Blog

Click here to go back

How to Create Customer Deposits in QuickBooks

There are a number of ways to handle deposits. These would be payments a customer would make before an invoice was created. We will describe two such methods in this section.

The easiest way is to just receive the customer payment as normal. When the customer is selected in the Receive Payment window, be sure no invoice is selected.

Most of the time, there will be no open invoices for QuickBooks to list in this window. But, if there are, just make sure none of them are selected.

Save the transaction. QuickBooks make ask in a popup message if you want to apply the payment to an invoice or retain it as a customer credit. Retain as a customer credit.

At some point, an invoice is created for the customer. QuickBooks will present an option to apply existing customer credits to the invoice. If that option is selected, the invoice will be partly or completely paid.

Some businesses prefer the see the balance for customer deposits on their financial reports. Technically, this is the accepted accounting technique.

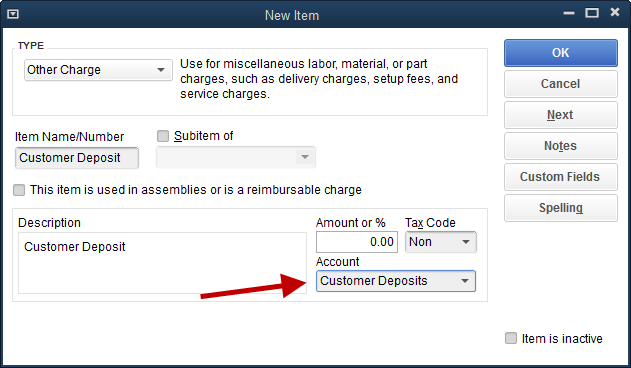

If this is the solution you refer, begin by creating an item to be used for customer deposits.

It is important that the account used in the item setup is an account used only for this purpose. Name the account in a way that makes sense to you, the QuickBooks user, but be sure it is setup as an Other Current Liability type of account in QuickBooks.

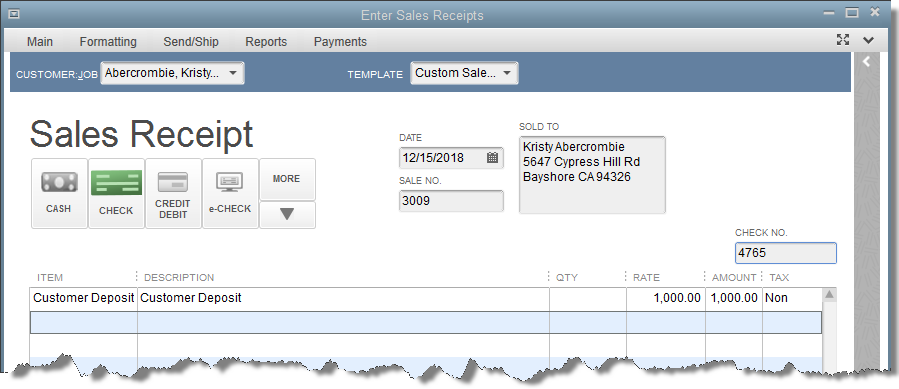

When a customer deposit is received, record it using a Sales Receipt.

Simple. For most people, the payment associated with this sales receipt will post to Undeposited Funds and can be deposited to the bank as normal.

The customer deposit will show on the balance sheet as a liability for the company. But, and this is important, it will not show as a credit on the customer’s account.

If many deposits are taken over time, it may be difficult to distinguish which customers have outstanding deposits and how much those deposits are.

Double-click on the Customer Deposits line on the balance sheet. Change the resulting transaction report to include a greater date range, perhaps All.

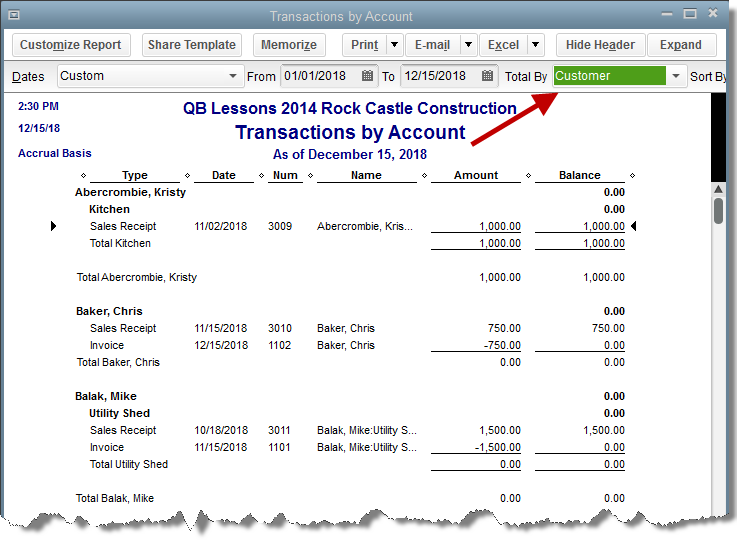

The following could be the result.

Who still has an outstanding deposit in the above report? While examining the report line by line and manually calculating the amounts, there is an easier way.

Change the Total By field from Account list to Customer. The report shows at a glance the customer deposit total for each customer.

As mentioned, these customer deposits do not show in QuickBooks as customer credits. Accordingly, another way must be used to credit them against customer invoices as the sale is made.

At the appropriate time, the invoice for the sale is created, Add a line using the customer deposit item and a negative amount to subtract the customer deposit amount from the invoice total.

As you can see from the screenshot of the filtered report earlier, Chris Baker is one of our customers. He is shown on the report with a net zero amount as a customer deposit.

The way the above invoice has been created is the reason why.

Still Waiting for Customer Payments?

QuickBooks 2020 has added some useful features. If you need to remind customers from time to time that you’re still waiting on a payment, QuickBooks can help with that.

QuickBooks has always had the ability to customize letters using data, like customer names, balances, etc., in your company file. What QuickBooks 2020 does is add a layer of automation that may save you time.

This feature is called Automated Customer Payment Reminders. Let’s see how it works.

Navigate to Customers->Payment Reminders->Manage Mailing List.

There’s actually more than one step, but the wizard for creating your mailing list is pretty straightforward and easy to follow. The reason you may want more than one mailing list is that you may not treat all your customers the same. You might choose wording in a reminder for one group of customers different from the wording you would like to use with another, perhaps less trusted, group of customers.

You don’t have to have multiple mailing lists though. You can have one and all (or most) of your customers can be included.

Once at least one mailing list has been selected, it’s time to create the schedule.

In the screenshot above, you can see the steps in the reminder setup process. We have created a reminder, 1 day after due date, in the first window. The second window (to the right), allows us to edit the text that should be included in the message emailed to the customer.

Note the circled “[Name-First-Last]” text. Bracketed test like this indicates data that will come from QuickBooks. The customer’s name will appear here. Invoice number is filled in a couple of lines above. In the body of the message you can see where QuickBooks will pull information from the company file like invoice total, company information, etc.

You can include additional fields of custom info by clicking on the Insert Field button in the lower right, selecting the data field you want, and placing it in the message.

There are some new preferences that control how the feature works. As you can see from the above screenshot, we can turn Payment Reminders on or off. We can tell QuickBooks when to remind us and how often to look for customers that meet our mail list criteria.

So, with our setup so far, here’s what QuickBooks will do.

Each day QuickBooks scans our customers and the status of their open invoices. If it finds a customer that is on the mailing list we specified at the beginning of this process AND that customer has an invoice that is unpaid, but was due yesterday, QuickBooks will notify us at 10:00 the day the invoice becomes delinquent.

If we decide to send the reminder, we are presented with the following screen. If we have set everything up the way we would like this feature to function, we should only have to click Send Now and the message is sent, hopefully to generate some action on the part of our customer.

QuickBooks also keeps a record of the emails we’ve sent. See the screenshot below. In the Customer Center, Sent Forms tab, is a record of all emails transmitted to this customer including the reminders we’ve sent.

Price Levels

Using discounts on a more regular basis or as the normal price for certain customers, Price Levels will offer an easier solution.

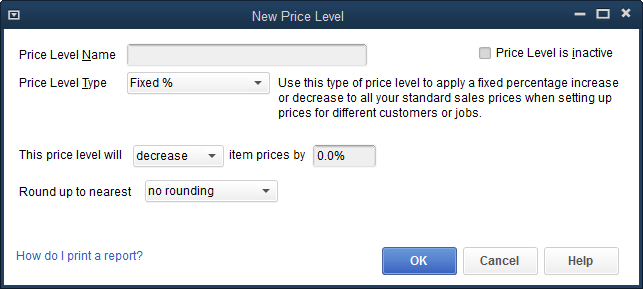

Price Levels are found on the Lists drop down menu. Different types of Price Levels are available in the Pro and Premier levels of QuickBooks.

In QuickBooks Pro, only Fixed % price levels are available.

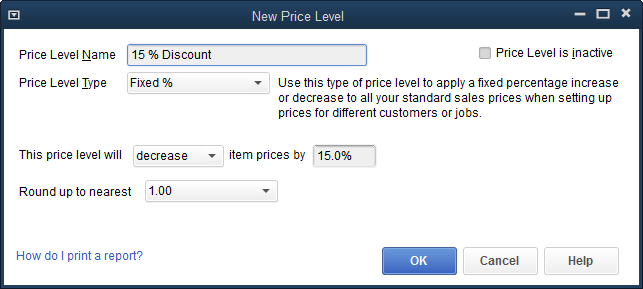

Navigate to Lists->Price Levels and select New from the menu that pops up with a right mouse click. You will see the above window.

Name the price level so it can easily be identified. Set whether the price level is an increase or a decrease over the price set in the Item List.

Then round in a way you wish prices to appear on your customer invoices.

The completed Price Level is shown in the above graphic. We’ve named our new price level “15% Discount.” The price level will decrease item prices by 15%.

The rounding has been set so discounted prices will show as whole dollars. There are many options for rounding. Prices can be specified to end in .25, .50, .49, .89, .99 and many others.

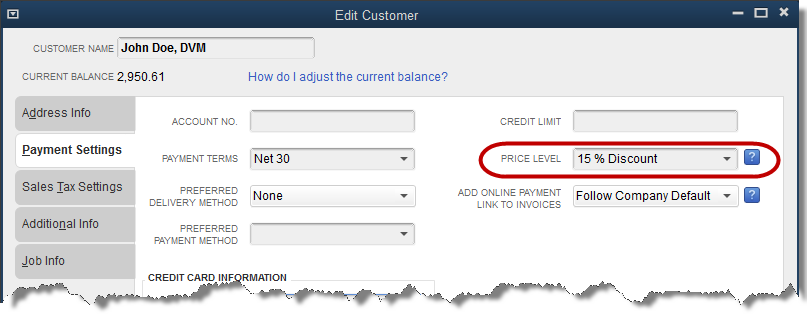

A powerful feature in the use of price levels is assigning a certain price level to a certain customer. Then QuickBooks will always use a that price for that customer without any ‘reminding.’

To specify that a certain customer should receive a certain price level, access the Payment Settings tab in the customer edit window.

Now, without the need for a discount item, the lower price comes up automatically for this customer.

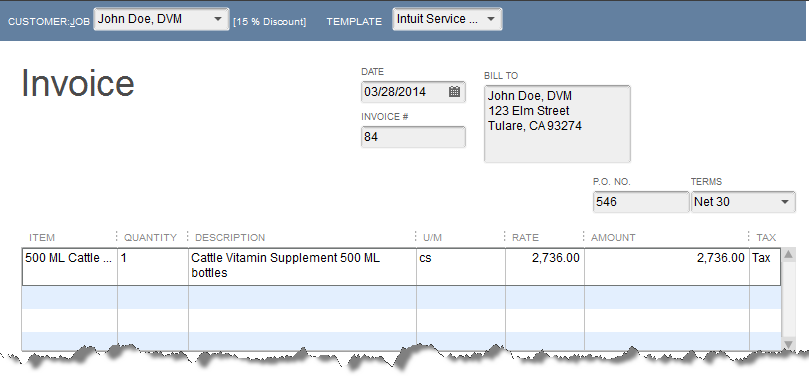

After using a 15% discount item in the first invoicing example, the price of a case of 500 ML mineral supplement for cattle was $2713.20. Now, with our same customer, QuickBooks automatically charges $2736.

Why the difference?

Well, in the first example QuickBooks began with the total price of $3192 and deducted 15% (478.80) to arrive at a discounted price of $2713.40.

A case however, is 24 bottles priced at $133 each.

So in the second example, QuickBooks starts with $133, discounts by 15% (19.95) to arrive at a price of 113.05.

Per our rounding instructions, it then sets the price at $114, rounding up to the nearest whole dollar. The last part of the calculation is to multiply the each price times 24 to reach a case price of $2736.

You could alter the pricing or units of measure to make these two examples come out the same. But, this is a good illustration of how using different methods can yield different results.

The Premier level of QuickBooks offers an additional option to price levels. Per Item price levels.

Many of the same calculation and rounding parameters found in Fixed % type price levels are available options for Per Item price levels as well. But, a Per Item price level can apply to specific items rather than all items.

In addition, the calculation can be based on the price, as with Fixed % price levels, or cost.

Just like Fixed % price levels, the Per Item price levels can be applied to one or more specific customers.

Unfortunately, only one price level can be applied to a customer.

How Do You Create a Discount in QuickBooks?

Discounts are common in many businesses. Discounts for special events, special customers, or special payment terms. Just as there are a variety of reasons for granting discounts, there are various ways to create them in QuickBooks.

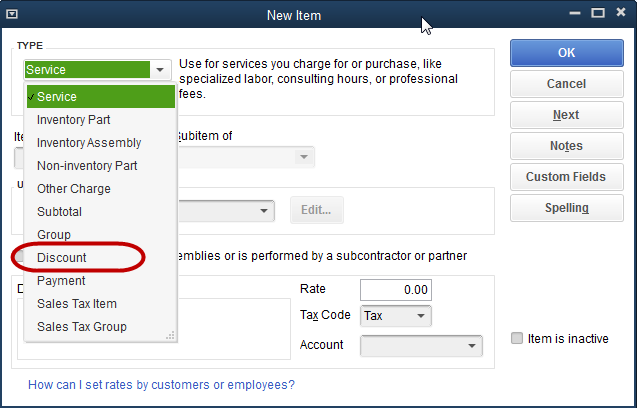

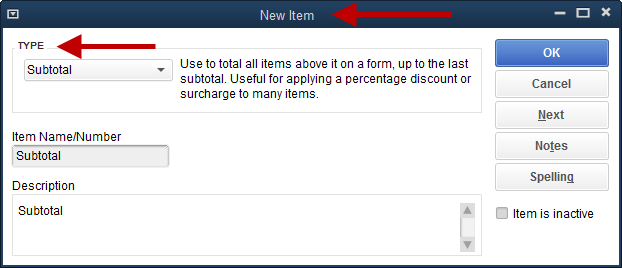

Let’s start with a simple method to grant a customer discount directly on an invoice. We can create a Discount type item.

A Discount item would be used for a one-time or unusual event.

Cases where a discount is always granted a certain customer, or a discount is given to reward early payment are more efficiently handled in other ways.

The above screenshot shows the setup screen for a Discount type item. The following screenshot, shows the item setup screen after all the pertinent information is entered.

You must decide if the item, by default, is taxable or not. If using the discount item to reduce the price of taxable items, and the discount item is set to a non-taxable code, sales tax will not be reduced by the amount of the discount. The taxable merchandise will compute sales tax at the before discount sales amounts.

Setting the discount item to taxable, would then cause the discounted items to accrue sales tax at the discounted price.

Another setting is the account from the chart of accounts to which the discount item will post. There are two common designs. One, the discount posts to the same income account as the items you normally sell. Or, two, you can create a special income type account to track the amount of discounts.

In the graphic of the Discount item, this latter approach was used. The discount amount will post to an income type account entitled, Discounts Given.

The graphic above shows an invoice using the new Discount item.

The use of Discount type items can often be enhanced by adding a subtotal after the discount showing the net price.

You can see that adding the subtotal line makes this appear a little better to your customer. They now can see the price of the merchandise before sales tax.

This becomes critical for more complex invoices. For example, perhaps several lines need to be discounted, several lines do not.

The discount item in QuickBooks discounts the line immediately above it. If there are three lines of merchandise and/or services, then the discount item is used on line four, the discount is computed on line three only.

In order to discount the entire amount, use a subtotal item on line four, then the discount item on line five. Now the discount will apply to the entire amount.

Add a Logo to Your QuickBooks Invoices

Forms like invoices can be customized in QuickBooks to a much greater degree than many realize. One of the many customization options available is adding a company logo.

A logo can be added to invoices, sales orders, credit memos, purchase orders, reminder statements, estimates, and sales orders.

When customizing forms in QuickBooks we are working with templates. There is a list of templates available at Lists->Templates. This list will show all the saved templates in your company file. You can edit some of them. Some, the defaults that come with QuickBooks, can be easily copied and then edited.

Another way to edit an existing template is to open it. Then, from the format tab of the ribbon, select Customize Data Layout.

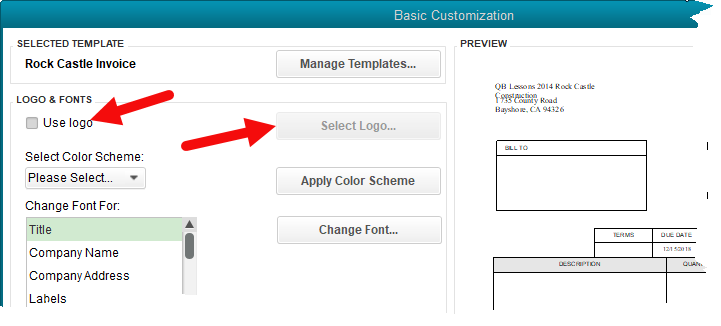

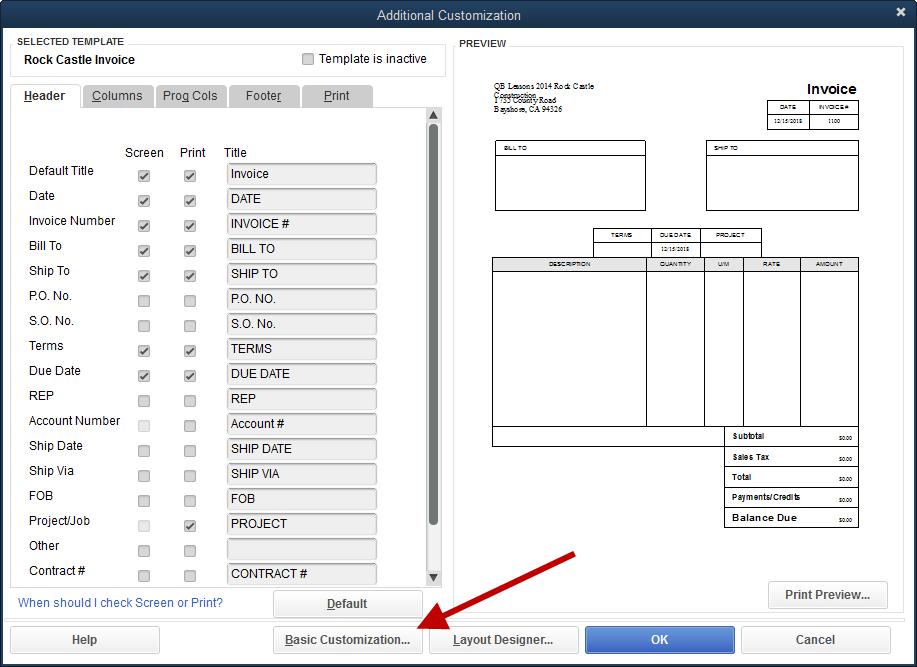

After either selecting a template from the list and choosing edit, or clicking the customize icon from the form itself, a screen opens with many options. Along the bottom of the screen are several buttons. One is labeled Basic Customization. Choose this button.

You can see in the screenshot the checkbox that tells QuickBooks you want to use a logo. Once that is selected, click the Select Logo button to navigate to the location on your computer where the graphic file of the logo exists.

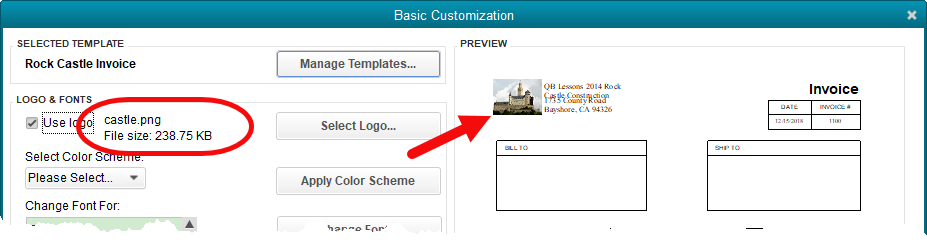

Once the logo is selected, QuickBooks copies it into the folder where the company file resides. The name of the graphic file now shows next to the Use logo checkbox.

QuickBooks has also placed the logo on the invoice template. You can see that in the Preview panel where the arrow is pointing.

We may not be happy with the placement. To change that, we would click on the Layout Designer button.

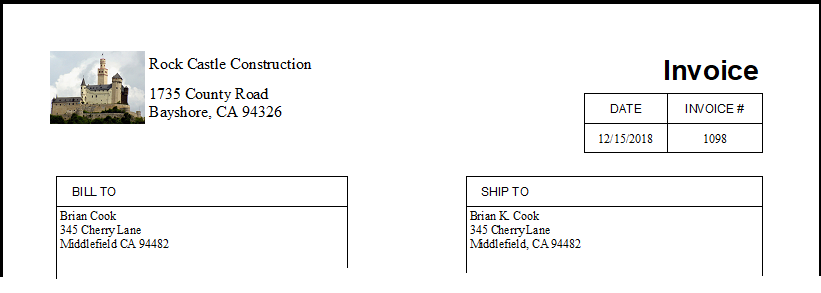

In Layout Designer we can drag text and data boxes to the locations we desire. We can also change the way some of the information shows.

In the end, we can create something that looks more like this:

Making an Invoice of Your Own

Adding the Company Phone Number to an Invoice Template

A fact that many QuickBooks users do not know is that various forms used in QuickBooks can be customized. In today’s post, we will add a company phone number to a printed invoice template.

There are two ways to access this capability. One is from the list of templates at Lists->Templates. The other is from the window of the form itself.

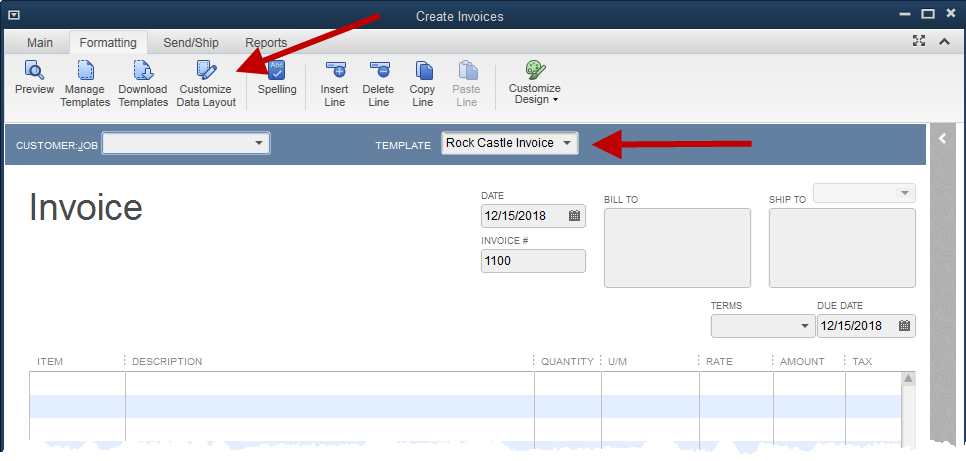

The above graphic shows the window for creating a new invoice. Look at the second arrow. It points to the field that identifies the template being used for this invoice transaction. This field will always be available on any transaction window where the form can be changed or customized.

The template can be changed at any time. It will not change the transaction. It is merely a different way of viewing the same transaction.

The top arrow points to an icon on the Formatting tab of the transaction window ribbon. This icon will open the customization options for this template.

Above is the window that opens when selecting the Customize Data Layout icon. For this simple change, we will select Basic Customization.

The company phone number can be added by simply selecting the checkbox indicated.

This tells QuickBooks to add the selected information (company phone number), but it doesn’t tell it where to place that information on the printed form. For that, we will select the Layout Designer button seen at the bottom of the above screenshot.

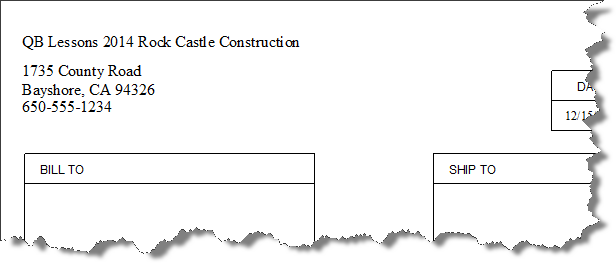

Below is a screenshot of the layout designer, scrolled to the bottom of the invoice template, showing the new company telephone number data field.

The boxes can be selected and dragged, using the mouse, to the location desired.

In this example, we will drag the phone number boxes to appear just under the company address. Then we will delete the label field. That is the box containing the word Phone #.

The other field, the one filled in with 555-555-5555 sample data, is the data field. We will drag that into position and click on the Properties button at the top of the window.

From this window, we can create a number of changes. The font can be changed to match the address. The borders can be removed. The data can be left justified to match the margin of the address.

In the end, the address/phone number block will appear like this:

This is a small example of a simple change one can make to customize their invoice form. Using these tools, it’s possible to make extensive changes to a form in QuickBooks, like an invoice, that will give a completely individualized look to your business forms.

Sales Tax Code - Sales Tax Item - Which to Use?

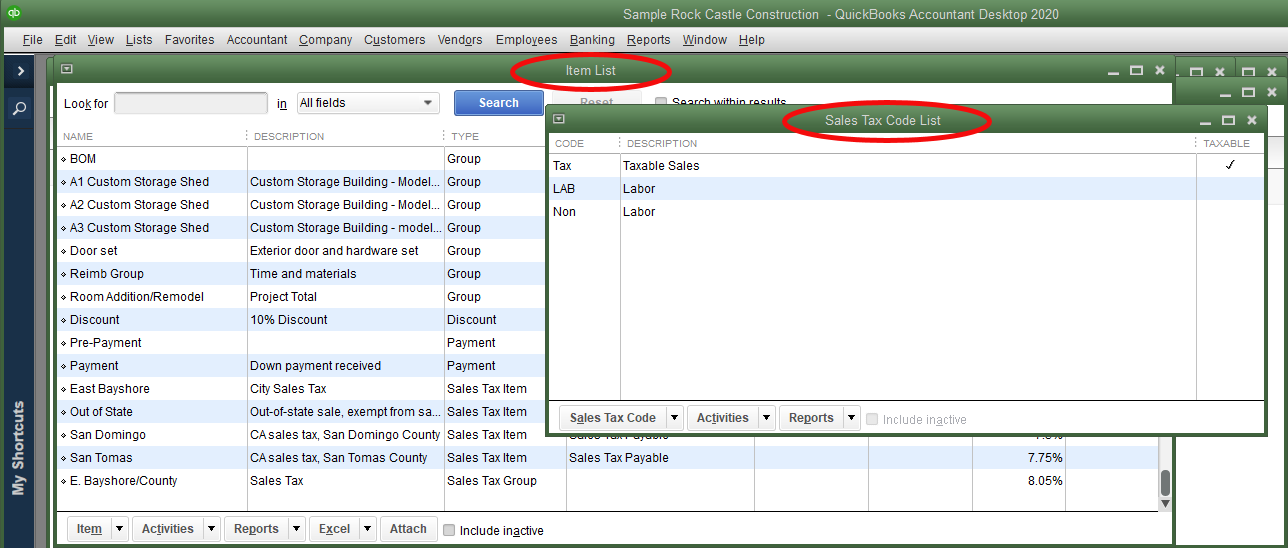

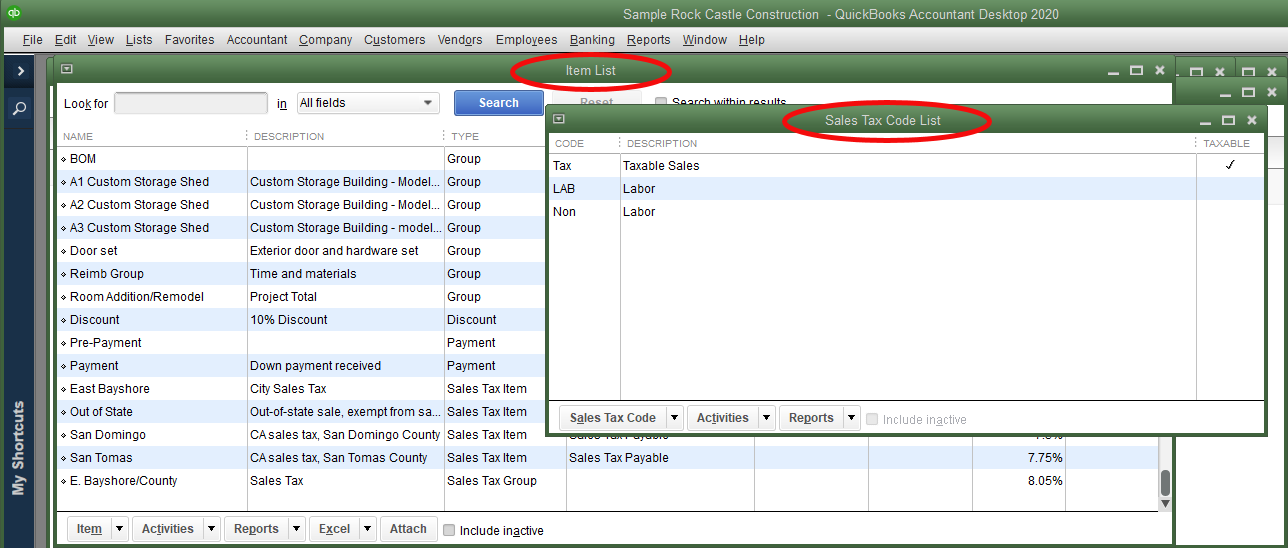

Sometimes people are confused about sales tax items vs. sales tax codes. A simple way to think of it is this: the sales tax item computes how much sales tax, the sales tax code tells QuickBooks whether something is taxable or not.

There are two different lists. Sales Tax Items are on the Item List. They usually show near the bottom of the list if you haven’t changed the sort order. So, sorted by item type (most common), you will scroll to the bottom of the list to find sales tax items.

Sales Tax Codes have their own list. Lists->Sales Tax Code List.

Sales Tax Codes appear on sales forms like invoices in the right-hand column.

While the tax code can be set on the sales form by changing what appears in that tax column, the field auto-fills from other settings in QuickBooks. It depends on what customers and what items may be taxable.

If a company sold on a Resale basis to other retailers, they would set such customers like this:

Determining an item’s taxable status is also part of the item’s setup in QuickBooks.

The above item, Light Pine Cabinets, is set as a taxable item. QuickBooks will normally compute sales tax on it when sold. That is, unless it is sold to a non-taxable customer like Kristy Abercrombie who we used to demo sales tax setup for customers. In that case, QuickBooks will follow the customer setup and make the item non-taxable.

So, the sales tax codes serve two very useful functions. First, they tell QuickBooks whether or not something is taxable.

If set up to do so, sales tax codes will also tell QuickBooks why something is not taxable. To accomplish that, one needs to create a non-taxable sales tax code for every reason a product might be exempt from sale tax.

Some examples would be Labor, Resale, Out of State, Sales to Federal Government, etc. By setting up the sales tax codes needed in your business and using them, more information is available to you at the time of creating the sales tax return.

The Sales Tax Revenue Summary report, will show sales for the period by sales tax code. The report will then show the amount of sales for taxable, how much for labor, how much for resale, and so on.

If you have multiple reason a sale might not be taxable, this report will give you that information which is usually required for completing a sales tax return.

Is it a Check or a Bill?

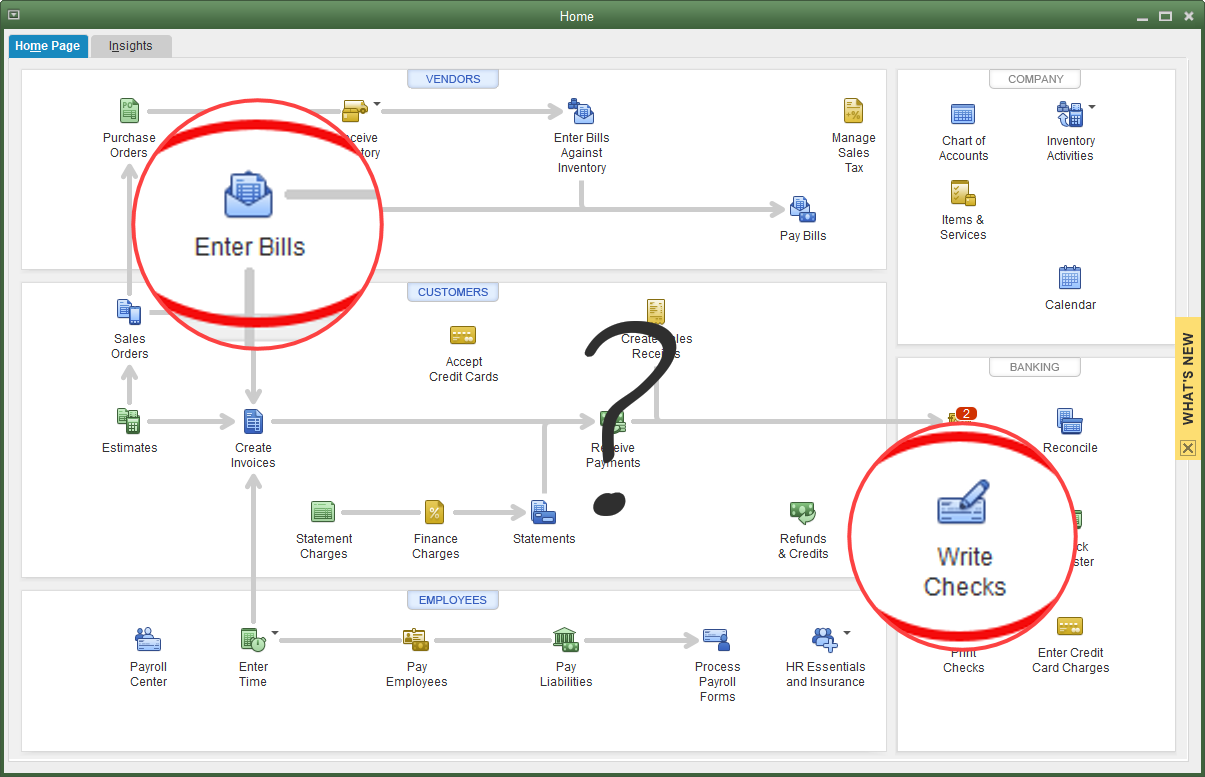

This is a question that arises from time to time. Should I be entering expenses into QuickBooks as checks or as bills?

To answer that, we need a little background on what these two transactions do. When a check is created, whether by using the check form as will happen with the Write Checks icon circled in the above image, or in the Check Register, the amount will post to the account used in the Account field, and the bank balance will be lowered. That’s it. It’s a simple transaction.

You can see the two affected accounts in the above screenshot. The bank account, in which the balance will be reduced, at the top. The account that shows lower in the graphic is the expense account that will be increased by the same amount.

Now, what if you enter an expense as a Bill?

The bill form still increases expense, posting to the account you enter on the stub portion of the form as shown. It does not affect a bank account though. Instead, the other side of the accounting entry posts to Accounts Payable.

For the QuickBooks user, that means with a bill an expense is created and a debt to the selected vendor is also created. The bank account is not affected until the bill is paid.

If you refer back to the screenshot of the Home Page, the first graphic in this article, you see the Pay Bills icon to the right of the Enter Bills icon. When paying bills that have been entered, this is the choice you want to make.

So, using bills is a two-step process instead of one like Write Checks. Why use it?

The expense posts to your books as of the date on the check or bill, whichever you use. Sometimes, it’s important for an expense to show in a certain month, the month in which it was incurred. But, we plan to pay later, perhaps in thirty days. Using a bill allows you to do that.

If such control over dates is unimportant, you may be fine with Write Checks instead.

Always follow the correct procedure. Write Checks is one step. If you Enter Bills, you Pay Bills when that time comes. Remember, the bill creates the expense. If you enter a bill for something and then come back later and write a check to actually pay it, you have created that expense twice in your books.

Collecting Money

In our last post we examined sales forms in QuickBooks. A logical next step to looking at QuickBooks features is collecting money. When customers pay, what’s the process in QuickBooks?

We’ll look at alternative methods to adding to your bank balance later in this article, first let’s review the process QuickBooks normally expects you to follow.

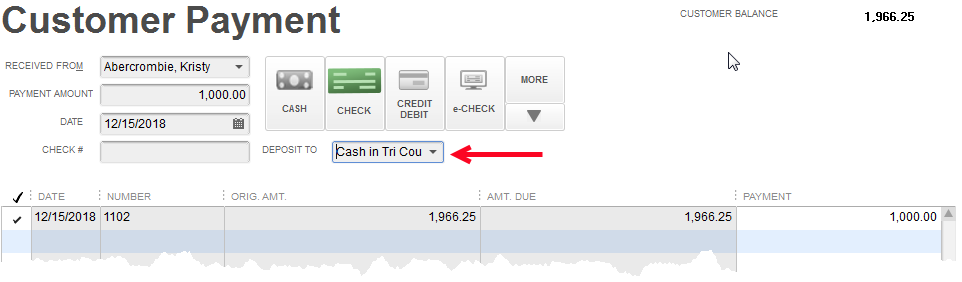

If you invoice a customer, they will pay (hopefully) at some point in the future. When they do, choose Receive Payments from the QuickBooks home page or the Customer menu. The following screenshot is the window you will get.

Filling out the top portion of the form is pretty straightforward. In the center of the window, QuickBooks lists all the open invoices for this customer. In the case above, there’s only one.

Sometimes, there may be several open invoices. If the payment is not for all of them, be sure QuickBooks selects the correct invoice to pay. Note also that an invoice may be partially paid and QuickBooks will show that next time you receive a payment. In the example above, the original invoice was $5732.23 but has been partially paid. Only $4732.23 remains as an open balance.

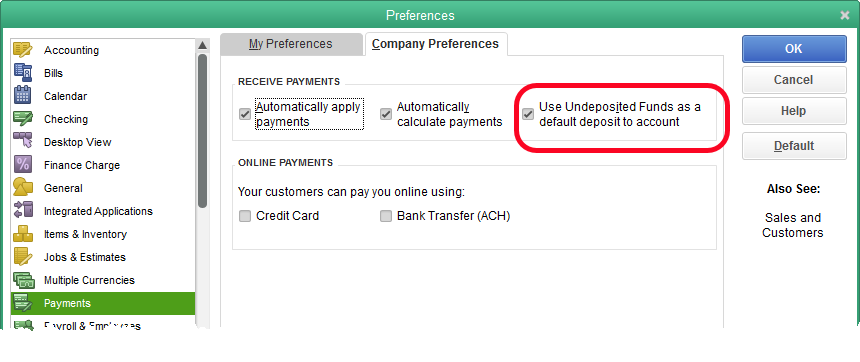

By default, QuickBooks posts payments to an account called Undeposited Funds. This allows QuickBooks to accumulate the payments you record on one list. Then, when creating the deposit, you select multiple payments to create a bank deposit in QuickBooks that will match the amount of the same deposit that appears on your bank statement. It makes reconciliation much easier.

Sometimes, a QuickBooks user only receives a few payments a month and they all go directly to the bank. There’s really no need for Undeposited Funds. It only adds another step.

You can tell QuickBooks not to use the Undeposited Funds account by unchecking the checkbox in Preferences.

With the preference changed, we can decide to deposit this payment to a bank account rather than Undeposited Funds. This means we won’t have to use a Record Deposit transaction in QuickBooks to get this into our bank balance. Once we save the payment, it’s already there.

How to Sell Stuff in QuickBooks

Sales forms

Let’s take a brief tour of sales forms in QuickBooks. How many are there.

Very few get this, but there’s actually three. Invoice, Sales Receipt and Credit Memo.

The difference between an invoice and a sales receipt is that in invoice creates a sale and a receivable. That is, the customer owes you for the sale. No money has changed hands.

A sales receipt assumes payment is received at the time of sale. So, no customer balance due is created with a sales receipt.

A Credit memo is a refund. Either it’s a refund that offsets the balance a customer owes, or QuickBooks allows you to create a check to give a cash refund back to the customer. QuickBooks does a really fine job of walking you through that process either way.

Credit memos are more important than a lot of people realize. Sometimes they should be used when an invoice has existed for a while waiting for the customer to pay. Finally, we realize… we’re not going to get paid.

It’s often a mistake to simply go back and void or delete the original invoice. The credit memo form exists just for this purpose. Use that instead.

Items

We sell customers either products or services. This is accomplished in QuickBooks by using items. See the screenshot below.

It’s important to select the right item type. While there are several to choose from, only three are commonly used to sell a company’s products or services. Service is self-explanatory. It’s for selling services.

Inventory Part is for tracking inventory on hand and you won’t have this option unless inventory tracking is turned on in your QuickBooks file.

The third is Non-Inventory Part. That’s just a word QuickBooks made up to describe an item we would create to sell products that we don’t wish to track as inventory on hand.

Entering a description that will commonly be used and setting the correct taxable status as far as sales tax will speed data entry when sales forms are created. The account field is almost always an income type of account from the chart of accounts and will make accounting entries that will show as revenue on your profit and loss statements.

Estimates and Sales Orders

It’s important to note that QuickBooks has the ability to track proposals for you so you have a record, along with all the details, and can easily turn those proposals into invoices, without entering all that information a second (or third, or…) time.

The Sales Order form is found only n the Premier level of QuickBooks or higher. It allows the business to record a customer’s order, then fill it later. Multiple invoices can be created from one sales order. It’s great for keeping track of special orders or back orders.

Estimates are available in Pro as well as the higher levels of QuickBooks. Most often, this form is used to record the details of a proposed job or project. Multiple invoices can be created from one Estimate. QuickBooks will track what has been invoiced and what hasn’t. There are also terrific report that compare what you expected the various components of a project to cost, and what they cost in reality.

Both sales orders and estimates are non-posting. That is, you can create and delete (if you wanted) at will and your accounting numbers are unaffected.

Tips for QuickBooks Bank Reconciliation

Today’s post discusses several tips to make reconciling the bank account in QuickBooks easier.

First, navigate to the bank reconciliation screen from the Reconcile icon on the Home Page.

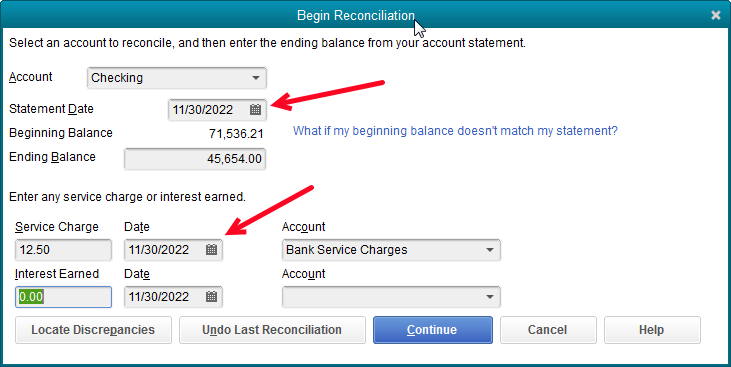

First tip, make sure your statement date and the date of any service charges or interest earned, agree.

Often these dates can become out-of-sync. Many QuickBooks users will click through this screen without even checking, unacquainted with what effects this may have on their QuickBooks file.

When the transaction date for the service charge is later than the statement date, the bank reconciliation report will not agree with the actual check register. While overall numbers are still correct, any accountant working on your numbers for reporting purposes will be sent looking for the cause of the discrepancy. For you, it’s needless billable time spent over a very small error.

One of the improvements in the bank reconciliation window from a few years back is the ability to sort the data from any of the columns. This works for either the check side or the deposit side.

It used to be that checks sorted by number only. With the increasing number of EFT and other type payments that did not align with the numbering sequence of paper checks, finding the checks became more difficult.

Now, the user can select to sort by check number, date (as in this example) or any of the other columns.

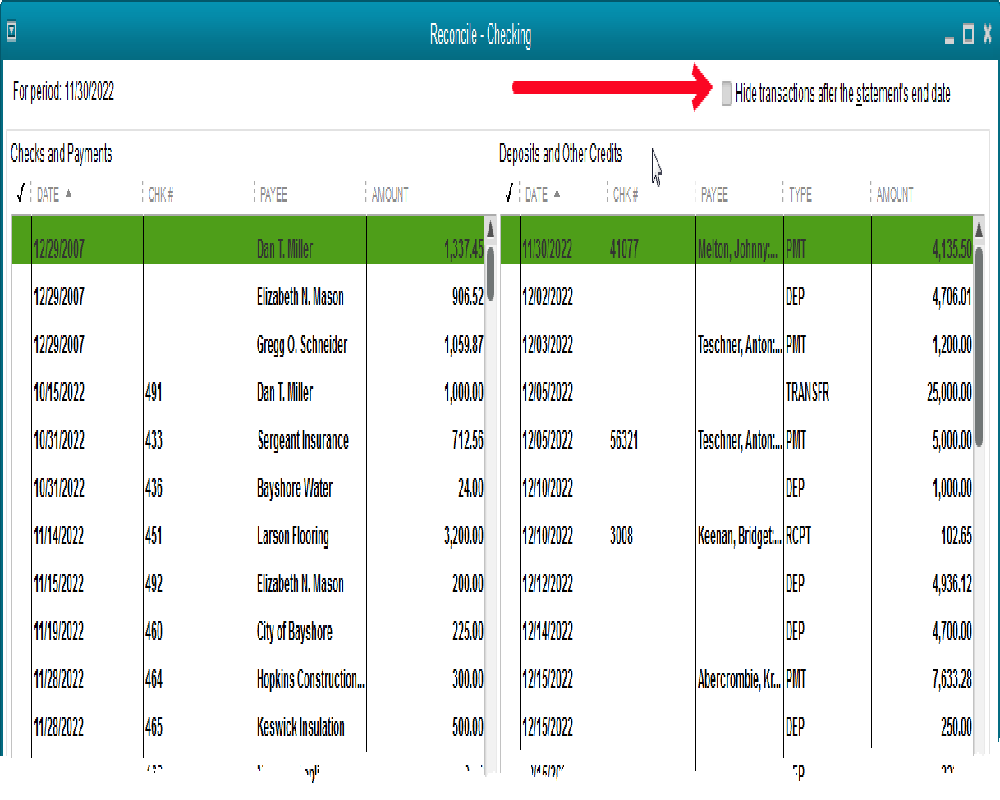

This one we’ve had for awhile. The checkbox to eliminate all transactions dated after the statement date. This results in a much shorter list of transactions to work with while finding items to clear.

Another tip. Especially for those companies that issue debit cards to certain employees. Being in the middle of a reconciliation and finding items that have not been entered into QuickBooks can be frustrating.

The check register can be opened and additional transactions added without closing the reconciliation window. It will automatically update. When you close the register, the new transactions will show in your list to be cleared.

Another frustration is items with small differences from the amount that cleared on the bank statement. From within the reconciliation window, items can be brought up in their original detail window with a double-click of the mouse.

This works best with regular checks. The amount can be edited. It will update immediately in the reconciliation window and be ready to mark as cleared.

In either of these last two cases, if the reconciliation needs to be put on hold for such an amount of time that the window needs to be closed, no worries.

You can click the Leave button. When you next return to the reconciliation window, all your work has been saved.

One last tip. Remember to continue correcting and reconciling till the Difference line is zero.

QuickBooks Own Book of Lists

An integral part of tracking hundreds of transactions within a computer program like QuickBooks, is lists. Lists of customers, of vendors. Lists of things we sell, of accounts used for creating financial reports. And on and on.

There are similarities in managing the lists in QuickBooks. This post comes from the Lists sections of the Basic QuickBooks class we offer a few times each year.

Not all, but many lists are available on the Lists menu.

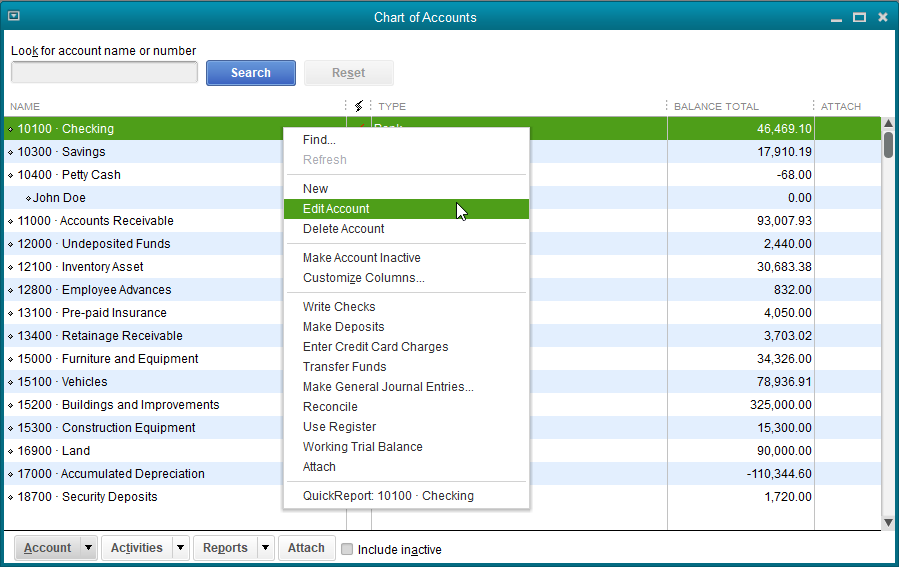

Let’s start with the Chart of Accounts, one of the most basic and important lists in QuickBooks.

Once the Chart of Accounts is chosen from the Lists menu, right-click on one of the accounts and a popup menu appears.

The Checking Account is selected. From the popup menu, we’ll choose Edit Account…

And change the name to Cash in Bank.

You can change account names at will and not impact any of the transactions. In other words, those transactions are all still there. The bank balance is still the same. It’s just that all past transactions now carry the new name as will future transactions.

Other lists can be edited much the same as the chart of accounts. Vendors and customers are each displayed in the Vendor Center or Customer Center. A double click on the name will open an edit window.

Much of the information in the vendor or customer names is easily entered and the procedure is pretty easy to follow. The tabs down the left side of the edit window identify different sections of data that pertain to the selected name.

One special area for vendors is Tax Settings, where information needed to create 1099s is stored. Similarly, customers also have a special tax area. In this case, it is for sales tax information that is necessary for QuickBooks to charge the correct amount of tax on an invoice.

There are two common challenges with lists in QuickBooks.

One, you no longer need a name on the list. This happens when a customer moves away, you no longer buy from a certain vendor, etc. If the name has been used in a transaction in QuickBooks (and that’s usually the case), the name can’t be deleted.

Two, you end up with duplicates. William Smith and Bill Smith as customers for instance. If there are transactions for both (and again, there usually are), you can’t delete either one of them.

Let’s make a customer inactive. We highlight the customer in the Customer Center and right click on the customer name. This brings up a popup menu where we make the appropriate selection.

The customer will no longer appear on lists in QuickBooks either in the customer center or when creating customer transactions like invoices. They should have a zero balance before you make them inactive. If they don’t, and you run a report showing customer balances, they will still be on the report since they owe you money.

You can always get these customers back if you need to.

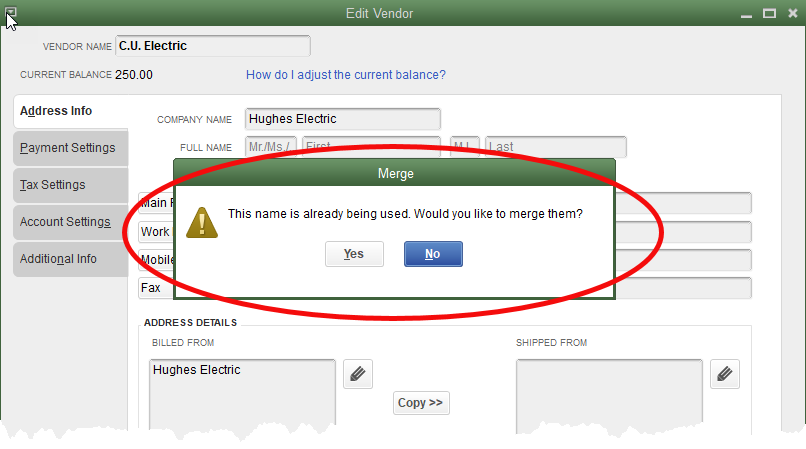

To get rid of duplicates, we usually merge the extra name. Let’s use a vendor.

Rock Castle Construction has a vendor C.U. Electric. The owner of the vendor business is named Hughes. It seems someone was confused and created a vendor, Hughes Electric. Both vendor names in QuickBooks have transactions and both have a balance due.

The easiest way to fix this is to edit the Hughes Electric vendor to be the exact same name, including spaces and punctuation, as C.U. Electric. When we save the vendor file after editing, QuickBooks displays this warning:

QuickBooks gives us this chance to change our mind since this is a permanent change. There’s no going back.

If you’re certain the merge is appropriate, click yes at the message and QuickBooks completes the process. All transactions in QuickBooks that used to show Hughes Electric as the vendor now show C.U. Electric.

Refresher Course W2s and 1099s

It's that time of year. Doing your 1099s and/or W2s in QuickBooks? Here are some links you might find useful.

W2s

https://www.youtube.com/watch?v=f1qv7TMA198

https://www.mgreencpas.com/index.jsp?page=blog&postId=22163

1099s

https://www.youtube.com/watch?v=2buq9FGwp8U&t=17s

https://www.mgreencpas.com/index.jsp?page=blog&postId=22008

My Company

Basic QuickBooks, From Step One

Let’s take a few weeks, and examine using QuickBooks much as we would in a class. With a desire to learn the product. Make your life a little easier. Make bookkeeping both simpler and less time-consuming.

We might also find some ways that will correct a few unnoticed errors that have slipped into your accounting procedures. Find some better numbers to tell you how your business is really doing.

Today, a brief look at the My Company section of QuickBooks. It won’t take long and you might learn why certain pieces of information pop up on forms and reports.

First, the My Company window. Navigate to Company->My Company.

Note the pencil-point icon circled in the My Company window. This opens the smaller window shown in front of the screenshot.

Sure, most of this is self-explanatory, but let’s just look at a couple of things for clarity.

Fill out the Contact Information section. I know you know your own address, etc., but QuickBooks will pull from this section when putting your company information on an invoice header, customer statement, etc.

Fill out the Legal Information as well. Again, while QuickBooks may pull from the Contact Information section for things like customer forms, other functions will search the Legal Information area. Payroll forms, 1099s, etc.

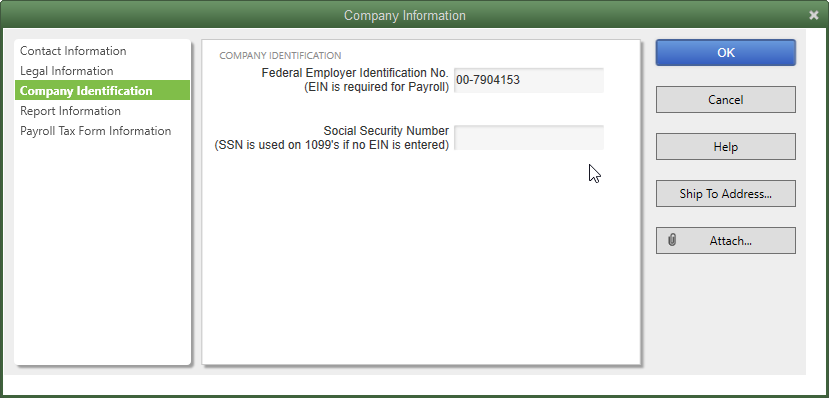

Company Information is short. If you have a Federal Employer Identification number, enter it here. If you don’t, use your Social Security number in the bottom field.

Most people get a Federal ID number when they either start payroll, or when they form a business entity other than sole proprietor. Think Partnership, LLC, S Corp, etc.

You may use your Social Security number if you are a sole proprietor with no payroll.

QuickBooks is going to use one of these numbers (and Needs one of these numbers) when filling out official forms. Filing payroll tax returns? QuickBooks looks here for the Federal ID. Create 1099s? QuickBooks looks here for your number, either Federal ID or Social Security.

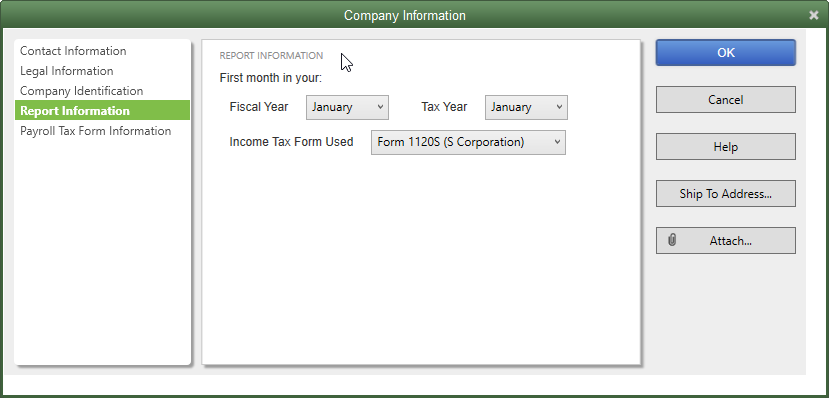

If the Report Information section sounds trivial, pause here a minute and understand how QuickBooks uses it.

This determines your fiscal year. The setting shown above means that reports are going to show on a calendar year basis. You may be non-profit with a year-end of June 30. If your QuickBooks were set as above, and you asked for a Profit and Loss report for this year, you’d get from January 1 forward, not July 1 forward.

It’s not uncommon for this question to come to me. No worries. If the dates are set incorrectly, just change them. Nothing bad will happen and you can change the dates here at will.

In more than twenty years, I have yet to find anyone who wanted their tax year set differently than their fiscal year, but it’s possible.

The Tax Form setting usually only becomes significant if you use income tax software that pulls the data directly from QuickBooks and fills out the return. I have yet to experience that either.

Yeah, the last section, Payroll Tax Form Information, is a little more involved. Of course, you only need to fill it out if you are doing payroll from QuickBooks. Otherwise, it’s irrelevant. The AutoFill Contact Information window only opens if you choose the AutoFill button.

It’s handy if you complete your own payroll tax returns. Fill out the information once here and Quickbooks fills it in each time you create a 941, 940, W2s, or state payroll forms. It’s not required, but it’s a BIG time saver.

There you have it. The My Company section of QuickBooks.

Next time? Lists!

QuickBooks Enterprise and Inventory Cost and Price Updates

A lot of the work Intuit has done in recent years to improve inventory management in QuickBooks has gone into their Enterprise software. Even without the Advanced Inventory features that are part of the highest subscription level, Enterprise has several inventory features the other versions of QuickBooks don’t have.

One of those is automatic cost and price changes.

It’s important to note a couple of things about cost information in QuickBooks. First, the value of inventory is maintained on an average cost basis. That is, if we purchase a widget at $5 and one at $10, QuickBooks tracks inventory as 2 widgets valued at $7.50 each.

The sale of one of those widgets will generate a charge to cost of goods sold of $7.50.

An item record actually has two cost fields.

The bottom circled area titled Calculated Average, is the QuickBooks generated average cost for this item. It is not an editable field.

The upper circled area is editable. You can put any number you want in that field. It affects very little. QuickBooks uses the average cost in all accounting entries.

Some of this can change with QuickBooks Enterprise. That user-entered cost field can matter very much when using the automatic cost and price updates. Let’s see how that feature works.

First, turn on the preference.

Several settings are available in the Automatic Cost & Price Updates window. The top dropdown field labeled Markup, gives the QuickBooks user two choices. Percent over cost or Amount over cost.

The middle section determines how automatic cost updates will be handled by QuickBooks. The first field is labeled “If item cost changes on a purchase.” The choices are Always update item cost, Never update item cost, or Ask about updating item cost. Selecting Always or Ask and then assuming the QuickBooks user responds positively when asked, will cause QuickBooks to update the Cost field in the item setup window.

The second field is labeled “When item cost changes.” The selections for this field are Always update sales price, Never update sales price, or Ask about updating sales price.

In the sample file is a product named Virus Vac A. The cost field is filled in with the amount 37.50. The price is set at 75.00.

If we enter a bill purchasing Virus Vac A at 30.00, the following popup appears.

The popup appears because the setting selected in preferences is “Ask about updating item cost.” Yes has been selected as the answer in the graphic, in order to show the price options. If yes is not selected, the price update options are grayed out. If you do not automatically change the cost, there is no way to automatically change the price.

So, the new cost is $30. QuickBooks will change this value in the item window when this transaction is completed. The markup on the old cost is 100%. A cost of 37.50 times 100% yields a price of 75.00.

Now, if QuickBooks updates the new cost to 30.00, in order to maintain the price markup of 100%, the price will be updated to 60.00.

Slice and Dice Data Like a QuickBooks Pro

We’ve done several posts this year on ways you can view your QuickBooks transactions in smaller segments. The benefit of that, is to gain a clearer picture of which parts of your business work, and which don’t.

Projects can be just that, specific customer jobs or projects, or for those that think creatively, may be rentals, grants, scholarships, clubs, or any number of things.

In order for this function to be useful, you should be able to tie all income and expense for the project (or whatever) to the specific customer and/or job.

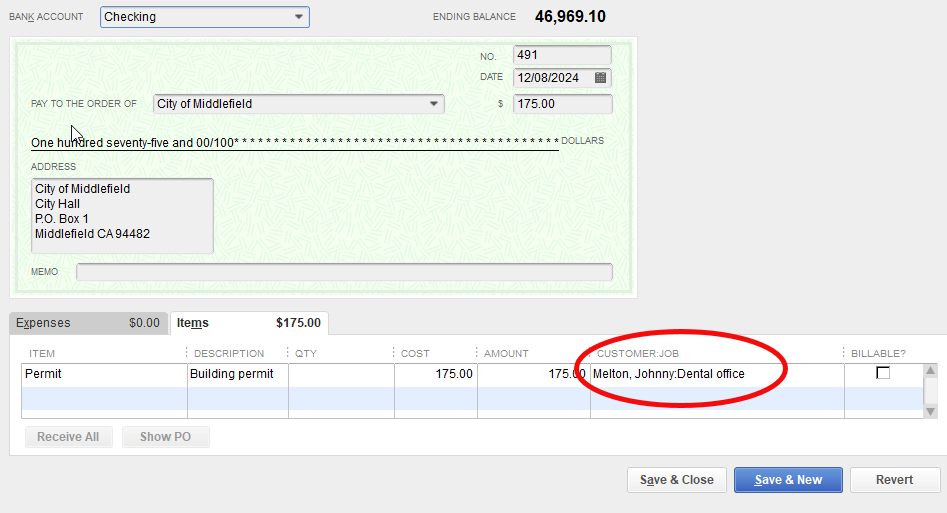

You do this by including the customer/project name in all the transactions.

It helps to use the Items tab on checks and bills rather than the Expenses tab. This one tip will give you much better reports. It’s important to create “double-sided items.” That is, items with both an income account and an expense account.

QuickBooks knows when you are using the item in an expense transaction (check, bill, credit card charge…), or an income transaction (invoice, sales receipt…).

The result will be reports like this:

Each of the items, phases or some other definable segment of the project, show as separate lines on the report, breaking down profitability measurements even more.

Measuring smaller and smaller pieces of the business helps profit-minded owners determine which parts of the business to concentrate on and which to improve or cancel.

You can find a video detailing these QuickBooks features here:

https://www.facebook.com/mgreenandcompany/videos/584909585382528/

Top Icon Bar? Left Icon Bar?

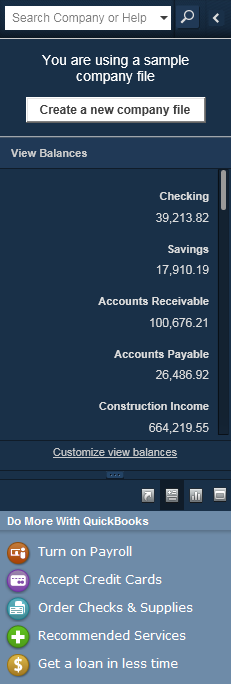

Those of us who have used QuickBooks for a couple decades are familiar with seeing the Account Balances list in this way; on the right side of the Home Page.

While a good idea, the most frustrating thing about the Account Balances list was that no customization was possible.

You could not determine which accounts were listed, or the order in which they appeared. The accounts listed the same way they do everywhere else in QuickBooks. They were either in alphabetical order (account numbers turned off), or numerical order (account numbers turned on).

QuickBooks 2013 moved the Account Balances to the new Left Icon Bar by default. The old view is still available in QuickBooks with a change of settings. Either way, the feature retained the old weakness, no customization.

If the left-hand icon bar is not already showing in your QuickBooks, navigate to the View drop down menu and select it. Click on View Balances from the shortcuts in the center of the icon bar. From the View Balances panel, select Customize view balances.

As you can see from the screenshot below, the Account Balances section is very customizable now.

The above customization window is available when selecting the link, “Customize view balances”, at the bottom of the View Balances list (not shown). As you can see, the QuickBooks user can select which accounts are shown in the list and in what order they should appear.

In addition, the list of available accounts, the field label at which the arrow points, seems to include all accounts. Note the accounts listed in the right-hand column titled “Selected Accounts”. Construction Income and Payroll Expenses have been added.

Important accounts for tracking, including income and expense, can be selected to show the current balance at a glance.

Searching for Profits - Divisions and Locations

In the search to understand our business, we’re looking for ways to whittle down the mass of transactions in QuickBooks to smaller chunks we can understand and evaluate.

This post is for companies that can divide their business activity by divisions, maintenance & repair services vs. new construction, or location. To do this, we use a feature called Class.

If this might work for your business, you can turn on the feature in Preferences.

The screenshot shows where to select the option to use Classes. If you are going to make this choice, you almost certainly want the option to Prompt to assign classes as well.

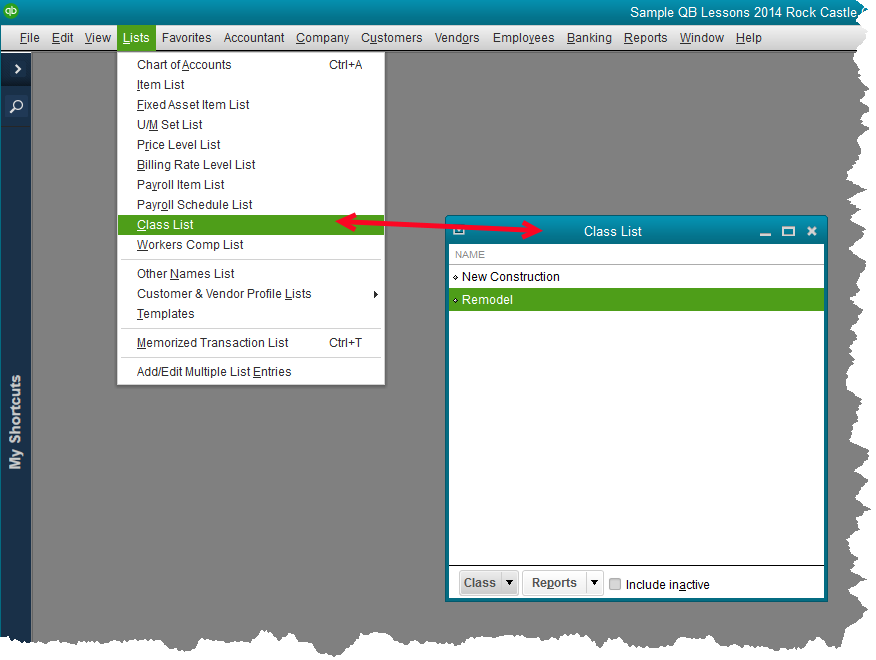

With the Preference set, you now have a new list on the Lists dropdown menu. In the QuickBooks sample file, the two classes already established are New Construction and Remodel.

Creating a new class is simple. See the screenshot below. Really, you only need a name.

You can also add a new class ‘on-the-fly’ by typing in a new name as a new transaction is entered.

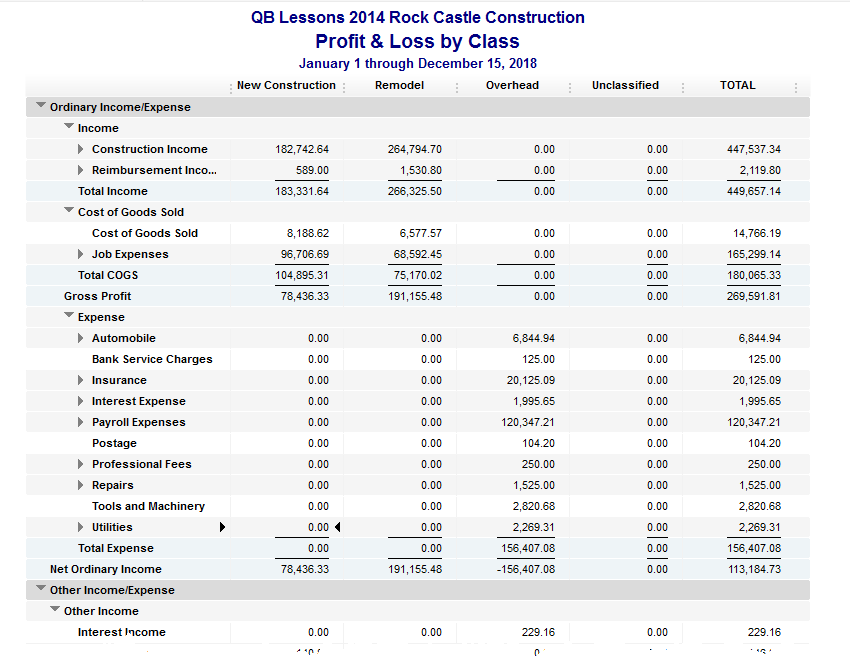

The main benefit in using this feature is keeping the chart of accounts from becoming overwhelmingly large, and the ability to create reports that are far more readable than using the chart of accounts as the only set of ‘buckets’ in which to categorize income and expense.

While the QuickBooks sample file gives a very limited example of how the class feature is used, it’s enough to visualize how this could benefit your organization. Instead of having expense accounts for Cost of Goods Sold, New Construction, and another expense account for Cost of Goods Sold, Remodel, there is only one Cost of Goods Sold account. Transactions posting to that account are then categorized, using the class feature, as New Construction or Remodel, and as many additional classes as you think necessary.

The reports are eminently more readable.

Some Additional Considerations

- Class should be used for only one strategy. That is, to break up business operations by location or grant. If you use class for grant, and also for location for instance, the reports fail to be very informative.

- If you opt to use class, create a class for General, or Administrative, or similar. That way, even transactions that don’t fall neatly into one of your main classes can be categorized by class. This way, when you create a Profit and Loss by Class report, and you see transactions in the Uncategorized column, you that’s an error and you can open and fix those transactions.

- Class works for income and expense accounts and creates a great profit and loss report broken down by these additional criteria. It is very complex and rarely works well with balance sheet accounts. So, it won’t help you if your organization needs separate balance sheets.

For a more visual demonstration and some more in-depth ideas on using it, see this video:

https://www.facebook.com/mgreenandcompany/videos/406010763431187/