Blog

Click here to go back

QBO’s Easier Bank Reconciliation

Since we covered bank downloads in another section, it makes sense for us to take a look at reconciliations as well. While the process is very similar to QuickBooks desktop, there is a major difference allowing the procedure to take significantly less time.

Bank transactions can import into your QBO directly from your bank account. We examined that earlier.

Procedures differ from one organization to another. Some people prefer not to enter bank information manually. They use electronic transfers and/or debit cards. These transactions then download into their accounting software, QBO.

Occasionally an edit is still necessary to be sure a downloaded transaction posts to the right account. But there’s really very little manual data entry.

That same procedure won’t work for everyone. Some QBO users still need to manually enter that data.

Checks written, bill payments to track, and so on, these will require manual data entry even in QBO for some. Perhaps these users want the reduction to the account balance to show now, not when the transaction hits the bank.

So what are the benefits of downloading and matching bank transactions in a case like that? If you enter all your banking transactions manually, why do you care if QBO imports directly from your bank account?

Let’s look at reconciliation.

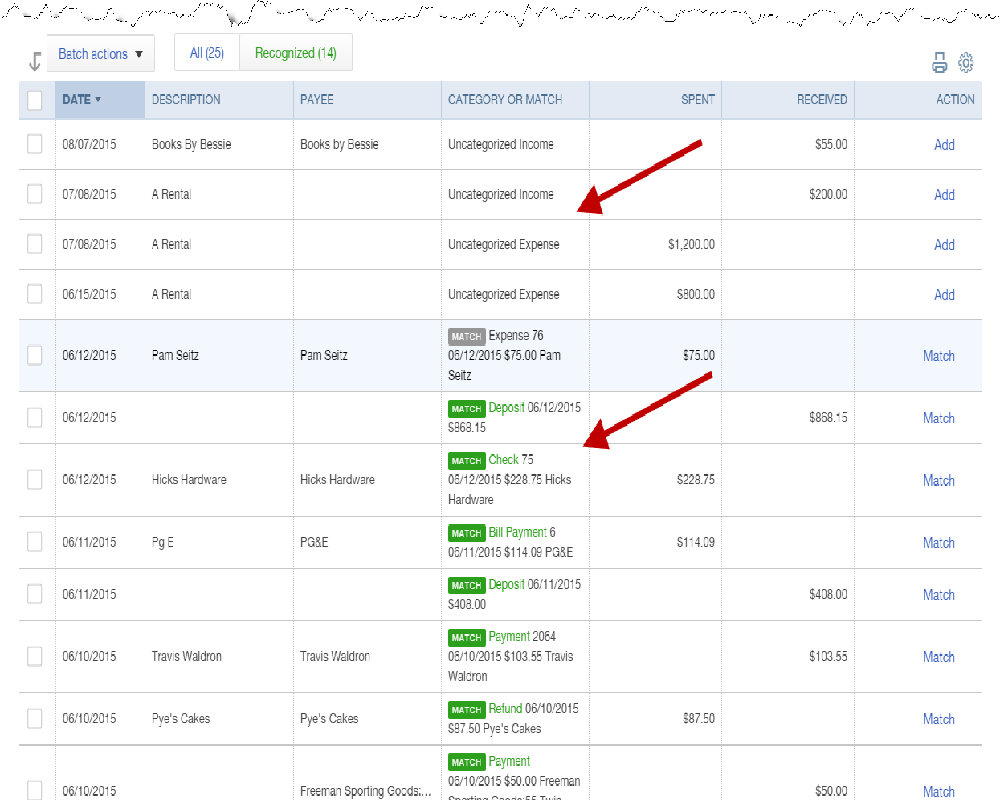

Above is a screenshot showing the transactions that downloaded from the bank. The lower arrow points to those QBO has already matched. You can see the green “match” symbol.

These can all be accepted, entire batches at a time, with a couple of mouse clicks. Simple.

The others, the ones indicated by the upper arrow, do not exist in QBO now. Those will have to be edited so they post to the correct expense account.

Still, you can see the rapid procedure for matching transactions.

We’ll complete this process as a step one. It will take a few minutes at most.

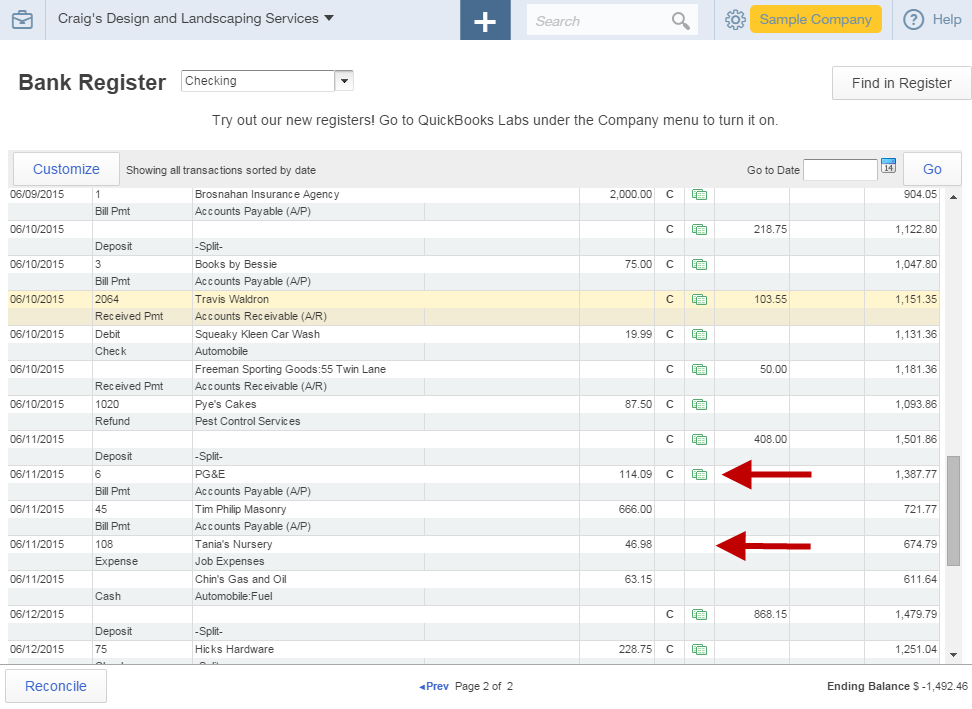

The above screenshot shows the check register after the downloaded bank transactions have been matched or entered.

Note the green icons next to the “C” designation. These transactions were either matched or entered from the bank downloads. Those that have no such designation have not been matched to a corresponding bank transaction.

The “C” indicates this transaction has cleared the bank, but has not yet been reconciled.

Now, let’s reconcile the bank account.

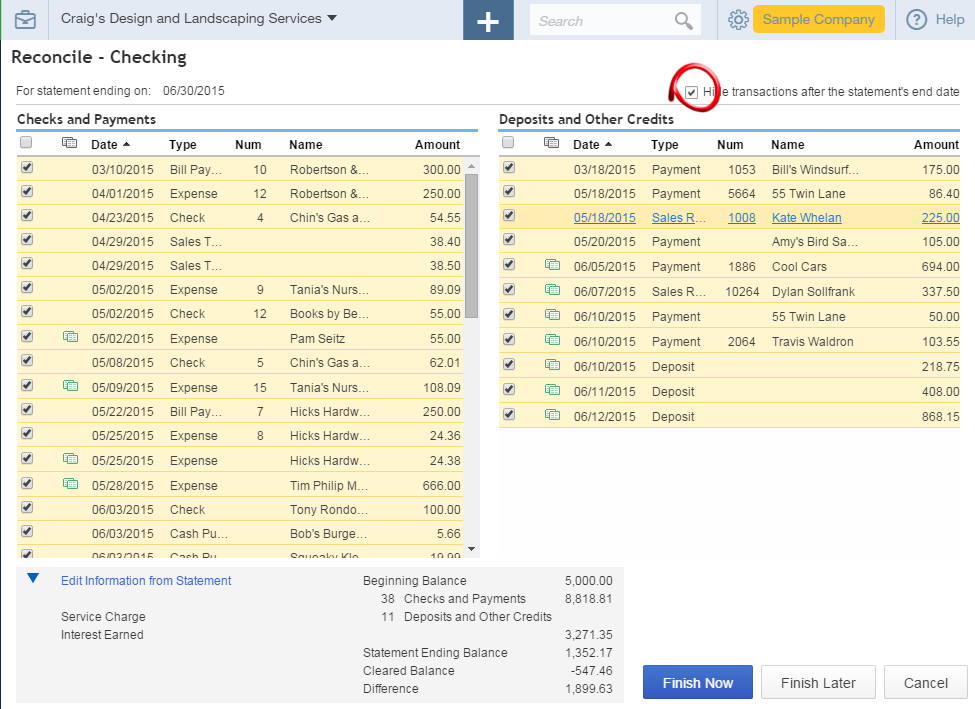

Click on the gear icon and select Reconcile from the Tools section. Which account to reconcile will be the first selection you make. Then, the bank or credit card statement date, and the ending balance.

A handy tip is to check the box highlighted in the upper right part of the window. This selection causes QBO to only show the relevant transactions, those dated on or before the statement date.

The green icons indicate transactions that have been matched with the bank already. They show in this window as well. If all the transactions had been matched, there would be no hunting and scrutinizing of the bank statement to match them in this window. QBO has already done that.

Once the transactions listed in the window are marked as cleared to match those shown on the statement, the Difference field, which appears in the bottom central section of the screen should be zero.

At that point, you can click Finish Now.

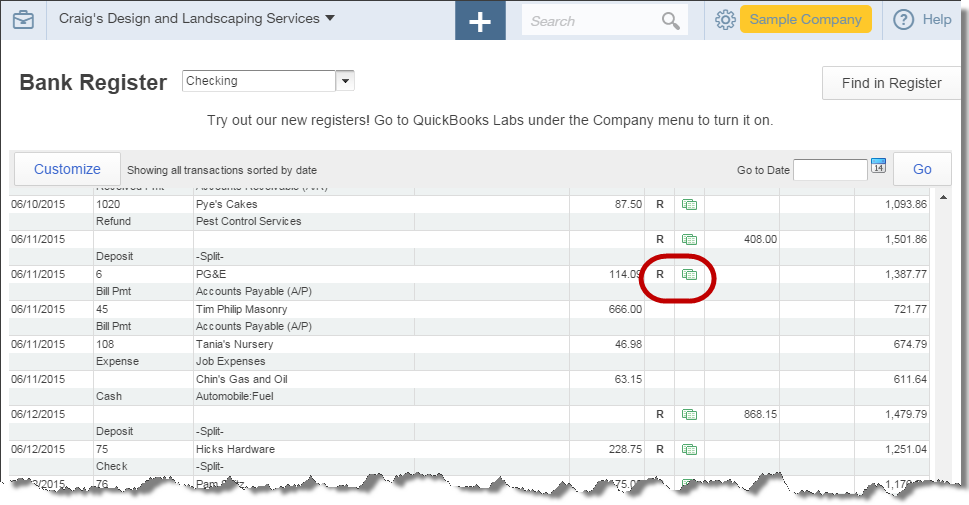

Above is another screenshot of the check register. This one though is after the reconciliation has been completed.

The “C” designation, indicating a transaction had cleared the bank, is replaced with an “R” designation if that transaction had been reconciled in the bank reconciliation window.

If all transactions are downloaded and matched from the bank feed, the reconciliation will be practically complete when you go to perform that function in QBO.