. Either accept the suggestion or type in the number of the check form that will be used, if different.

Once the check has printed, Save the paycheck with the new number.

The check register will now show the old check number as a voided check and the replacement check will, of course, have the new number as printed.

How to Correctly Void a Check in QuickBooks

Hint: It’s not on the Edit menu

This is an area of QuickBooks that seems to generate more mistakes than almost any other.

QuickBooks provides a command, located on the Edit menu, to void a transaction. When this command is used, the transaction amount is changed to zero. A memo is added indicating the transaction has been voided.

But it is an edit. That is, the transaction retains its original date. The amount just changes to zero.

The problem with this solution is the impact on older transactions being voided.

Assume a company’s bookkeeping is complete, financial statements have been printed, perhaps given to a bank, and a tax return filed.

Then, it is decided something needs to be done about the old checks that won’t clear the bank. They are listed as outstanding on the bank reconciliations, perhaps the check dates are year or more old.

So, the checks in QuickBooks are voided. The result? Besides voiding the checks, the previously issued financial statements are incorrect and the filed tax return is now incorrect.

Voiding a check in a current period causes few issues. It can be located in the check register or on any report. Double click on the line with the check in order to view it. Then, from the edit menu or the Delete icon of the transaction ribbon, choose Void Check.

It might be a good idea to add a note of explanation in the memo field of the check. Then Save and Close to record the transaction. Since the check was originally written in the current period, prior account balances are not affected.

Voiding Checks From Prior Periods

This is the more common situation and a task that must be handled with more care. The first step is the same. Find the check to be voided either in the account register or on a QuickBooks report.

Double click on the entry to view the check. In the memo field of the check make a note that the check is being voided with a deposit entry as of a current date.

Do not void the check with the QuickBooks Void command. Only note in the memo field that the check will be voided, and on what date.

Using a current date, create a Deposit in QuickBooks. The Name column can be left blank.

In the Account column, use the same expense account as was used on the original check. In the Memo column explain that check #XXX from (original date of the check), is being voided by this deposit. In the Amount column, use the amount of the check being voided.

The next and final step will be when the bank account is next reconciled.

The old check will still be there, but so will the new deposit. Check off both even though they are not on the bank statement. They are the same amount so will net to zero and not affect your bank reconciliation.

Dealing With Delinquent Customers

Statements and finance charges can help small businesses receive more timely payments from their customers.

There is a little setup in order to use finance charges in QuickBooks. Let’s look at that first.

Navigate to Preferences->Finance Charges->Company Preferences.

The first field asks for an annual percentage rate the finance charge computation should use. Keep in mind this is an annual rate. In the sample company, QuickBooks will compute what the annual amount should be, then divide to only charge for the appropriate period, usually one month.

What is the minimum amount QuickBooks should charge? This field should really be filled in. Otherwise, the amount could be very small, making it less than the cost of charging the fee.

A grace period is often a good idea. Where this is most useful is preventing a customer payment and a statement with a finance charge from crossing in the mail.

As an example, say the customer has terms allowing thirty days before payment is due. They pay on the thirtieth day. At the same time, finance charges are computed and statements sent by the business. The customer will receive notification they are late and have been charged a finance charge even though they paid on time.

Finance Charge Account allows the selection from the chart of accounts. Finance Charge income will post to this account. A best practice is to use an Other Income type of account.

Most QuickBooks users will charge from the due date as shown.

Rarely does anyone want to print an invoice for each finance charge created. Most companies will leave the final checkbox unchecked.

To calculate the finance charges, either the menu option on the Customer menu or the icon on the Home Page can be selected. The following window shows the Assess Finance Charges window from the sample company Rock Castle Construction.

Only one customer has overdue invoices as of 12/31/2018 (the date in the sample file).

The overdue balance is $3500. If we looked up the details of this balance, we would find an invoice that was due on 11/14/18. The amount is overdue by several weeks.

Ten percent (the amount of our annual rate) of $3500 is $350. At December 31 the invoice is forty-seven days late. The result of that calculation is a finance charge of $45.07.

Different states may have regulations controlling the amount that can be charged customers for late payments and when those can be assessed. Be sure when you set your preferences you are in compliance with these regulations in your state.

Do you charge your customers finance charges? Does it help you get paid faster?

How to Manage Duplicate Names in QuickBooks

It happens. Baker, Chris has been a customer for a long time. But so has Christine Baker. And they’re the same person.

If you have used QuickBooks long enough, you know that if you try to delete one of those customers, QuickBooks won’t allow you to do it. At least, not if transactions have been recorded under both names.

You could go back and change the customer name on every transaction, leaving one of those duplicate entries with no activity in your QuickBooks company file. Then you could delete it. But there’s an easier way.

Above is our customer center. You can clearly see the duplicate customers. Both names have a balance due. Both have transactions.

To fix this, we first need to decide which version of the customer name we want to keep. Christine Baker? Okay, let’s do that.

Either click on the Baker, Chris name and choose the Edit icon, or right click on the name and choose Edit from the popup menu.

This is how that edit window appears now:

The very first field of this window is what QuickBooks sees as the customer name. That is Baker, Chris. Edit that to read Christine Baker. Then click okay and if you’ve spelled the new name right, you should get this warning message.

QuickBooks gives you a chance to reconsider since this is a permanent change. There’s no going back. Once you say yes to this message, QuickBooks has no way of recovering the old information.

In this case, it’s a simple change and we know we want to do it, so we’ll choose Yes. As soon as we do, our new customer list looks like this:

There is only one Chris or Christine Baker now. The two customer balances are now one. All transactions in the QuickBooks company file that used to show Baker, Chris as the customer name now show Christine Baker as the customer name.

This works with other lists as well. You can re-vamp your chart of accounts by editing and merging account names. Vendors, classes, items, etc. Just use care and think through your change before implementing it.

If there is some question about the impact on your company file, create a backup, make your change, and see how it works for you. If some surprising result pops up that makes you wish you hadn’t made the change, restore the backup and you’re back to your original company file.

Bartering in QuickBooks

What to Do When a Customer is Also a Vendor

This is a common scenario for small businesses. Another business buys product from you. They are a customer. But, they also sell to you. They are a vendor.

This is an issue in QuickBooks because a name cannot be both a customer and a vendor. And there is no way to trade services or products between customers and vendors.

At least, not in a straightforward, documented way. There is a solution.

Creating a name as both a customer and a vendor is not difficult. Change the name a little.

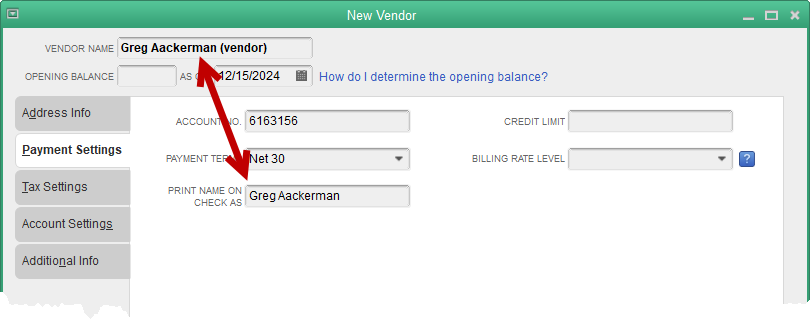

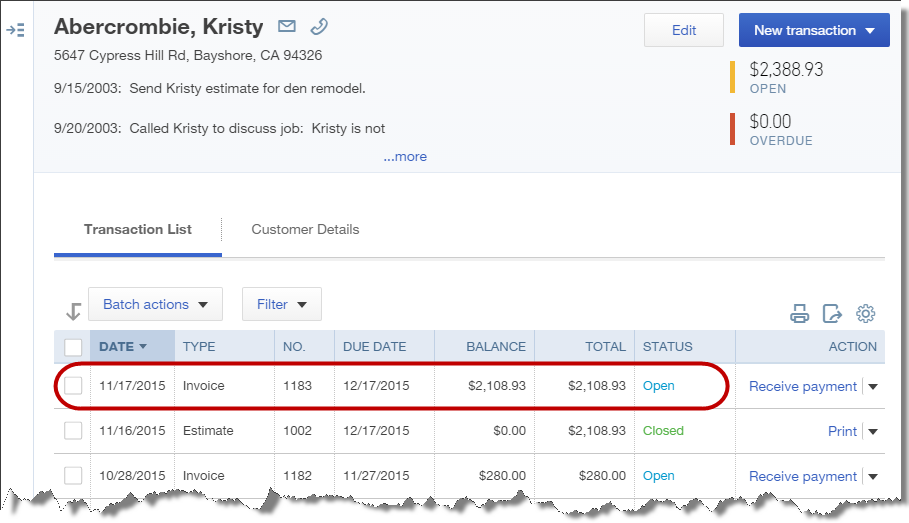

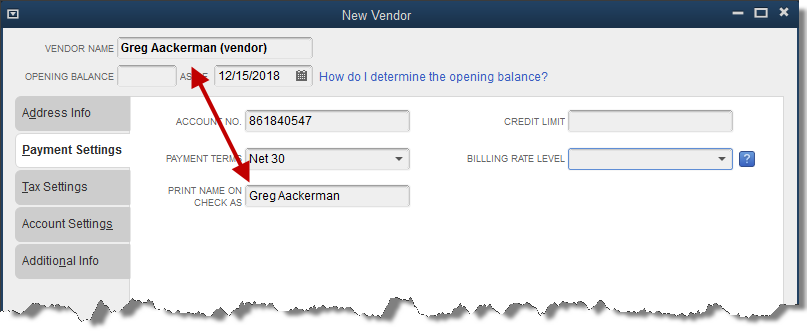

Let’s say we have a customer named Greg Aackerman. We want to put Greg on the vendor list as well.

In vendor setup, use the vendor name ‘Greg Aackerman (vendor)’, and fill in the “Print on Check as” field with the name only.

Create a new bank type of account. You’ll see why in a few paragraphs. Name the new bank type of account “Clearing Account.”

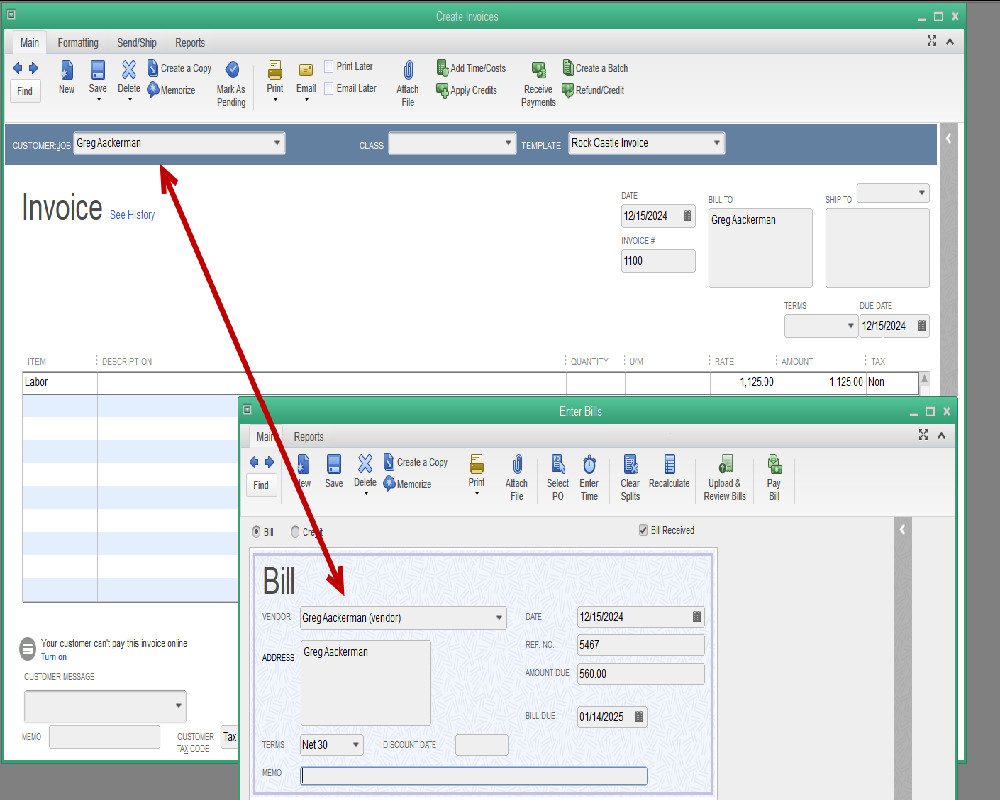

Recording transactions is simple. Use the customer, in our case Greg Aackerman, to record sales on invoices. Use the vendor, in our case Greg Aackerman (vendor), to record purchases on bills.

Saving the above transactions results in the following customer/vendor balances.

The puzzling part for most QuickBooks users comes now. How do we offset the balances?

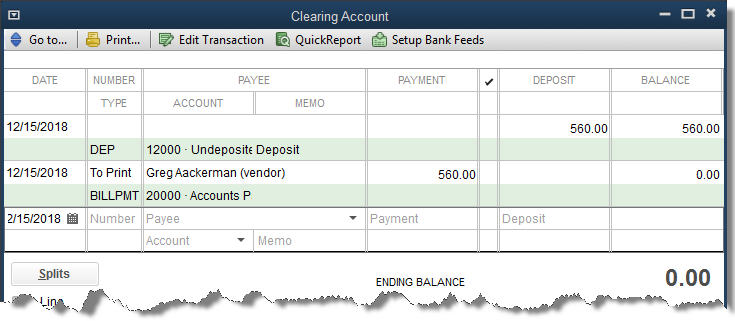

First, note the amounts. Greg owes us $1125. We owe him $560. So whatever we do, we want to end up with a zero balance due to Greg the vendor and a balance due us of $565 ($1125 - $560) from Greg the customer.

Receive a customer payment from Greg in the amount of $560.

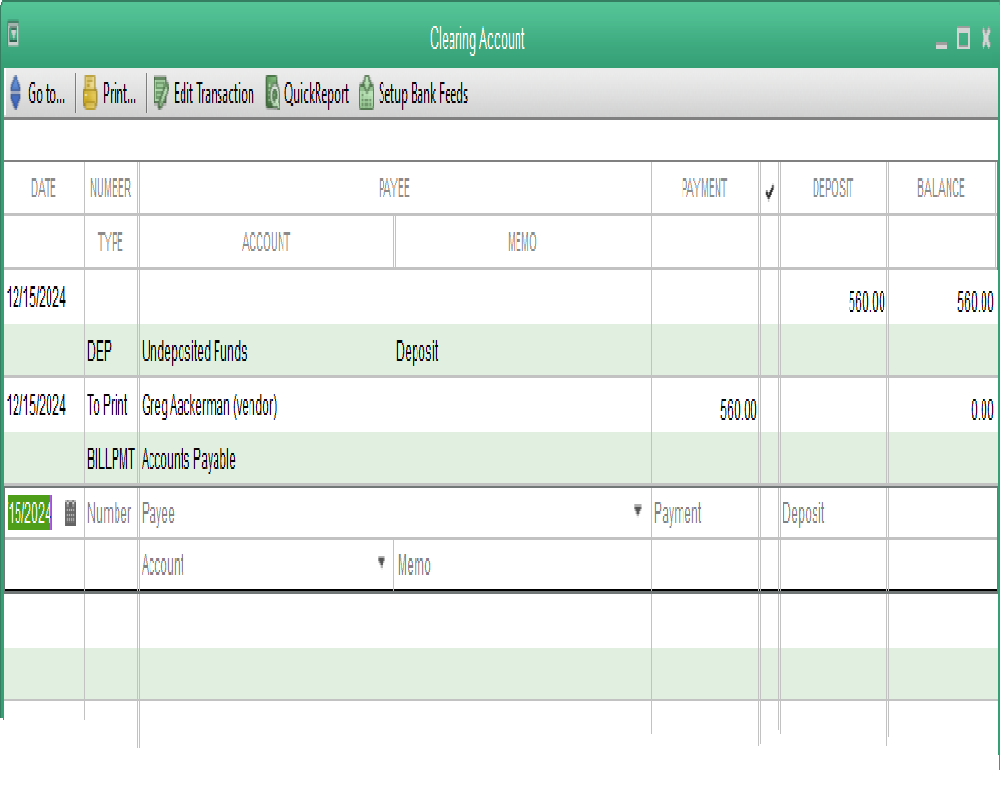

Navigate to Pay Bills and pay the bill we owe to Greg the vendor. Use the Clearing Account as the bank account to pay from.

Record a bank deposit. Deposit only the $560 payment we received from Greg and deposit it to the Clearing Account.

The result is that we no longer have a balance due to Greg in accounts payable. We show a balance due from Greg in accounts receivable of $565.

It’s important to double check and be sure we have created the transactions correctly. If we have, there should be a zero balance in the bank type account, Clearing Account.

Working With Vendor Credits in QuickBooks

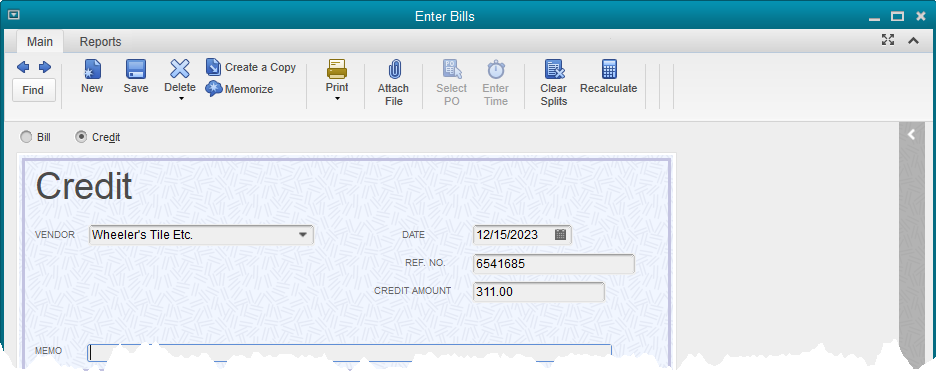

Creating a vendor credit is a simple transaction. Start by using the Enter Bills command, then mark the bill form as a credit. It’s an easy click of a button. See the screenshot below.

Once QuickBooks knows this is a credit, not a bill, fill in the information as normal. It’s very much like entering a bill.

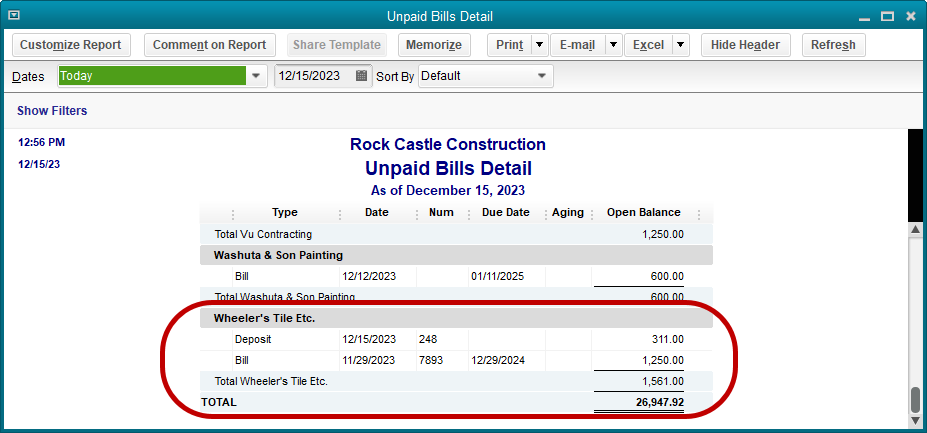

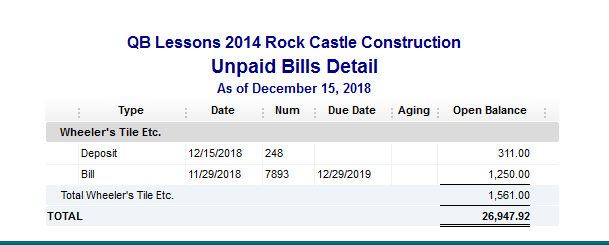

Open credits that already exist in QuickBooks can be seen on the Unpaid Bills report.

An area that is a struggle for some QuickBooks users is the posting of the credits against payments to vendors.

Credits must be taken against an individual bill. That is, they cannot be used on a vendor payment check without first applying them to a bill.

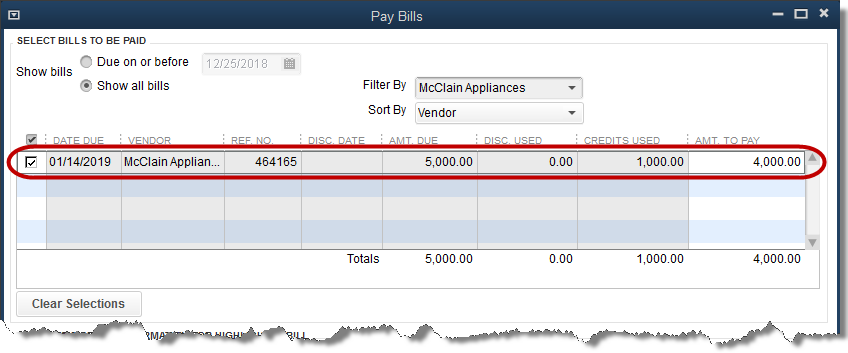

The left-hand arrow indicates the bill that we wish to pay with a vendor credit. Once a bill has been selected, as it has here in the screenshot, available credits will be shown. See the area indicated by the right-hand arrow.

In this case, we have $125 in credits to be used if we choose.

Clicking the Set Credits button will bring up a list of the available credits to select from. In this example there is only one, the $125 credit we created earlier.

Select this credit and click Done, and the Pay Bills window appears as follows.

Note the change now that we have selected a vendor credit to apply to the bill.

The original amount due, still shows $1250.00. The $125 shows in the Credits Used column. It is subtracted from the original amount, resulting in $1125.00 in the Amt to Pay column.

The bill payment can now be processed as normal. Be sure the correct bank account is selected, as well as the other options chosen, and click on Pay Selected Bills. QuickBooks creates the bill payment check.

There are times when bill credits may equal the amount of a bill, causing a vendor balance of zero. If these transactions have not been applied to one another however, they still show on the Unpaid Bills Detail report.

This can be a problem for accountants. It is best to apply the transactions resulting in no entries for the vendor on the Unpaid Bills report.

Use the same procedure as above. The only difference will be that QuickBooks will not create a check since the resulting amount will be zero.

The Customer’s Check Bounced, Now What?

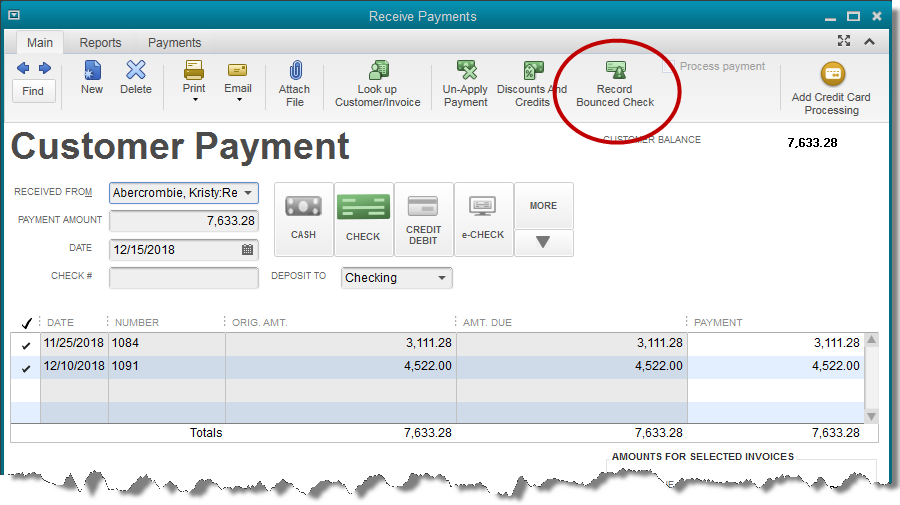

There is a feature, introduced in QuickBooks 2014, that will make the entries for a customer’s bounced check in QuickBooks. It uses the method we have suggested to QuickBooks users in the past, but those entries had to be created manually. Now, the software does it automatically.

Above is a screenshot showing a typical payment transaction in QuickBooks and highlighting the icon on the transaction ribbon that will activate the Bounced Check feature. Note the manner in which the payment is currently allocated.

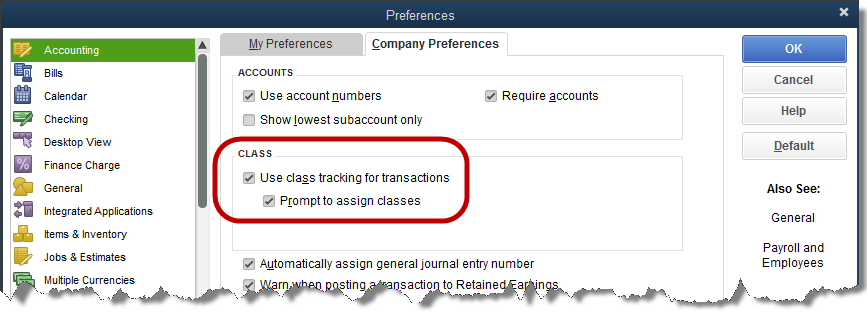

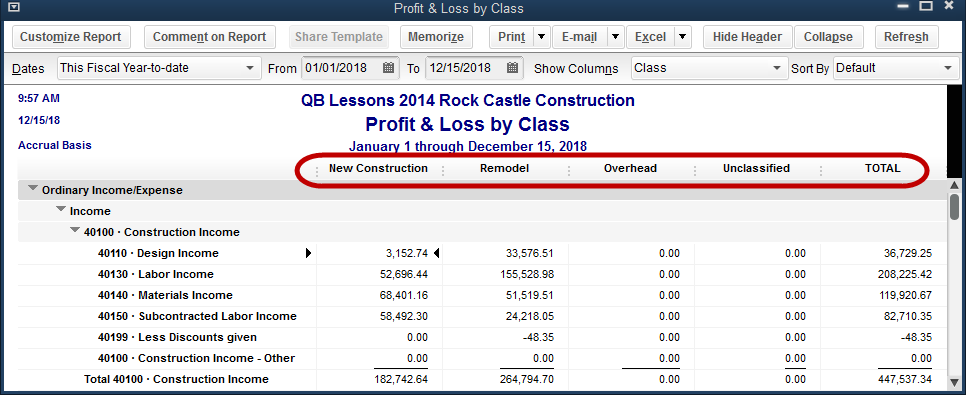

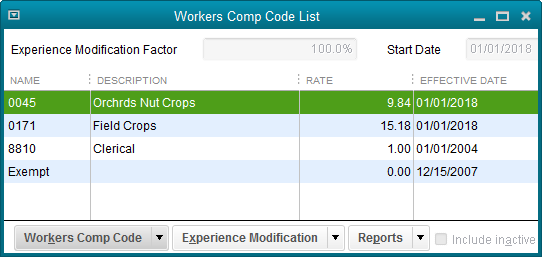

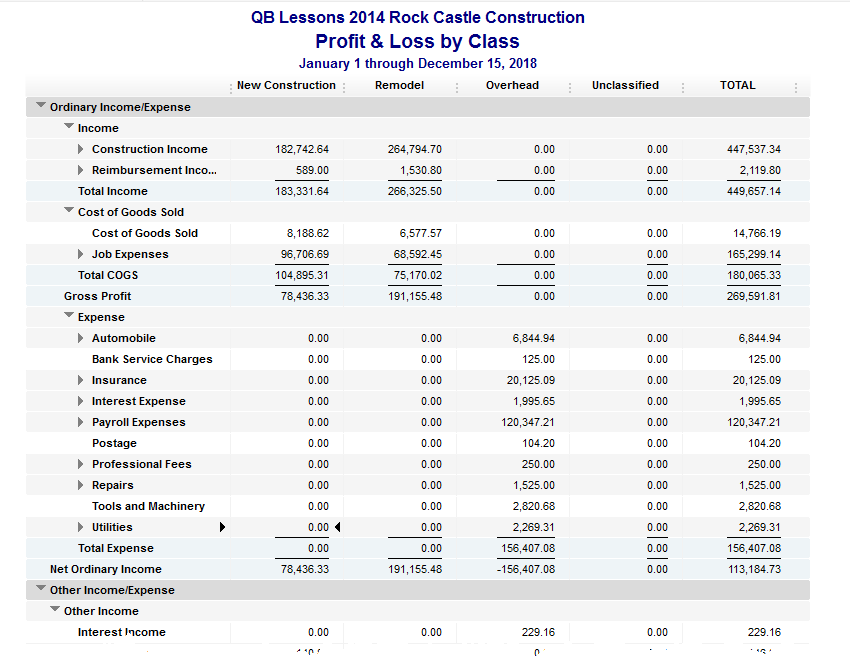

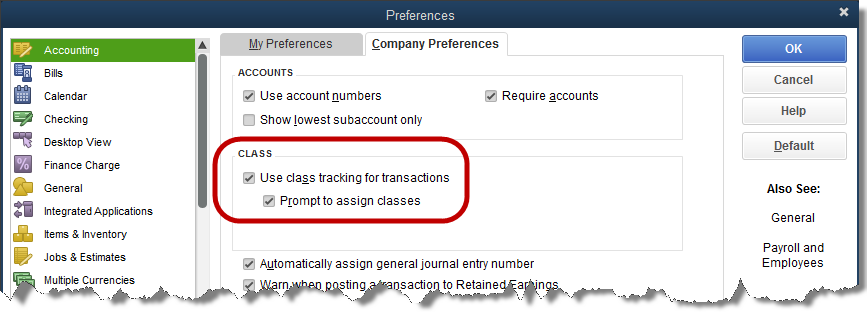

Above is the window that opens once the Bounced Check icon is selected. Note that all the fields in this popup window are editable. You are able to choose the amount the bank has charged you for the bounced check. You are also able to set the transaction date, the expense account charged for the bank fee, class (if you use the class feature), and the fee you wish to charge your customer.

Once the information is filled in correctly, you may select the Next button at the bottom of the window.

This is an informational window, explaining what entries QuickBooks will make.

Note that in section 1, QuickBooks is explaining that the two original invoices paid by this payment, are now marked as open, or unpaid. Section 2 explains that the amount of the bad check, $7,633.28 and the service amount charged by the bank, $25.00, have both been deducted from the QuickBooks bank balance.

Section 3 informs you that a new invoice will be created for the customer, charging them and adding to their balance, the amount you, the QuickBooks user, chose to charge your customer for the returned check. We chose $35.00.

The customer name in the graphic is “Remodel Bathroom” which can seem a little confusing. This sample file is for a contractor who tracks income and expense by job. The payment was for a particular job, Remodel Bathroom. In your QuickBooks file, if you used an actual customer name on the invoice, rather than a job, that name would show here.

Old Invoices in QuickBooks? A Simple Fix

From time to time, it becomes necessary to write off a customer balance that has become uncollectable. Let’s look at how to record this transaction in QuickBooks.

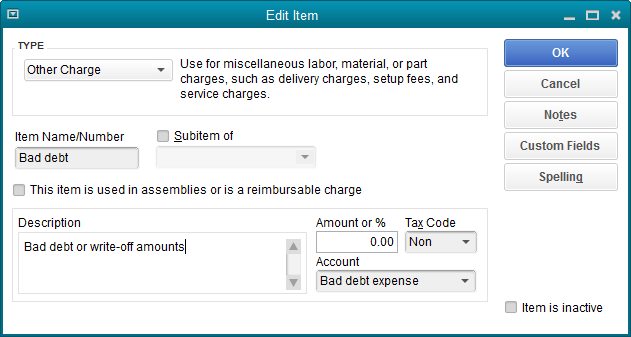

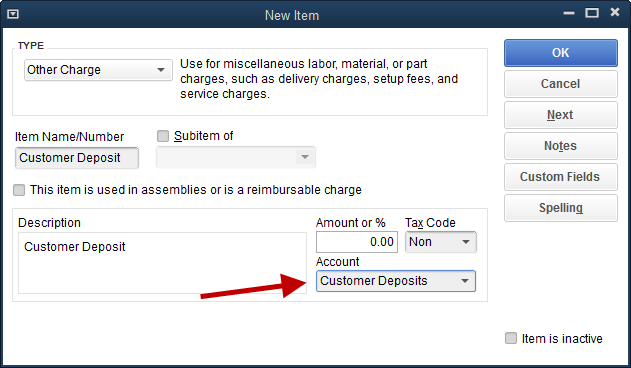

1. Add a new Item for Bad Debts

Open the Item list, click the Item button in the lower left corner, and select New.

Select ‘Other Charge’ as the item type.

Name the item ‘Bad Debt’.

Do not enter a default amount.

Make the item taxable and in the Account field, select the expense account for Bad Debt Expense. If you don’t already have an expense account for this purpose, you can create one without leaving item setup.

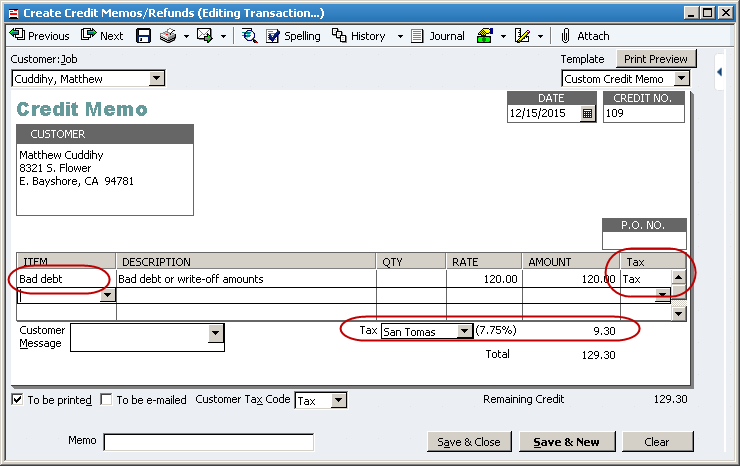

2. Issue a Credit memo

Choose the Refunds and Credits icon from the Home Page or select Create Credit Memos/Refunds from the Customer drop- down menu

Enter the customer, a current date, etc. in the header of the credit memo.

Use the bad debt item just created as the line item in the credit memo. Enter the amount to be written off exclusive of any sales tax amounts.

Enter the appropriate Sales Tax Code. Use a non-taxable code if there is no sales tax to be written off.

If applicable, select the appropriate Sales Tax Item from the drop down list at the bottom of the Credit Memo form

Click Save and Close.

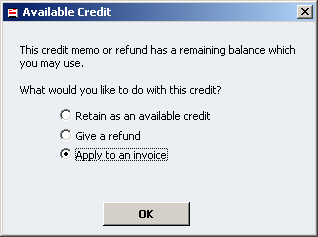

3. Apply the Credit Memo.

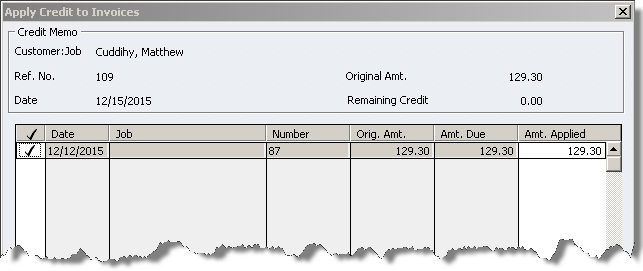

Choose the selection to Apply to an invoice when this popup appears.

Be sure the correct invoice, if there is more than one, is selected in this window, and click Done.

That’s it. This method allows the recovery of any sales tax that may have been paid on the customer’s original invoice. As long as you use a current date for the credit memo, it preserves the account balances from previous periods. Your accountant will thank you for that.

Recording Customer Payments in QuickBooks

Receiving payments and recording deposits in QuickBooks Desktop

The process of receiving customer payments and recording bank deposits in QuickBooks may seem pretty straightforward, but there are a few lesser known situations we’ll cover in today’s post.

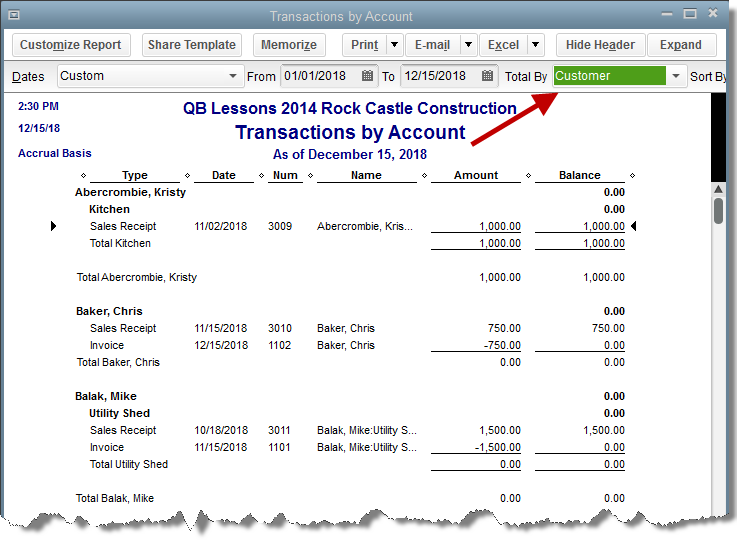

Posting payments to customers and jobs

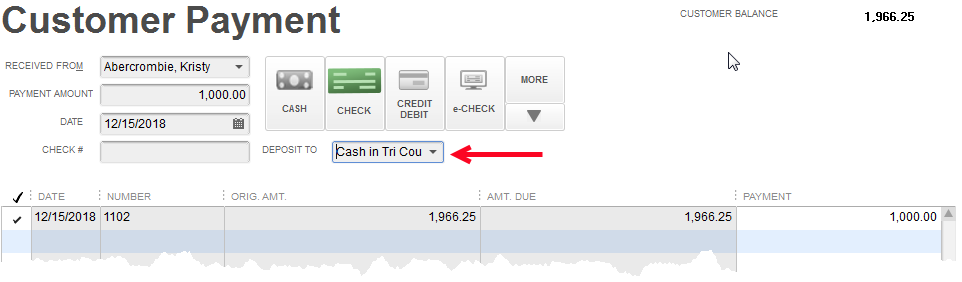

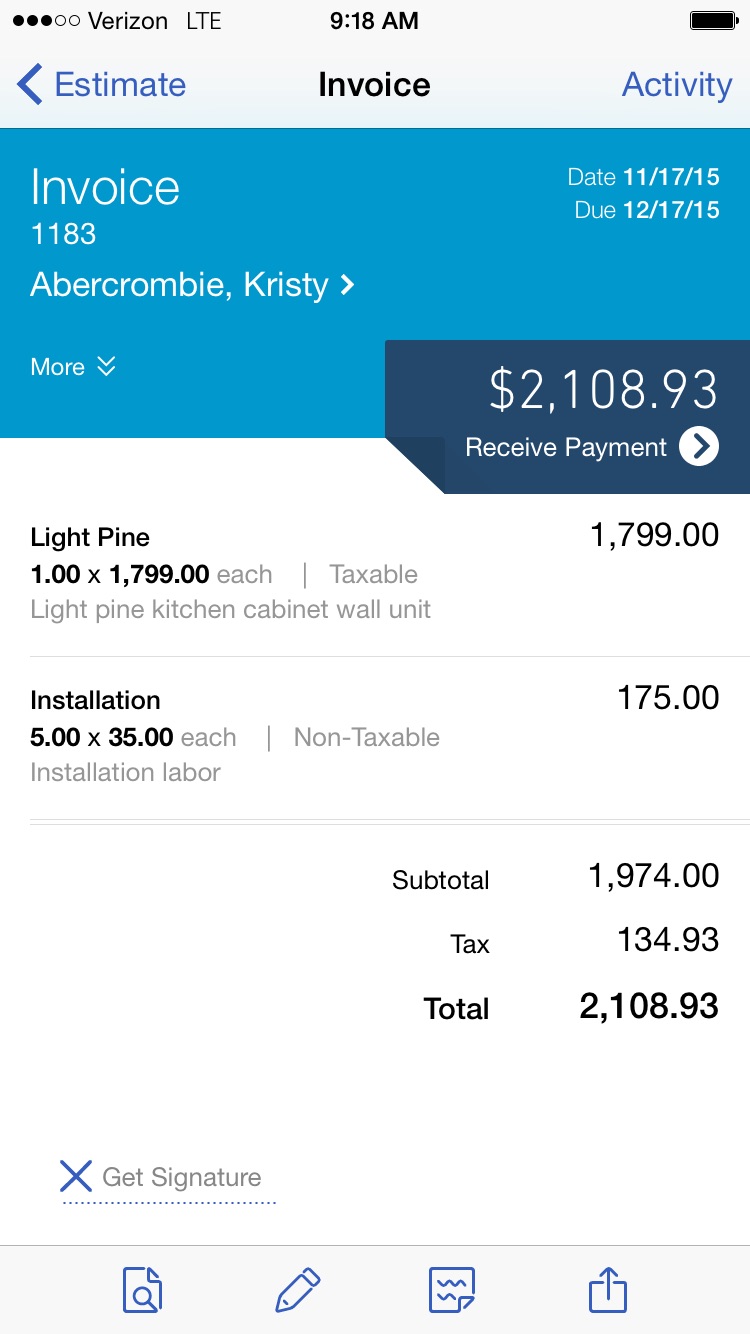

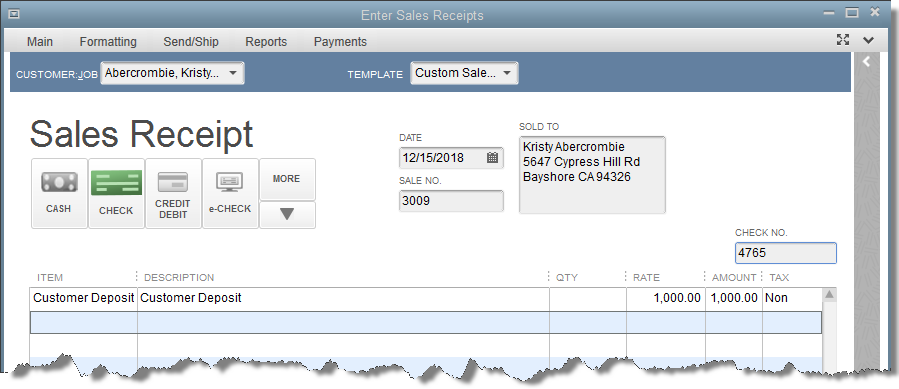

When tracking jobs or projects in QuickBooks we are used to specifying not only the applicable customer in job expenses, but the particular project as well. As we have covered before, the jobs show in the Customer Center as indented entries. So, in the above screenshot, Kristy Abercrombie has three jobs in Rock Castle Construction. Family Room, Kitchen, and Bathroom Remodel.

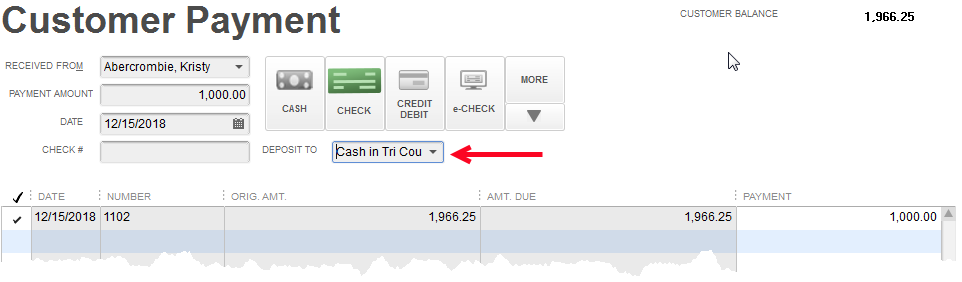

Normally, when receiving a payment from a customer, we would receive it as a transaction specific to the project it was for. What about when a customer sends a payment that covers more than one project?

By using the customer name, not any of the individual projects (see arrow), QuickBooks will populate the Receive Payments window with all open invoices for that customer, not just the ones from a certain job. At this point, you have the option to apply the payment in any way you want regardless of project or job.

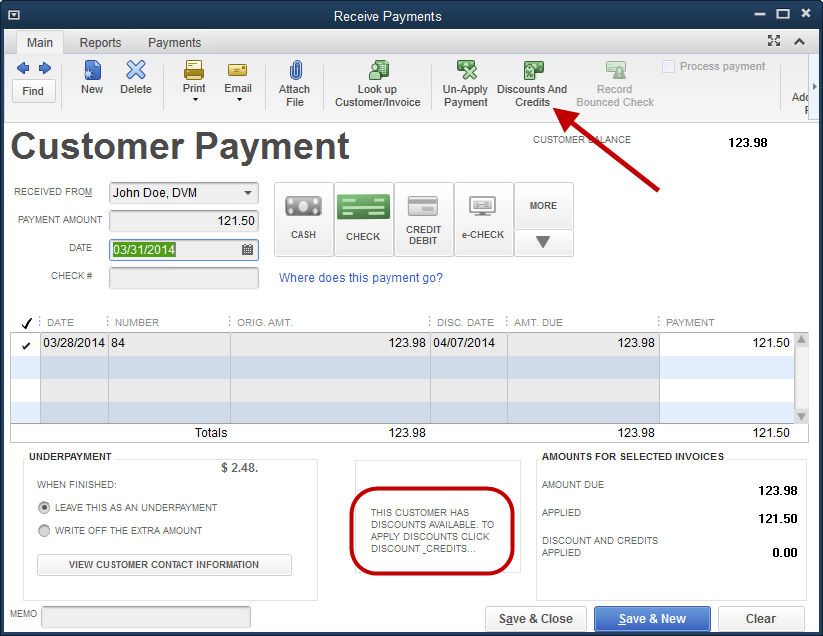

Giving customers discounts for speedy payment

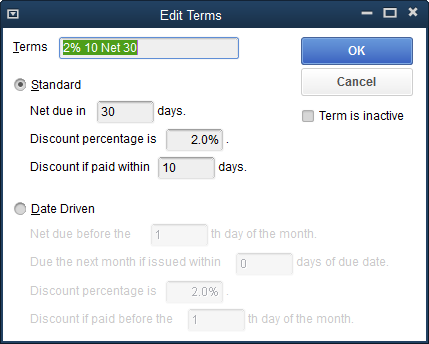

Sometimes, offering a discount for early payment is a strategy you may want to use. That starts by setting the terms in the customer file and making sure the correct terms are entered on the invoice when it is created and saved.

If the customer pays within the discount period, how do you give the discount?

In this example, we’ve given Kristy a 2% discount if she will pay her invoice within 10 days. Those terms in QuickBooks would look like this: 2% 10 Net 30.

Kristy pays $1372.00 on a $1400.00 invoice. Clicking on the Discounts and Credits button opens the Discounts and Credits window seen in the lower right part of the screenshot.

QuickBooks knows the terms that are on the invoice. It does the math, both date and amount, and fills in all the pertinent information seen in the Discounts and Credits window. Two percent of $1400 is $28. If you think the amount should be slightly different, or if the customer rounded slightly differently to come up with a different amount, you can specify in this screen what the amount should be.

The Discount Account is specified by you, the QuickBooks user. Once you select the account for one discount, QuickBooks will continue to suggest that same account on future discounts. In this case, Rock Castle has a special account setup just for discount amounts.

What if the customer has a credit?

Sometimes, a customer can have a credit that needs to be applied to a current invoice. This could be the result of an overpayment from the past, or a credit memo, or other similar event.

In the above screenshot, the same button, Discounts and Credits, was selected to use the customer’s credit on this invoice. This time, we are looking at the Credits side of that window.

The customer had a $1000 credit, probably from a down payment before work started, in the system. They make a $400 payment on the $1400 invoice. Now, when we accept the payment and apply the existing credit, the invoice will be paid in full.

Speaking of advance payments…

While there are different ways to account for prepayments from customers, following is by far the easiest and most common method used.

If you look close, you can see the gray text in the screenshot that reads, “There are no unpaid invoices for this customer”.

That’s okay. We can still save the payment. Just be sure the selection in the lower left (see arrow) is Leave the credit to be used later.

When receiving payment on an actual invoice, you would use the payment and the credit created by this payment transaction to pay the invoice just as we did in the last section when we had the $1000 credit.

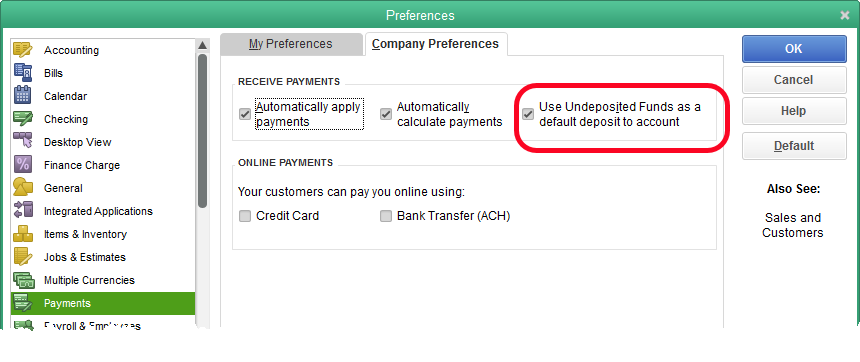

How many payments will you deposit?

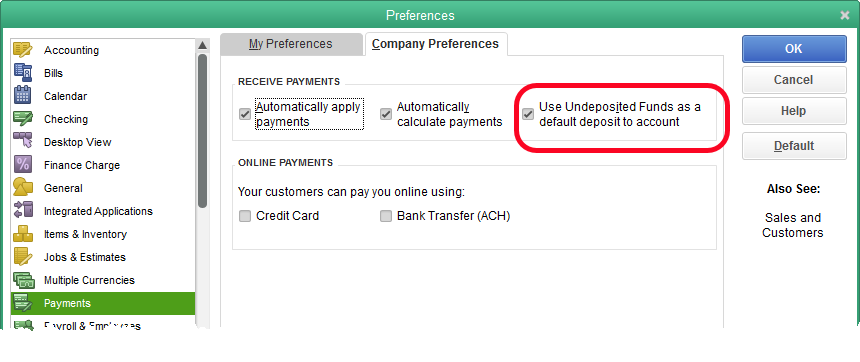

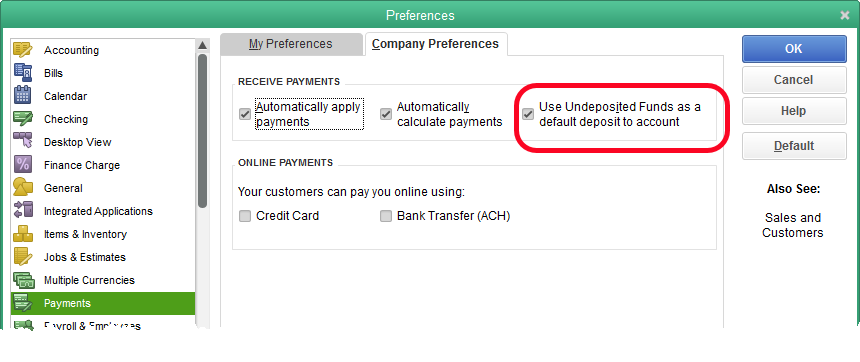

By default, QuickBooks posts payments to an account called Undeposited Funds. This allows QuickBooks to accumulate the payments you record on one list. Then, when creating the deposit, you select multiple payments to create a bank deposit in QuickBooks that will match the amount of the same deposit that appears on your bank statement. It makes reconciliation much easier.

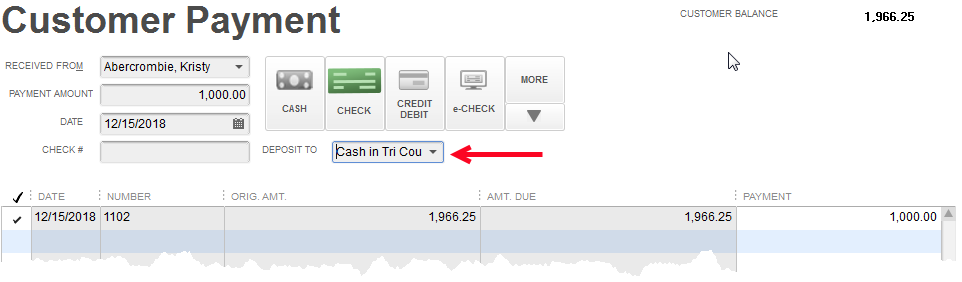

Sometimes, a QuickBooks user only receives a few payments a month and they all go directly to the bank. There’s really no need for Undeposited Funds. It only adds another step.

By unchecking the box with the label ‘Use Undeposited Funds as a default deposit to account’, you can change this behavior.

Now, with the preference changed, we can decide to deposit this payment to a bank account rather than Undeposited Funds. This means we won’t have to use a Record Deposit transaction in QuickBooks to get this into our bank balance. Once we save the payment, it’s already there.

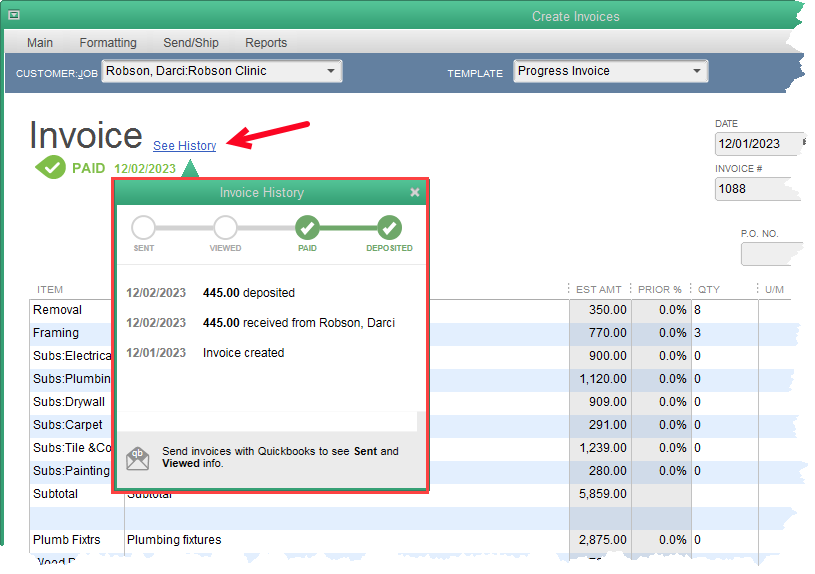

Use QuickBooks’ Tools to Make Invoicing Easy

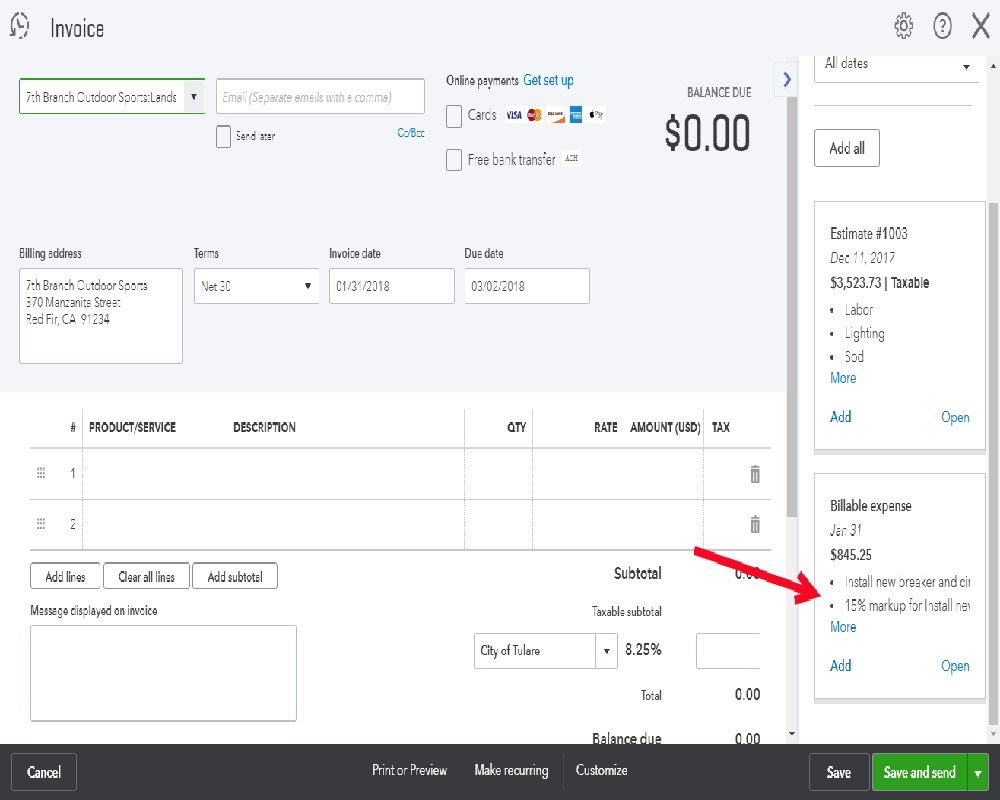

In a previous post, we reviewed QuickBooks’ ability to create a simple project budget based on the Estimate form. In this post we’ll focus on some additional tools in QuickBooks that can make invoicing customers easier.

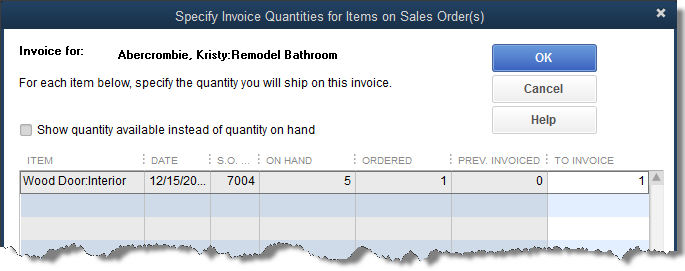

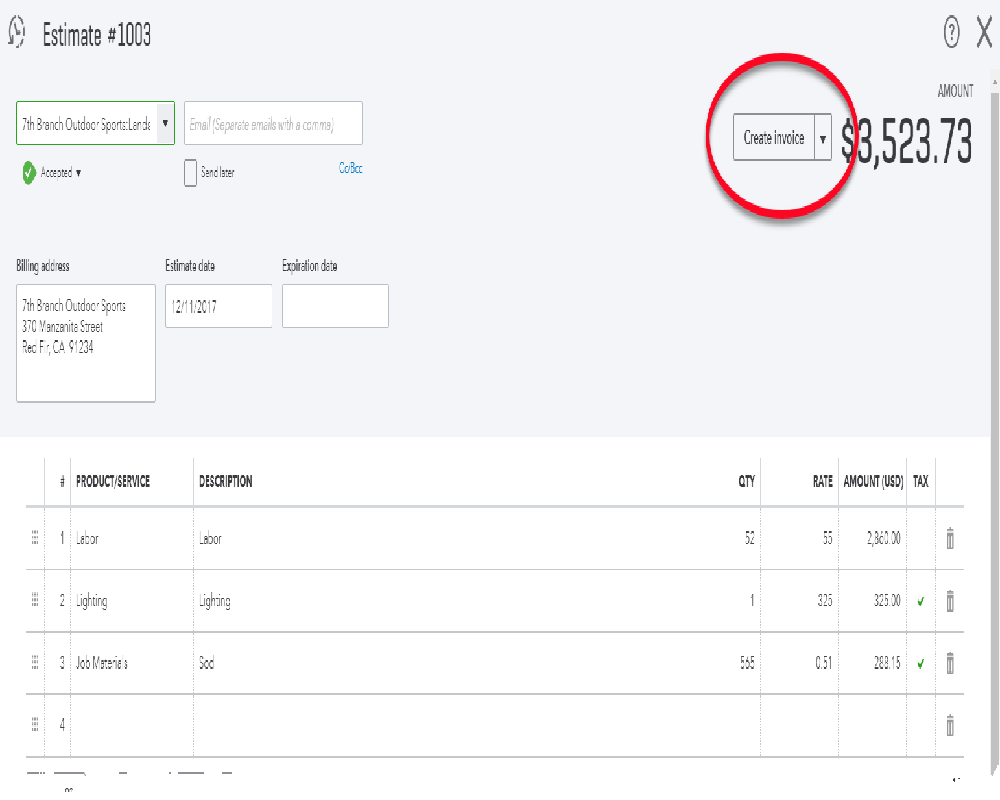

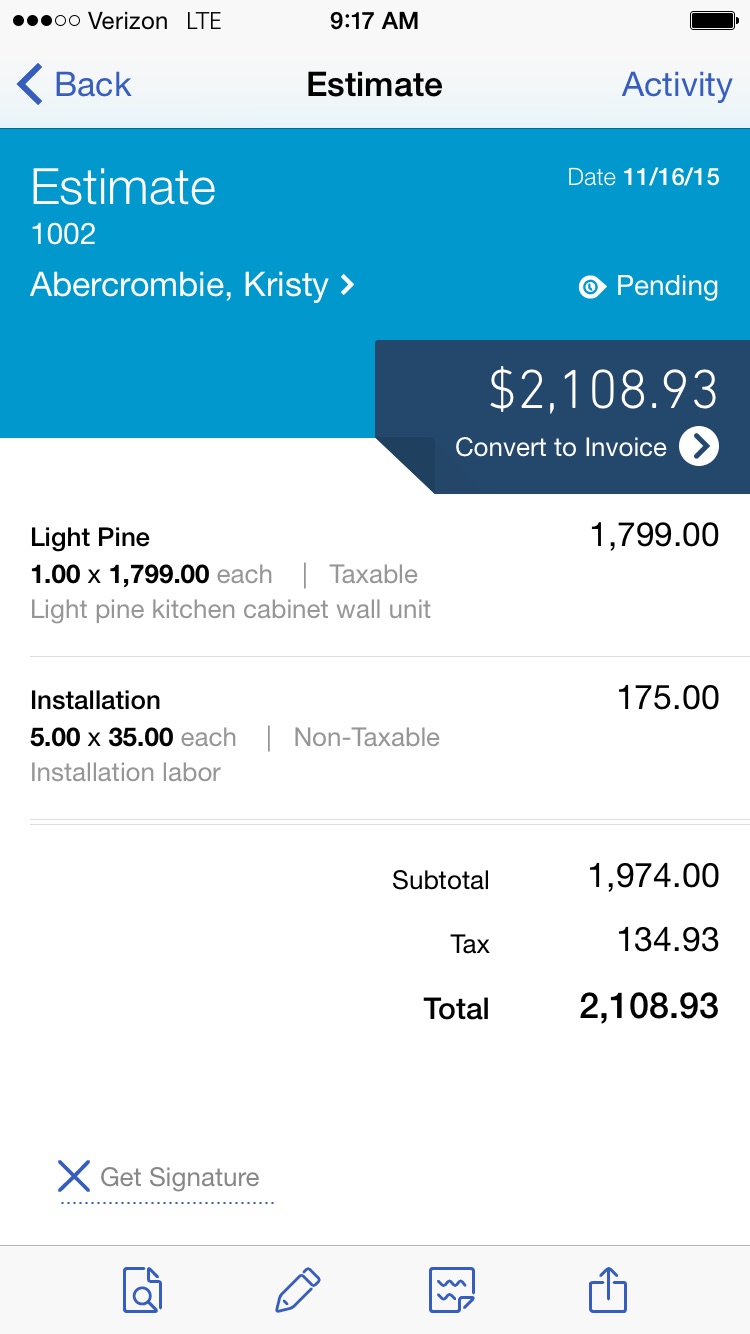

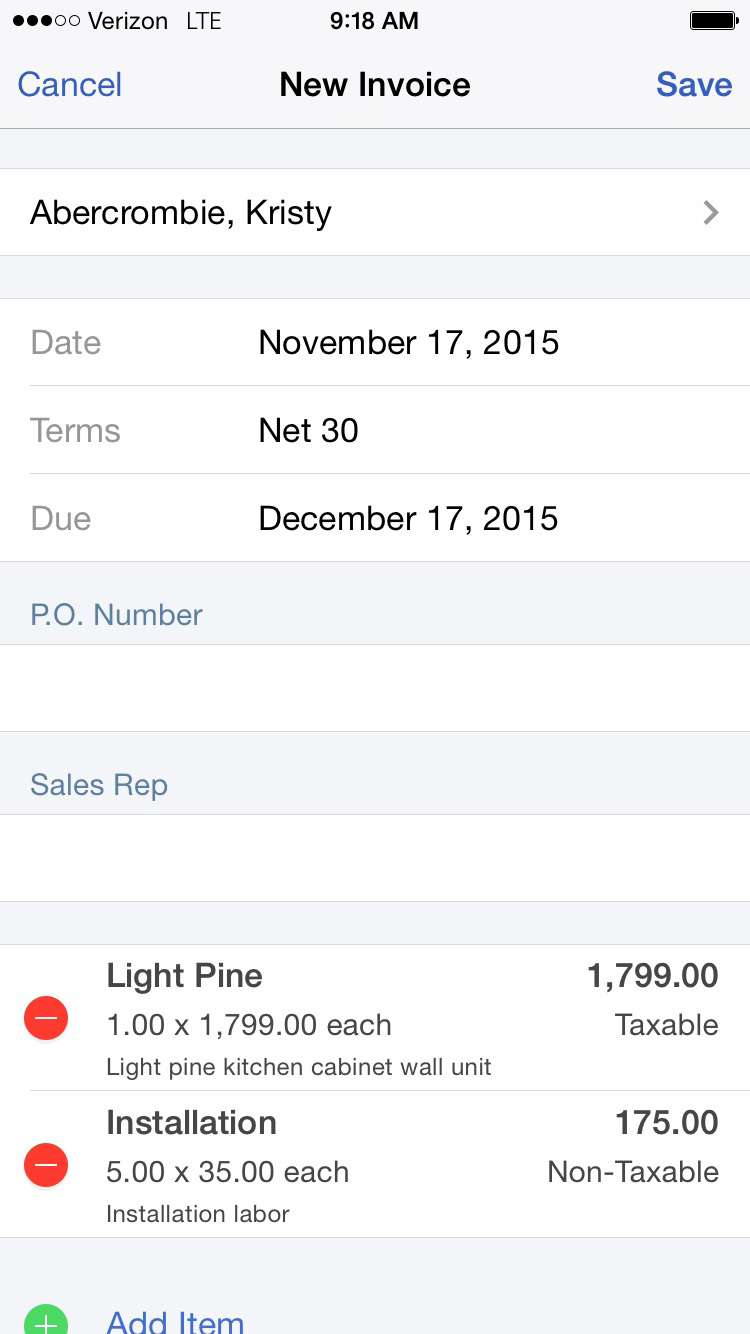

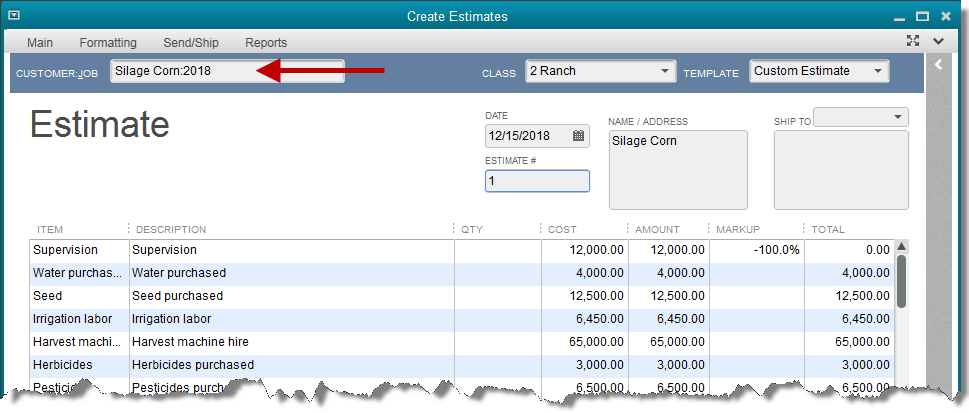

Creating an estimate in QuickBooks is an optional step. An invoice can be created without having used the estimate form at all. If an open estimate exists for a certain Customer:Job, when you begin an invoice for that Customer:Job, QuickBooks will ask if you want to use the estimate as a basis to begin the invoice.

You can see the estimate listed in the popup window in the screenshot above. If more than one estimate had been created for the job/project, all the open estimates would appear here and you would be able to select which one you were using as the basis for your invoice.

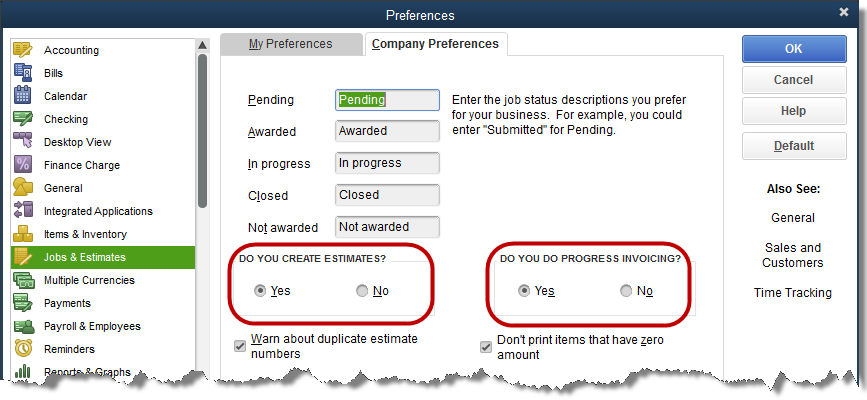

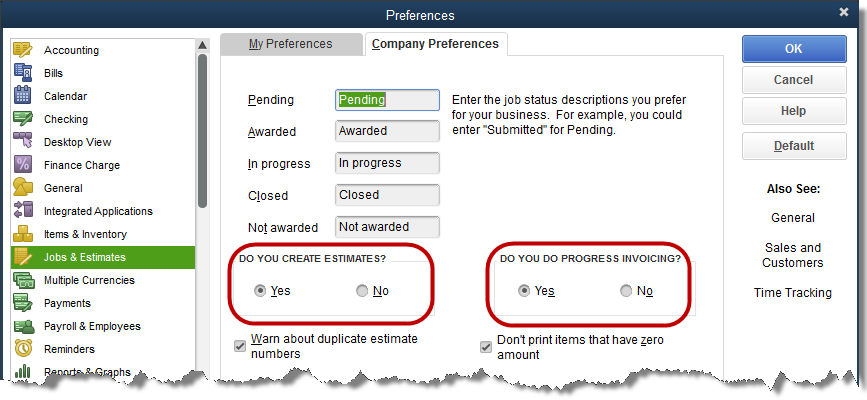

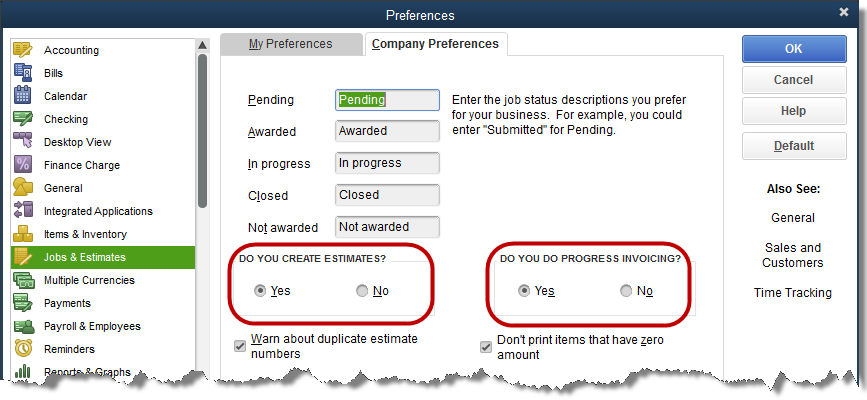

Select the estimate (if there are more than one), and click OK. What happens next depends on your Preference settings.

If this is turned on in Preferences (Edit->Preferences->Jobs & Estimates->Company Preferences->Do you do progress invoicing?), once you select the estimate to use for the invoice, the following message appears.

At this point, there are more options to choose from. QuickBooks allows you to create several invoices from one estimate. So your agreement with your customer may be to invoice at certain points of the project’s completion. QuickBooks will help you keep track of that process.

Let’s review the choices. One is to create the invoice for 100% of the estimate. That’s easy and does not involve the progress invoicing ability at all.

Two, is to create an invoice for a specific percentage of the job. 25%. 50%, whatever you choose. Each line of the estimate is invoiced for that percentage.

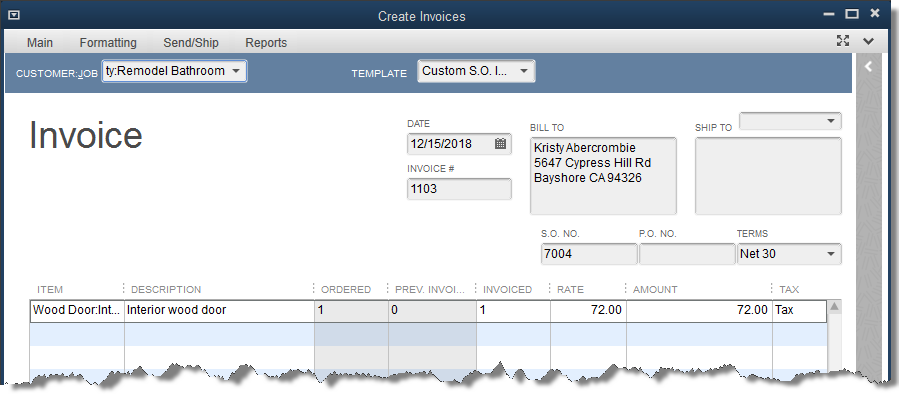

Third, is to specifically select the items from the estimate that will be invoiced. Let’s look at that option.

Above is the table QuickBooks opens when choosing the third option described. The arrow points to the column where you would select those items to be included on the current invoice. In the example, a bathroom remodel is being done. The customer is to be invoiced for tearing out the old fixtures, new framing, and the electrical work.

Note the circled column headers. If we had created an invoice for this project before, the amounts previously invoiced would show here and would not be available to invoice again.

With the items presently selected, this will be a $1715.00 invoice.

More possibilities for invoices in QuickBooks

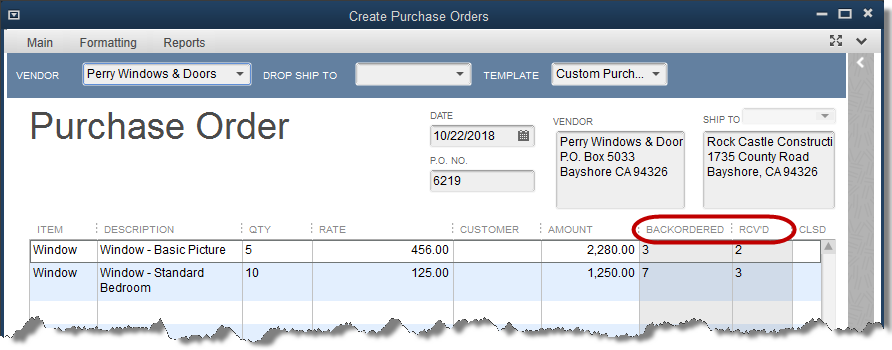

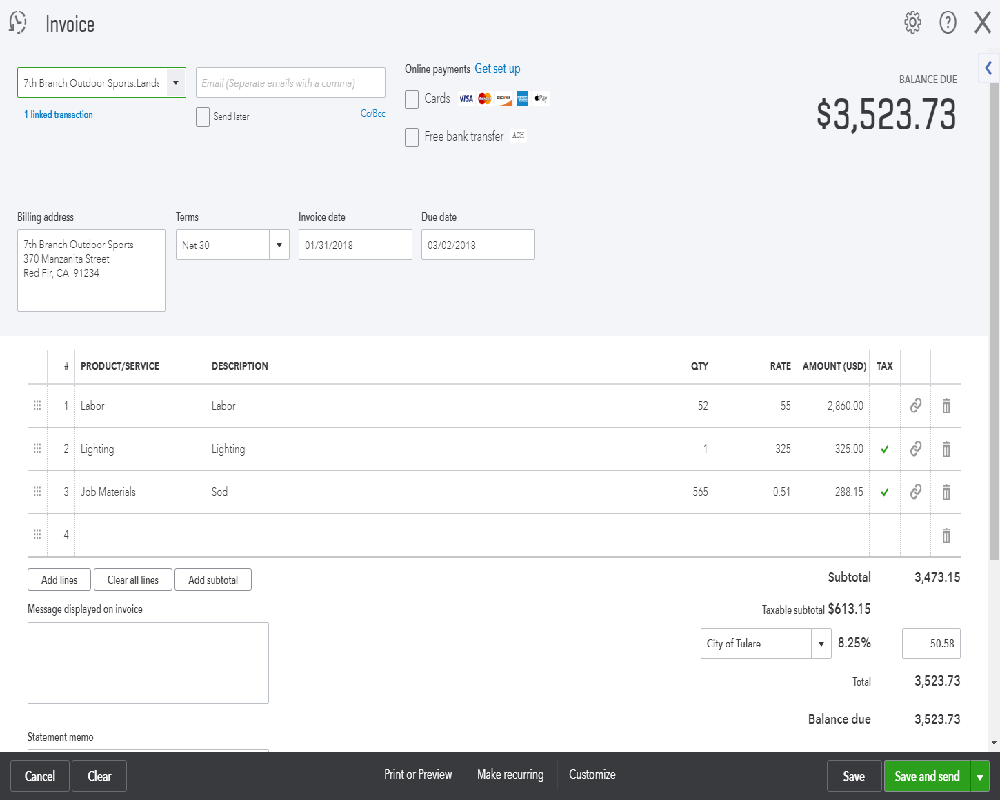

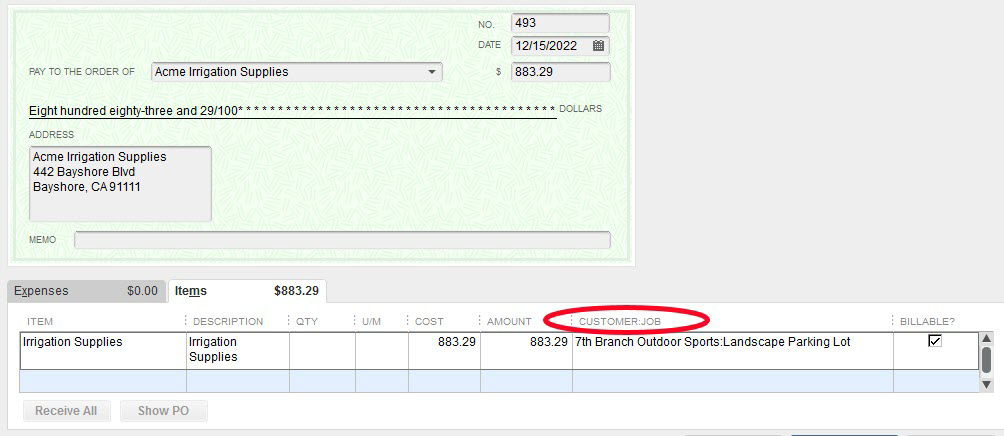

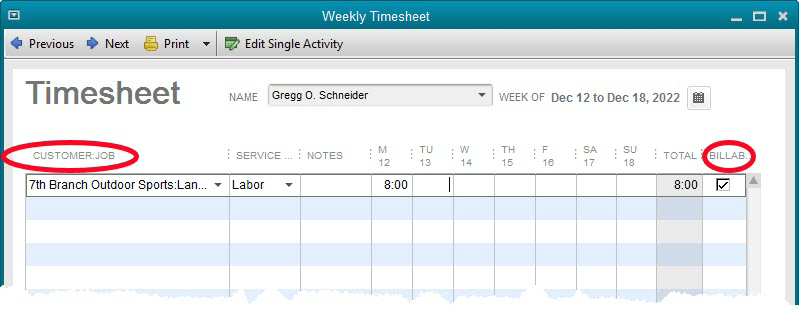

A feature in QuickBooks often used by companies in service-based enterprises is the ability to track time and expenses and then easily invoice those to a customer without a lot of additional manual entry. Let’s see how that works.

The most important part of the above check is the Customer:Job entered and the checkbox Billable with the checkmark in it. Additionally, the fact an item was used rather than Expense helps with some job reports, but that’s another topic for another day.

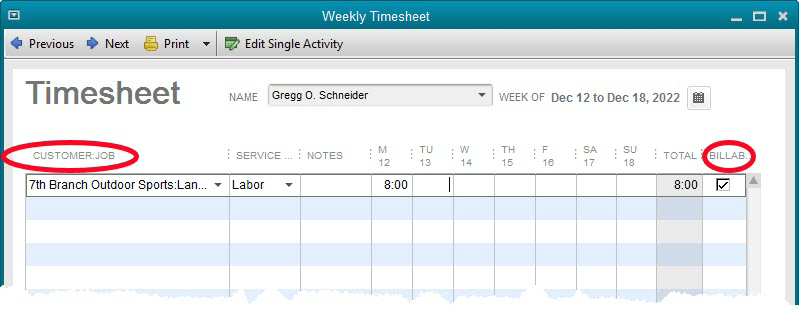

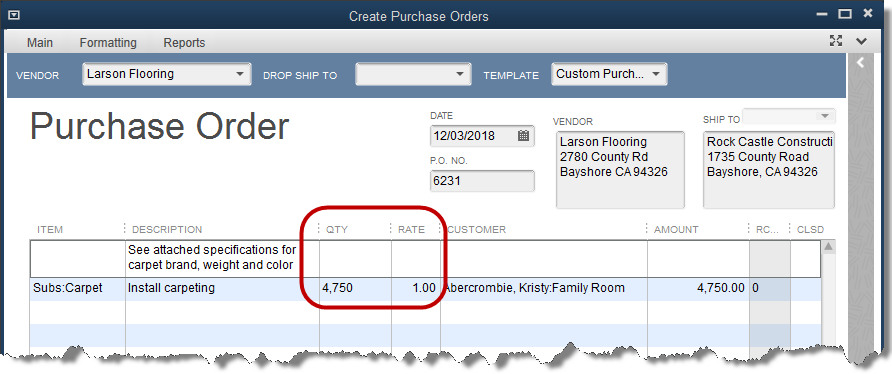

Before we invoice our customer, let’s add some time to the job.

Again, the most important part about this process is that a Customer:Job name is included and the Billable box is checked.

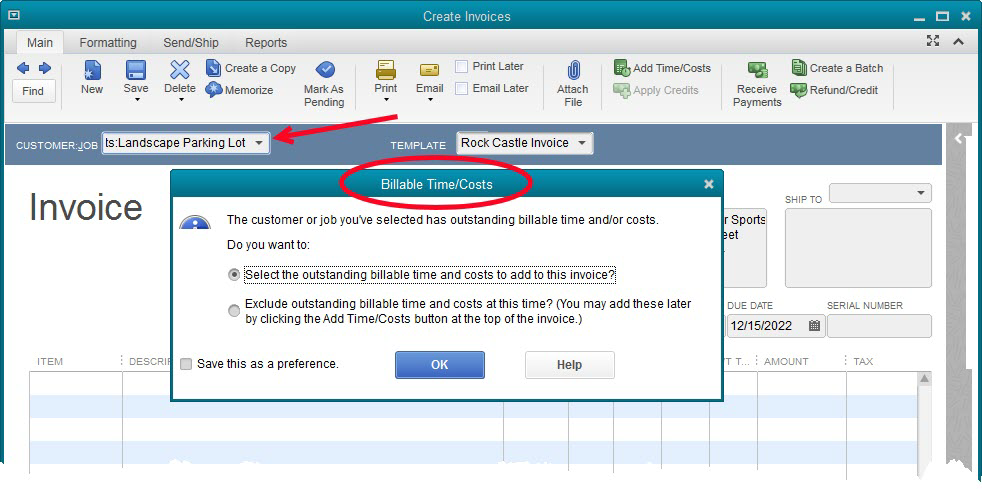

Now, let’s invoice the customer.

As soon as we enter a Customer:Job with outstanding billable time/costs, QuickBooks asks us if we want to invoice those items now. In this case we do.

We have both time and an item to add to the invoice. These are the entries we made with the check and the timesheet. There are more options for those that use this feature. For now, we’ll select both entries and click the OK button (not shown) at the bottom of the window.

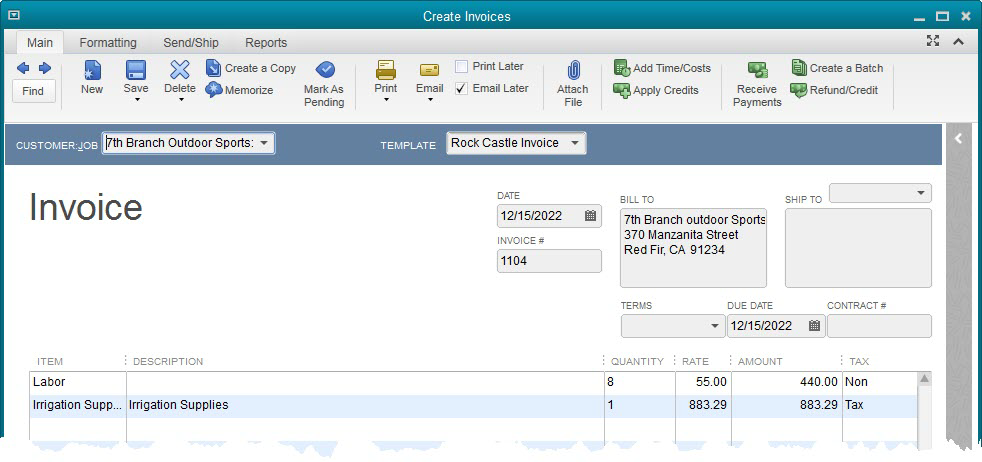

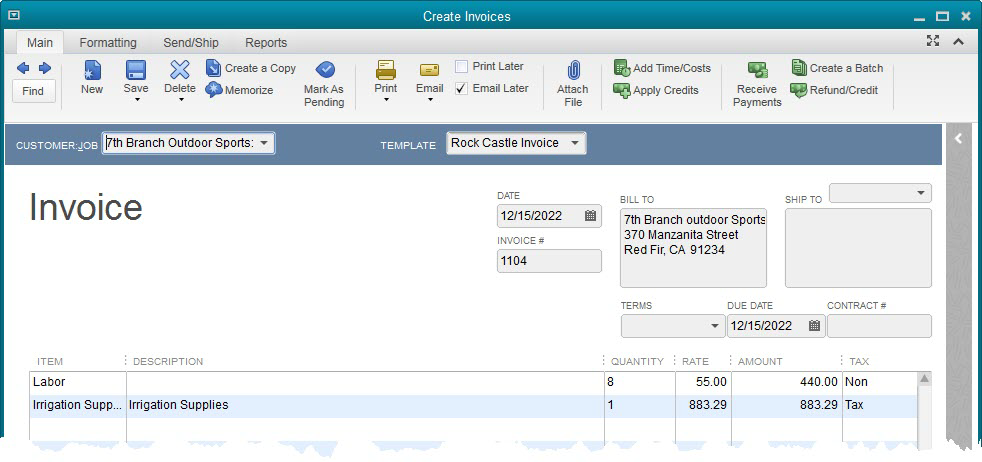

Here is the resulting invoice.

The billable items are added to the invoice. Labor is invoiced at $55 per hour because that is the sales price in the item setup. The amount for the irrigation supplies carried to the invoice at cost since there is no sales price setup for this item. In a case like this, the markup would have to be determined and the invoice amount edited to reflect that.

Two more quick invoice tools useful to service providers

Invoicing for a service provided on regular schedule, say monthly or weekly, is common. It is possible to Memorize an invoice. This memorization would include the customer name, so a memorized invoice transaction would have to be created for each customer on a repeated schedule like this.

Create the invoice as normal. Click the Memorize icon just to the right of the big Delete X icon. Choose how often you want the invoice repeated. Weekly, monthly, etc.

QuickBooks will remind you the first time you open QuickBooks on or after the date the memorized transaction should be entered. You have the opportunity to accept or reject the entry of the invoice at that point.

The other invoice tool we want to include today is Batch Invoicing. This is accessed from the Customer dropdown menu, Create Batch Invoices. This tool allows you to create a ‘batch’ of customers that should each receive basically the same invoice. You will be invoicing the same item and the same price for each customer. QuickBooks will create an individual invoice for each customer.

If there is a difference from one customer to another in, say, sales tax, or delivery method (email or printed), QuickBooks will pick up that information from the customer file and customize the invoice for that particular customer.

QuickBooks has some really great features that simplify the job of tracking project expenses and invoicing customers.

Where Was the Budget on That Project?

Estimates in QuickBooks do far more than just tell a customer how much a certain repair job will cost. They create project budgets.

Estimates are non-posting. You can create as many as you like and the accounting numbers are unaffected. They can also be edited and deleted/voided without concern for financial reports.

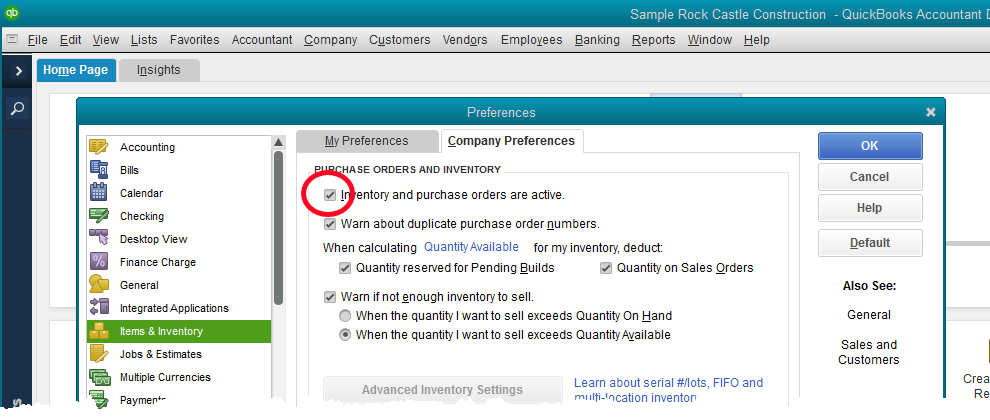

First, be sure the use of estimates is enabled in your QuickBooks company file.

In the screenshot, you can see the setting to activate estimates. A companion setting is progress invoicing. If your company sometimes invoices more than once for a single job or project, you will want to select both of these settings.

The estimate serves as a simple project budget. That’s why it’s so important to companies tracking costs and revenues by project.

The pieces of the project that need to be tracked are done by using service type items for each piece. Be sure each of those items is setup as a two-sided item, utilizing both a purchase and a sales side to the item.

We examined two-sided items a couple of posts ago.

Remember to use an income type of account for the Income Account field, and a COGS or expense type of account for the Expense Account field. For job expenses, a COGS type account is usually the best choice.

The example estimate in the above screenshot is from one of the QuickBooks sample files. The items are two-sided as discussed. Cost as well as revenue for each item are included in the appropriate columns.

Actual income (invoice) and expense (bills & checks) are recorded in QuickBooks using items and coding to this specific job. One result is a detailed report of the ongoing performance of the project.

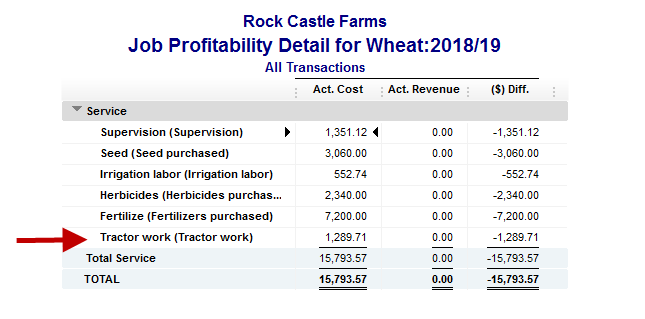

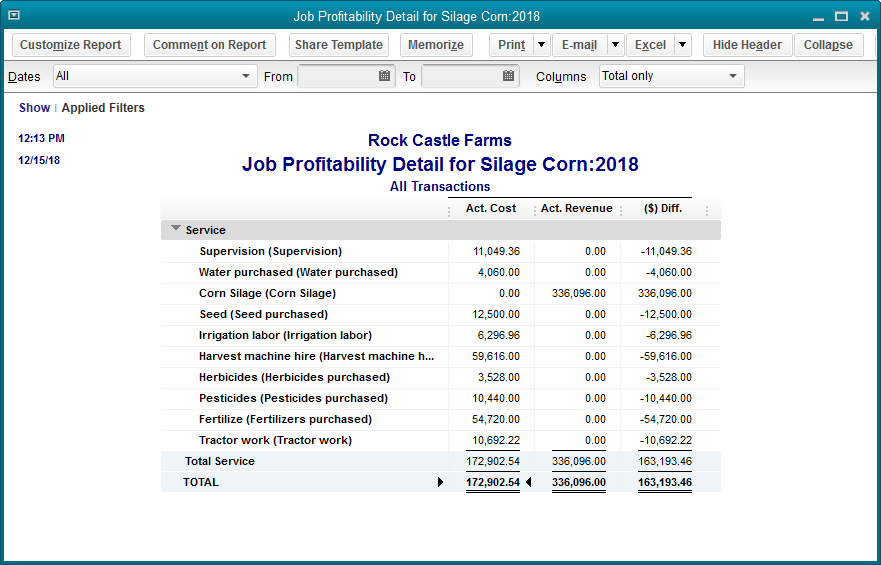

The following report is found in the Jobs, Time, & Mileage section of the Reports menu.

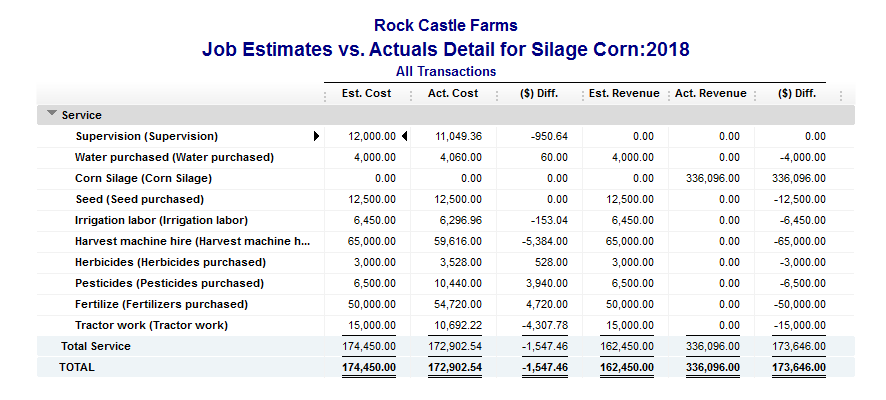

The actual amounts for cost and revenue come from actual transactions recorded in QuickBooks. The estimated numbers all come from the Estimate form created.

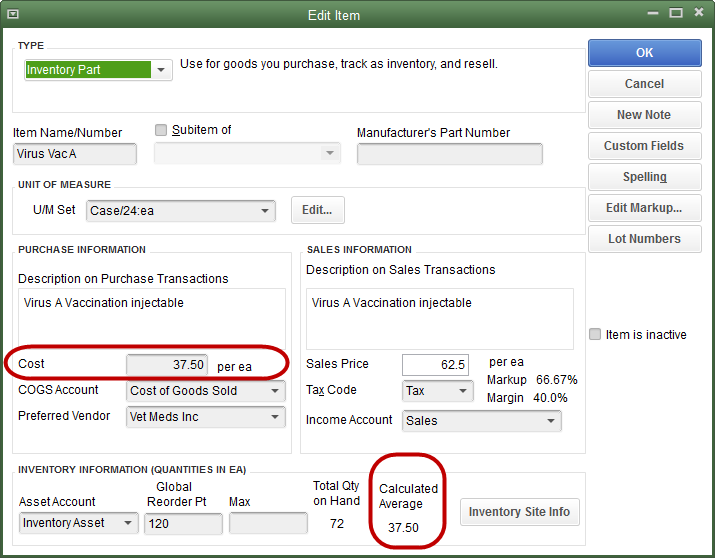

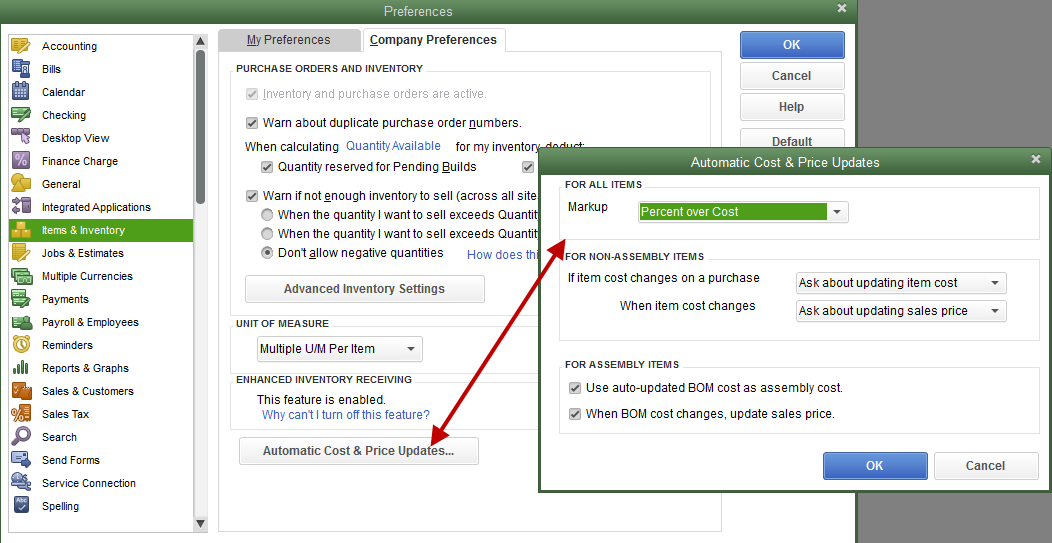

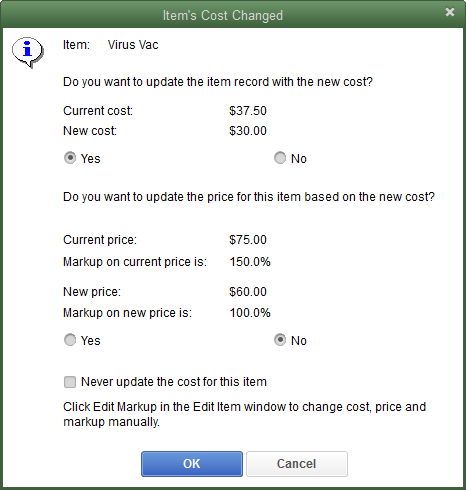

Do You Sell at a Profit? Are You Sure?

Items are necessary for selling to customers. We can’t create a sales receipt or an invoice without them.

In their most basic form of setup, items contain a description for the sales document, the price, taxable status, and for accounting, an income account to tell QuickBooks where to post the revenue.

Items can also be used in expense transactions. Inventory is a good example. In an inventory situation QuickBooks must record cost as well as sales information in order for the inventory system to work. Accordingly, an expense type of account is part of the required item setup for inventory.

There are other times when both expense and income needs to be tracked by item even though the QuickBooks user is not tracking inventory. In these cases a service type item is usually created.

An example of this kind of setup would be a company selling services and the user wants to track activity by job or project. Besides contractors, examples of companies using this sort of technique would include architectural firms, engineering firms, and the like.

In these cases, the QuickBooks user must instruct the software to track both sides of transactions by item.

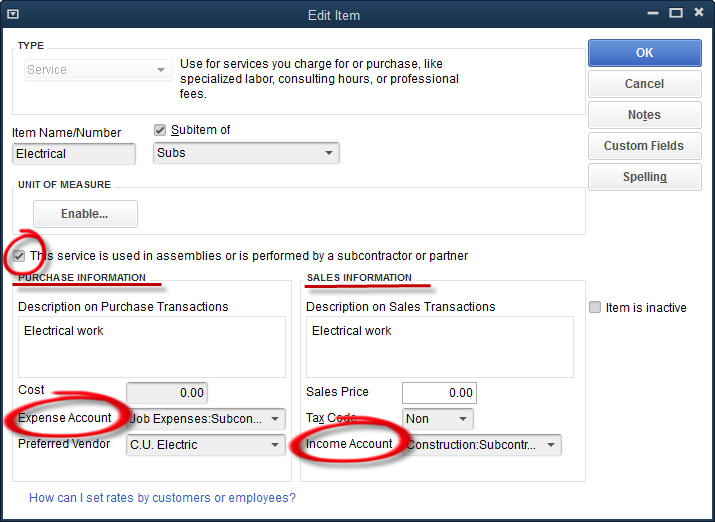

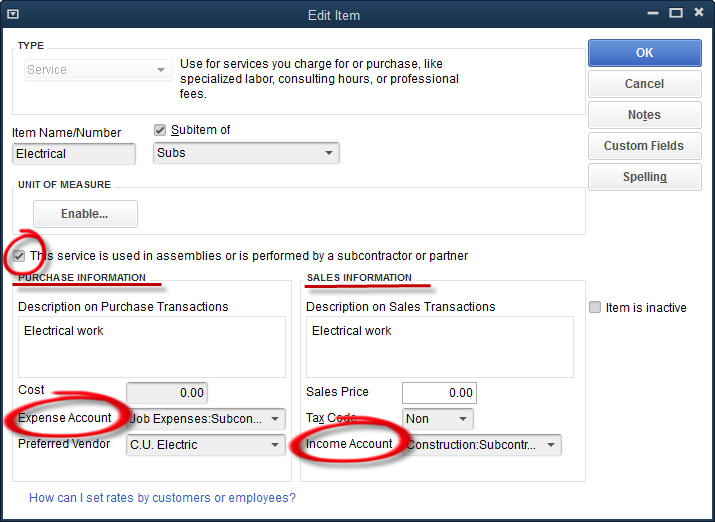

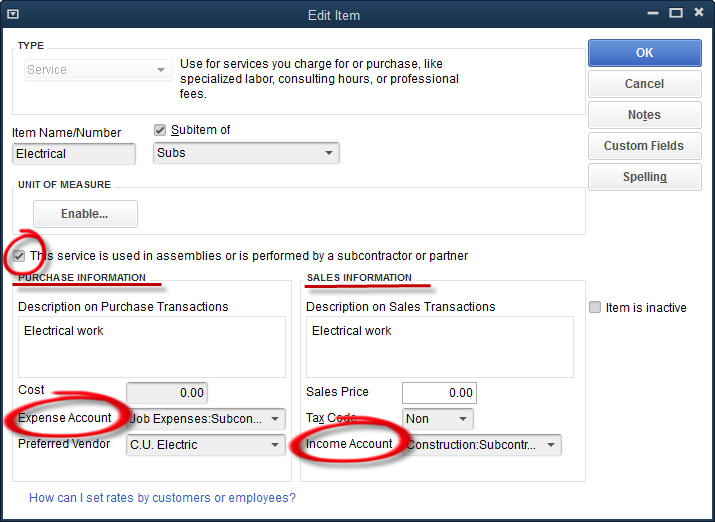

For our example, we will use the sample company Rock Castle Construction, a company specializing in remodeling projects. Above is a screenshot showing the edit window of a two-sided item. Note the checkbox in the center-left of the window.

“This service is used in assemblies or is performed by a subcontractor or partner.” This explanation can confuse some QuickBooks users, but basically the setting means there will be both a purchase side and an income side to the item setup.

You can see the lines drawn underneath the labels, purchase information and sales information. Then, even lower in the window, the circled areas denoting the appropriate accounts for each type of transaction.

With this setup, QuickBooks will know which account to use depending upon the type of form selected for a transaction. Checks and bills will cause it to use the expense account, invoices and sales receipts will post to the income account.

The reason for this setup is to allow the comparison of income and expense for a certain item. Let’s create an expense and income for a particular job, Kristy Abercrombie’s Kitchen. We’ll create an expense and then invoice the customer for the electrical work.

A bill is created using the Items tab (as shown) rather than the Expenses tab. As you can see, the Electrical item shown earlier in this article has been used to create an expense for this project in the amount of $588.75.

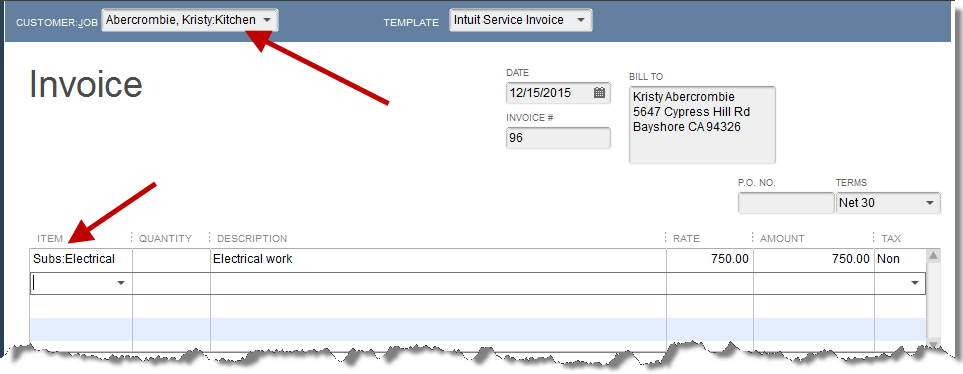

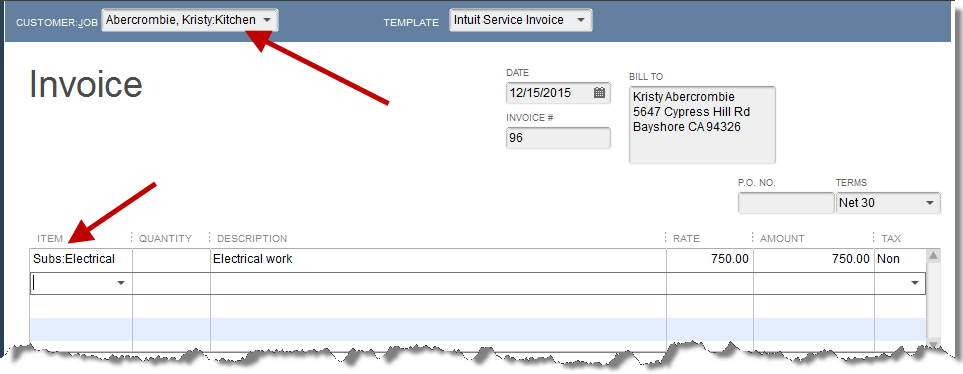

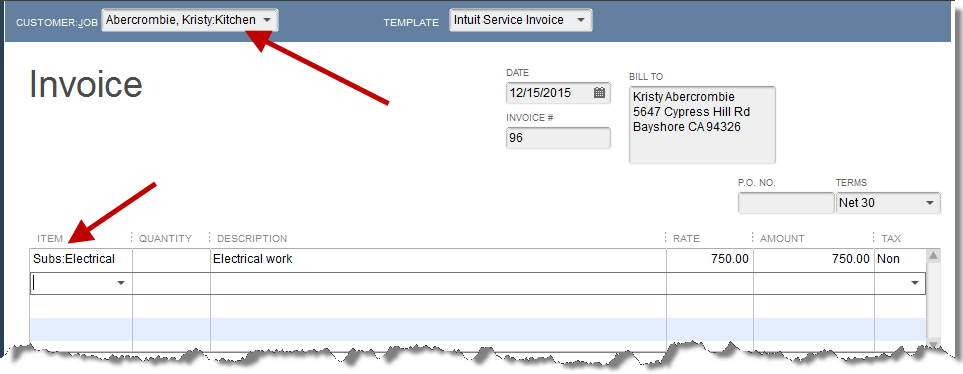

Let’s invoice Kristy $750.00 for the work done by C.U. Electric.

Above is an invoice for the Kristy Abercrombie Kitchen project using the same item, Electrical, that was used in the bill for C.U. Electric.

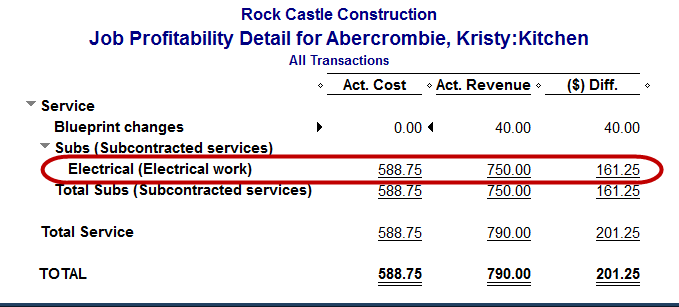

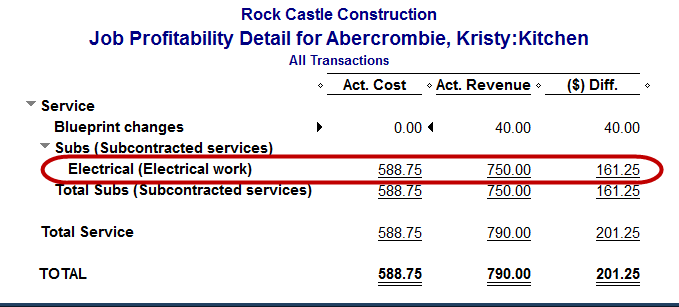

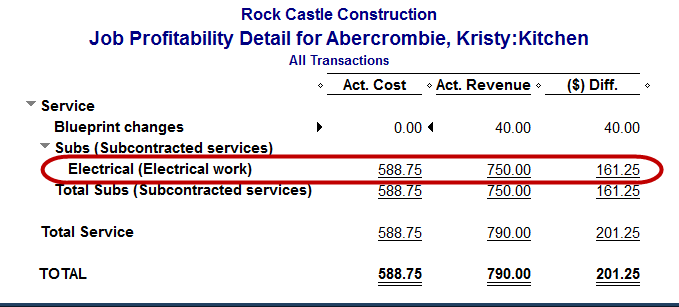

Now, let’s look at a report that will compare our expense and income for this project.

The highlighted line shows how the Job Profitability Detail report compares the revenue and the cost for one particular item for one particular project or job.

This is only possible with the use of two-sided items. Using the Expenses tab in transactions will prevent this comparison in this report. Fail to use jobs/projects in either expense transactions or invoices and this report will not work.

Used properly, two-sided transactions, in companies that sell by jobs or projects, can yield valuable information greatly affecting the company’s profitability.

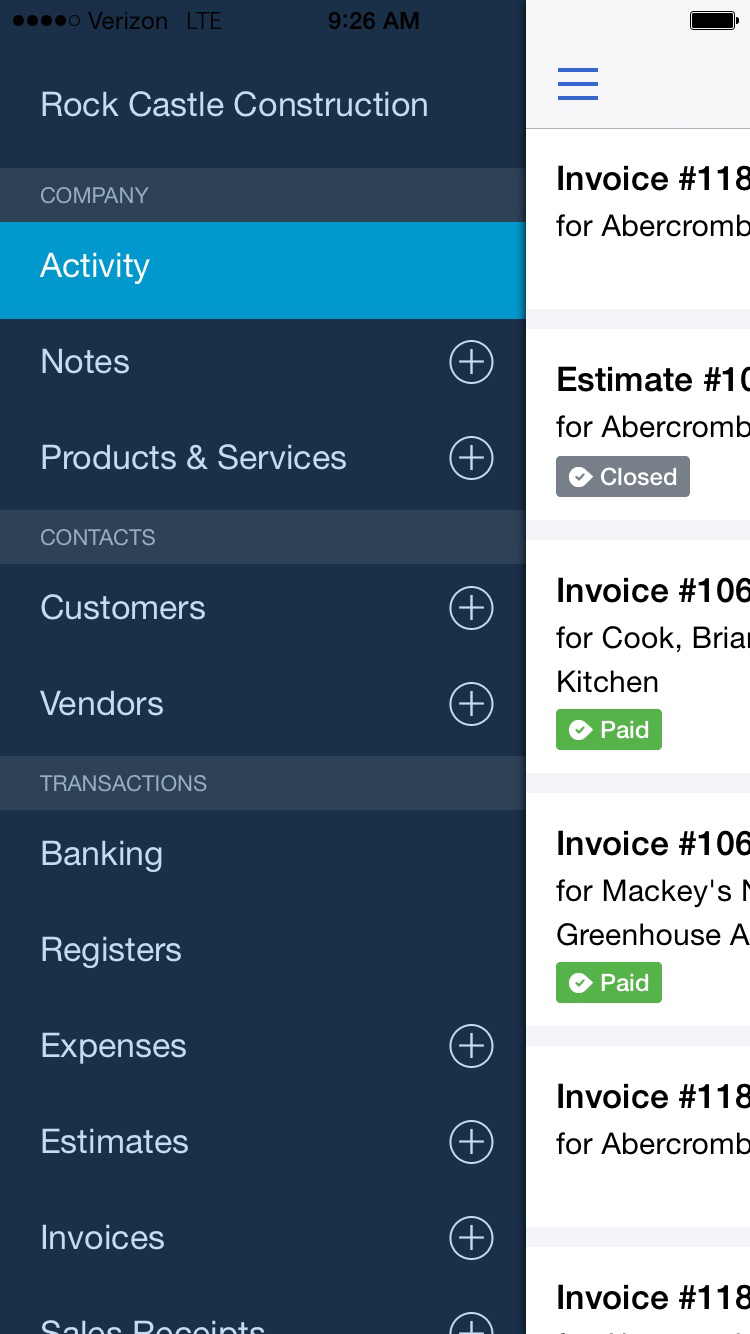

How QuickBooks Can Help You Manage and Retain Customers

This is the start of a series of posts in which we look at the features in QuickBooks that would be used in a business that sells services to its customers. It may sell materials as well, but the significant portion of its business is to provide a service to the public.

These are industries that QuickBooks serves well. The software, both the desktop version and the online, is rich with features to aid business-owners that fall into this category.

We will alternate the posts. As QuickBooks Online (QBO) continues to grow in popularity in some circles, it’s important we cover the features of both.

This post examines specifically the desktop version. We’ll start at the beginning and look at customer setup and the specifics that can help you keep tabs on your service-based company.

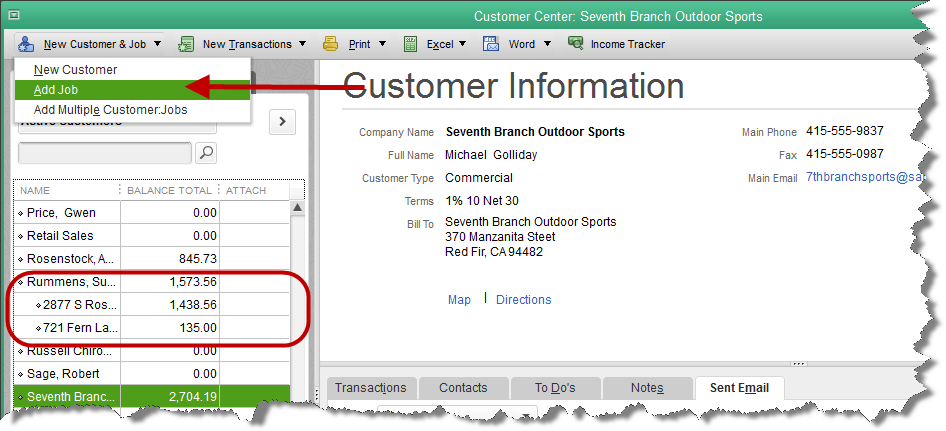

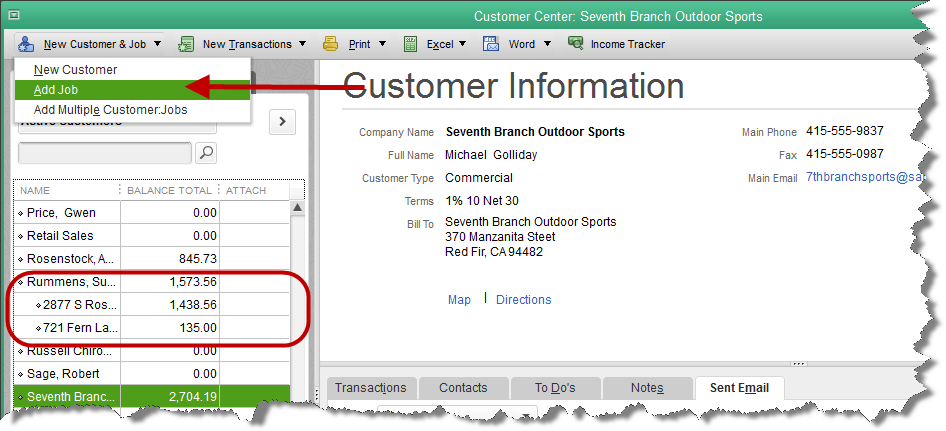

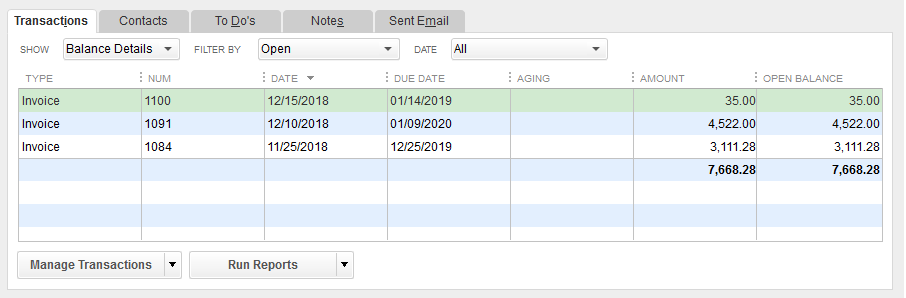

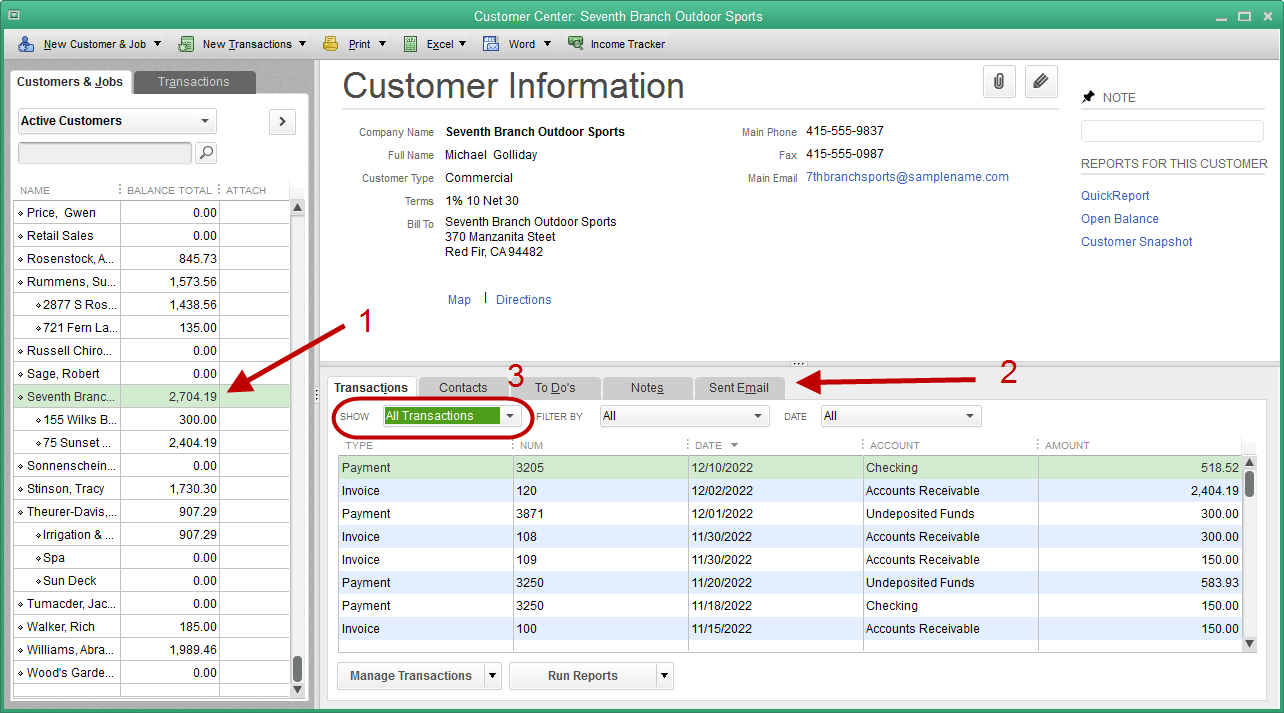

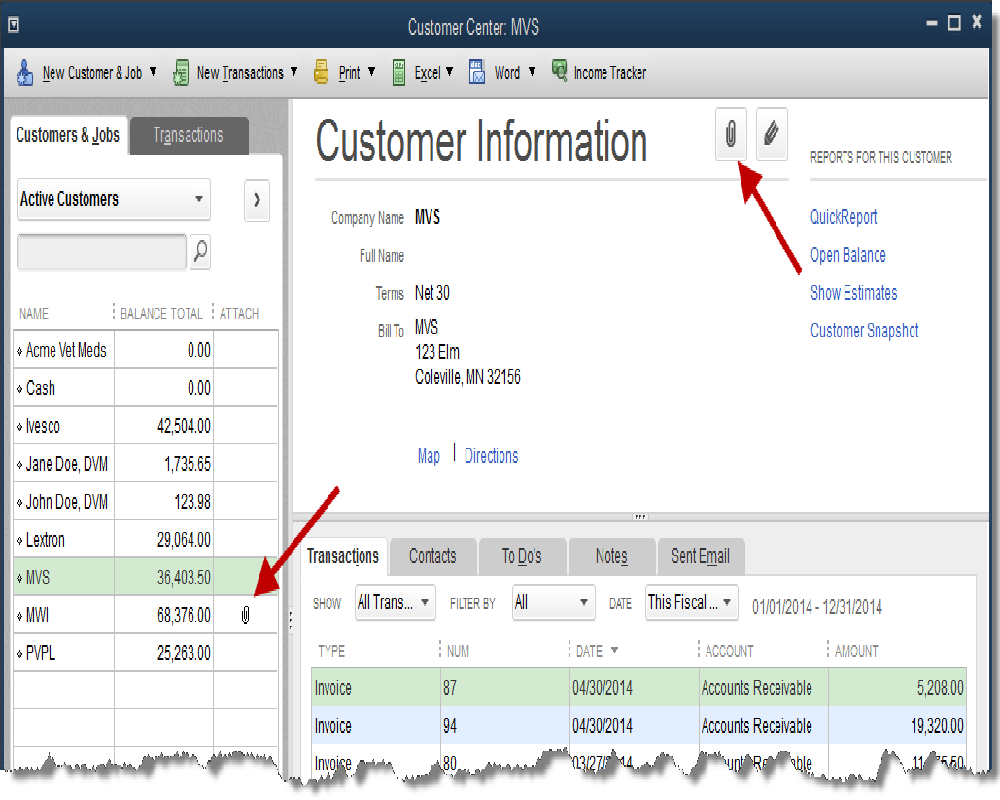

Start with the Customer Center, Customers->Customer Center. When looking for a particular transaction, people often ask where they should go to find it. If it is a customer transaction, this is usually the best place to start.

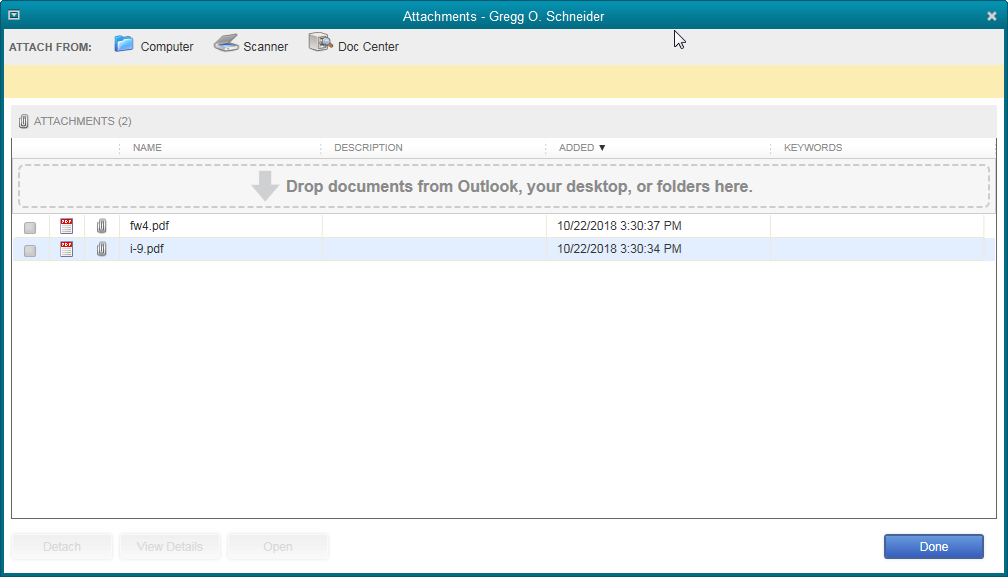

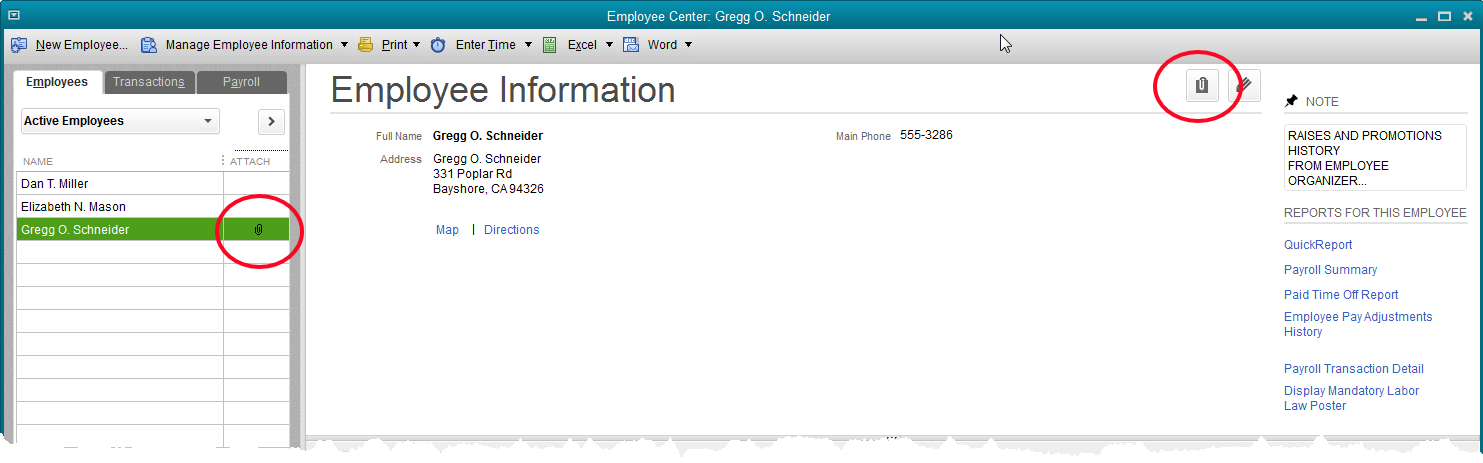

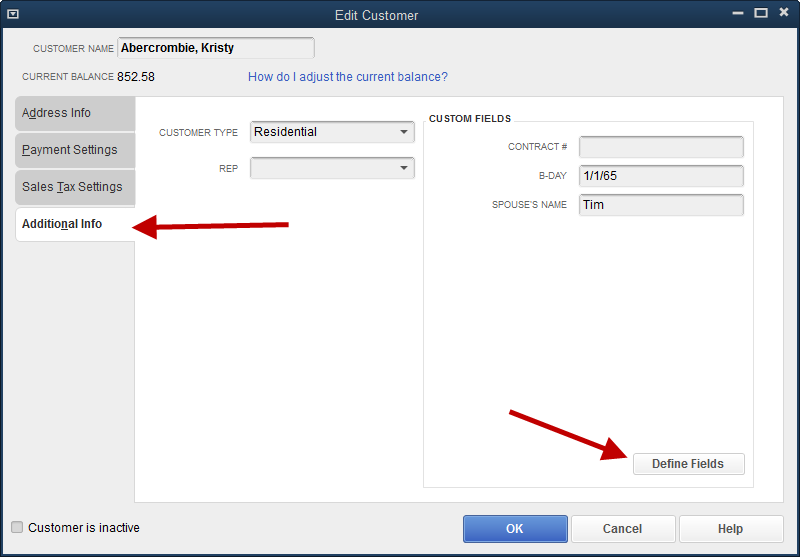

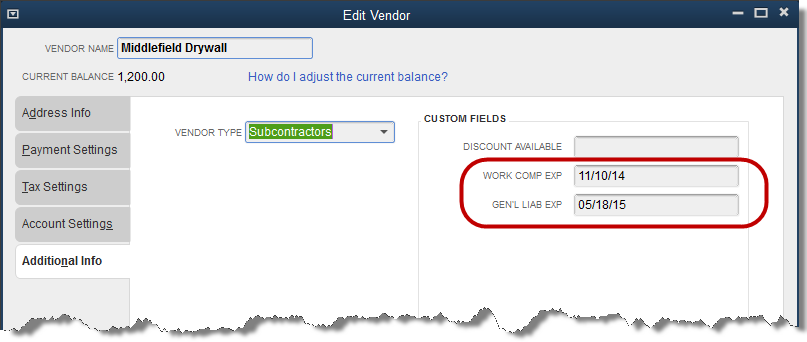

Customer Center